Application for a Refund of Overdeducted CPP Contributions or EI Premiums Pd24 22e PDF Form

What is the Application for a Refund of Overdeducted CPP Contributions or EI Premiums (PD24)?

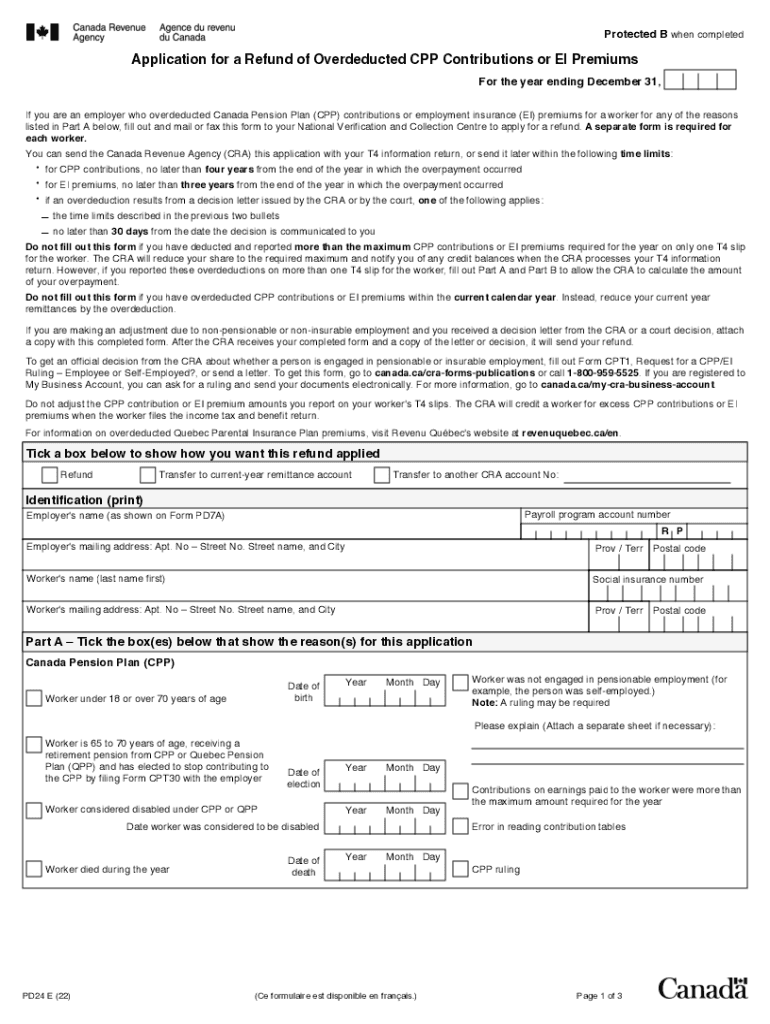

The PD24 form is an official application used in Canada to request a refund for overdeducted Canada Pension Plan (CPP) contributions or Employment Insurance (EI) premiums. This form is essential for individuals who have had excess amounts deducted from their paychecks due to various employment circumstances. Understanding the purpose of the PD24 is crucial for anyone seeking to reclaim funds that may have been incorrectly withheld.

How to Use the PD24 Form

Using the PD24 form involves several straightforward steps to ensure a successful application. First, gather all necessary information, including your Social Insurance Number (SIN), details of your employment, and the amounts overpaid. Next, accurately fill out the form, providing all required information to avoid delays. Once completed, the form can be submitted to the appropriate authority for processing, ensuring you follow any specific submission guidelines provided by the Canada Revenue Agency (CRA).

Steps to Complete the PD24 Form

Completing the PD24 form requires careful attention to detail. Begin by downloading the form from the official CRA website. Fill in your personal information, including your name, address, and SIN. Next, indicate the amounts you believe were overdeducted for both CPP and EI. It is important to attach any supporting documents that verify your claims, such as pay stubs or tax documents. Finally, review the form for accuracy before submitting it to ensure that your application is processed without issues.

Eligibility Criteria for the PD24 Form

To be eligible to submit the PD24 form, individuals must have experienced overdeductions in their CPP contributions or EI premiums during their employment. This typically occurs in situations where an employee has multiple jobs or has earned income that fluctuates throughout the year. It is essential to verify that the deductions exceed the allowable limits set by the CRA to qualify for a refund.

Form Submission Methods for the PD24

The PD24 form can be submitted through various methods, depending on the preferences of the applicant. Individuals can choose to mail the completed form to the designated CRA address, ensuring that it is sent to the correct location for processing. Alternatively, some applicants may have the option to submit the form electronically through the CRA's online services, which can expedite the review and approval process. Always check the CRA guidelines for the most current submission options.

Key Elements of the PD24 Form

Understanding the key elements of the PD24 form is vital for its successful completion. The form requires personal identification information, including the applicant's name, address, and SIN. Additionally, it must detail the amounts overpaid for both CPP and EI, along with the relevant pay periods. Providing accurate and complete information is crucial, as any discrepancies can lead to delays or denials in processing the refund request.

Important Dates for Filing the PD24 Form

Filing deadlines for the PD24 form are critical for ensuring timely processing of your refund request. Applicants should be aware of the CRA's annual deadlines for submitting refund applications, which may vary based on personal circumstances and the type of employment. It is advisable to file the PD24 form as soon as overdeductions are identified to avoid missing any important deadlines that could affect the refund process.

Quick guide on how to complete application for a refund of overdeducted cpp contributions or ei premiums pd24 22e pdf

Effortlessly Prepare Application For A Refund Of Overdeducted CPP Contributions Or EI Premiums Pd24 22e pdf on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Application For A Refund Of Overdeducted CPP Contributions Or EI Premiums Pd24 22e pdf on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

The Easiest Way to Modify and Electronically Sign Application For A Refund Of Overdeducted CPP Contributions Or EI Premiums Pd24 22e pdf with Ease

- Obtain Application For A Refund Of Overdeducted CPP Contributions Or EI Premiums Pd24 22e pdf and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of the documents or cover sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature utilizing the Sign feature, which takes only seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, either by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, and mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Application For A Refund Of Overdeducted CPP Contributions Or EI Premiums Pd24 22e pdf and ensure excellent communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for a refund of overdeducted cpp contributions or ei premiums pd24 22e pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pd24 form and how can I use it with airSlate SignNow?

The pd24 form is a document that can be electronically signed and managed using airSlate SignNow. With our platform, you can easily upload, send, and eSign the pd24 form, making it efficient for businesses to handle paperwork without the hassle of printing or scanning.

-

Is airSlate SignNow compliant with pd24 form signing requirements?

Yes, airSlate SignNow is fully compliant with all legal standards for eSigning, including those related to the pd24 form. Our platform ensures that your signed pd24 forms are secure, legally binding, and easily accessible for record-keeping.

-

What features does airSlate SignNow offer for managing the pd24 form?

airSlate SignNow offers a variety of features to manage the pd24 form effectively, including customizable templates, secure document sharing, and real-time status tracking. These tools help streamline the signing process, ensuring that all parties can easily access and complete the pd24 form.

-

How much does it cost to use airSlate SignNow for the pd24 form?

Pricing for airSlate SignNow varies based on the plan you choose, but we offer cost-effective solutions for businesses of all sizes. You can expect affordable rates that provide excellent value for managing your pd24 form and other essential documents.

-

Can I integrate airSlate SignNow with other software while handling the pd24 form?

Absolutely! airSlate SignNow offers seamless integrations with popular software and platforms, allowing you to work efficiently with the pd24 form. Whether you use CRM systems, cloud storage services, or other applications, integrating our solution can enhance your workflows.

-

What are the benefits of using airSlate SignNow for the pd24 form?

Using airSlate SignNow for the pd24 form provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform allows for fast, digital transactions, which can signNowly improve your business efficiency and client satisfaction.

-

Is there a mobile app for airSlate SignNow to manage the pd24 form?

Yes, airSlate SignNow offers a mobile application that enables you to manage the pd24 form on the go. This allows users to send, sign, and track their documents anytime, anywhere, ensuring flexibility and convenience for busy professionals.

Get more for Application For A Refund Of Overdeducted CPP Contributions Or EI Premiums Pd24 22e pdf

Find out other Application For A Refund Of Overdeducted CPP Contributions Or EI Premiums Pd24 22e pdf

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form