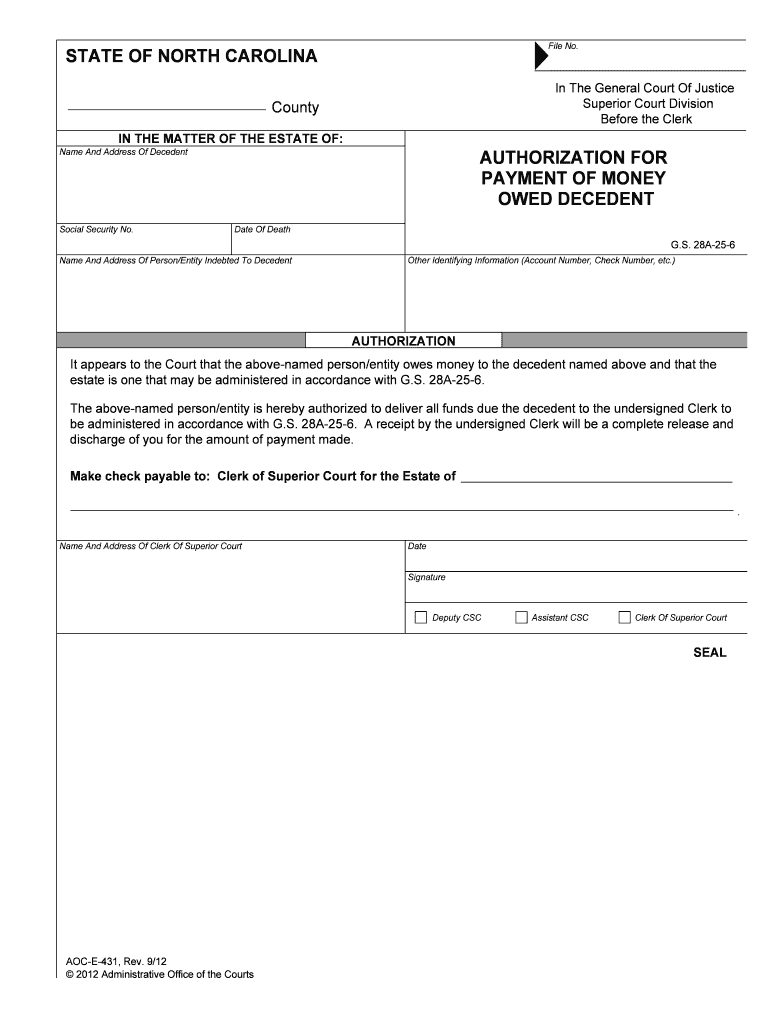

OWED DECEDENT Form

What is the owed decedent?

The owed decedent form is a legal document used to claim debts owed to a deceased individual. This form is essential for settling the estate of the deceased, ensuring that any outstanding financial obligations are addressed. It serves as a formal request to collect funds or assets that the decedent was entitled to before their passing. Understanding the purpose and implications of this form is crucial for executors, beneficiaries, and creditors involved in the estate settlement process.

How to use the owed decedent

Using the owed decedent form involves several steps to ensure accuracy and compliance with legal standards. First, gather all necessary information regarding the decedent's debts and assets. This includes documentation such as bank statements, loan agreements, and any relevant correspondence. Next, complete the form with precise details, ensuring that all required fields are filled out correctly. After completing the form, it should be submitted to the appropriate parties, such as creditors or financial institutions, to initiate the claims process.

Steps to complete the owed decedent

Completing the owed decedent form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant documents related to the decedent's financial obligations.

- Fill out the owed decedent form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the relevant creditors or institutions.

- Keep copies of all submitted documents for your records.

Legal use of the owed decedent

The legal use of the owed decedent form is governed by state laws and regulations. It is important to ensure that the form is used in accordance with these legal frameworks to avoid complications. The form must be signed and dated by the appropriate parties, and in some cases, may require notarization. Compliance with local laws ensures that the claims made through this form are valid and enforceable in court, protecting the rights of the estate and its beneficiaries.

Key elements of the owed decedent

Several key elements must be included in the owed decedent form to ensure its validity:

- Full name and contact information of the decedent.

- Details of the debts owed, including amounts and types of obligations.

- Information about the claimant, including their relationship to the decedent.

- Signature of the claimant, affirming the accuracy of the information provided.

- Date of submission to establish a timeline for the claims process.

State-specific rules for the owed decedent

Each state may have unique rules and regulations regarding the owed decedent form. It is essential to consult state-specific guidelines to ensure compliance. These rules may dictate the required documentation, submission procedures, and deadlines for filing claims. Understanding these nuances can help avoid delays and ensure that the claims process proceeds smoothly.

Quick guide on how to complete owed decedent

Complete OWED DECEDENT effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage OWED DECEDENT on any device with the airSlate SignNow apps for Android or iOS, enhancing any document-related task today.

How to modify and electronically sign OWED DECEDENT with ease

- Obtain OWED DECEDENT and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight signNow sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only moments and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign OWED DECEDENT to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'OWED DECEDENT' mean in the context of signing documents?

The term 'OWED DECEDENT' refers to the financial obligations related to a deceased person's estate. Understanding this concept is crucial when using airSlate SignNow to manage documents associated with estate settlement or inheritance issues. Our platform facilitates easy eSigning for such sensitive documents, ensuring compliance and clarity.

-

How can airSlate SignNow help with documents related to an OWED DECEDENT?

airSlate SignNow simplifies the process of managing and signing documents pertaining to an OWED DECEDENT. Users can securely send, receive, and eSign all necessary documentation quickly, which is essential for timely resolution of estate matters. This helps eliminate delays that might arise in processing signNow estate-related transactions.

-

What is the pricing structure for airSlate SignNow when handling OWED DECEDENT documents?

airSlate SignNow offers a flexible pricing structure suitable for individuals and businesses dealing with OWED DECEDENT matters. Plans start at a competitive rate, providing access to essential features that streamline document management. You can choose a plan based on your volume of transactions and document needs.

-

What features of airSlate SignNow are beneficial for managing OWED DECEDENT documentation?

Key features of airSlate SignNow that benefit OWED DECEDENT documentation include secure eSignature capabilities, customizable templates, and audit trails. These features ensure that all documents are legally binding and maintain authenticity throughout the signing process. This level of trust is vital when handling sensitive estate-related documents.

-

Is airSlate SignNow compliant with legal standards for OWED DECEDENT documents?

Yes, airSlate SignNow is compliant with various legal standards necessary for OWED DECEDENT documentation. Our eSignature solutions meet not only federal laws but also state regulations governing the validity of electronic signatures. This compliance gives users peace of mind when managing estate-related documents.

-

Can I integrate airSlate SignNow with other tools for managing OWED DECEDENT documents?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party tools, making it a perfect choice for managing OWED DECEDENT documents. Whether you need to sync with accounting software or customer relationship management (CRM) systems, our platform enhances your workflow to maximize efficiency.

-

What are the benefits of using airSlate SignNow for OWED DECEDENT related matters?

Using airSlate SignNow for OWED DECEDENT matters streamlines the signing process and increases operational efficiency. It not only saves time with instant document turnaround but also provides a secure environment for sharing sensitive information. Most importantly, it helps ensure that all agreements related to a deceased person's estate are legally binding.

Get more for OWED DECEDENT

Find out other OWED DECEDENT

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple