8453 Pe 2020

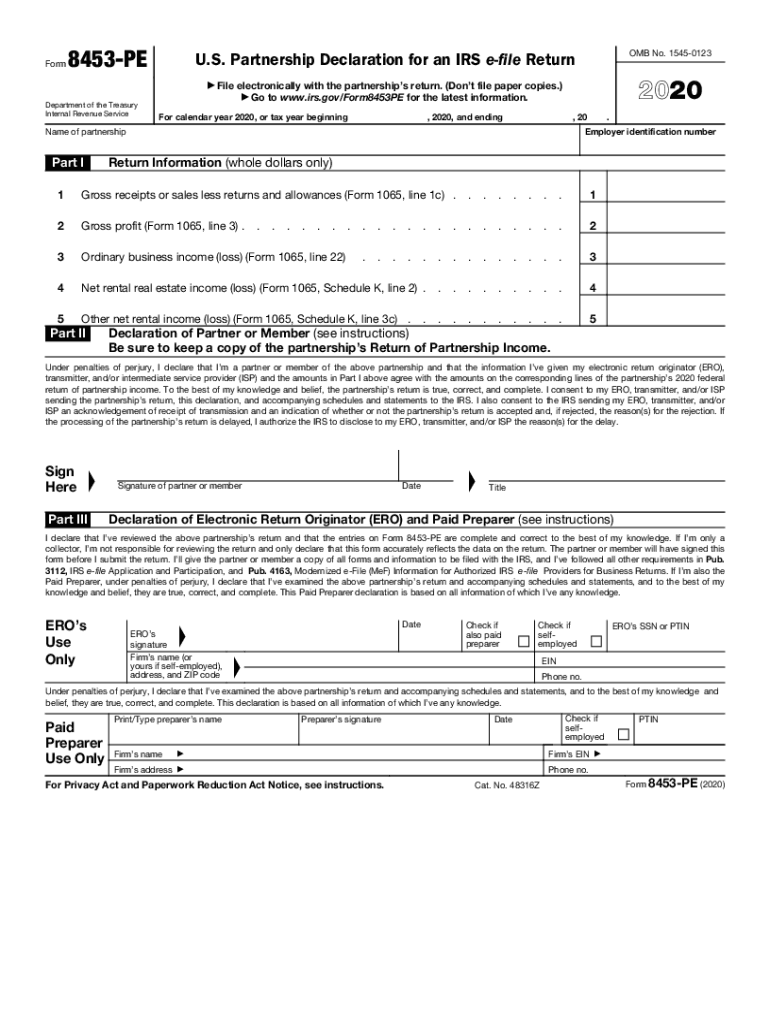

What is the 8453 PE?

The 8453 PE form is a crucial document used by taxpayers in the United States to authenticate their electronic tax return submissions. Specifically designed for use with the IRS, this form serves as a declaration that the taxpayer has reviewed their return and consents to its electronic filing. It is essential for ensuring that the electronic submission is legally binding and compliant with IRS regulations.

Steps to Complete the 8453 PE

Completing the 8453 PE form involves several key steps to ensure accuracy and compliance. First, gather all relevant tax information, including income details and deductions. Next, fill out the form with your personal information, such as your name, address, and Social Security number. After entering the required data, review the information for any errors. Finally, sign the form electronically, which confirms your consent to file your tax return electronically. Ensure that you keep a copy of the completed form for your records.

Legal Use of the 8453 PE

The 8453 PE form is legally binding when it meets specific criteria set forth by the IRS. To be considered valid, the form must be signed electronically using a compliant eSignature solution. This ensures that the submission adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations. The form acts as a safeguard, protecting both the taxpayer and the IRS by ensuring that the electronic return is filed with the taxpayer's explicit consent.

IRS Guidelines

The IRS provides detailed guidelines for the use of the 8453 PE form, emphasizing the importance of accuracy and compliance. Taxpayers must ensure that the form is completed accurately, as any discrepancies could lead to delays in processing their tax returns. Additionally, the IRS requires that the form be retained for a specific period for audit purposes. Familiarizing oneself with these guidelines helps ensure that taxpayers meet all necessary requirements when filing their returns electronically.

Form Submission Methods

The 8453 PE form can be submitted electronically as part of the overall electronic tax return filing process. Taxpayers typically use tax preparation software that integrates this form into the e-filing process. It is important to note that the form should not be mailed separately to the IRS; it must accompany the electronic submission of the tax return. This method streamlines the filing process and ensures that all necessary documentation is submitted simultaneously.

Required Documents

To complete the 8453 PE form, taxpayers need to gather several essential documents. These include their W-2 forms, 1099 forms, and any other documentation related to income and deductions. Having these documents on hand simplifies the process of filling out the form and ensures that all information is accurate. Additionally, taxpayers should have their previous year's tax return available for reference, as it can provide valuable insights into their current filing.

Quick guide on how to complete 8453 pe 2020

Complete 8453 Pe effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely archive it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage 8453 Pe on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign 8453 Pe with ease

- Retrieve 8453 Pe and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Choose your preferred method to submit your form via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device of your choice. Modify and eSign 8453 Pe and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8453 pe 2020

Create this form in 5 minutes!

People also ask

-

What is 8453 pe in the context of airSlate SignNow?

8453 pe refers to our unique document management feature within airSlate SignNow, designed to streamline the eSigning process. This feature enhances the user experience by ensuring that all documents are easily accessible and securely managed. With 8453 pe, businesses can send and eSign documents efficiently, saving time and reducing errors.

-

How does 8453 pe improve document security?

The 8453 pe feature incorporates advanced encryption protocols to safeguard your documents during transmission and storage. This ensures that sensitive information remains protected from unauthorized access. By using 8453 pe, businesses can maintain compliance with industry standards for data security.

-

Is there a trial available for the 8453 pe feature?

Yes, airSlate SignNow offers a free trial that includes access to the 8453 pe feature. This allows potential customers to explore its full capabilities without any initial investment. The trial period is an excellent opportunity to evaluate how 8453 pe can meet your eSigning needs.

-

What are the pricing options for using 8453 pe?

airSlate SignNow provides flexible pricing plans that include the 8453 pe feature as part of their offerings. Customers can choose from various tiers based on their business needs, ensuring affordability while accessing essential eSigning tools. For detailed pricing, visit our website or contact our sales team.

-

Can I integrate 8453 pe with other software?

Absolutely! The 8453 pe feature is designed to integrate seamlessly with various third-party applications and platforms. This allows businesses to streamline their workflows by connecting airSlate SignNow with tools they already use. Our API documentation provides clear guidelines for integration.

-

What are the key benefits of using 8453 pe?

Using 8453 pe offers multiple benefits, such as improved efficiency in document handling and enhanced collaboration among team members. It simplifies the eSigning process, reducing turnaround times signNowly. Furthermore, 8453 pe supports multiple document formats, making it versatile for any business.

-

How does 8453 pe enhance user experience?

The user interface of 8453 pe is intuitive and user-friendly, ensuring that users can easily navigate the platform. This feature minimizes the learning curve for new users and improves overall satisfaction. With 8453 pe, businesses can foster a more productive environment for document management.

Get more for 8453 Pe

Find out other 8453 Pe

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe