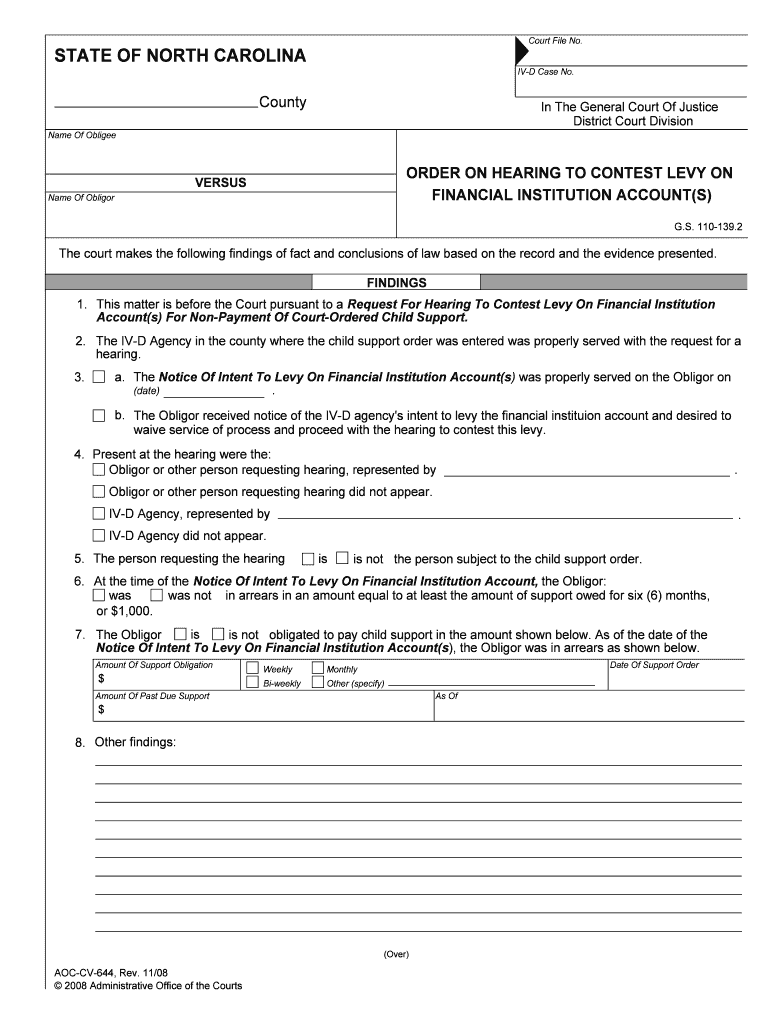

Request for Hearing to Contest Levy on Financial Institution Form

What is the Request For Hearing To Contest Levy On Financial Institution

The Request For Hearing To Contest Levy On Financial Institution is a formal document used by individuals or entities to challenge a levy imposed on their financial accounts by the Internal Revenue Service (IRS). This levy can occur when the IRS seeks to collect unpaid taxes by seizing funds directly from a taxpayer's bank account. The request allows the taxpayer to present their case and potentially halt the levy while the hearing is pending.

How to Use the Request For Hearing To Contest Levy On Financial Institution

To effectively use the Request For Hearing To Contest Levy On Financial Institution, a taxpayer must fill out the form accurately and submit it to the appropriate IRS office. This form typically requires detailed information about the taxpayer's identity, the financial institution involved, and the reasons for contesting the levy. Providing clear and concise explanations will support the case during the hearing.

Steps to Complete the Request For Hearing To Contest Levy On Financial Institution

Completing the Request For Hearing To Contest Levy On Financial Institution involves several key steps:

- Gather necessary information, including your taxpayer identification number and details about the levy.

- Fill out the form, ensuring all sections are completed accurately.

- Provide any supporting documentation that substantiates your claim.

- Review the form for completeness and accuracy before submission.

- Submit the form to the designated IRS office, either online or by mail.

Legal Use of the Request For Hearing To Contest Levy On Financial Institution

The Request For Hearing To Contest Levy On Financial Institution is legally recognized as a means for taxpayers to assert their rights against IRS levies. It is essential to understand that submitting this request does not automatically stop the levy; however, it initiates a process where the taxpayer can present their case. Legal representation is often advisable to navigate the complexities of tax law during this process.

Filing Deadlines / Important Dates

Timeliness is crucial when filing the Request For Hearing To Contest Levy On Financial Institution. Taxpayers typically have a limited timeframe, often within thirty days of receiving the notice of levy, to submit their request. Missing this deadline can result in the continuation of the levy and may limit the taxpayer's options for relief.

Required Documents

When submitting the Request For Hearing To Contest Levy On Financial Institution, it is important to include several key documents to support your case. These may include:

- A copy of the notice of levy issued by the IRS.

- Proof of income or financial hardship.

- Any previous correspondence with the IRS regarding the levy.

- Documentation that supports the reasons for contesting the levy.

Form Submission Methods

The Request For Hearing To Contest Levy On Financial Institution can be submitted through various methods. Taxpayers may choose to file the form online through the IRS website, mail it to the appropriate IRS office, or deliver it in person. Each method has its own processing times, so it is important to consider which option best suits the taxpayer's needs.

Quick guide on how to complete request for hearing to contest levy on financial institution

Complete Request For Hearing To Contest Levy On Financial Institution seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any holdups. Manage Request For Hearing To Contest Levy On Financial Institution on any device using airSlate SignNow apps for Android or iOS and enhance any documentation process today.

How to alter and eSign Request For Hearing To Contest Levy On Financial Institution effortlessly

- Obtain Request For Hearing To Contest Levy On Financial Institution and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive data with tools specifically designed for that by airSlate SignNow.

- Generate your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign Request For Hearing To Contest Levy On Financial Institution to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Request For Hearing To Contest Levy On Financial Institution?

A Request For Hearing To Contest Levy On Financial Institution is a legal document that taxpayers can file to dispute a levy imposed by the IRS on their financial accounts. This hearing provides taxpayers an opportunity to present their case and seek relief from the levy, making it crucial for anyone facing such a situation.

-

How can airSlate SignNow help me with my Request For Hearing To Contest Levy On Financial Institution?

airSlate SignNow streamlines the process of creating and eSigning documents like a Request For Hearing To Contest Levy On Financial Institution. Our platform allows you to quickly prepare necessary documents, ensuring they are professional and compliant with legal requirements, which helps you respond effectively to your levy.

-

What features does airSlate SignNow offer for creating legal documents?

airSlate SignNow offers intuitive features including customizable templates, drag-and-drop document editing, and easy eSigning capabilities. With these tools, you can efficiently create a Request For Hearing To Contest Levy On Financial Institution and ensure all necessary information is accurately included, saving you time and effort.

-

Is airSlate SignNow cost-effective for handling legal documents?

Yes, airSlate SignNow provides a cost-effective solution for businesses and individuals needing to manage legal documents. With various pricing plans, you can choose an option that fits your needs while efficiently handling processes like a Request For Hearing To Contest Levy On Financial Institution without incurring high legal fees.

-

Can I integrate airSlate SignNow with other tools for managing my legal documents?

Absolutely! airSlate SignNow offers seamless integrations with popular tools such as Salesforce, Google Drive, and Dropbox. This capability allows you to manage your documents and track your Request For Hearing To Contest Levy On Financial Institution in one centralized platform, enhancing efficiency.

-

What are the benefits of using airSlate SignNow for legal document management?

Using airSlate SignNow provides numerous benefits, including enhanced document security, the convenience of eSigning, and accelerated workflows. By utilizing our platform to manage a Request For Hearing To Contest Levy On Financial Institution, you ensure the protection of your sensitive information while also expediting the legal process.

-

How secure is airSlate SignNow for handling sensitive documents?

AirSlate SignNow prioritizes your data security with advanced encryption methods and compliance with industry standards. When you manage a Request For Hearing To Contest Levy On Financial Institution through our platform, you can trust that your personal and financial information remains protected against unauthorized access.

Get more for Request For Hearing To Contest Levy On Financial Institution

Find out other Request For Hearing To Contest Levy On Financial Institution

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now