, MISSISSIPPI STATE TAX COMMISSION, Form

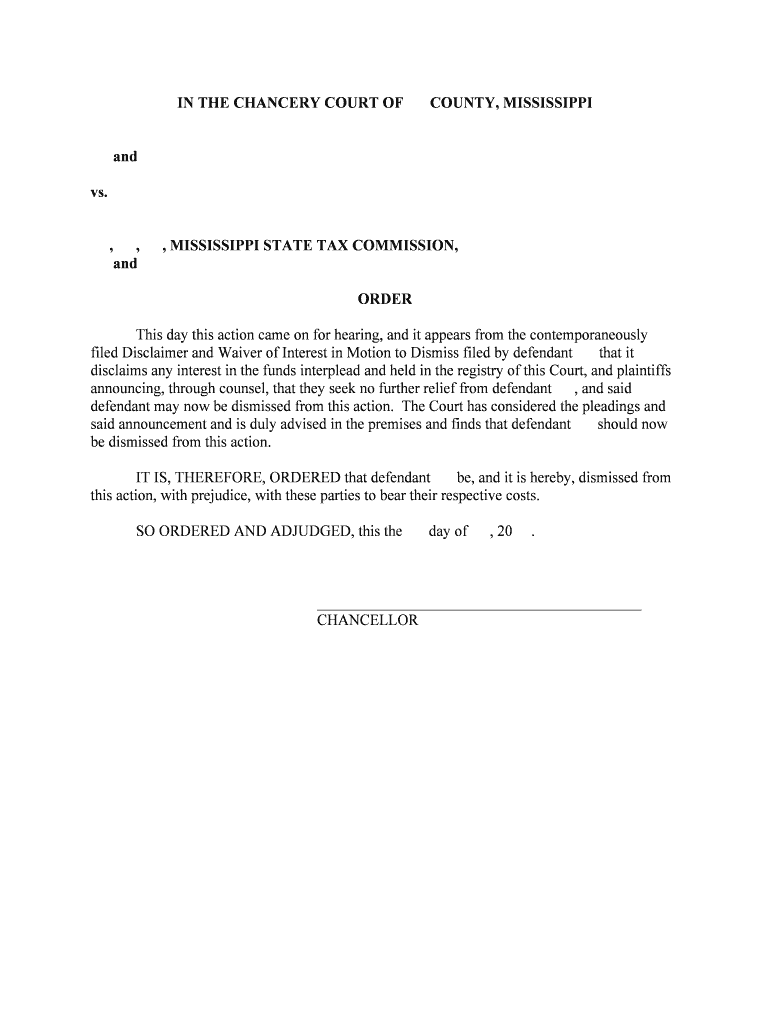

What is the Mississippi State Tax Commission?

The Mississippi State Tax Commission is the governing body responsible for managing and enforcing tax laws within the state of Mississippi. This commission oversees various tax-related activities, including the assessment and collection of state taxes, ensuring compliance with tax regulations, and providing guidance to taxpayers. It plays a crucial role in the administration of state tax policies, including income tax, sales tax, and property tax. The commission also offers resources and support to help individuals and businesses understand their tax obligations.

How to obtain the Mississippi State Tax Commission form

To obtain the Mississippi State Tax Commission form, individuals can visit the official website of the commission, where forms are available for download. These forms can typically be found in the forms section, categorized by type of tax or purpose. Alternatively, taxpayers can request forms directly from the commission's office by contacting them via phone or email. It is essential to ensure that you are using the most current version of the form, as tax regulations and requirements may change over time.

Steps to complete the Mississippi State Tax Commission form

Completing the Mississippi State Tax Commission form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements, previous tax returns, and any relevant financial records. Next, carefully read the instructions provided with the form to understand the specific requirements. Fill out the form completely, ensuring that all information is accurate and up to date. After completing the form, review it for any errors before submitting it. Finally, choose a submission method—either electronically or by mail—and ensure it is sent before the deadline.

Legal use of the Mississippi State Tax Commission form

The Mississippi State Tax Commission form is legally binding when completed and submitted according to the state's tax laws. To ensure its legal validity, the form must be signed by the taxpayer or an authorized representative. Digital signatures are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations. It is crucial to retain a copy of the submitted form and any supporting documents for your records, as these may be needed for future reference or in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Mississippi State Tax Commission form vary depending on the type of tax being filed. Generally, individual income tax returns must be filed by April 15 of each year. However, extensions may be available under certain circumstances. It is important to stay informed about specific deadlines for various forms, as late submissions may incur penalties and interest. Taxpayers should regularly check the Mississippi State Tax Commission's website for updates on deadlines and any changes to tax laws that may affect filing dates.

Required Documents

When completing the Mississippi State Tax Commission form, certain documents are typically required to support your submission. These may include proof of income, such as W-2 forms or 1099 forms, documentation of deductions and credits, and previous tax returns. Additionally, if applicable, records of any estimated tax payments made throughout the year should be included. Ensuring that all required documents are attached will facilitate the processing of your form and help avoid delays or issues with your tax return.

Penalties for Non-Compliance

Failing to comply with the requirements of the Mississippi State Tax Commission can result in various penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for willful non-compliance. It is essential for taxpayers to understand their obligations and to file their forms accurately and on time to avoid these penalties. Regularly reviewing tax responsibilities and seeking assistance when needed can help ensure compliance and mitigate the risks associated with non-compliance.

Quick guide on how to complete mississippi state tax commission

Easily Prepare , MISSISSIPPI STATE TAX COMMISSION, on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Handle , MISSISSIPPI STATE TAX COMMISSION, on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Edit and Electronically Sign , MISSISSIPPI STATE TAX COMMISSION, Effortlessly

- Obtain , MISSISSIPPI STATE TAX COMMISSION, and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign , MISSISSIPPI STATE TAX COMMISSION, and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of the MISSISSIPPI STATE TAX COMMISSION in document eSigning?

The MISSISSIPPI STATE TAX COMMISSION oversees the compliance and regulations related to tax documents in Mississippi. Using airSlate SignNow, businesses can efficiently prepare and eSign documents that meet the necessary requirements set by the commission, ensuring legal compliance.

-

How can airSlate SignNow help with tax filing for the MISSISSIPPI STATE TAX COMMISSION?

airSlate SignNow streamlines the process of preparing, signing, and submitting tax documents to the MISSISSIPPI STATE TAX COMMISSION. With its easy-to-use platform, users can quickly gather signatures and organize all required paperwork for timely submissions.

-

What are the pricing plans for airSlate SignNow tailored to activities involving the MISSISSIPPI STATE TAX COMMISSION?

airSlate SignNow offers competitive pricing plans that cater to businesses needing to interact with the MISSISSIPPI STATE TAX COMMISSION. Users can choose between various subscription models depending on their volume of documents and features needed, ensuring a cost-effective solution for eSigning.

-

Does airSlate SignNow offer features that comply with Mississippi state regulations?

Yes, airSlate SignNow is designed to comply with Mississippi state regulations, including those set by the MISSISSIPPI STATE TAX COMMISSION. The platform ensures that all electronic signatures meet legal standards, allowing businesses to confidently manage their tax-related documents.

-

Can I integrate airSlate SignNow with my accounting software for dealing with the MISSISSIPPI STATE TAX COMMISSION?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage documents related to the MISSISSIPPI STATE TAX COMMISSION. This integration streamlines your workflow by linking tax documents directly with your accounting processes.

-

What are the benefits of using airSlate SignNow when working with the MISSISSIPPI STATE TAX COMMISSION?

Using airSlate SignNow offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance when dealing with the MISSISSIPPI STATE TAX COMMISSION. The platform’s user-friendly interface allows for quick document preparation and eSigning, saving time and reducing errors.

-

Is the airSlate SignNow platform secure for documents related to the MISSISSIPPI STATE TAX COMMISSION?

Yes, security is a top priority for airSlate SignNow. The platform employs advanced encryption technologies to ensure that all documents related to the MISSISSIPPI STATE TAX COMMISSION are safely stored and transmitted, protecting sensitive information from unauthorized access.

Get more for , MISSISSIPPI STATE TAX COMMISSION,

Find out other , MISSISSIPPI STATE TAX COMMISSION,

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney