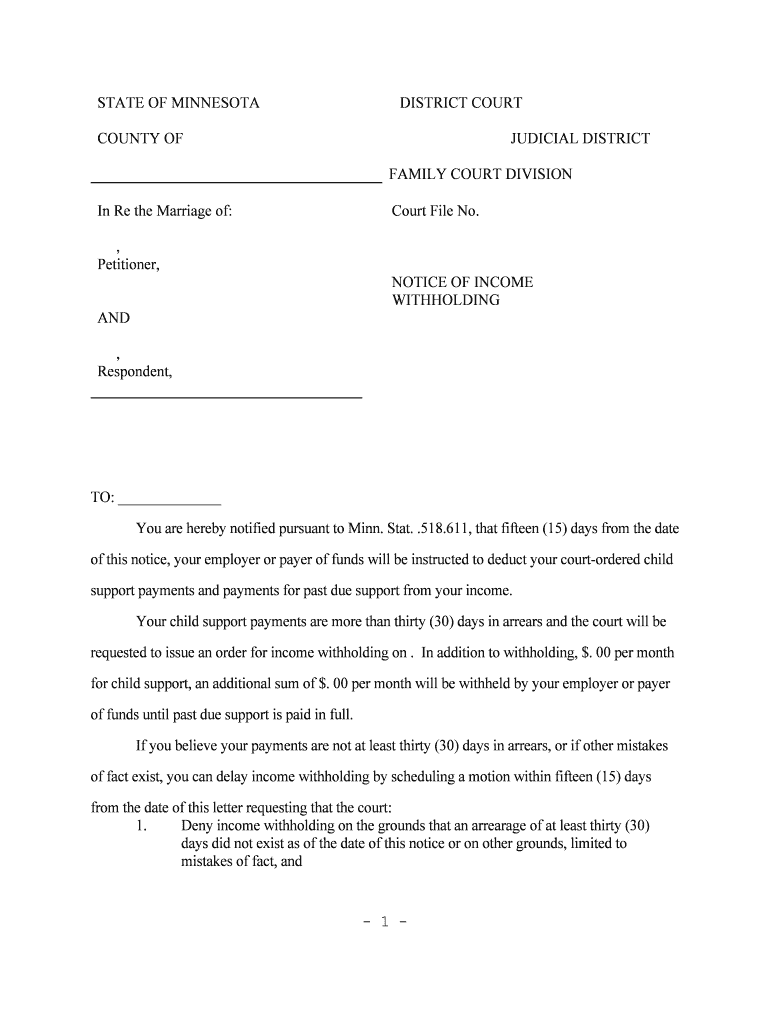

NOTICE of INCOME Form

What is the notice of income?

The notice of income is a formal document used to report various types of income received by an individual or business. This form is essential for tax reporting purposes and may include information on wages, interest, dividends, and other earnings. It serves as a record for both the taxpayer and the Internal Revenue Service (IRS), ensuring that all income is accurately reported and taxed accordingly. Understanding this document is crucial for compliance with federal and state tax regulations.

How to use the notice of income

Using the notice of income involves filling out the required information accurately and submitting it to the relevant tax authorities. This form can be utilized by individuals, businesses, or organizations to report income received during a specific period. It is important to ensure that all figures are correct and that the form is submitted by the appropriate deadlines. This helps in avoiding penalties and ensures that tax obligations are met efficiently.

Steps to complete the notice of income

Completing the notice of income requires careful attention to detail. Follow these steps for accurate completion:

- Gather all necessary income documentation, such as W-2s, 1099s, and any other relevant financial records.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income, ensuring to categorize them correctly (e.g., wages, interest, dividends).

- Double-check all entries for accuracy before finalizing the form.

- Submit the completed notice of income to the IRS or the appropriate state tax agency by the designated deadline.

Legal use of the notice of income

The notice of income is legally binding when filled out and submitted according to IRS guidelines. It is essential to ensure compliance with all applicable laws and regulations to avoid potential legal issues. The form must be signed and dated, and it is advisable to keep a copy for personal records. Proper use of this document helps in maintaining transparency with tax authorities and can serve as evidence in case of audits.

Key elements of the notice of income

Several key elements must be included in the notice of income to ensure its validity:

- Personal Information: This includes the taxpayer's name, address, and Social Security number.

- Income Sources: Clearly list all sources of income, such as employment wages, freelance work, and investment earnings.

- Tax Year: Specify the tax year for which the income is being reported.

- Signature: The form must be signed and dated by the individual or authorized representative.

Filing deadlines / Important dates

Filing deadlines for the notice of income are crucial to avoid penalties. Typically, the IRS requires that this form be submitted by April 15 of the following tax year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to stay informed about any changes in deadlines and to plan accordingly to ensure timely submission.

Quick guide on how to complete notice of income

Effortlessly prepare NOTICE OF INCOME on any device

Digital document management has surged in popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without interruptions. Manage NOTICE OF INCOME on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign NOTICE OF INCOME with minimal hassle

- Find NOTICE OF INCOME and select Get Form to begin.

- Utilize the tools provided to finalize your document.

- Highlight important sections of your documents or redact sensitive details with tools specifically designed for that by airSlate SignNow.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to store your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign NOTICE OF INCOME and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a NOTICE OF INCOME?

A NOTICE OF INCOME is a document that provides detailed information about an individual's or business's income. It’s essential for tax reporting purposes and can also be used for loan applications or financial assessments. Using airSlate SignNow, you can efficiently create and manage your NOTICE OF INCOME documents, ensuring they are signed and stored securely.

-

How can airSlate SignNow help me with my NOTICE OF INCOME?

airSlate SignNow allows you to easily create, send, and eSign your NOTICE OF INCOME documents. The platform’s user-friendly design ensures that you can quickly navigate through the process without needing extensive technical knowledge. With customizable templates, you can streamline the preparation of your NOTICE OF INCOME.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to cater to various business needs, starting from a free trial to more comprehensive paid options. Each plan allows you to manage multiple NOTICE OF INCOME documents and provides access to essential features such as templates and automated notifications. Choose the plan that best fits your volume of document management.

-

Is it secure to eSign my NOTICE OF INCOME with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. The platform complies with industry-standard encryption and security protocols, ensuring that your NOTICE OF INCOME documents are safe from unauthorized access. eSigning your documents is not only secure but also legally binding, making it a reliable method of obtaining signatures.

-

Can I integrate airSlate SignNow with other tools I use?

Absolutely! airSlate SignNow offers seamless integration with various third-party applications and services, making it easier to manage your NOTICE OF INCOME alongside your existing workflows. Whether you’re using CRM tools, cloud storage, or project management software, integration helps streamline the whole process.

-

What features are included with airSlate SignNow for managing NOTICE OF INCOME?

With airSlate SignNow, you can take advantage of features such as document templates, bulk sending, workflow automation, and instant notifications. These features are designed to enhance the handling of your NOTICE OF INCOME documents, making the signing and management process efficient and organized. The platform is equipped to handle all aspects of document management.

-

How can airSlate SignNow improve my workflow for NOTICE OF INCOME documents?

airSlate SignNow automates tedious processes associated with handling NOTICE OF INCOME documents, leading to faster turnaround times. By using features like automated reminders and template management, your team can focus on more critical tasks while the software takes care of the document routing and signature collection. Streamlining your workflow reduces the risk of errors and delays.

Get more for NOTICE OF INCOME

Find out other NOTICE OF INCOME

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free