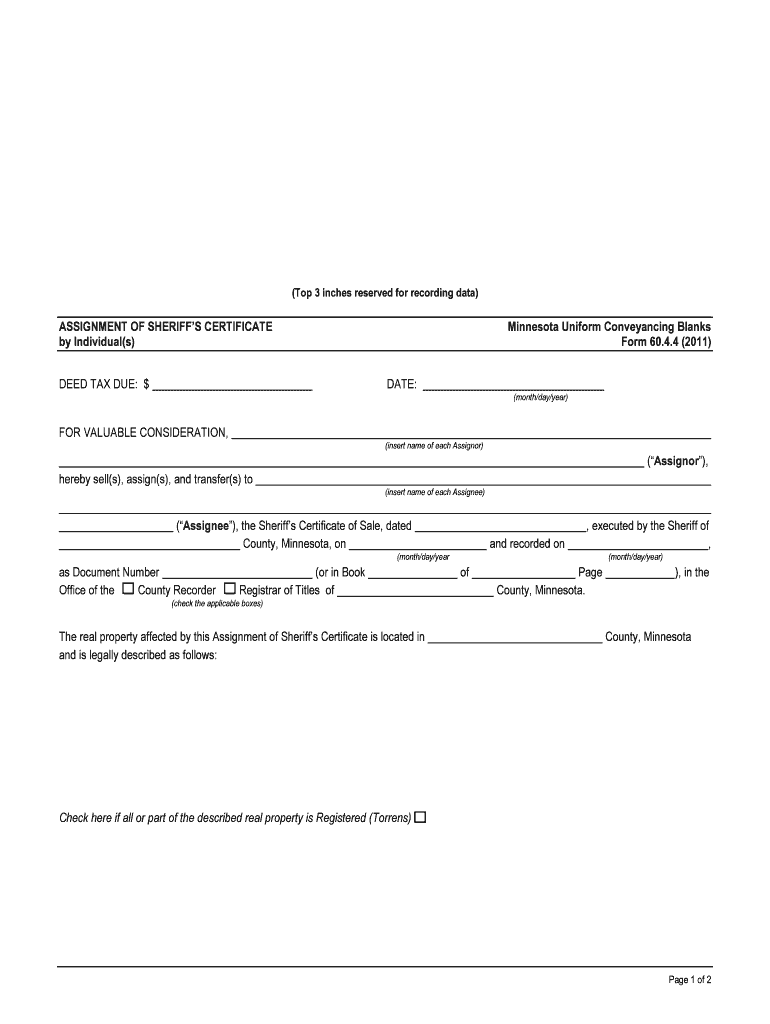

DEED TAX DUE Form

What is the DEED TAX DUE

The deed tax due refers to a tax levied on the transfer of real estate or property ownership. This tax is typically assessed by state or local governments and is calculated based on the sale price or value of the property being transferred. Understanding the deed tax due is crucial for both buyers and sellers, as it can impact the overall cost of a real estate transaction. The tax is often required to be paid at the time of closing, and failure to do so can result in penalties or delays in the transfer process.

How to use the DEED TAX DUE

Using the deed tax due form involves several steps to ensure compliance with local regulations. First, determine the applicable tax rate based on the property's location and sale price. Next, complete the deed tax due form accurately, providing all required information such as the property address, buyer and seller details, and the sale amount. Once the form is completed, it must be submitted along with the payment to the appropriate local tax authority. Keeping a copy of the submitted form and payment receipt is advisable for your records.

Steps to complete the DEED TAX DUE

Completing the deed tax due form requires careful attention to detail. Follow these steps:

- Gather necessary information, including property details and transaction amounts.

- Locate the specific deed tax due form for your state or locality.

- Fill out the form with accurate and complete information.

- Calculate the total tax due based on the applicable rates.

- Submit the form and payment to the relevant tax authority.

Legal use of the DEED TAX DUE

The legal use of the deed tax due form is essential for ensuring that property transfers comply with state and local laws. This form serves as a formal declaration of the transaction and the associated tax obligations. It is important to understand that submitting the deed tax due form is not just a formality; it is a legal requirement that protects both parties in the transaction. Proper completion and submission of this form help prevent future disputes regarding ownership and tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for the deed tax due can vary by state and locality, making it important to be aware of specific timelines. Generally, the form must be filed within a certain number of days following the property transfer. Missing these deadlines can lead to penalties or additional fees. It is advisable to check with your local tax authority for the exact deadlines and any important dates related to the deed tax due to ensure compliance.

Penalties for Non-Compliance

Failing to comply with the requirements for the deed tax due can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal complications regarding property ownership. Understanding the consequences of non-compliance is crucial for both buyers and sellers to avoid financial repercussions. It is advisable to consult with a tax professional or legal advisor if there are uncertainties regarding the deed tax due process.

Quick guide on how to complete deed tax due

Complete DEED TAX DUE seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle DEED TAX DUE on any device with airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

The easiest way to adjust and electronically sign DEED TAX DUE without stress

- Find DEED TAX DUE and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign DEED TAX DUE and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is deed tax due and why is it important?

Deed tax due refers to the taxes owed on property transfers, typically requiring payment at the time of a transaction. Understanding deed tax due is crucial for buyers and sellers as it can signNowly impact overall costs during real estate transactions. Accurately calculating deed tax due helps avoid unexpected financial liabilities.

-

How does airSlate SignNow assist with deed tax due documents?

airSlate SignNow provides an efficient platform for eSigning and managing documents related to deed tax due. Users can easily send, sign, and store essential paperwork, streamlining the process of complying with tax obligations. This enhances accuracy and efficiency in handling deed tax due documents.

-

What are the costs associated with using airSlate SignNow for deed tax due?

airSlate SignNow offers a range of pricing plans to cater to different business needs, ensuring that handling deed tax due is both affordable and effective. Plans are structured to provide flexibility, allowing users to choose features that best fit their requirements without overspending. Compare our pricing options to find the best fit for managing your deed tax due.

-

Can airSlate SignNow integrate with my existing tools for managing deed tax due?

Yes, airSlate SignNow easily integrates with various business applications, making it simple to manage deed tax due alongside your other software tools. This seamless integration enhances workflow efficiency, allowing you to handle documents and payments directly from the platforms you already use. Check our integrations page for a list of compatible applications.

-

What are the key benefits of using airSlate SignNow for deed tax due?

Using airSlate SignNow to manage deed tax due provides several benefits, including increased efficiency, reduced paperwork, and improved compliance. The platform's user-friendly interface makes it easy to track deadlines and ensure timely payment of deed tax due, ultimately saving you time and minimizing risks of penalties. Experience peace of mind knowing your transactions are handled professionally.

-

Is it easy to track deed tax due deadlines using airSlate SignNow?

Absolutely! airSlate SignNow features notifications and reminders that help you stay on top of important deed tax due deadlines. This ensures that you are consistently aware of upcoming obligations, signNowly reducing the risk of missing payments. With our platform, you can track all critical dates for deed tax due easily.

-

What types of documents can be managed regarding deed tax due?

With airSlate SignNow, you can manage a variety of documents related to deed tax due, including tax forms, transfer deeds, and payment confirmations. The platform allows for secure electronic signatures and document storage, streamlining the management process for all your deed tax due paperwork. This ensures you have everything you need in one accessible location.

Get more for DEED TAX DUE

- Development services contact uscity of edmontoncontactedmonton toweredmonton service centrecity of edmontonaboutedmonton tower form

- Loan guarantee form

- Award for fortitude or jack cornwell decoration scouts canada form

- Www signnow comfill and sign pdf form21935 howaccess a ride fill out and sign printable pdf template

- Pathology request healius form

- Continence related assistive technology assessment template form

- Residential tenancies regulation 2019schedule 2 c form

- Www moh gov jmwp contentuploadspharmwatch ministry of health drug monitoring form

Find out other DEED TAX DUE

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself