the Hartford Evidence of Insurability 2007-2026

What is the Hartford Evidence of Insurability

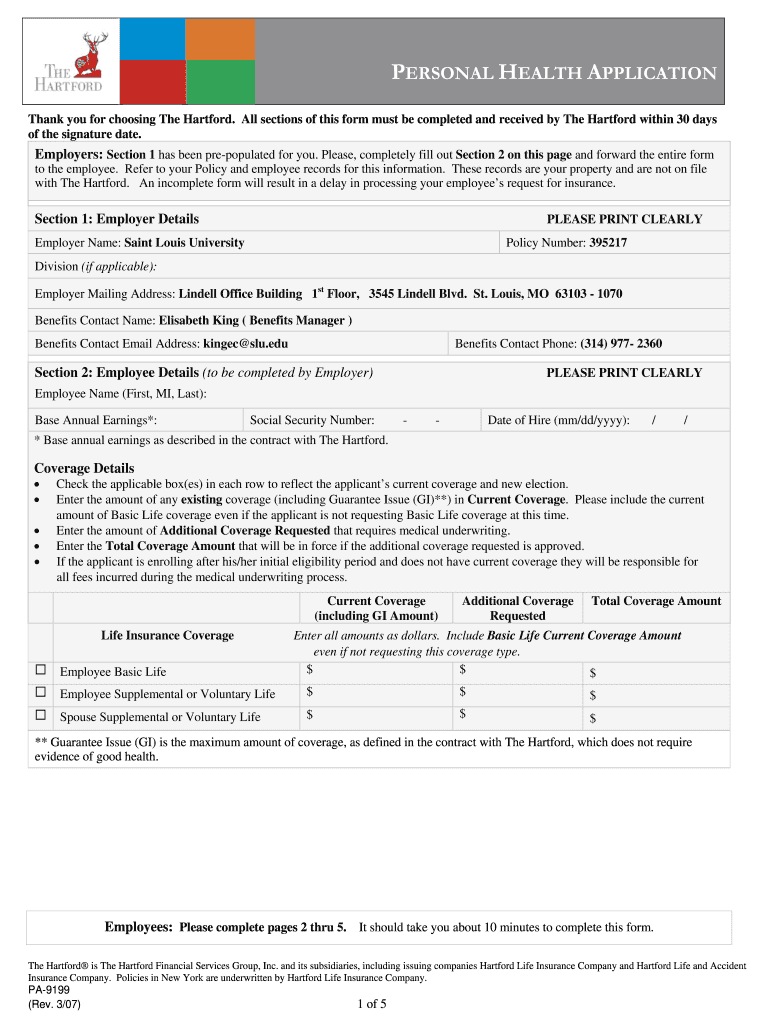

The Hartford Evidence of Insurability is a crucial document used primarily in the insurance sector, specifically for health and life insurance applications. This form serves as proof of an applicant's health status and medical history when applying for coverage. It is often required by insurers to assess the risk associated with insuring an individual, ensuring that they meet the eligibility criteria for the desired insurance plan.

How to Use the Hartford Evidence of Insurability

Using the Hartford Evidence of Insurability involves several steps. First, applicants need to obtain the form, which can typically be accessed through The Hartford's official website or directly from an insurance agent. Once the form is in hand, individuals should fill out their personal information accurately, including medical history and any relevant health conditions. It is essential to provide truthful and complete information, as inaccuracies can lead to delays or denial of coverage.

Steps to Complete the Hartford Evidence of Insurability

Completing the Hartford Evidence of Insurability requires careful attention to detail. Here are the steps to follow:

- Obtain the form from The Hartford's website or your insurance representative.

- Fill in your personal information, including name, address, and contact details.

- Provide a comprehensive medical history, including any pre-existing conditions.

- Review your answers for accuracy and completeness.

- Submit the form as instructed, either online or via mail.

Legal Use of the Hartford Evidence of Insurability

The Hartford Evidence of Insurability is legally binding and must be filled out accurately to comply with insurance regulations. It is essential for applicants to understand that providing false information can lead to legal repercussions, including the potential denial of claims in the future. The form must adhere to the legal standards set forth by state regulations and insurance laws to ensure its validity.

Eligibility Criteria for the Hartford Evidence of Insurability

Eligibility for completing the Hartford Evidence of Insurability typically depends on the type of insurance being applied for. Generally, applicants must be of a certain age and meet specific health criteria outlined by The Hartford. Those with pre-existing conditions may face additional scrutiny during the approval process. It is advisable to review the eligibility requirements carefully before submitting the form.

Form Submission Methods

The Hartford Evidence of Insurability can be submitted through various methods, providing flexibility for applicants. Options typically include:

- Online submission via The Hartford's secure portal.

- Mailing the completed form to The Hartford's designated address.

- In-person submission at a local insurance office, if applicable.

Key Elements of the Hartford Evidence of Insurability

Key elements of the Hartford Evidence of Insurability include personal identification details, comprehensive medical history, and any supporting documentation that may be required. Applicants should ensure that all sections are completed thoroughly to avoid processing delays. Understanding these elements can significantly impact the outcome of the insurance application process.

Quick guide on how to complete hartford life insurance evidence of insurability form

The optimal method to discover and authorize The Hartford Evidence Of Insurability

At the level of your entire organization, ineffective workflows surrounding document approval can consume numerous working hours. Signing documents like The Hartford Evidence Of Insurability is a fundamental aspect of operations across any sector, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the overall performance of the company. With airSlate SignNow, finalizing your The Hartford Evidence Of Insurability is as straightforward and rapid as it can be. You will discover with this platform the most recent version of nearly any form. Even better, you can sign it instantly without the necessity of installing external software on your device or printing anything as physical copies.

How to obtain and authorize your The Hartford Evidence Of Insurability

- Explore our repository by category or utilize the search bar to find the document you require.

- View the form preview by selecting Learn more to confirm it is the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and enter any necessary information using the toolbar.

- Once finished, click the Sign tool to authorize your The Hartford Evidence Of Insurability.

- Select the signature method that is most suitable for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to handle your documentation proficiently. You can find, complete, edit, and even send your The Hartford Evidence Of Insurability in a single tab with no complications. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

In what cases do you have to fill out an insurance claim form?

Ah well let's see. An insurance claim form is used to make a claim against your insurance for financial, repair or replacement of something depending on your insurance. Not everything will qualify so you actually have to read the small print.

-

What rules of thumb are there for figuring out how much life insurance to buy?

If you are not married, and have no dependents, then you don't need life insurance.If you are married and your spouse also works, one year's salary is enough insurance for them to cover funeral expenses, mourn, and move to a smaller home and sell the current house if needed.If you have dependents, and/or your spouse doesn't work, the situation becomes very dependent on your personal finances overall. Assuming you are a one-income household, with two pre-school aged children, you may want to consider a total life insurance value equal to enough money to cover:-Cost of paying off your mortgage immediately-Cost of fixed annuity to pay for annual expenses for your spouse, less housing cost-Children's educational expensesThat's the most common rule of thumb, but you should consider whether it is an outdated notion that your spouse will never be able to work or provide for themselves if you die.Also, whether you believe that parents should pay for a child's college education, or even whether a child needs to go to college (or a state school vs. private school) can impact that part of the equation.As you age, you will likely set aside 529 plans for your kids, pay down your mortgage, etc. In that case, you should adjust the total value of your insurance downward to save yourself on monthly premium costs. The very wealthy self-insure for the most part - you want to move in that direction as your personal wealth increases.Finally, don't mix investments with insurance. Insurance is for protection only. Therefore, "buy term and invest the rest" is the best advice. Whole insurance makes it difficult to remember how much you are spending on the insurance part, and how much you're investing.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Does life insurance in general pay out in the event of any form of diagnosed cancer?

You bet. As long as the insurance company has agreed to issue the policy, and the questions on the application and medical exam have been truthfully answered, the policy pays. HOWEVER...There ARE some possible pitfalls:IF the policy is sold with "no medical questions" then there may be language in the policy which excludes coverage on account of any pre-existing medical condition. But the exclusion is usually limited to a certain time frame -2 years is typical. Get past the 2 years, and you're good.Otherwise, if the policy is underwritten with medical questions, and/or a medical exam, full disclosure of everything is a must. If cancer has been diagnosed, the next questions will run from diagnosis to prognosis. I, for example, had a pre-cancerous skin condition which had been surgically removed. No problem. But if I had an ongoing skin cancer issue which required frequent monitoring and intervention, I might be accepted, but at a higher rate. And if I had cancer in my lymph system, with a life expectancy calculated in months, I would probably not be accepted.In general, the insurance company doesn't plan to lose money. Consequently, the control of early payouts owed to health conditions will occur either in the underwriting and application phase, or otherwise within the policy limitations. Thus, "newspaper" insurance offers may claim, "No medical questions!" However, read the small print in the policy. And realize that such insurance as shows up in magazines and the paper or TV tend to be hideously expensive, and only for limited amounts of coverage, with restrictions.While we're at it, let's take a look at Colonial Penn's "Guaranteed Acceptance Whole Life Policy." Here's my quote, for 66 year old male:8 "units" provides a maximum benefit of about $7,000. Enough to lay me away and provide funds for the exciting wake sure to follow. Cost? About $80 a month, or $960 per year. That is an absolutely DREADFUL rate. In other words, I could put aside $80 per month at 4% interest and have $7,000 in less than 7 years. AND there's the big GOTCHA:"We can guarantee your acceptance because of a two-year limited benefit period for death from non-accidental causes. If death from non-accidental causes occurs during the first two years of coverage, the beneficiary will receive the premiums paid plus 7% interest compounded annually. After the first two years, the full face amount will be paid for death from any cause."By contrast, I calculate a cost of $45 per month for a $7,000 benefit from New York Life, with no 2 year limitation. That's still a chunk o' change, but it is a far better bet then Colonial Penn. Hope that helps.

-

When I filled out my insurance form from my employer, they asked if I smoke. How can they verify this?

They can probably tell by smelling your breath or looking at your teeth, but no one is gong to challenge what you put on the form.HOWEVER…What will happen if you develop a smoking-related illness is that the insurance company can deny coverage based on your fraud when filling out the forms.That’s they way insurance contracts always work. For example, you could get cheaper car insurance if you tell them your car is a cheaper model. Then, if you have an accident and put in a claim to repair a more costly model, they deny it saying that’s not the car they insured. Or perhaps you have a homeowner policy in which you declared all electrical work had be done by licensed electricians. Then there is a fire and they find you had done some of your own wiring to finish a basement room. Coverage denied.So, no one is going to question your answers. But the insurance will be pretty worthless if you lie on the application. They will accept your statements as fact and take your money, but when it comes time to collect, they can deny payment based on your lies.

Create this form in 5 minutes!

How to create an eSignature for the hartford life insurance evidence of insurability form

How to create an electronic signature for your Hartford Life Insurance Evidence Of Insurability Form in the online mode

How to create an eSignature for your Hartford Life Insurance Evidence Of Insurability Form in Google Chrome

How to make an eSignature for signing the Hartford Life Insurance Evidence Of Insurability Form in Gmail

How to create an eSignature for the Hartford Life Insurance Evidence Of Insurability Form straight from your smart phone

How to create an electronic signature for the Hartford Life Insurance Evidence Of Insurability Form on iOS devices

How to make an eSignature for the Hartford Life Insurance Evidence Of Insurability Form on Android

People also ask

-

What is the linkviaxrouter 'hi external metlifedisc' functionality?

The linkviaxrouter 'hi external metlifedisc' feature allows users to seamlessly integrate external links within the airSlate SignNow platform. This enhances workflow efficiency by enabling easy access to related materials or documents. It's an ideal solution for businesses looking to streamline their document signing process while maintaining external link connectivity.

-

How does the 'inchildwindow y' option benefit users?

The 'inchildwindow y' option provides users the ability to open documents in a child window, enhancing multitasking capabilities. This feature ensures that users can review, edit, or eSign documents without losing their place in the main interface. It's a convenient tool for those managing multiple documents simultaneously.

-

What is the benefit of using the 'window type external unmanaged' in document signing?

Using the 'window type external unmanaged' option can signNowly improve user experience during the document signing process. It allows users to open external documents in a way that keeps their primary workflow intact. This ensures that businesses can operate more fluidly while utilizing various document types.

-

Are there any integration options available for linkviaxrouter functionality?

Yes, the linkviaxrouter 'hi external metlifedisc' feature is designed to integrate seamlessly with various software solutions. This means you can connect your existing systems easily, enhancing your document management processes. Such integrations save time and reduce errors, making airSlate SignNow an efficient choice for businesses.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow provides several pricing plans to cater to different business needs. These plans are designed to be cost-effective, ensuring that organizations of all sizes can utilize the linkviaxrouter 'hi external metlifedisc' feature. The flexible pricing structures make it easy to choose the right plan for your specific requirements.

-

Can I customize the features related to linkviaxrouter 'hi external metlifedisc'?

Absolutely! airSlate SignNow allows users to customize features related to linkviaxrouter 'hi external metlifedisc' to better fit their workflow. From document templates to integration preferences, you can tailor the platform to address your unique signing needs effectively. Customization is key to maximizing productivity.

-

How secure is the signing process with linkviaxrouter functionality?

Security is a priority with airSlate SignNow, including the linkviaxrouter 'hi external metlifedisc' feature. The platform employs advanced encryption methods to protect sensitive data during the signing process. Users can trust that their documents are secure while they utilize the 'inchildwindow y' and other features.

Get more for The Hartford Evidence Of Insurability

- Nvc contact information united states department of state

- Alabama department of transportation special agreement for form

- Form med4 ampquotcustomer vision reportampquot virginia templateroller

- Disabled parking application for individuals application for disabled parking privileges for individuals form

- Illinois secretary of state mobile driver services facility form

- Fillable online dmv 185 trlegal heir affidavit fax email form

- How to get and read your ohio crash report bensinger form

- Hawthorne ln form

Find out other The Hartford Evidence Of Insurability

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast