North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property Form

What is the North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property

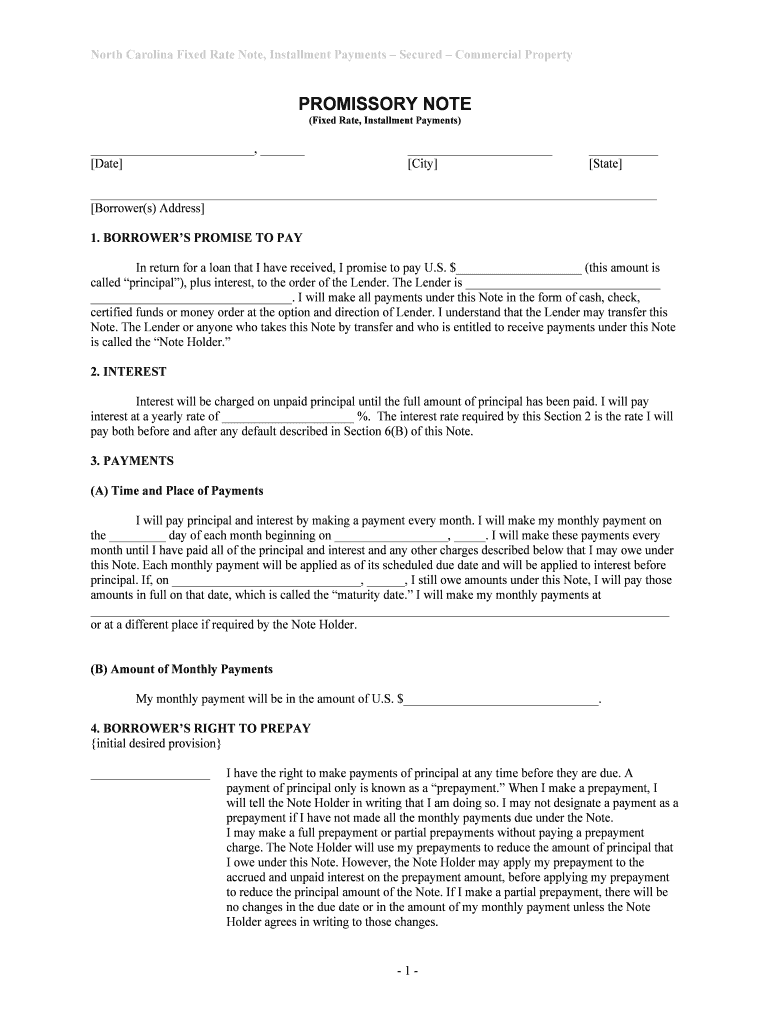

The North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property is a legal document that outlines the terms of a loan secured by commercial property in North Carolina. This note specifies the fixed interest rate, payment schedule, and the obligations of the borrower. It serves as a binding agreement between the lender and the borrower, ensuring that the lender has a secured interest in the property until the loan is fully paid. This form is crucial for real estate transactions involving commercial properties, providing clarity and legal protection for both parties involved.

How to use the North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property

Using the North Carolina Fixed Rate Note involves several steps. First, both parties must agree on the loan terms, including the interest rate and payment schedule. Once agreed upon, the borrower fills out the form with accurate information regarding the property and loan details. After completing the form, both parties must sign it to make it legally binding. It is advisable to keep a copy of the signed document for future reference. Utilizing digital tools for this process can streamline execution and enhance security.

Steps to complete the North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property

Completing the North Carolina Fixed Rate Note involves the following steps:

- Gather necessary information about the loan, including the amount, interest rate, and payment terms.

- Provide details about the commercial property being used as collateral.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the document for accuracy and completeness.

- Both the borrower and lender must sign the document, either in person or through a secure eSigning platform.

- Retain copies of the signed note for personal records and future reference.

Key elements of the North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property

Several key elements are essential in the North Carolina Fixed Rate Note. These include:

- Loan Amount: The total amount borrowed by the borrower.

- Interest Rate: The fixed rate applied to the loan, which remains constant throughout the term.

- Payment Schedule: Details on how often payments are due, typically monthly or quarterly.

- Property Description: A detailed description of the commercial property securing the loan.

- Default Terms: Conditions under which the lender can claim the property if the borrower fails to make payments.

Legal use of the North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property

The North Carolina Fixed Rate Note is legally binding when executed according to state laws. It must include all necessary information and signatures from both parties. The document must comply with the Uniform Commercial Code (UCC) and other relevant state regulations to ensure enforceability. Using a reliable eSigning platform can enhance the legal standing of the document by providing a digital certificate and maintaining compliance with eSignature laws.

State-specific rules for the North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property

In North Carolina, specific rules govern the execution and enforcement of the Fixed Rate Note. These include compliance with state lending laws, proper notarization of signatures, and adherence to the UCC guidelines regarding secured transactions. It is vital for both parties to understand their rights and obligations under state law to avoid potential disputes. Consulting with a legal professional familiar with North Carolina real estate law can provide additional guidance.

Quick guide on how to complete north carolina fixed rate note installment payments secured commercial property

Complete North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property smoothly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow offers you all the features necessary to create, modify, and eSign your documents swiftly without delays. Handle North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to alter and eSign North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property effortlessly

- Locate North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property and then click Get Form to commence.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional written signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property?

A North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property is a type of real estate financing where the borrower agrees to repay a structured loan with fixed-rate monthly payments. This financial instrument is secured against commercial property, offering stability and predictability in your payment schedule.

-

How do I create a North Carolina Fixed Rate Note with airSlate SignNow?

Creating a North Carolina Fixed Rate Note with airSlate SignNow is simple and user-friendly. You can easily fill out the necessary forms, customize the terms, and securely eSign the document online, making the entire process efficient and quick.

-

What are the typical interest rates for a North Carolina Fixed Rate Note?

Interest rates for a North Carolina Fixed Rate Note generally vary based on market conditions and individual creditworthiness. To find competitive rates for your specific situation, it’s recommended to consult with lenders or financial advisors familiar with commercial real estate financing.

-

Can I ensure my North Carolina Fixed Rate Note is legally binding?

Yes, using airSlate SignNow to eSign your North Carolina Fixed Rate Note ensures that the document is legally binding. Our platform adheres to stringent legal standards and offers secure storage, giving you peace of mind regarding the enforceability of your installment payment agreement.

-

Are there any fees associated with using airSlate SignNow for my North Carolina Fixed Rate Note?

airSlate SignNow offers a cost-effective solution with transparent pricing. While we aim to keep fees low, there may be transaction fees or subscription costs depending on the plan you choose. It's best to review our pricing page for detailed information.

-

How can I integrate airSlate SignNow into my existing workflow for managing North Carolina Fixed Rate Notes?

Integrating airSlate SignNow into your workflow is straightforward. We provide various integration options with popular CRM and document management systems, allowing you to streamline the process of managing your North Carolina Fixed Rate Notes efficiently.

-

What features does airSlate SignNow offer to manage installment payments for secured commercial properties?

airSlate SignNow offers features such as automated reminders, secure eSigning, custom templates, and document tracking. These tools can enhance your experience in managing installment payments for North Carolina Fixed Rate Notes secured by commercial properties.

Get more for North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property

Find out other North Carolina Fixed Rate Note, Installment Payments Secured Commercial Property

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now