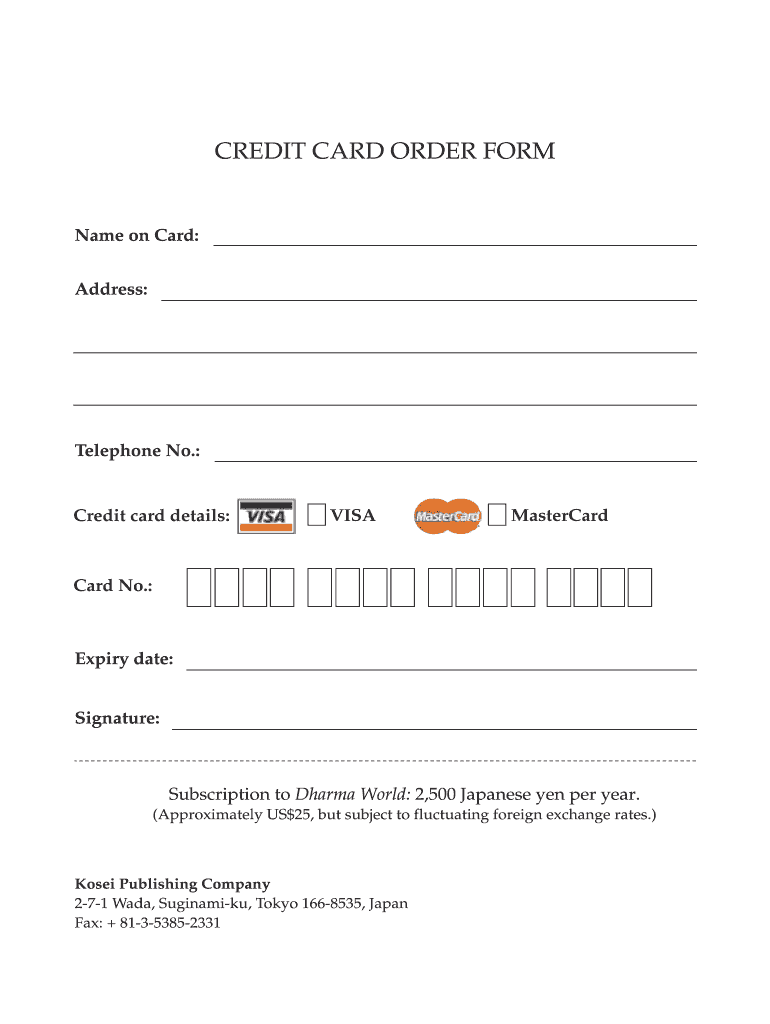

CREDIT CARD ORDER FORM

What is the credit card order form

The credit card order form is a document used by businesses and individuals to request a credit card. This form typically includes personal information, such as the applicant's name, address, and social security number, as well as financial details like income and employment status. It serves as a formal request to a financial institution to issue a credit card to the applicant, allowing them to access credit for purchases and transactions.

Steps to complete the credit card order form

Completing the credit card order form involves several straightforward steps:

- Gather personal information: Collect necessary details, including your name, address, date of birth, and social security number.

- Provide financial information: Input your employment details, income level, and any existing debts.

- Review terms and conditions: Read the credit card issuer's terms, including interest rates and fees, to ensure you understand the agreement.

- Sign and submit: Sign the form to certify that the information provided is accurate and submit it to the credit card issuer, either online or via mail.

How to use the credit card order form

The credit card order form is used primarily to apply for a new credit card. To utilize the form effectively, follow these guidelines:

- Ensure all information is accurate and complete to avoid delays in processing.

- Submit the form through the preferred method of the credit card issuer, which may include online submission or mailing a physical copy.

- Keep a copy of the completed form for your records, as it may be useful for future reference.

Legal use of the credit card order form

When filling out the credit card order form, it is crucial to ensure compliance with legal standards. This includes:

- Providing truthful information to avoid issues related to fraud or misrepresentation.

- Understanding the legal implications of signing the form, which may bind you to the terms of the credit card agreement.

- Being aware of consumer protection laws that apply to credit card applications, ensuring your rights are protected throughout the process.

Key elements of the credit card order form

The credit card order form typically includes several key components:

- Personal details: Name, address, and contact information.

- Financial information: Employment status, income, and existing financial obligations.

- Credit card preferences: Desired credit limit and type of card.

- Signature: A section for the applicant's signature to authorize the application.

Form submission methods

The credit card order form can be submitted through various methods, depending on the issuer's preferences:

- Online: Many issuers allow applicants to fill out and submit the form electronically through their website.

- Mail: Applicants may download a printable version of the form, complete it, and send it to the issuer's designated address.

- In-person: Some financial institutions may offer the option to complete the form at a branch location with assistance from a representative.

Quick guide on how to complete credit card order form

The simplest method to obtain and sign CREDIT CARD ORDER FORM

On the scale of an entire organization, ineffective procedures related to paper approvals can consume a signNow amount of work hours. Signing papers like CREDIT CARD ORDER FORM is an inherent aspect of operations across all sectors, which is why the effectiveness of each agreement's lifecycle impacts the overall productivity of the business. With airSlate SignNow, signing your CREDIT CARD ORDER FORM can be as straightforward and swift as possible. You will discover on this platform the latest version of nearly any document. Even better, you can sign it immediately without having to install external software on your computer or printing anything as hard copies.

How to obtain and sign your CREDIT CARD ORDER FORM

- Browse our collection by category or use the search box to locate the document you require.

- View the document preview by clicking on Learn more to ensure it’s the correct one.

- Click Get form to start editing instantly.

- Complete your document and include any required information using the toolbar.

- Once finished, click the Sign tool to authorize your CREDIT CARD ORDER FORM.

- Select the signature method that is most suitable for you: Draw, Generate initials, or upload a photo of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as needed.

With airSlate SignNow, you possess everything necessary to manage your documents efficiently. You can discover, fill out, modify, and even send your CREDIT CARD ORDER FORM in a single tab without any complications. Optimize your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Why is Ikea requiring me to email them my credit card information in order to make a lousy appointment to see a kitchen planner? They’re requiring me to fill out forms, scan them, and email back.

The reason they are requiring your credit card information is because Ikea’s kitchen planning service isn’t free. In some cases, a portion of the planning and/or measuring fees may be reimbursed when you place your kitchen purchase, but the details may vary from store to store.

-

Why do racial minorities disproportionately make up the American prison population?

Remember what Macy’s did to Black and Hispanic shoppers?Macy’s used to stop them in the middle of the store, take them to an office, and accuse them of credit card fraud.When that didn’t work, the story changed. They were shoplifting.Usually, the terrified shoppers would sign confessions. They would get a bill for restitution of the “stolen” merchandise. Most people paid it immediately. Even if they hadn’t stolen anything. Which was most of the time.This was illegal. In fact, Macy’s had been fined and scolded sternly by NYS Attorney’s General for its solution to store “shrinkage”.But no one paid attention until actor Rob Brown got the Macy’s treatment.‘Treme’ star says he was racially profiled at Macy’sBy the time they put the cuffs on the soap opera/movie star for his Macy’s spree, an 18-year-old engineering student, Trayon Christian, who is also black, had been dealing with the same policy at Barney’s for weeks. Black student wins $45G settlement over Barneys stop-friskBy now, you should be thinking: WTF?So you tell me: Why do you think racial minorities disproportionately make up the U.S. prison population?Why do you think certain people get arrested for shopping while black?If they can corner and coerce confessions out of people for shopping, if they can arrest ordinary people and give them criminal records because they buy things with their own credit cards at a famous department store, is it any surprise that prisons are packed with people of color?I realize this is hard to believe. But I’ve got a DVD for one of those shopping sprees that ended in criminal charges. The arrested shopper refused to plea bargain. That guy’s lawyer DIDN’T EVEN ASK for the Macy’s security tape. The phony charges weren’t dropped for 4 years — after Robert Sanger took his case over.But that shopper wasn’t famous. He was just innocent. And his story was really hard to swallow … unless you saw the tape.I’ve been shopping in Macy’s for 60 years and I’ve never been accused of credit card fraud. Or shoplifting. Or anything.Because I’m white.Black people are uneducated. They drop out of school. They are undisciplined. Black people live in projects where they commit crimes and do drugs. Black people don't have jobs. So they have no money. White people work. Black people want the things that white people have. So they steal them.Sometimes black people are caught. They go to jail. Jails are filled with black people for a reason.Are black Americans incarcerated more than whites because they commit more crimes or because the system discriminates against them?My teenage daughter was down by Roslyn train station one weekend evening, doing plenty of nothing with her teenage friends, when someone noticed the mother of one boy as she drove past them, through a stop sign, in full view of the police.Hey Alan, is that your mom?Alan’s mother was an alcoholic. A white alcoholic.The police lights flashed. Alan’s mother stopped her car and rolled down the window. The teens watched nervously from the train station. The officer ordered the female driver to get out of her car. They watched her struggle through his tests.Alas, she stumbled badly, unable to stand on one leg, or touch her nose, or walk a straight line. Had the police not stopped this woman, she might have crashed into another car or hit someone on a bicycle. She might even have run over Alan. She was that stewed.Alan’s mother sat in her car, still, while the officer sat filling out a form in the police car. The teens waited. They worried. The woman had clearly failed the sobriety test. Because she was drunk as a skunk.But then the officer got out of his car. He walked back to Alan’s mother. They spoke, he handed her a ticket, and got back in the police car. Then she drove off in the direction of affluent East Hills, the police car close behind. Alan would later report that the police had escorted his mother home, warned her not to drink and drive ever again, and then went back to work.Because she was white.If you have two neighborhoods — 1 black, 1 white — and you put 9 cops in the black neighborhood and 1 in the white neighborhood, most of your arrests will be black.Because that’s where all the police are.Reverse this arrangement, and most arrests will be white. Because that’s where all the police are. Crime data would show that white neighborhoods have a crime problem.But that’s not how they do it.In black neighborhoods, black people are stopped for trespassing, jay-walking, graffiti, littering, loitering, selling loose cigarettes, fighting, smoking marijuana, shopping, driving or just walking down the street.If there are no police, no one gets arrested.It’s good to be white. I dare you to tell me you disagree.A commenter at the right-wing Crime Prevention Research Center wrote in July:The percentage of unemployed young black men has always been north of 40% since 1970; whereas for caucasians it has always been less than 20% during the same time period.Couple this with the reality of the life experience with authority (police, school discipline) and declining community structure (single parent families etc.) and you get all the reasons why the percentages of black youth get involved in crime.The Real Root Causes of Violent Crime: The Breakdown of Marriage, Family, and CommunityIn other words, this whole trend, black people being arrested and going to jail, is their own fault! If young black men would just get a job, like young Caucasian men, and work, maybe they wouldn’t be in so much trouble all the time.Right?!In 55 days, Donald Trump will be President.Trump likes private prisons: Donald Trump's Election Win Is Making This Stock SoarLast March, Trump told Chris Matthews, “I do think we can do a lot of privatizations and private prisons. It seems to work a lot better.” MSNBC Town Hall with Donald Trump Moderated By Chris MatthewsIt certainly works better for white people.But it’s bad news for certain other people who tend to get arrested.What else? Donald Trump likes the death penalty. That’s old news. But it’s bad news, for certain other people.We should all be worried. I’m not worried about me. I’m worried about them.Racial minorities disproportionately make up the American prison population. Racial minorities will have the fight of their life with Donald Trump.Think things are bad now? The worst is yet to come.

-

How can I forward postal mail to someone?

Forward MailRegular Forward MailChange Your AddressWhether you’re making a long-term move or you’ll just be at a new address for just a few months, USPS® mail and package forwarding services can send your mail to you.How It WorksIf you’re making a permanent move, use this service to update your address.If your move is temporary, you can use this service for as short as 15 days or as long as 1 year. After the first 6 months, you can extend for another 6 months.Direct your mail to a new address with a few clicks and a $1.05 charge to your credit card (the charge verifies your identity).Mail is sent piece by piece to the new address.You will receive a welcome kit with coupons from our partners.Premium Forwarding Service ResidentialGet Your Mail Wherever You AreFor a one time enrollment fee and weekly fees thereafter, we’ll hold your mail, package it, and ship it to you each week via Priority Mail® service. Premium Forwarding Service Residential® (PFS-Residential®) is a temporary service that can be used a minimum of 2 weeks up to a maximum of 1 year. Unfortunately, the PFS-Residential Online option is not currently available for PO Box™addresses. PO Box customers may be eligible for the Premium Forwarding Service Local™option.How It WorksEnroll. There is an enrollment fee of $21.10 retail or $19.35 if you enroll online.Pay $21.10 for each week of service.Most mail is packaged every Wednesday and sent to you via Priority Mail® service. You will receive an email notification to your Welcome | USPS account with the tracking number for each weekly shipment. You'll also receive notification when there is no mail to be shipped. Your package should arrive in 1, 2, or 3 business days, depending on distance.Priority Mail Express® items are not held and instead are immediately rerouted directly to you.Priority Mail items are shipped to you immediately or included in your weekly package, whichever is faster.First-Class Mail® items that don't fit in the weekly package are sent separately at no extra cost.Premium Forwarding Service Residential is a domestic service only. APO/FPO/DPO and ZIP Codes™ starting with "969" are excluded.

-

How can I apply for a credit card?

1. Know your credit score :Knowing your credit score or an estimate of it is one thing — but you also need to know what your score means and whether it’s high enough to qualify you for a credit card. We recently looked at what constitutes a Good Score, and, according to credit expert John Ulzheimer, here’s how credit score ranges tend to stack up from top to bottom:A credit score of 760 or higher is considered excellent credit.A score between 701 and 759 is considered good credit.A score of 651 to 700 is considered fair credit (695 is the national average).Under 650 is considered poor credit.The higher your credit score, the more likely you are to get approved for a credit card. So is your score high enough? In 2013, only 39.1% of all applicants were approved for general purpose credit cards, according to a study by the Financial Bureau. However, 58.7% of Americans with “prime” credit scores — those in the 660 to 720 range — were approved, and 85.5% of applicants with “superprime” credit scores (720 or above) were approved.There are other variables that may determine whether you’re ultimately approved for a credit card or denied, but once you know your credit score you’ll have a better sense of your chances. And if your score is on the lower end of that spectrum, you’ll know it’s time to make some changes — paying down balances and paying bills on time — to get that number moving in the right direction before applying for a credit card.2. Check your actual credit report for free.In addition to your credit score, it can be helpful to get a copy of your actual credit report. Fortunately, you can get a free copy of your credit report from all three major credit reporting agencies – Experian, Equifax, and TransUnion – for free, once per year.If everything reported it is accurate, you have nothing to worry about. If you find a mistake, however, you should do what you can to have it fixed right away.3. Make all of your monthly payments on time.If you need to improve your credit before applying for a Reward Credit Card — or simply want to keep it in perfect shape for the long haul — paying all of your bills on time is the best and easiest way to do it. Conversely, missing a payment or paying your bills late can wreak havoc on your credit score in a hurry. You should avoid making late payments on any of your bills if you can.4. Pay down your debts.Another big factor in your credit score is your credit utilization. This term, utilization, is used to describe how much money you owe in relation to your credit limits. While utilizing some of your available credit is generally a good thing, running up too many large balances is frowned upon and reflects negatively on your credit score.Most experts suggest keeping your credit utilization below 30% — meaning, if your credit limit is $1,000, you shouldn’t carry a balance larger than $300. When you’ve used up more than 30% of your overall credit limit, it makes you appear riskier to lenders and can cause your credit score to drop.When you pay off debt and get your utilization below 30%, on the other hand, your credit score will have the best chance to surge — and it does so right away. So if your credit score is borderline, pay down any outstanding balances before applying for a credit card to give yourself the best chance of getting approved.5. Search for the right credit card offer.While you might be anxious to get any type of credit card, it’s important to take some time to search for the best offer and find one that suits your needs.If you want a credit card to consolidate your debt, for example, you can start by looking at Balance Transfer Credit Cards that will let you pay zero interest for a limited time. If you’d rather earn rewards, there are dozens of Great Rewards Credit Card to consider that offer everything from Cash Back to Airline miles.Once you find a card that seems like a good match for your spending habits, applying is as simple as filling out an application online, including your personal information and details about your income. Most credit card issuers will give you a response in minutes.Just remember that the best credit cards and offers generally go to those with good or excellent credit. If your credit needs some work, you might need to consider a different type of credit card to get started.6. Consider a secured credit card as your last resort.If your credit score isn’t high enough to qualify you for a traditional credit card, you should consider a secured credit card to get the ball rolling. Unlike unsecured credit cards that actually extend you a line of credit, secured cards offer credit that is tied to a cash deposit you put down.For example, many secured credit cards offer a $500 credit limit but require a $500 deposit to get started. While this may not seem beneficial at first, secured credit cards are often the only way for people with bad credit or no credit to raise their credit score.Once you begin using your secured card responsibly, paying it off each month, your credit score will improve, and you’ll typically be able to upgrade your card to an unsecured credit card and get your deposit back. If your credit score improves dramatically, you may even be able to qualify for a top rewards credit card after a stretch using a secured card. It really depends on your situation, your goals, and how much your score improves7. Use credit wisely and never give up.If you aren’t able to qualify for a credit card right now, the best thing you can do is give yourself some time. By using the credit you do have responsibly — paying utilities, car payments, and student loan bills on time, every time — you’ll put yourself in the best position to boost your score over time. And if you have bills in default, a lot of debt, or other negative marks on your credit report, you should focus on repairing that damage before you take on more credit anyway.Pay all of your bills on time, refuse new debts and pay down old ones, and monitor small changes in your credit report for signs of progress. Over time, your score will inevitably rise as long as you treat it with the respect it deserves.

-

How do I register and buy voucher for OCAJP, OCPJP, Java certifications?

You can register for exam in three ways.Purchase Exam Voucher from Oracle University and Register at Pearson VUERegister for an Exam at Oracle Testing CenterRegister at Pearson VUE websiteIn the below sections read every option in detail.1)Purchase Exam Voucher from Oracle University and Register at Pearson VUEYou can purchase exam voucher at Oracle University.Two kinds of vouchers availableOracle proctored exam voucher :This voucher cost is Rs 10100. Only credit cards are accepted to buy any voucher in India.Here is the link to purchase this voucher : Oracle proctored exam voucherAfter you place your order you will receive an order confirmation e-mail. Once payment is processed you will receive a second e-mail that will include your exam voucher number -- you need this number to register for your exam at Pearson Vue (Oracle :: Pearson VUE)Exam vouchers are only valid for scheduling an Oracle proctored exam at a Pearson VUE test center in India. When scheduling an exam, use the voucher as payment for the exam. Vouchers expire six months from date of purchase. The Voucher must be used to schedule and sit for the exam on or before the expiration date. The specific expiration date will be sent with the voucher number via email. All sales of exam vouchers are final, no exceptions.Purchase Bundle:This voucher is only for Indians.This voucher cost is Rs. 11,957 .This voucher features are1 Certification Exam Voucher1 Free Exam retake30-days access to the Kaplan SelfTest practice TestThe rules of above voucher will be applicable to this voucher also.Here is the link to purchase this voucher : Bundles2)Register for an Exam at Oracle Testing CenterWe don’t have many Oracle Testing centers in India . We have few Oracle Testing centers in major cities like Mumbai, Bangalore, Chennai, etc.You can directly register for the exam through Oracle Testing center.First Open this link on any of the browser: https://education.oracle.com/pls...Follow the steps as shown in the website.Many people doesn’t go with this option. Because there are less centers.Prefer to register at Pearson VUE website.3)Register at Pearson VUE websiteFirst open this link (Oracle :: Pearson VUE). It opens the website and click on sign-in if you registered or create account yourself an then sign-in. It asks you sign in credentials , Enter your credentials.Once you sign-in with your credentials it takes you into the below screen. Now click on Proctored exam.Type Java SE 8 in the Find Exam test box and select Java SE 8 Programmer INow Click on Schedule this Exam button and it asks you to confirm Exam details , check it once and then click on Proceed to scheduling Button.Enter your address in the Find test centers near text box and select the test center which is near to you and click on Next Button.Select any date on the calendar which is comfortable for you. And it opens available timings and select particular timing.Confirm the exam details and click Proceed to checkout button at bottom right side corner.Click on Next Button.Click on Next Button and again click on Next buttonIf you have bought voucher from Oracle website apply that voucher code.If you don’t Enter your credit card details. Only Credit cards are accepted.Enter Billing address and click on Next and finally submit the Order.Once your payment done , you will receive two details one regarding payment confirmation and other your slot confirmation. Take print out of second email.ID Proof’sYou need to bring two of the following ID proof’s for exam center.Primary IDExamples of accepted Primary ID:A currently valid signed passport of any countryA currently valid signed government issued photo driving licence (full or provisional)Employee ID / work badgeMilitary IDSchool IDSecondary IDMust contain your signature. Examples of accepted Secondary ID:Credit CardDebit CardBank Cardanother ID from the Primary ID listExam Reschedule PolicyIf you wish to reschedule your exam appointment, you must reschedule at least 24 hours prior to your appointment. Rescheduling an exam less than 24 hours before an exam appointment is subject to a same-day forfeit exam fee. Exam fees are due for no-shows.Exam Cancellation PolicyIf you wish to cancel your exam appointment, you must cancel at least 24 hours prior to your exam appointment. Canceling an exam less than 24 hours before scheduled exam is subject to a same-day forfeit exam fee. Exam fees are due for no-shows.If you want any other help , you can take Pearson VUE customer serviceFollow this link Customer ServiceExam ResultsOnce you done with your exam , you will get an email within 15 minuets which contains link to your results .Opent his URL (CertView Login)Login with you credentials(Oracle account details).You results will appear there.You will also get E-Certficate within 2 days in same website.You need to fill a separate form to get your printed Certificate , you will get it after 2 10 weeks to your address.Free Java T ShirtIf you pass OCAJP 8 , you can get free Java T shirt .You need apply in a separate form for Java T shirt.You can apply for this at this link: https://go.oracle.com/java-tshirt.You will get this T-shirt after 1 month through courier to your address.If you are preparing for the exam, read the below links to understand how to prepare for each exam:How to prepare for OCAJP exam?How to prepare for OCPJP Certification Exam?

-

How do credit card payments work?

Great question.To help you get a grasp of how payment network transactions work specifically, here’s a step-by-step explanation of everything that happens after you hit the ‘Order now’ button.Once you complete an order on the merchant’s website, the system redirects you to the payment form, where you enter your credit card details. After you fill out the necessary information, you click ‘Submit.’The merchant receives your credit card information. Afterwards, your credit card information along the order amount is transmitted to the payment gateway[1].Using payment card information, a payment gateway sends an authorization request to the acquiring bank.The authorization request is redirected to your IPS (Visa / MasterCard / etc.). Upon approval, it’s redirected to an issuing bank.If your card is 3DSecure, the system will redirect you to a page where you should enter the password.The system redirects the information from the IPS to the acquiring bank.Upon completion, a payment gateway sends a request to the acquiring bank and later to the IPS and the issuing bank to subtract an order amount from customer’s cart.If there are sufficient funds on card owner’s balance, the issuing bank sends confirmation of the transaction to IPS.IPS gives its confirmation in about 15 minutes after the authorization and merchant finds out that a transaction is successful.This is a detailed description of information exchange happening between all parties involved in the payment process.To dive deeper into the whole payments ecosystem, check out my article below:‘How an online payment gateway works’It covers everything you need to know about payment gateways, payment processing, and merchant accounts.Hope I was helpful!Footnotes[1] Difference between a payment gateway, processor and merchant accounts

-

What are some money saving tips?

I recently realized how much money I save without being aware of it. What I do is...I have two bank accounts, one of them is a saving account and every month I put some money on it no matter what. Every now and then I also invest in gold.Shop off-season. Wait for the discounts and for example get winter boots in summer.Calculate which ways are the cheapest. As an every day tea drinker, last year I realized with the gas price in my country, making the tea on the stove was costing me more money than if I had an electrical tea maker, which I also use as a kettle. I save about $20 a month just with this.Recycling is not just good for the environment but for your budget too. I got yogurt in glass packages, I now use them to store vegetables, dips...etc Since I rarely put on too much make-up, I only have mascara, couple lip glosses, two blushes and that's all. If I'm going somewhere and need to wear more make-up, I go to a make-up artist. The shelf life of most cosmetic products is two years, so unless you can finish something in two years, you will throw them away without even finishing it. Why spend money on something you won't finish?I rarely drink alcohol. Let's be honest, booze is expensive. You can save a lot of money by not drinking. Same goes for smoking.If you need to eat out, make that meal the light one. Main courses are usually the most expensive ones on the menu. Instead choose something cheaper, you can have more when you go back home.Try to do two things at once. For example, if you want to hang out with a friend, try to get together with him/her on your lunch break from work or for lunch on a weekend. You will have lunch either way, it's more expensive if you have lunch by yourself and later have coffee with your friend.Take well care of your clothes and accessorizes. I don't shop a lot, yet I have a very large wardrobe at the age of 28. Everything I bought in the last 9 years is still in great condition.A wealthy man in my country once said, "I'm not rich enough to buy cheap products." Meaning that when you buy cheap products (cheap here means bad quality), they break in a short time and you need to buy the same product again or send it to service, and that costs more money. This is especially true for electronics and cars. Unless you're in rush to get something, wait to buy the good quality product and save up money for it.Take care of your health. Having a good diet is cheaper than spending a lot of money on medical bills.(This one I used to do a lot when I was a teenager.) Support your friends and get support from them. We used to borrow books from each other, get together to watch a movie or TV show when we got its DVD set...etc

-

How do I check my credit score?

Here is the extract from my blog.You can get your Credit Score for FREE from Credit Information Companies(CICs). The Reserve Bank of India (RBI) in September 2016 had mandated every Credit Information Company (CIC) in the country to give one Free Full Credit Report (FFCR) to every individual starting from 1st January 2017. This detailed report mainly carries the Credit Score, among other things financial points. Due to this mandate, you can now check your CIBIL score for free once in a year. Many people are finding it hard to know how to check CIBIL score online for free. So here I am to help you out with this my latest post.What is a Credit Score?The Credit Score is a number that indicates an individual’s credit worthiness. It impacts the individual’s capability to borrow and take new credit from lenders. Usually, banks or lenders use this credit score to evaluate the probability of whether an individual repay his debts or not.Higher your Credit Score, higher are the chances of loan approval such as personal loan, business loan, home loan, loan against property, credit cards in India.A CIBIL Score is a score or rating given to individuals as an indicator of the individual’s credit behavior. The CIBIL score range is 300 to 900 (low to high). The credit score of 750 and above is considered good and is in most cases you are seen as loan worthy. The score below 750 is a pointer of a possible underlying issue in the individual’s credit worthiness.Importance of CIBIL Score\ Credit Score reportsThese reports are a highly valued information bunch that helps banks and financial institutions analyze an individual’s credit worthiness based on his/her borrowing history and repayment discipline. The major importance of CIBIL reports are:Better Credit Score\ CIBIL score helps you get loans at much better rates from lenders. A better Credit Score also helps you get offers from multiple lenders – giving you a better deal.A unified report with all your past and current credit history.A good credit score helps borrowers to get loans easily from banks.Credit score reports form the basis of releasing loans to a borrower.An exhaustive report to help you nurture better financial discipline.Helps in staying clear of debt traps.Better score on the credit report gives leverage when negotiating interest rates.In India, three credit rating bureaus or agencies compute your score.CIBIL (Credit Information Bureau India Limited)Equifax andExperianEach of these rating agencies has various ranges for their credit scores. The most popular credit score in India is the one issued by CIBIL.CIBILThis is one of the most known or trusted Credit Information Company. People generally refer Credit score as CIBIL score due to its popularity and wide use.I have given a detailed Do It Yourself (DIY) Guide on how to check CIBIL score and get a free credit report from CIBIL under next heading.How to check CIBIL score or Credit score online for free?Now that you have completely understood the importance of credit score. Also, you must be feeling happy that RBI made it mandatory to all Credit Information Companies (CIC’s) to provide one free credit report per year.Let’s go ahead with my Do It Yourself (DIY) Guide on how to check CIBIL score\ Credit score online for free. There are three steps to getting free CIBIL score.Complete the FormAuthenticate Yourself – Here you may be asked 3-5 questions about your loans and credit cardsAccess your free CIBIL score and reportComplete Form –Go to CIBIL homepage.You will get the below shown page. Here you have to give your Email Address, Date of Birth, Gender and PAN card number. Then enter characters shown in below text box. Now accept the terms and conditions and click on Submit button.Once you click on Submit button, you will get a new pop-up window as shown below. Here you have two options, either to go with paid subscription (Rs.800 for two reports and Rs.1200 for four reports) or Free (1 report per year) method. As we want to get a one-time free CIBIL score, click on “No, thanks” button.CIBIL account is created successfully; you will get a congratulation message as shown below and requesting you to login to myCIBIL by using the password provided by CIBIL.Authenticate Yourself –Now check your email address for the email from CIBIL as shown below. To access your report, click on the link given in the email. CIBIL also provides a one time password to access your account first time.Access your free CIBIL score and report –Once you log in using these credentials, you will be asked to change your password. Enter desired password and re-login to your account once again to see your CIBIL score.When you are logged into your account, you will get Consumer Details section. There are few fields which will be auto-populated like Name, Mailing Address, City and Pincode (shown in green color below). You need to enter your Mobile Number as it is compulsory (shown by orange color).Click on Submit button once you enter Mobile Number. And here comes the much awaited CIBIL Score\Credit score on your account Dashboard. Here in below case, it is 799, which is a great score.Under View Report you can see personal information, contact information, Account information (existing and past credit history) and Enquiry information (list of banks who asked for your credit report).View Report Section –Personal Information – You can see your all personal information here.Contact Information – Here you see all your addresses that you have previously declared.Employment Information – Here your Account Type, Income (tentative), and Income Indicator, etc. are shown.Account Information – This section lists all your Credit Cards, Account Numbers, all Account Details and any dues on it. It also lists all your loans such as Personal or Car loans. You need to make sure that you have closed your unused accounts to have a healthy Credit score record.Enquiry Information – In this section, you can see who all have requested your Credit score\CIBIL score. This section also shows the Date of enquiry, Enquiry Purpose and the amount for which query was raised.What your Credit score\ CIBIL score says?Here is the detailed explanation of what your credit score says.Great – 800-900: This is a great score. It reflects an ideal track record of repayments of all your previous borrowings that means you get the great offers on various loans and credit cards.Good – 600-799: If you are planning to apply for a fresh loan or a new credit card, this score offers a good chance that your application will be granted. A score in this range shows that you have handled your previous borrowings judiciously and are a safe borrower.Bad – 300-599: This is considered as a bad (low) CIBIL score and your chances being approved for the new loans or credit card are very less in this case. Primary reason for getting this score can include the default on loan payments or missing credit card payments.Hope this Do It Yourself (DIY) guide on how to get a free full credit card\CIBIL score will be helpful to you. Share this with all your friends.What affects your Credit Score?Irregularity in Credit card and loan repayments.Cheque bounceToo many unsecured loans such as credit cards and personal loans.Default as a guarantorHigher the rate of application for credit cards or unsecured loans.If you are defaulter for your friend’s loan for whom you are acted as guarantor.Using your credit cards to the full limit.How to improve your score?Never utilize more than50-60 percent of your credit cards limit.Never default your Credit card bills or loan EMI. Pay them without fail and within a specified period.Don’t try to overburden yourself with the too many loans. If your credit score is good, then banks are ready to sanction more loan than what you asked for. In such cases limit yourself for needed amount.Avoid having many unsecured loans and credit cards on a single name.Do not forget to collect “No Due Certificate” from your banker after closing the cards accounts or loan.Have 6-9 months of a gap while applying for fresh loans.Never try to run away from your loans. Settle them as soon as possible in a friendly way with your banker.Final NoteThis is a great opportunity to know your CIBIL score which is essentially required for every loan or cards that you take. The free full credit report will help you identify your credit outstanding, old loans or may fling up surprises against credit cards which you had not even applied for or loans which you might not have taken. Study the report and take necessary steps to get such things rectified to ramp up your future credit score.Hope this helps..Ashu,Co-founder The Investment ManiaLike our page on The Investment Mania | Facebook

Create this form in 5 minutes!

How to create an eSignature for the credit card order form

How to create an electronic signature for your Credit Card Order Form in the online mode

How to create an electronic signature for your Credit Card Order Form in Google Chrome

How to create an eSignature for putting it on the Credit Card Order Form in Gmail

How to create an eSignature for the Credit Card Order Form right from your smart phone

How to make an electronic signature for the Credit Card Order Form on iOS

How to make an electronic signature for the Credit Card Order Form on Android OS

People also ask

-

What is a credit card order form template?

A credit card order form template is a pre-designed document that enables businesses to collect payment information securely. By utilizing a credit card order form template, companies can streamline their payment processing and enhance customer experience. This template is essential for organizations looking to simplify transactions while ensuring data security.

-

How can I create a credit card order form template using airSlate SignNow?

Creating a credit card order form template with airSlate SignNow is straightforward. Simply log into your account, select 'Create Template', and use our drag-and-drop editor to customize the form to your needs. You can include fields for necessary payment information, making it user-friendly for your customers.

-

What are the key features of the credit card order form template?

The credit card order form template offers several key features, including customizable fields, electronic signature capabilities, and secure data encryption. Additionally, it integrates seamlessly with various payment gateways, ensuring smooth transactions. These features make it an efficient tool for businesses aiming to enhance their billing processes.

-

Is the credit card order form template compliant with payment regulations?

Yes, the credit card order form template is designed to comply with industry regulations, including PCI DSS standards. airSlate SignNow prioritizes security, ensuring that all sensitive information transmitted through the form remains protected. Your organization can confidently use this template to handle customer payment details responsibly.

-

Can I customize the credit card order form template to match my brand?

Absolutely! airSlate SignNow allows you to fully customize your credit card order form template. You can modify colors, logos, and field layouts to align with your branding. Customization enhances the customer experience by providing a familiar interface for users.

-

Are there any integration options for the credit card order form template?

The credit card order form template integrates with numerous third-party applications, including popular payment processors like PayPal and Stripe. This allows for easy synchronization of transactions and customer data across platforms. Enhanced integration capabilities make it a versatile choice for businesses of all sizes.

-

What are the pricing options for using the credit card order form template with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs when using the credit card order form template. Depending on your organization’s size and requirements, you can choose from basic, professional, or enterprise plans. Each plan provides different features, ensuring you find a suitable option.

Get more for CREDIT CARD ORDER FORM

- Power of attorney business form

- Hawaii child support calculator excel form

- Carnival cake walk oak hall school form

- Quadratic formula worksheet 1

- Legionella risk assessment form for landlords pdf

- Msbc youth ministry servant team commitment form msbchurch

- Athletic participation form physical

- Ermc online application form

Find out other CREDIT CARD ORDER FORM

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF