Unrelated Business Income Tax Ubit Finance & Accounting 2022

Understanding Unrelated Business Income Tax (UBIT)

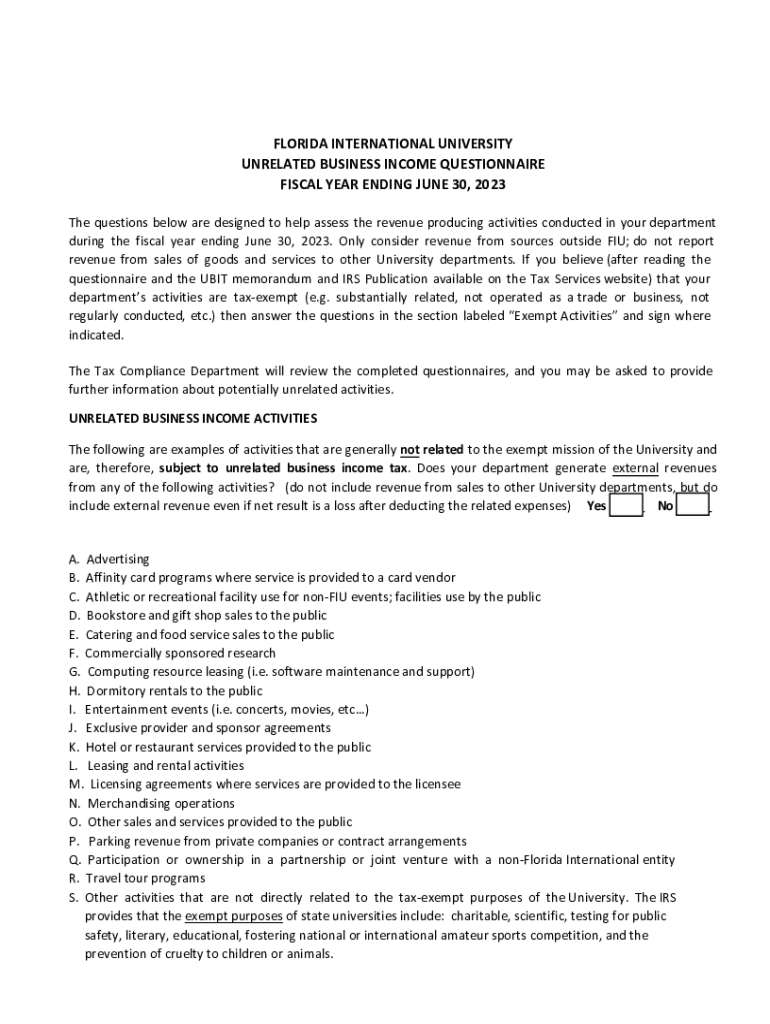

The Unrelated Business Income Tax (UBIT) applies to tax-exempt organizations that engage in business activities unrelated to their exempt purpose. This tax is designed to level the playing field between tax-exempt organizations and for-profit businesses. When a tax-exempt entity generates income from activities not substantially related to its mission, it may be subject to UBIT. This includes income from advertising, rental properties, and other business ventures that do not directly support the organization's primary purpose.

Steps to Complete the Unrelated Business Income Tax Form

Completing the UBIT form involves several important steps. First, organizations must determine if their income qualifies as unrelated business income. Next, they should calculate the total unrelated business taxable income, which may involve deducting certain expenses directly related to the business activities. After calculating the taxable income, the organization must fill out the appropriate IRS form, typically Form 990-T, and ensure all required information is included. Finally, the completed form should be submitted to the IRS by the designated deadline.

Key Elements of the Unrelated Business Income Tax

Several key elements define UBIT. These include:

- Definition of Unrelated Business Income: Income generated from activities that are not substantially related to the organization’s exempt purpose.

- Exemptions: Certain types of income, such as dividends, interest, and royalties, are generally exempt from UBIT.

- Calculating UBIT: Organizations must accurately calculate their unrelated business taxable income by deducting allowable expenses.

- Filing Requirements: Organizations must file Form 990-T if they have $1,000 or more in gross income from unrelated business activities.

IRS Guidelines for Unrelated Business Income Tax

The IRS provides specific guidelines regarding UBIT, which organizations must follow to ensure compliance. These guidelines outline what constitutes unrelated business income, the types of expenses that can be deducted, and the filing requirements. Organizations should familiarize themselves with these guidelines to avoid penalties and ensure accurate reporting of their unrelated business income.

Filing Deadlines and Important Dates

Organizations must adhere to specific deadlines when filing for UBIT. Generally, Form 990-T is due on the 15th day of the fifth month after the end of the organization’s tax year. If the organization operates on a calendar year, the form would typically be due by May 15. Extensions may be available, but organizations should be aware that any tax owed must still be paid by the original due date to avoid penalties.

Required Documents for Filing UBIT

To file for UBIT, organizations need to gather several key documents, including:

- Financial statements detailing income and expenses from unrelated business activities.

- Records of any deductions claimed related to the business activities.

- Previous tax returns, if applicable, to provide context for the current filing.

Having these documents ready will streamline the filing process and help ensure compliance with IRS regulations.

Quick guide on how to complete unrelated business income tax ubit finance amp accounting

Complete Unrelated Business Income Tax ubit Finance & Accounting effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without any delays. Manage Unrelated Business Income Tax ubit Finance & Accounting on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Unrelated Business Income Tax ubit Finance & Accounting effortlessly

- Find Unrelated Business Income Tax ubit Finance & Accounting and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to store your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Alter and eSign Unrelated Business Income Tax ubit Finance & Accounting and guarantee outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct unrelated business income tax ubit finance amp accounting

Create this form in 5 minutes!

How to create an eSignature for the unrelated business income tax ubit finance amp accounting

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Unrelated Business Income Tax (UBIT) and why is it important in Finance & Accounting?

Unrelated Business Income Tax (UBIT) is a tax imposed on income generated from activities not substantially related to an organization's primary purpose. In Finance & Accounting, understanding UBIT is crucial for non-profits and other tax-exempt organizations to ensure compliance and optimize revenue streams without jeopardizing their tax-exempt status.

-

How does airSlate SignNow support organizations dealing with Unrelated Business Income Tax (UBIT)?

airSlate SignNow provides an easy-to-use platform for managing documents related to Unrelated Business Income Tax (UBIT) efficiently. By simplifying the document signing and management process, organizations can focus more on compliance and less on administrative tasks, ensuring they handle UBIT properly in their Finance & Accounting practices.

-

Is there a specific pricing structure for groups who need to handle Unrelated Business Income Tax (UBIT)?

Yes, airSlate SignNow offers flexible pricing plans designed to accommodate the needs of organizations managing Unrelated Business Income Tax (UBIT) documentation. These plans allow users to choose a solution that fits their budget while providing essential features tailored for Finance & Accounting applications.

-

What features does airSlate SignNow offer that are beneficial for managing Unrelated Business Income Tax (UBIT)?

airSlate SignNow offers features like document templates, customizable workflows, and secure eSignature capabilities, which are all beneficial for managing Unrelated Business Income Tax (UBIT). These features streamline the document flow related to UBIT, allowing organizations to maintain accurate records and enhance tax compliance in their Finance & Accounting processes.

-

Can airSlate SignNow integrate with existing Finance & Accounting software for UBIT management?

Yes, airSlate SignNow can integrate seamlessly with many popular Finance & Accounting software solutions. This integration allows users to synchronize their UBIT documents with their accounting systems, ensuring that all financial data is consistent and accurate, thus simplifying the management of Unrelated Business Income Tax (UBIT).

-

How can airSlate SignNow help in improving efficiency for managing UBIT-related documents?

By using airSlate SignNow, businesses can signNowly improve efficiency in managing UBIT-related documents through automated workflows and electronic signatures. This minimizes the time spent on manual processes and enhances collaboration among team members, allowing for faster completion of finance and accounting tasks related to Unrelated Business Income Tax (UBIT).

-

What benefits can organizations expect when using airSlate SignNow for UBIT documentation?

Organizations using airSlate SignNow for UBIT documentation can expect increased accuracy, reduced processing time, and enhanced compliance with tax regulations. The platform's robust features make it easier to manage Unrelated Business Income Tax (UBIT) paperwork, contributing to overall improvements in Finance & Accounting operations.

Get more for Unrelated Business Income Tax ubit Finance & Accounting

- Annual gala benefiting womens health at form

- Bangor union elementary school mission and goals form

- Ca low income assistance form

- Medical history questionnaire concourse optometry 450182972 form

- Setting smart goals ampamp january goal sheets justin ampamp mary form

- Consent to cosmetic mesotherapy treatment bdrrohdebbcomb form

- Babysitter information sheet pdf 11910467

- Supplemental fringe benefit fund sfbfveba form

Find out other Unrelated Business Income Tax ubit Finance & Accounting

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement