ORDER to WITHHOLD from INCOME Form

What is the ORDER TO WITHHOLD FROM INCOME

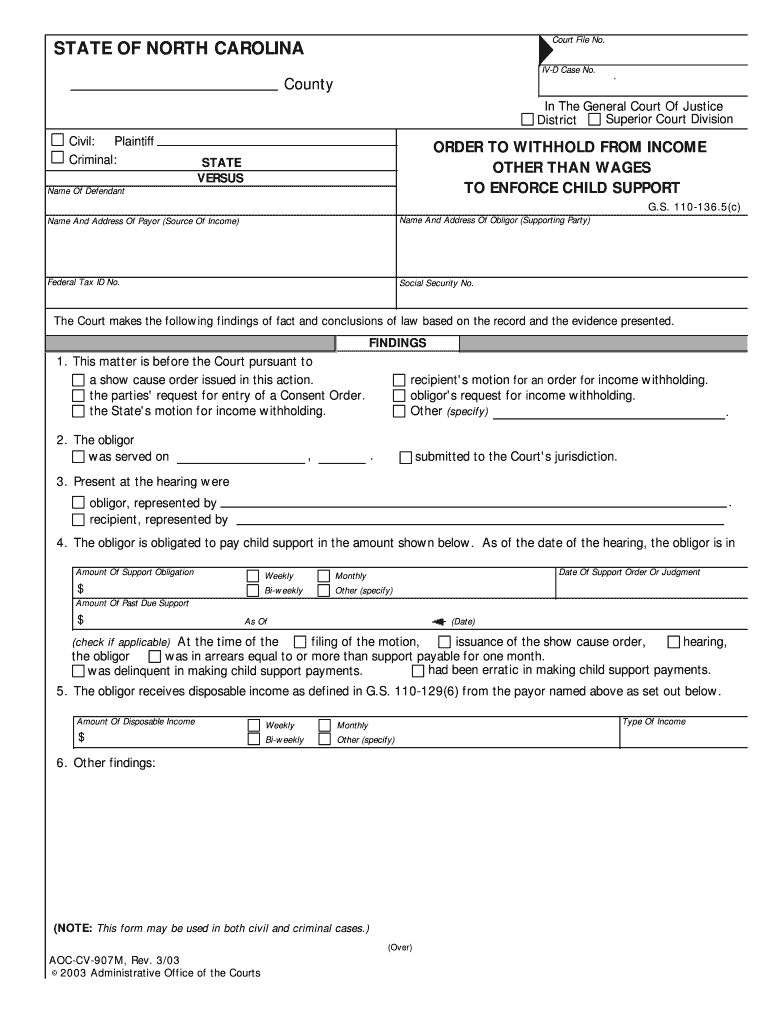

The order to withhold from income is a legal document that instructs an employer to deduct a specified amount from an employee's paycheck. This form is often used for child support, tax levies, or other financial obligations. It serves as a formal request to ensure that the required payments are made directly from the employee's earnings, thereby ensuring compliance with court orders or government mandates.

How to use the ORDER TO WITHHOLD FROM INCOME

Using the order to withhold from income involves several steps. First, the issuing authority, such as a court or government agency, must complete the form with relevant details, including the amount to be withheld and the employee's information. Once completed, the form should be delivered to the employer, who is responsible for implementing the withholding. Employers must ensure that the deductions are made accurately and timely, following the instructions provided in the order.

Steps to complete the ORDER TO WITHHOLD FROM INCOME

Completing the order to withhold from income requires careful attention to detail. Here are the steps to follow:

- Obtain the official form from the relevant authority.

- Fill in the employee's full name, address, and Social Security number.

- Specify the amount to be withheld and the frequency of deductions.

- Include any additional instructions or notes as required.

- Sign and date the form to validate it.

- Submit the completed form to the employer for processing.

Legal use of the ORDER TO WITHHOLD FROM INCOME

The order to withhold from income is legally binding when issued by an authorized entity, such as a court. It must comply with federal and state laws governing wage garnishment and withholding. Employers are legally obligated to follow the order as long as it meets the necessary legal requirements. Failure to comply can result in penalties for the employer, including fines or legal action.

Key elements of the ORDER TO WITHHOLD FROM INCOME

Several key elements must be included in the order to withhold from income to ensure its validity:

- The name and contact information of the issuing authority.

- The employee's identifying information, including name and Social Security number.

- The specific amount to be withheld from each paycheck.

- The frequency of the withholding (weekly, bi-weekly, monthly).

- Any additional terms or conditions related to the withholding.

Who Issues the Form

The order to withhold from income is typically issued by a court or a government agency. This can include family courts for child support, tax authorities for tax levies, or other legal entities that require financial compliance. It is essential to ensure that the issuing body has the authority to mandate such withholdings, as this affects the legality and enforceability of the order.

Quick guide on how to complete order to withhold from income

Complete ORDER TO WITHHOLD FROM INCOME effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can locate the correct form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without interruptions. Handle ORDER TO WITHHOLD FROM INCOME on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign ORDER TO WITHHOLD FROM INCOME with ease

- Locate ORDER TO WITHHOLD FROM INCOME and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for such tasks.

- Generate your signature using the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign ORDER TO WITHHOLD FROM INCOME and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an ORDER TO WITHHOLD FROM INCOME?

An ORDER TO WITHHOLD FROM INCOME is a legal document that requires an employer to withhold a specified amount from an employee's wages to satisfy a debt or obligation. Understanding how to properly manage this process can be crucial for businesses dealing with garnishment orders.

-

How can airSlate SignNow help with an ORDER TO WITHHOLD FROM INCOME?

airSlate SignNow simplifies the process of sending and eSigning documents related to an ORDER TO WITHHOLD FROM INCOME. Our platform allows you to quickly create, send, and manage these documents securely, ensuring compliance and efficiency in your workflow.

-

What features does airSlate SignNow offer for handling ORDER TO WITHHOLD FROM INCOME documents?

Our solution includes easy document creation, customizable templates, and secure eSignature capabilities specifically for ORDER TO WITHHOLD FROM INCOME. This ensures that all parties can sign documents quickly and efficiently, reducing processing time.

-

Is airSlate SignNow cost-effective for managing ORDER TO WITHHOLD FROM INCOME?

Yes, airSlate SignNow offers a cost-effective solution for managing ORDER TO WITHHOLD FROM INCOME documents, with various pricing plans to suit businesses of all sizes. Our platform eliminates the need for paper-based processes, helping reduce costs associated with traditional document management.

-

Can airSlate SignNow integrate with other software to manage ORDER TO WITHHOLD FROM INCOME?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, allowing you to manage ORDER TO WITHHOLD FROM INCOME documents alongside other operational workflows. This interoperability enhances efficiency and keeps your documents organized.

-

What are the benefits of using airSlate SignNow for ORDER TO WITHHOLD FROM INCOME documentation?

Using airSlate SignNow for ORDER TO WITHHOLD FROM INCOME documentation streamlines the eSigning process, ensures compliance, and improves record-keeping. With features designed for speed and security, you can enhance your business processes and focus on more critical tasks.

-

Is it easy to get started with airSlate SignNow for ORDER TO WITHHOLD FROM INCOME?

Yes, getting started with airSlate SignNow is straightforward. Simply sign up for an account, and you'll have access to a user-friendly interface that allows you to create and manage ORDER TO WITHHOLD FROM INCOME documents in no time.

Get more for ORDER TO WITHHOLD FROM INCOME

Find out other ORDER TO WITHHOLD FROM INCOME

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself