For DECEDENTS DYING PRIOR to JANUARY 1, Form

What is the FOR DECEDENTS DYING PRIOR TO JANUARY 1

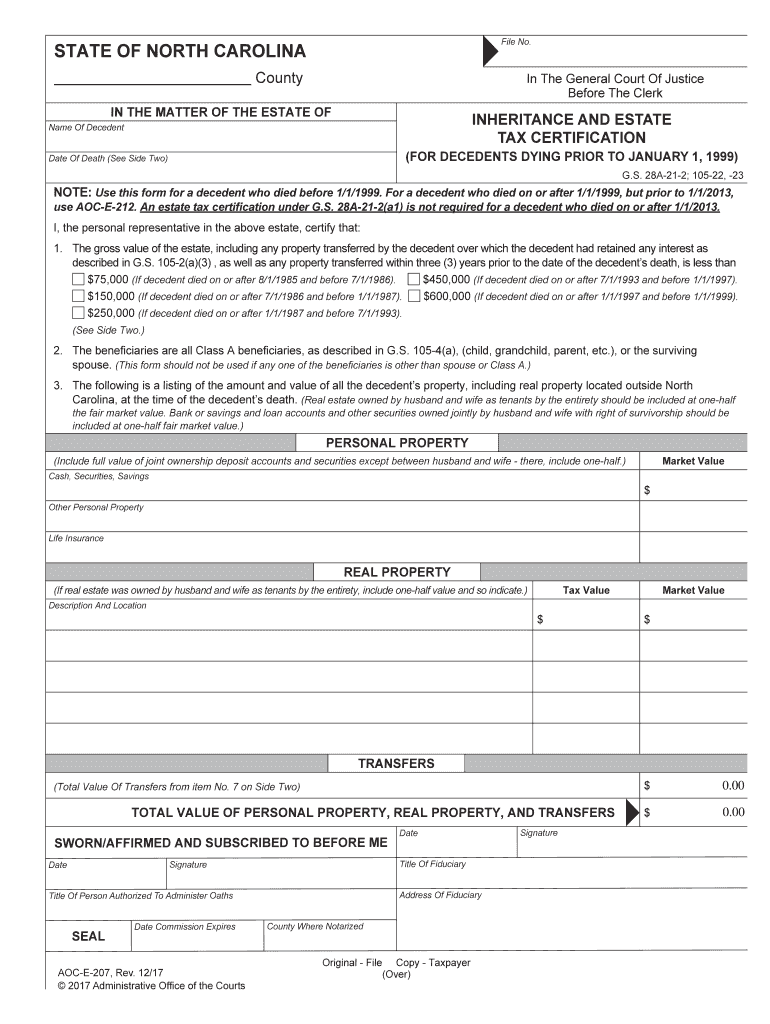

The form for decedents dying prior to January 1 serves as a crucial document in the context of estate administration and tax obligations. This form is specifically designed for individuals who passed away before January 1 of a given year, allowing their estates to address any outstanding tax matters appropriately. It ensures that the decedent's financial affairs are settled in accordance with the applicable laws and regulations, reflecting the unique circumstances surrounding their date of death.

How to use the FOR DECEDENTS DYING PRIOR TO JANUARY 1

Using the form for decedents dying prior to January 1 involves several key steps to ensure proper completion and submission. First, gather all necessary information regarding the decedent's financial status, including income, assets, and any liabilities. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled out, it should be reviewed for accuracy before submission. Depending on the specific requirements, the form may need to be submitted electronically or via traditional mail.

Steps to complete the FOR DECEDENTS DYING PRIOR TO JANUARY 1

Completing the form for decedents dying prior to January 1 requires careful attention to detail. Follow these steps:

- Gather all relevant documentation, including previous tax returns and financial statements.

- Fill out the form with accurate information regarding the decedent's estate.

- Ensure that all signatures are obtained from the necessary parties.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online or by mail.

Legal use of the FOR DECEDENTS DYING PRIOR TO JANUARY 1

The legal use of the form for decedents dying prior to January 1 is governed by specific regulations that dictate how estates must handle tax obligations. This form must be used in compliance with federal and state laws to ensure that the decedent's estate is properly settled. Failure to adhere to these legal requirements may result in penalties or complications during the estate settlement process.

Required Documents

To complete the form for decedents dying prior to January 1, several documents are typically required. These may include:

- Death certificate of the decedent.

- Previous tax returns for the decedent.

- Financial statements detailing assets and liabilities.

- Any relevant estate planning documents, such as wills or trusts.

Filing Deadlines / Important Dates

Filing deadlines for the form for decedents dying prior to January 1 are critical to ensure compliance with tax regulations. Typically, the form must be submitted by a specific date following the decedent's passing. It is essential to be aware of these deadlines to avoid penalties and ensure that the estate is settled in a timely manner.

Quick guide on how to complete for decedents dying prior to january 1 1999

Complete FOR DECEDENTS DYING PRIOR TO JANUARY 1, effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage FOR DECEDENTS DYING PRIOR TO JANUARY 1, on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign FOR DECEDENTS DYING PRIOR TO JANUARY 1, without any hassle

- Locate FOR DECEDENTS DYING PRIOR TO JANUARY 1, and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign FOR DECEDENTS DYING PRIOR TO JANUARY 1, and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What services does airSlate SignNow offer for handling documents FOR DECEDENTS DYING PRIOR TO JANUARY 1,?

airSlate SignNow provides a seamless way to manage and sign documents specifically related to the estate process FOR DECEDENTS DYING PRIOR TO JANUARY 1,. Our platform simplifies document workflows, making it easier to collect signatures and ensure compliance with legal requirements for decedents' affairs.

-

How can airSlate SignNow assist in the estate planning process FOR DECEDENTS DYING PRIOR TO JANUARY 1,?

With airSlate SignNow, you can streamline the estate planning process FOR DECEDENTS DYING PRIOR TO JANUARY 1,. Our eSignature solutions facilitate quick approvals and reviews of essential documents, allowing for a smoother transition of assets and ensuring that wishes are executed effectively.

-

What are the pricing options available for airSlate SignNow when dealing with documents FOR DECEDENTS DYING PRIOR TO JANUARY 1,?

Our pricing plans are designed to be cost-effective, catering to both individuals and businesses needing to manage documents FOR DECEDENTS DYING PRIOR TO JANUARY 1,. We offer various subscriptions, including monthly and annual options, which provide flexibility depending on your document management needs.

-

Are there specific features in airSlate SignNow that cater to legal documents FOR DECEDENTS DYING PRIOR TO JANUARY 1,?

Yes, airSlate SignNow includes features such as templates for wills and trusts, compliance checking, and audit trails specifically designed for legal documents FOR DECEDENTS DYING PRIOR TO JANUARY 1,. These tools help ensure that all documents are handled professionally and securely.

-

Can airSlate SignNow integrate with other platforms for managing documents FOR DECEDENTS DYING PRIOR TO JANUARY 1,?

Absolutely, airSlate SignNow offers integrations with various platforms, including cloud storage services and CRM tools. This ensures that you can manage documents efficiently FOR DECEDENTS DYING PRIOR TO JANUARY 1, while maintaining a consolidated system for all your documentation needs.

-

What benefits does airSlate SignNow provide for individuals managing the affairs of decedents FOR DECEDENTS DYING PRIOR TO JANUARY 1,?

By using airSlate SignNow, individuals managing the affairs of decedents FOR DECEDENTS DYING PRIOR TO JANUARY 1, can enhance efficiency and reduce the stress of handling legal documents. Our user-friendly interface and secure eSignature capabilities allow for quick processing and peace of mind during a difficult time.

-

How secure is airSlate SignNow for processing documents FOR DECEDENTS DYING PRIOR TO JANUARY 1,?

Security is our top priority at airSlate SignNow. We utilize advanced encryption and secure authentication processes to ensure that all documents processed FOR DECEDENTS DYING PRIOR TO JANUARY 1, are protected against unauthorized access while meeting regulatory requirements for data security.

Get more for FOR DECEDENTS DYING PRIOR TO JANUARY 1,

Find out other FOR DECEDENTS DYING PRIOR TO JANUARY 1,

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online