For FAILURE to FILE Form

What is the FOR FAILURE TO FILE

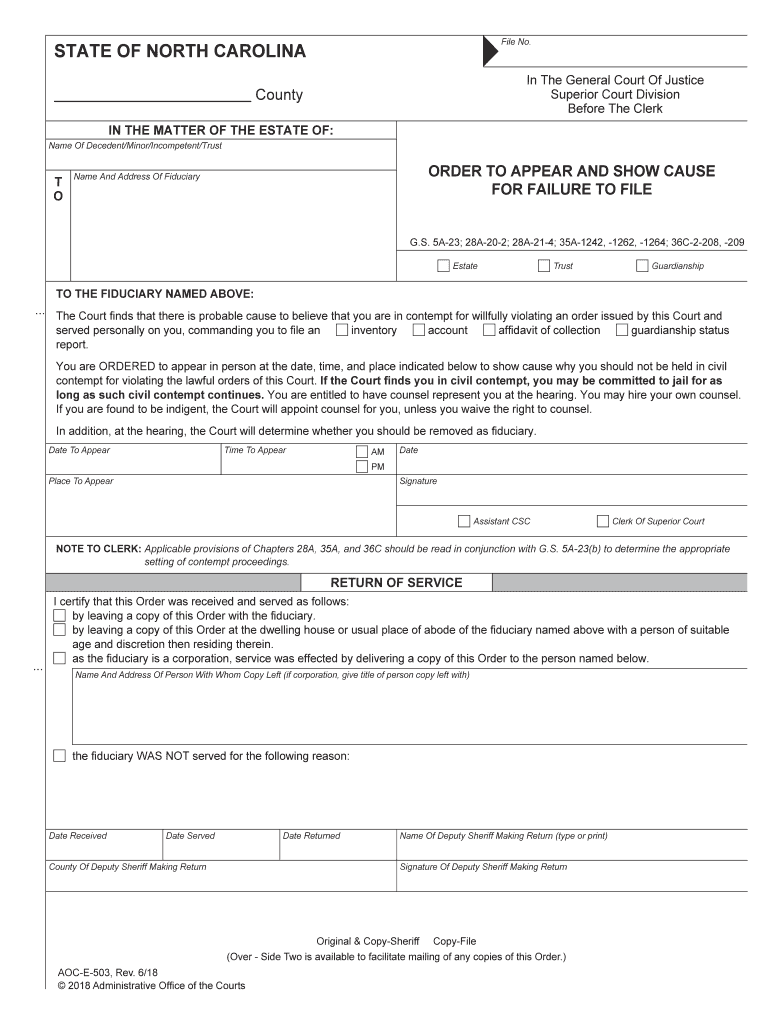

The "FOR FAILURE TO FILE" form is a crucial document used primarily in the context of tax compliance. It is issued by the Internal Revenue Service (IRS) to address situations where an individual or business has not submitted required tax returns by the designated deadlines. This form serves as a formal notice to taxpayers regarding their non-compliance and outlines the potential consequences they may face if the issue is not rectified. Understanding the implications of this form is essential for maintaining good standing with the IRS and avoiding further penalties.

Steps to complete the FOR FAILURE TO FILE

Completing the "FOR FAILURE TO FILE" form involves several important steps. First, gather all necessary documentation, including previous tax returns and any correspondence from the IRS regarding the failure to file. Next, accurately fill out the form, ensuring that all required fields are completed. It is important to double-check your information for accuracy to prevent delays. Once the form is completed, review it carefully before submitting. Finally, choose your preferred submission method, whether online, by mail, or in person, and ensure that you keep a copy for your records.

Legal use of the FOR FAILURE TO FILE

The legal use of the "FOR FAILURE TO FILE" form is governed by IRS regulations. This form must be used in accordance with the tax laws applicable in the United States. It is essential to ensure that the form is filled out correctly and submitted within the required timeframe to avoid additional penalties. The IRS recognizes electronically signed documents as legally binding, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws. Using a trusted eSigning solution can help ensure compliance and security when handling this form.

Penalties for Non-Compliance

Failing to file the required tax returns can lead to significant penalties. The IRS typically imposes a failure-to-file penalty, which is calculated based on the amount of tax owed and the duration of the delay. In addition to financial penalties, non-compliance can result in interest charges on unpaid taxes. It is crucial for taxpayers to address any issues related to the "FOR FAILURE TO FILE" form promptly to mitigate these risks. Ignoring the form can lead to more severe consequences, including liens or levies on assets.

Filing Deadlines / Important Dates

Filing deadlines for the "FOR FAILURE TO FILE" form are critical to understand. Typically, the IRS sets specific dates each year by which tax returns must be submitted. These deadlines may vary based on the type of taxpayer, such as individuals or businesses. It is important to be aware of these dates to avoid penalties. Taxpayers should also consider any extensions that may be available, as well as the implications of missing these deadlines. Keeping track of important dates can help ensure compliance and avoid complications.

Examples of using the FOR FAILURE TO FILE

There are various scenarios in which the "FOR FAILURE TO FILE" form may be applicable. For instance, an individual who has not filed their tax return for a previous year may receive this form as a reminder from the IRS. Similarly, a business that has failed to submit its quarterly tax returns may also be subject to this notice. Understanding these examples can help taxpayers recognize when they need to take action regarding their tax filings and the importance of addressing the form promptly.

Quick guide on how to complete for failure to file

Finalize FOR FAILURE TO FILE effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, enabling you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents quickly without any hold-ups. Manage FOR FAILURE TO FILE on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and electronically sign FOR FAILURE TO FILE effortlessly

- Obtain FOR FAILURE TO FILE and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize signNow portions of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as an original wet ink signature.

- Verify all the information and then click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign FOR FAILURE TO FILE and ensure exceptional communication at any point of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 'FOR FAILURE TO FILE' and how does it relate to airSlate SignNow?

FOR FAILURE TO FILE typically refers to penalties imposed by tax authorities when a required tax return is not submitted on time. With airSlate SignNow, businesses can streamline the filing process by ensuring that all necessary documents are signed and submitted promptly, reducing the risk of incurring such penalties.

-

How can airSlate SignNow help prevent issues related to 'FOR FAILURE TO FILE'?

By utilizing airSlate SignNow, businesses can automate their document workflow, ensuring timely eSigning and submission of forms. This proactive approach minimizes delays that could lead to 'FOR FAILURE TO FILE' complications, allowing you to focus on core business activities.

-

What are the pricing plans for airSlate SignNow when dealing with 'FOR FAILURE TO FILE' issues?

airSlate SignNow offers various pricing plans designed to cater to different business needs. Each plan includes features that help you manage and file documents efficiently, reducing the chances of 'FOR FAILURE TO FILE' penalties, all at a cost-effective rate.

-

What features in airSlate SignNow can assist with 'FOR FAILURE TO FILE' compliance?

Key features like automated reminders, document tracking, and eSignature capabilities are essential in managing compliance effectively. These tools ensure that all submissions are completed on time, helping to avoid any penalties related to 'FOR FAILURE TO FILE.'

-

Can airSlate SignNow integrate with other tools to manage 'FOR FAILURE TO FILE' scenarios?

Yes, airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow efficiency. By connecting with accounting and tax preparation software, you can better manage deadlines and submissions, helping to mitigate 'FOR FAILURE TO FILE' risks.

-

What benefits does airSlate SignNow provide in relation to 'FOR FAILURE TO FILE'?

Using airSlate SignNow not only simplifies document signing but also promotes timely submission of critical documents. This reduces the likelihood of experiencing 'FOR FAILURE TO FILE' penalties that can create financial strain on businesses.

-

Is airSlate SignNow suitable for small businesses facing 'FOR FAILURE TO FILE' issues?

Absolutely! airSlate SignNow offers solutions tailored for small businesses, equipping them with the tools needed to manage documents effectively. By utilizing our platform, smaller teams can navigate 'FOR FAILURE TO FILE' challenges with ease and confidence.

Get more for FOR FAILURE TO FILE

Find out other FOR FAILURE TO FILE

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free