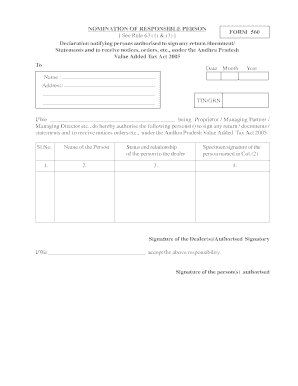

Form 560

What is the Form 560

The Form 560 is a tax-related document used in the United States, primarily for reporting specific financial information to the Internal Revenue Service (IRS). This form is typically utilized by businesses to disclose income, expenses, and other pertinent financial data. Understanding the purpose of the Form 560 is essential for accurate tax reporting and compliance with federal regulations.

How to obtain the Form 560

Obtaining the Form 560 is straightforward. It can be accessed directly from the IRS website, where it is available for download in PDF format. Additionally, physical copies may be available at local IRS offices or through authorized tax professionals. Ensuring you have the correct version of the form is vital for proper filing.

Steps to complete the Form 560

Completing the Form 560 involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the identification section with your business name, address, and taxpayer identification number.

- Report your income and expenses in the designated sections, ensuring accuracy.

- Review the form for any errors or omissions before finalizing it.

- Sign and date the form to certify its accuracy.

Legal use of the Form 560

The legal use of the Form 560 is governed by IRS regulations. To ensure compliance, the form must be filled out accurately and submitted by the specified deadlines. Failure to comply with these regulations can result in penalties or audits. It is important to keep a copy of the completed form for your records, as it may be requested during tax reviews or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 560 can vary based on the type of entity and the tax year. Generally, the form must be submitted by the due date of your tax return, which is typically April 15 for most businesses. However, extensions may be available. It is crucial to stay informed about specific deadlines to avoid late fees and penalties.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Form 560 can lead to significant penalties. These may include fines for late submissions, inaccuracies, or failure to file altogether. Understanding the potential repercussions is essential for businesses to maintain compliance and avoid unnecessary financial burdens.

Quick guide on how to complete form 560

Complete Form 560 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, as you can obtain the correct format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Manage Form 560 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Form 560 without hassle

- Obtain Form 560 and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 560 and maintain exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 560

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 560 and why is it important?

Form 560 is a crucial document used for various legal and financial purposes, providing essential information required by regulatory bodies. Completing this form correctly ensures compliance and can prevent potential legal issues for businesses. Understanding how to manage form 560 effectively can streamline your document workflows signNowly.

-

How can airSlate SignNow help me with form 560?

airSlate SignNow simplifies the process of preparing and eSigning form 560 by providing an intuitive platform to manage all your documents. With seamless integrations and user-friendly features, you can easily fill out and send form 560 to the right recipients efficiently. Plus, it ensures that all signatures are legally binding and secure.

-

Is there a cost associated with using airSlate SignNow for form 560?

Yes, airSlate SignNow offers various pricing plans tailored to fit every business need, which includes features specifically for managing form 560. The cost-effective solution ensures you get value for your investment, particularly for businesses that frequently use such forms. Pricing details can be found on our website, highlighting the versatility and scalability of our services.

-

Can I integrate airSlate SignNow with other software for managing form 560?

Absolutely! airSlate SignNow offers robust integrations with popular software tools, enhancing your workflow when dealing with form 560. This means you can connect it with your CRM, ERP, or any other essential applications to streamline the process further. Integrations allow for seamless data flow, improving efficiency in document management.

-

What features does airSlate SignNow offer for form 560?

airSlate SignNow includes a variety of features specifically designed to assist with form 560, such as templating, secure eSigning, and tracking capabilities. These features help you ensure that your documents are correctly filled out and verified before submission. Additionally, you can automate reminders for recipients to ensure timely completion.

-

How secure is my information when using airSlate SignNow for form 560?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like form 560. We utilize advanced encryption protocols and comply with industry standards to safeguard your data. You can confidently manage your form 560 knowing that your information is protected against unauthorized access.

-

Can I access form 560 from mobile devices using airSlate SignNow?

Yes, airSlate SignNow offers mobile compatibility, allowing you to manage and eSign form 560 from your smartphone or tablet. This flexibility ensures you can work on-the-go without compromising efficiency. Whether you’re at the office or away, completing and sending form 560 is quick and easy.

Get more for Form 560

- Practice site application ampamp declaration of intent form practice site application ampamp declaration of intent form

- Practice site application amp declaration of intent form

- Prep provider toolkit form

- Auto adjustment rfp state of michigan form

- Michigan nursing school certification form

- Michigan nursing school certification state of michigan form

- Michigan nursing school certification michigangov form

- Sf mslrp application form provider application form and declaration of intent

Find out other Form 560

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease