Florida Discretionary Sales Surtax Finance & Accounting 2022

Understanding the Florida Discretionary Sales Surtax

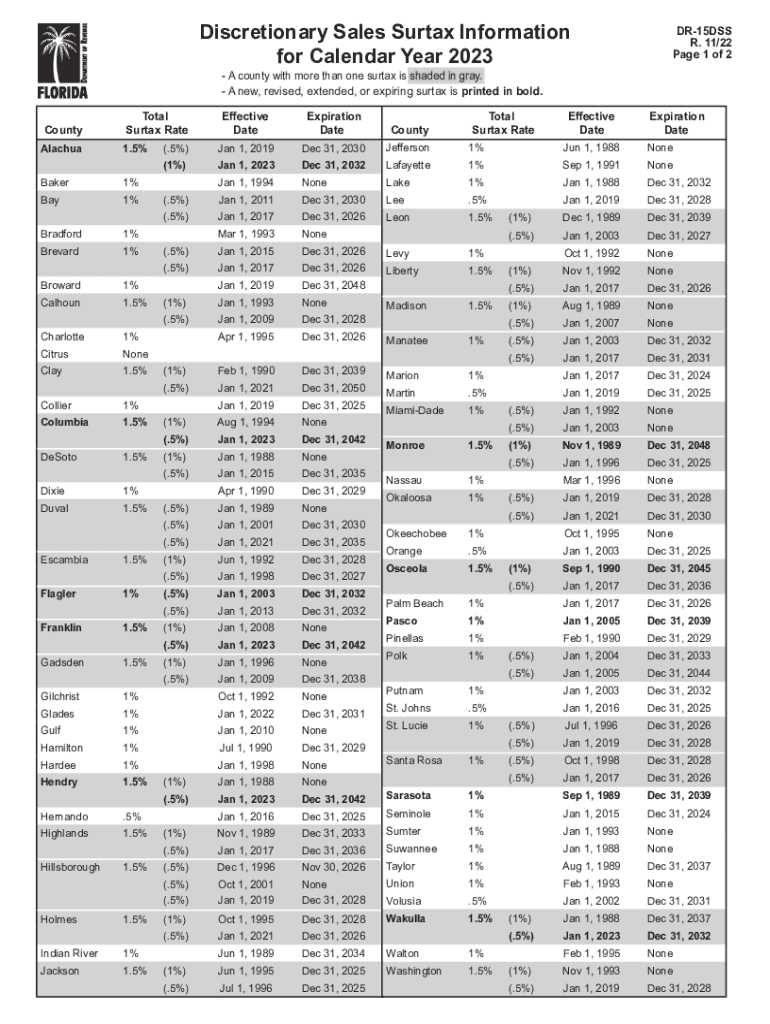

The Florida Discretionary Sales Surtax is an additional tax imposed by local governments on top of the state sales tax. This tax is utilized to fund various local initiatives, including education, infrastructure, and public safety. The rate of the surtax varies by county, allowing local governments to tailor the tax to their specific needs. It is essential for businesses and individuals to understand how this surtax impacts their financial obligations and pricing strategies.

Steps to Complete the Florida Discretionary Sales Surtax

Completing the Florida Discretionary Sales Surtax involves several key steps:

- Determine the applicable surtax rate for your county.

- Collect sales tax from customers, including both the state and local surtax amounts.

- Accurately report the total sales and the collected surtax on your sales tax return.

- Submit the sales tax return and remit the collected funds to the Florida Department of Revenue by the due date.

Ensuring accuracy in these steps is vital to avoid penalties and ensure compliance with state regulations.

Required Documents for Filing

When filing for the Florida Discretionary Sales Surtax, several documents are essential:

- Sales tax return forms, which may vary based on your business structure.

- Records of all sales transactions, including receipts and invoices.

- Documentation supporting any exemptions claimed, if applicable.

Maintaining organized records will facilitate a smoother filing process and help in case of audits.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Florida Discretionary Sales Surtax. Typically, businesses must file their returns on a monthly or quarterly basis, depending on their sales volume. Key deadlines include:

- Monthly filers must submit their returns by the 20th of the following month.

- Quarterly filers need to submit their returns by the last day of the month following the quarter.

Staying informed about these deadlines can help avoid late fees and penalties.

Legal Use of the Florida Discretionary Sales Surtax

The legal framework governing the Florida Discretionary Sales Surtax is established by state law. Local governments have the authority to impose this surtax, but they must comply with specific regulations, including public referendums in some cases. Understanding the legal implications is important for both businesses and consumers, as improper collection or reporting can lead to legal issues.

Examples of Using the Florida Discretionary Sales Surtax

Businesses in Florida may encounter various scenarios involving the Discretionary Sales Surtax:

- A retail store in a county with a one percent surtax must add this amount to the total sales tax charged to customers.

- A service provider in a different county with no surtax will only charge the state sales tax.

These examples illustrate how the surtax can affect pricing and customer transactions across different regions.

Quick guide on how to complete florida discretionary sales surtax finance ampamp accounting

Complete Florida Discretionary Sales Surtax Finance & Accounting effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without holdups. Manage Florida Discretionary Sales Surtax Finance & Accounting on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Florida Discretionary Sales Surtax Finance & Accounting with ease

- Locate Florida Discretionary Sales Surtax Finance & Accounting and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then press the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or misprints requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Florida Discretionary Sales Surtax Finance & Accounting while ensuring outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida discretionary sales surtax finance ampamp accounting

Create this form in 5 minutes!

How to create an eSignature for the florida discretionary sales surtax finance ampamp accounting

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Florida Discretionary Sales Surtax and how does it relate to Finance & Accounting?

The Florida Discretionary Sales Surtax is an additional sales tax applied at the local level, specifically designed to provide funding for local projects. In terms of Finance & Accounting, it impacts how businesses calculate sales tax liabilities, necessitating accurate record-keeping and reporting to ensure compliance with regulations.

-

How can airSlate SignNow assist with Florida Discretionary Sales Surtax documentation?

airSlate SignNow streamlines the process of sending and signing documents related to the Florida Discretionary Sales Surtax. Our platform ensures that your contracts and tax-related documents are securely eSigned and stored, making it easier for businesses to maintain organized financial records.

-

What features does airSlate SignNow offer for managing Florida Discretionary Sales Surtax transactions?

Our platform provides features like customizable templates, bulk sending, and real-time tracking, all tailored for managing documentation associated with the Florida Discretionary Sales Surtax. These features help businesses ensure that all necessary documents are prepared correctly and submitted on time.

-

Is airSlate SignNow cost-effective for small businesses dealing with Florida Discretionary Sales Surtax?

Yes, airSlate SignNow offers a cost-effective solution for small businesses managing the complexities of the Florida Discretionary Sales Surtax. Our pricing plans are designed to fit a variety of budgets, allowing small businesses to leverage professional eSigning capabilities without breaking the bank.

-

Can I integrate airSlate SignNow with my existing Finance & Accounting software?

Absolutely! airSlate SignNow seamlessly integrates with various Finance & Accounting software, allowing you to create a smooth workflow for managing Florida Discretionary Sales Surtax documentation. This integration ensures that all your data is synchronized, improving efficiency and accuracy in your financial processes.

-

What are the benefits of using airSlate SignNow for Florida Discretionary Sales Surtax eSigning?

Using airSlate SignNow simplifies the eSigning process for Florida Discretionary Sales Surtax documents, enhancing speed and reducing paper waste. The secure electronic signatures ensure legal compliance, and the easy access to documents enhances collaboration among stakeholders in your Finance & Accounting team.

-

Does airSlate SignNow comply with Florida state laws regarding the Discretionary Sales Surtax?

Yes, airSlate SignNow adheres to all Florida state laws, ensuring that your use of our eSigning services for Florida Discretionary Sales Surtax documentation is legally compliant. We stay updated on legal requirements, so you can focus on your business without worrying about compliance issues.

Get more for Florida Discretionary Sales Surtax Finance & Accounting

- Tax preparation agreement and privacy disclosure january form

- 85 lincoln street framingham ma 01702 form

- Personal injury questionnaire bbrombergchiropracticbbcomb form

- Medical release form capital soccer association

- Nyc department of finance parking tax exemption form

- Broken arrow neighbors community garden growing generosity form

- Choctaw nation cdib membership form

- Property controlloss list form

Find out other Florida Discretionary Sales Surtax Finance & Accounting

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer