Obligations under the Loan Documents to Which the Assignor is a Party and B Any and All Other Obligations of the Form

Understanding the Obligations Under The Loan Documents

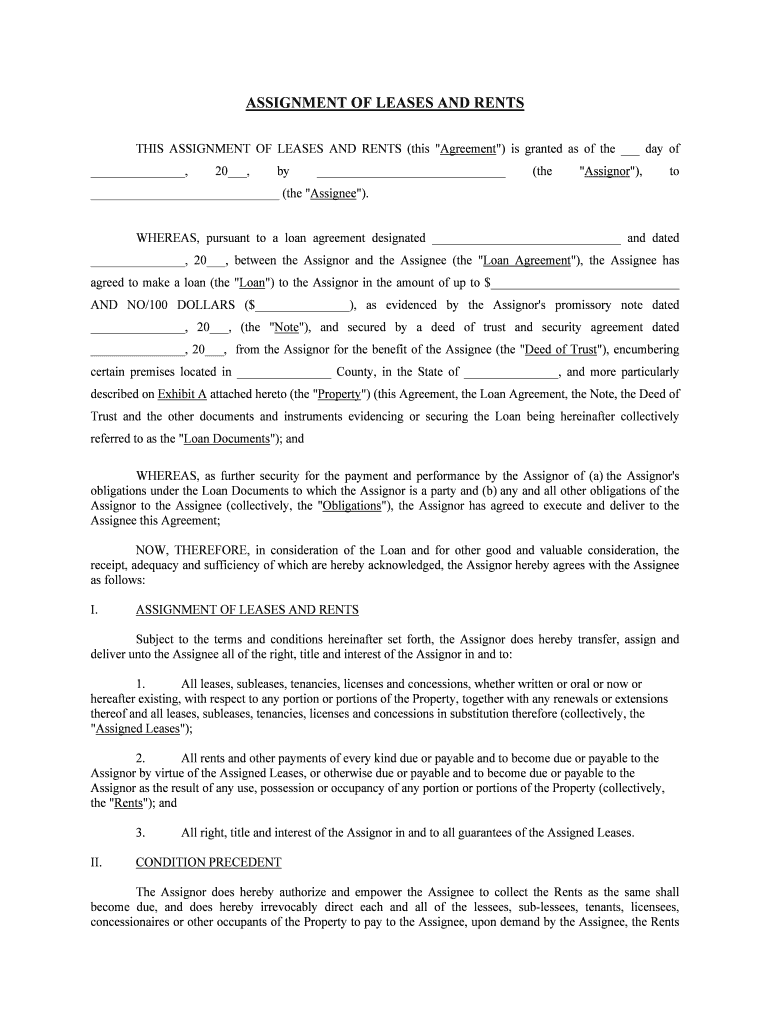

The obligations under the loan documents to which the assignor is a party encompass various responsibilities that must be adhered to by all parties involved. These obligations typically include the repayment terms, interest rates, and any collateral agreements. Understanding these elements is crucial for ensuring compliance and maintaining a good standing with lenders. The assignor must be aware of their specific duties as outlined in the loan documents, as failure to comply can lead to legal and financial repercussions.

Steps to Complete the Obligations Under The Loan Documents

Completing the obligations under the loan documents involves several key steps. First, review the loan documents thoroughly to understand all terms and conditions. Next, ensure that all required signatures are obtained, which may include the assignor and any co-signers. After signing, it is important to keep a copy of the signed documents for your records. Finally, submit any necessary documentation to the lender as specified in the loan agreement. This process ensures that all obligations are met in a timely and efficient manner.

Legal Use of the Obligations Under The Loan Documents

The legal use of the obligations under the loan documents is governed by various laws and regulations. These documents must comply with federal and state laws, including the Uniform Commercial Code (UCC) and any specific state regulations. It is essential to ensure that all terms are legally enforceable, which can include stipulations regarding default, remedies, and dispute resolution. Understanding these legal frameworks helps protect the rights of all parties involved in the loan agreement.

Key Elements of the Obligations Under The Loan Documents

Key elements of the obligations under the loan documents include the principal amount, interest rate, repayment schedule, and any covenants that may be imposed on the borrower. These elements define the financial relationship between the lender and the borrower and outline the expectations for repayment. Additionally, any requirements for maintaining collateral or insurance may also be detailed in the documents. Familiarity with these elements is vital for both parties to ensure compliance and avoid misunderstandings.

Examples of Using the Obligations Under The Loan Documents

Examples of using the obligations under the loan documents can vary widely based on the type of loan and the specific terms agreed upon. For instance, in a mortgage agreement, the obligations may include maintaining the property and making timely payments. In a business loan scenario, obligations might involve meeting certain financial ratios or providing regular financial statements to the lender. These examples illustrate how obligations can differ based on the context and purpose of the loan.

State-Specific Rules for the Obligations Under The Loan Documents

State-specific rules for the obligations under the loan documents can significantly impact how these agreements are structured and enforced. Each state may have its own laws regarding interest rates, foreclosure processes, and consumer protection regulations. It is important for assignors to be aware of these rules to ensure that their obligations are compliant with local laws. Consulting with a legal professional can provide clarity on how state laws may affect the obligations outlined in the loan documents.

Quick guide on how to complete obligations under the loan documents to which the assignor is a party and b any and all other obligations of the

Effortlessly Prepare Obligations Under The Loan Documents To Which The Assignor Is A Party And b Any And All Other Obligations Of The on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Obligations Under The Loan Documents To Which The Assignor Is A Party And b Any And All Other Obligations Of The on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The Easiest Approach to Modify and Electronically Sign Obligations Under The Loan Documents To Which The Assignor Is A Party And b Any And All Other Obligations Of The Effortlessly

- Find Obligations Under The Loan Documents To Which The Assignor Is A Party And b Any And All Other Obligations Of The and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and electronically sign Obligations Under The Loan Documents To Which The Assignor Is A Party And b Any And All Other Obligations Of The and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the primary obligations under the loan documents to which the assignor is a party?

The obligations under the loan documents to which the assignor is a party typically include the repayment terms, interest rates, and other conditions that must be fulfilled to maintain compliance. Understanding these obligations is crucial for any party involved in loan agreements to ensure that they meet their contractual responsibilities.

-

How does airSlate SignNow help with managing obligations under loan documents?

airSlate SignNow offers efficient document management tools that allow you to easily track and manage your obligations under the loan documents to which the assignor is a party. With features like reminders and automated workflows, you can stay on top of important deadlines and requirements.

-

What are the costs associated with airSlate SignNow for managing loan documents?

Pricing for airSlate SignNow is competitive and offers various plans to meet different business needs. The costs cover all the essential features including eSignature, document templates, and support tailored for management of obligations under the loan documents to which the assignor is a party.

-

Can airSlate SignNow integrate with other financial software?

Yes, airSlate SignNow can integrate with various financial software platforms to streamline processes related to obligations under the loan documents to which the assignor is a party. This integration allows for seamless data exchange, making it easier to manage financial obligations efficiently.

-

What features of airSlate SignNow are most beneficial for loan document management?

Key features of airSlate SignNow that benefit loan document management include customizable templates, secure eSignatures, and tracking capabilities. These features help ensure compliance with obligations under the loan documents to which the assignor is a party and facilitate overall document workflow.

-

How secure is airSlate SignNow when handling sensitive financial documents?

airSlate SignNow prioritizes security with advanced encryption and authentication protocols to protect sensitive financial documents. This ensures that all obligations under the loan documents to which the assignor is a party are handled with the utmost confidentiality and security.

-

What kind of customer support does airSlate SignNow offer?

airSlate SignNow provides dedicated customer support to assist users with any questions related to obligations under the loan documents to which the assignor is a party. Help is available through various channels, ensuring that all your queries are addressed promptly and effectively.

Get more for Obligations Under The Loan Documents To Which The Assignor Is A Party And b Any And All Other Obligations Of The

Find out other Obligations Under The Loan Documents To Which The Assignor Is A Party And b Any And All Other Obligations Of The

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy