Quit Claim Deed Business Entity to Individual 10 3 4 Form

What is the Quit Claim Deed Business Entity To Individual 10 3 4

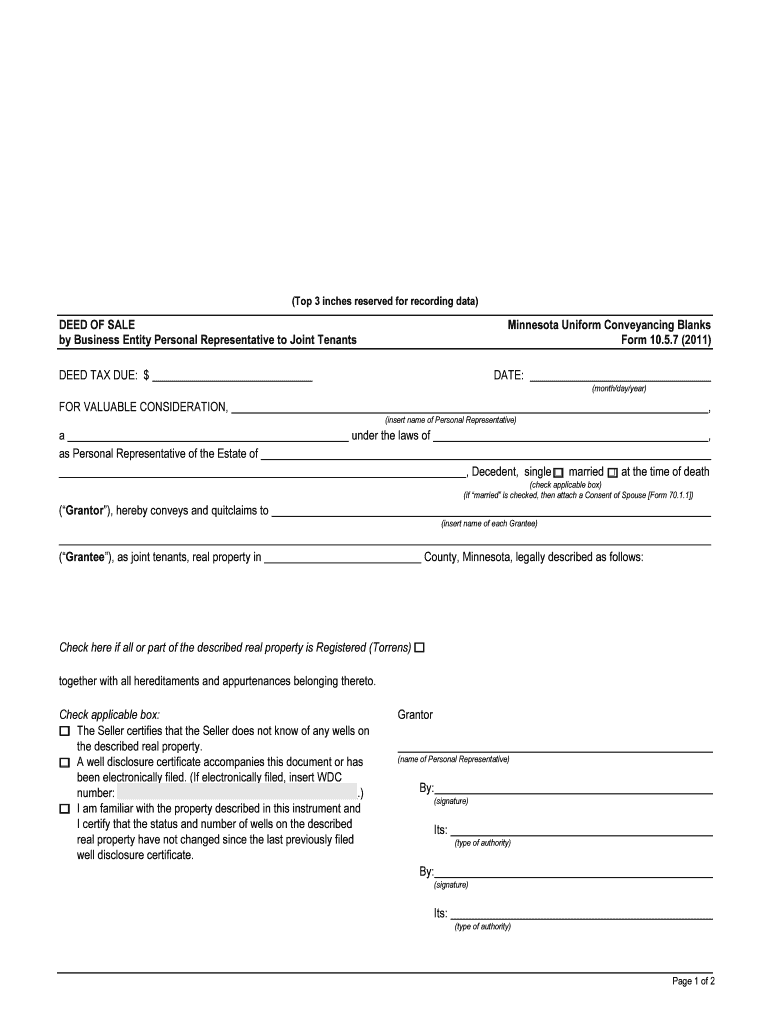

The Quit Claim Deed Business Entity to Individual 10 3 4 is a legal document used to transfer property ownership from a business entity, such as a corporation or limited liability company (LLC), to an individual. This form is particularly important when a business decides to divest its interest in real estate or when an owner wishes to transfer property to themselves personally. Unlike warranty deeds, quit claim deeds do not guarantee that the title is free of claims or liens, making it essential for the parties involved to understand the implications of the transfer.

Steps to Complete the Quit Claim Deed Business Entity To Individual 10 3 4

Completing the Quit Claim Deed Business Entity to Individual 10 3 4 involves several critical steps to ensure the document is legally binding and properly executed:

- Gather necessary information: Collect details about the property, including its legal description, the names of the business entity and individual, and any relevant identification numbers.

- Draft the deed: Fill out the quit claim deed form accurately, ensuring all required fields are completed. This includes specifying the nature of the transfer and the consideration, if any.

- Sign the document: The authorized representative of the business entity must sign the deed in the presence of a notary public. The individual receiving the property may also need to sign, depending on state requirements.

- Notarization: Ensure that the signatures are notarized to validate the document. This step is crucial for the deed to be accepted by local authorities.

- File the deed: Submit the completed quit claim deed to the appropriate county recorder's office to officially record the transfer of property ownership.

Legal Use of the Quit Claim Deed Business Entity To Individual 10 3 4

The Quit Claim Deed Business Entity to Individual 10 3 4 is legally recognized in the United States and can be used for various purposes, including:

- Transferring property ownership without warranties or guarantees.

- Facilitating estate planning by transferring assets between entities and individuals.

- Clearing up title issues by transferring interests among parties.

It is important to note that while the quit claim deed is a straightforward method for transferring property, it does not protect the grantee from any existing liens or claims against the property. Therefore, due diligence is recommended before completing the transfer.

Key Elements of the Quit Claim Deed Business Entity To Individual 10 3 4

Understanding the key elements of the Quit Claim Deed Business Entity to Individual 10 3 4 is essential for ensuring a smooth transfer process. The main components include:

- Grantor and Grantee Information: Clearly identify the business entity as the grantor and the individual as the grantee.

- Legal Description of the Property: Provide a detailed legal description of the property being transferred, including its address and parcel number.

- Consideration: Although not always required, stating the consideration (monetary or otherwise) can clarify the terms of the transfer.

- Signatures: Ensure that the authorized signatory for the business entity signs the document, along with notarization for validation.

State-Specific Rules for the Quit Claim Deed Business Entity To Individual 10 3 4

Each state in the U.S. has its own regulations and requirements for using quit claim deeds. It is essential to be aware of these state-specific rules, which may include:

- Notarization requirements and witnessing rules.

- Filing fees and deadlines for recording the deed.

- Specific language or clauses that must be included in the deed.

- Local tax implications or transfer tax obligations associated with the property transfer.

Consulting with a legal professional or local real estate expert can provide guidance tailored to the specific state where the property is located.

Quick guide on how to complete quit claim deed business entity to individual 1034

Complete Quit Claim Deed Business Entity To Individual 10 3 4 effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle Quit Claim Deed Business Entity To Individual 10 3 4 on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Quit Claim Deed Business Entity To Individual 10 3 4 with ease

- Obtain Quit Claim Deed Business Entity To Individual 10 3 4 and then click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method of sending your form, by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from your chosen device. Edit and eSign Quit Claim Deed Business Entity To Individual 10 3 4 and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quit Claim Deed Business Entity To Individual 10 3 4?

A Quit Claim Deed Business Entity To Individual 10 3 4 is a legal document that allows a business entity to transfer its interest in a property to an individual. This deed does not guarantee the value or title of the property, but it simplifies the transfer process. It is commonly used in real estate transactions.

-

How can I create a Quit Claim Deed Business Entity To Individual 10 3 4 using airSlate SignNow?

Creating a Quit Claim Deed Business Entity To Individual 10 3 4 with airSlate SignNow is straightforward. You can use our template library to find the Quit Claim Deed form, fill in the necessary details, and electronically sign it. This process streamlines the document preparation and signing, saving you time.

-

Are there any fees associated with using airSlate SignNow for a Quit Claim Deed Business Entity To Individual 10 3 4?

Yes, there are subscription plans available for airSlate SignNow that vary based on the features you need. Depending on your usage and requirements for the Quit Claim Deed Business Entity To Individual 10 3 4, we have pricing options suitable for businesses of all sizes. You can review our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing Quit Claim Deeds?

airSlate SignNow provides an array of features for managing Quit Claim Deeds, including document templates, electronic signatures, and collaborative tools. These features ensure that your Quit Claim Deed Business Entity To Individual 10 3 4 is processed quickly and securely. Additionally, you can track the signing process in real-time.

-

What are the benefits of using airSlate SignNow for my Quit Claim Deed Business Entity To Individual 10 3 4?

Using airSlate SignNow to manage your Quit Claim Deed Business Entity To Individual 10 3 4 offers numerous advantages. It simplifies document workflows, enhances security through encrypted signatures, and provides a clear audit trail. This results in a more efficient and reliable transfer process.

-

Can I integrate airSlate SignNow with other business tools for processing Quit Claim Deeds?

Absolutely! airSlate SignNow supports integrations with a variety of business tools, which can enhance your workflow for processing Quit Claim Deed Business Entity To Individual 10 3 4. You can connect with CRM systems, cloud storage services, and more for a seamless experience.

-

Is it legal to use an electronic signature on a Quit Claim Deed Business Entity To Individual 10 3 4?

Yes, electronic signatures are legally recognized in many jurisdictions, making them valid for Quit Claim Deed Business Entity To Individual 10 3 4 transactions. However, it is essential to check your local laws to ensure compliance. airSlate SignNow provides a legally-compliant platform for eSigning.

Get more for Quit Claim Deed Business Entity To Individual 10 3 4

- Tenant application formsjotformtenancy application form landlord information ampamp advicetenancy application form uks biggest

- Building notice building act 1984 and the building form

- Tonsillectomy referral form patient name southend nhs

- Reportlet co uk03517244worthing homes limitedworthing homes limited in north street bn11 1er form

- Greeley police department greeley co address and phone form

- Ao 367 solicitationofferacceptance u s district court for the cod uscourts form

- Ccdf temple form

- Cover sheet for protection order no contact order form

Find out other Quit Claim Deed Business Entity To Individual 10 3 4

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free