Itemize and Give Values as of Date of Decedents Death Form

What is the Itemize And Give Values As Of Date Of Decedents Death

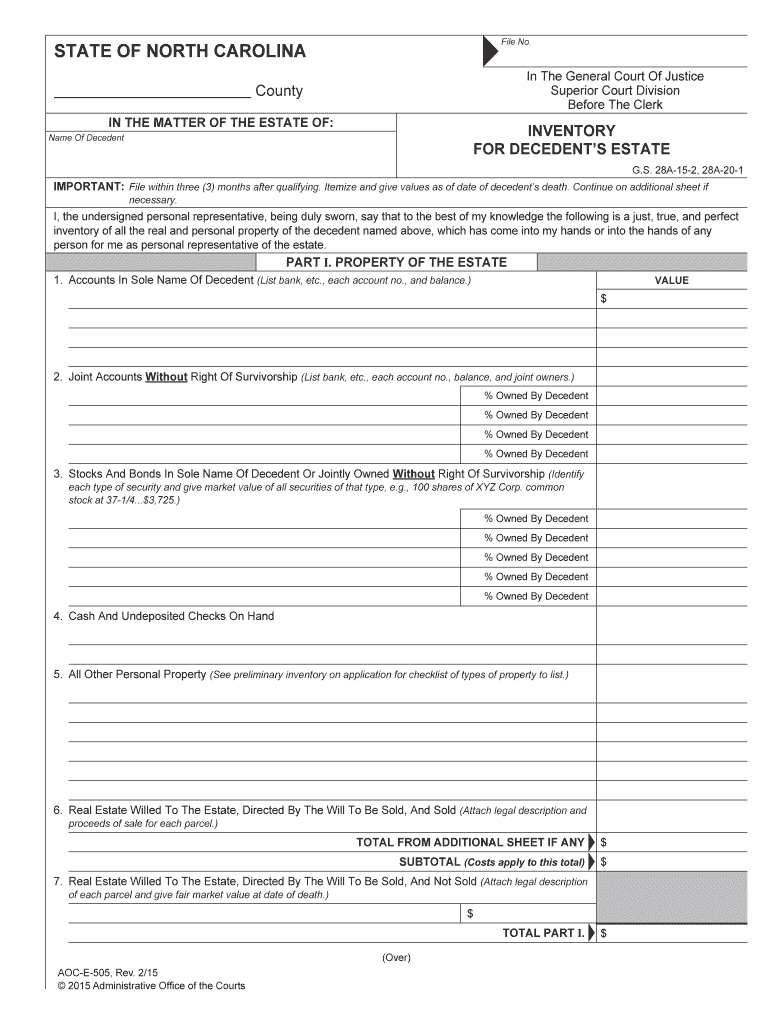

The Itemize And Give Values As Of Date Of Decedents Death form is a crucial document used in estate planning and probate processes. This form requires the executor or administrator of an estate to list all assets owned by the decedent at the time of their death, along with their respective values. It serves to provide a clear inventory of the estate, which is essential for settling debts, distributing assets to heirs, and ensuring compliance with tax obligations. The information must be accurate and comprehensive, as it may be subject to scrutiny by tax authorities or courts.

Steps to Complete the Itemize And Give Values As Of Date Of Decedents Death

Completing the Itemize And Give Values As Of Date Of Decedents Death form involves several key steps:

- Gather Documentation: Collect all relevant documents, including property deeds, bank statements, investment records, and personal property appraisals.

- List Assets: Create a detailed list of all assets owned by the decedent, categorizing them into real estate, personal property, financial accounts, and other relevant categories.

- Determine Values: Assign a fair market value to each asset as of the date of death. This may require professional appraisals for certain items.

- Complete the Form: Fill out the form with the collected information, ensuring accuracy and completeness.

- Review and Sign: Have the form reviewed by a legal professional if necessary, then sign and date it to validate the document.

Legal Use of the Itemize And Give Values As Of Date Of Decedents Death

The legal use of the Itemize And Give Values As Of Date Of Decedents Death form is primarily to provide a transparent account of the decedent's estate for probate proceedings. This form helps ensure that the estate is administered according to state laws and the decedent's wishes. It is important for the executor to understand that inaccuracies or omissions can lead to legal disputes or penalties. Therefore, maintaining detailed records and adhering to legal requirements is essential for proper estate management.

Required Documents

To complete the Itemize And Give Values As Of Date Of Decedents Death form, the following documents may be required:

- Death certificate of the decedent.

- Will or trust documents, if applicable.

- Property deeds and titles for real estate.

- Bank statements and investment account statements.

- Appraisals for valuable personal property, such as jewelry or collectibles.

Examples of Using the Itemize And Give Values As Of Date Of Decedents Death

Examples of utilizing the Itemize And Give Values As Of Date Of Decedents Death form include:

- An executor preparing the estate for probate by accurately listing the decedent's home, vehicles, and bank accounts.

- A family member seeking to understand the value of an estate for potential inheritance disputes.

- A financial advisor assisting a client with estate planning to ensure all assets are accounted for and valued appropriately.

Filing Deadlines / Important Dates

Filing deadlines for the Itemize And Give Values As Of Date Of Decedents Death form can vary by state. Generally, the form should be submitted within a specific timeframe following the decedent's death to initiate the probate process. Executors should check local probate court rules for exact deadlines to avoid delays or penalties. It is advisable to consult with a legal professional to ensure compliance with all relevant timelines.

Quick guide on how to complete itemize and give values as of date of decedents death

Complete Itemize And Give Values As Of Date Of Decedents Death effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Itemize And Give Values As Of Date Of Decedents Death on any platform with airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign Itemize And Give Values As Of Date Of Decedents Death effortlessly

- Obtain Itemize And Give Values As Of Date Of Decedents Death and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, via email, SMS, or invite link, or download it to your computer.

Forget about missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Itemize And Give Values As Of Date Of Decedents Death and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to itemize and give values as of the date of the decedent's death?

To itemize and give values as of the date of the decedent's death means to create a detailed list of all the assets and their respective values at the time of death. This process is crucial for estate planning and tax purposes, ensuring all assets are accurately represented and accounted for in legal documents.

-

How can airSlate SignNow help with itemizing values for estate planning?

airSlate SignNow streamlines the process of itemizing and giving values as of the date of the decedent's death by allowing you to easily send and eSign necessary documents. Our platform enhances clarity and accuracy, making it easier to compile and verify asset values efficiently.

-

Is airSlate SignNow cost-effective for managing estate documents?

Yes, airSlate SignNow offers a cost-effective solution for managing estate documents, including those that require you to itemize and give values as of the date of the decedent's death. By minimizing administrative costs and enhancing productivity, businesses can save both time and money.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow features a range of document management tools, including templates for estate documents that require itemizing values as of the date of the decedent's death. Additionally, our platform provides secure eSigning, cloud storage, and collaborative options to enhance workflow.

-

Can airSlate SignNow integrate with other software for better estate management?

Absolutely! airSlate SignNow offers integrations with various software solutions that facilitate efficient estate management. This includes accounting software and CRM systems that can assist in itemizing and giving values as of the date of the decedent's death effectively.

-

Are mobile options available for airSlate SignNow users?

Yes, airSlate SignNow provides a mobile application that allows users to access, manage, and eSign documents from anywhere. This flexibility is particularly beneficial for quickly itemizing and giving values as of the date of the decedent's death, making the process on-the-go seamless.

-

What are the security measures in place for sensitive documents?

airSlate SignNow understands the sensitivity of documents associated with itemizing and giving values as of the date of the decedent's death. Our platform employs advanced encryption, two-factor authentication, and secure cloud storage to ensure your documents remain confidential and protected.

Get more for Itemize And Give Values As Of Date Of Decedents Death

Find out other Itemize And Give Values As Of Date Of Decedents Death

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form