Type Names of Beneficiaries Form

What is the Type Names Of Beneficiaries

The type names of beneficiaries form is a crucial document used to designate individuals or entities that will receive assets or benefits from a trust, will, or insurance policy upon the death of the account holder. This form is essential in estate planning, ensuring that the intended recipients are clearly identified and legally recognized. By specifying the names of beneficiaries, individuals can avoid potential disputes and ensure that their wishes are honored after their passing.

Steps to complete the Type Names Of Beneficiaries

Completing the type names of beneficiaries form involves several key steps to ensure accuracy and compliance with legal standards. First, gather necessary personal information for each beneficiary, including full names, addresses, and relationship to the account holder. Next, clearly indicate the percentage or specific assets each beneficiary will receive. It is important to review the form thoroughly for any errors or omissions before signing. Finally, ensure that the completed form is securely stored and that all relevant parties are informed of its existence.

Legal use of the Type Names Of Beneficiaries

The legal use of the type names of beneficiaries form is governed by various state laws and regulations. To be considered valid, the form must be executed in accordance with the legal requirements of the jurisdiction in which it is created. This typically includes proper signatures, notarization, and adherence to any specific state provisions regarding beneficiary designations. Understanding these legalities helps ensure that the form will withstand scrutiny in the event of a dispute.

Key elements of the Type Names Of Beneficiaries

Several key elements must be included in the type names of beneficiaries form to ensure its effectiveness. These elements include:

- Full Name of Beneficiaries: Each beneficiary's complete legal name must be provided.

- Contact Information: Addresses and contact details should be included for each beneficiary.

- Relationship to the Account Holder: Clearly stating the relationship helps clarify intentions.

- Distribution Percentage: Specify the percentage of the total assets each beneficiary will receive.

- Signatures: The form must be signed by the account holder and possibly witnessed or notarized, depending on state laws.

Examples of using the Type Names Of Beneficiaries

Examples of the type names of beneficiaries form can vary based on the context in which it is used. For instance, in a life insurance policy, the policyholder may designate family members or charitable organizations as beneficiaries. In a will, an individual might name children, spouses, or friends to inherit specific assets. Each scenario requires careful consideration of the beneficiaries' names and their respective shares to ensure that the document reflects the account holder's wishes accurately.

Filing Deadlines / Important Dates

While the type names of beneficiaries form itself may not have specific filing deadlines, it is important to keep it updated, especially after major life events such as marriage, divorce, or the birth of a child. Additionally, certain deadlines may apply to related documents, such as wills or trusts, which could impact the validity of beneficiary designations. Regularly reviewing and updating the form ensures that it remains current and legally binding.

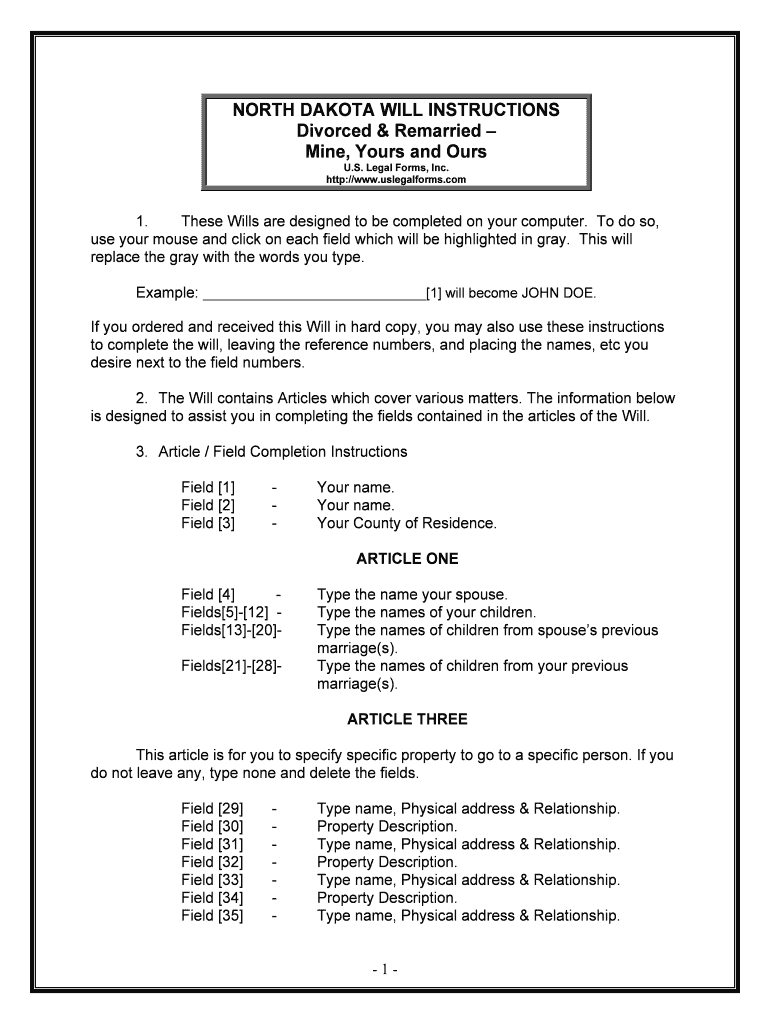

Quick guide on how to complete type names of beneficiaries

Complete Type Names Of Beneficiaries effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle Type Names Of Beneficiaries on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to edit and electronically sign Type Names Of Beneficiaries easily

- Locate Type Names Of Beneficiaries and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Type Names Of Beneficiaries to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How do I type names of beneficiaries in airSlate SignNow?

To type names of beneficiaries in airSlate SignNow, simply open the document you need to sign, and use the text field tools to add the names where required. The platform allows you to easily customize and designate fields for beneficiaries, ensuring accuracy. This streamlined process helps in creating documents efficiently.

-

Is airSlate SignNow suitable for multiple beneficiaries?

Yes, airSlate SignNow is designed to handle documents that require multiple beneficiaries. You can type names of beneficiaries in designated fields and manage their signing order effectively. The user-friendly interface ensures that all parties can easily navigate the signing process.

-

What features does airSlate SignNow offer for beneficiary management?

airSlate SignNow includes features such as custom fields, reminders, and notifications specifically for managing beneficiaries. You can type names of beneficiaries, assign roles, and track document status seamlessly. These functionalities enhance collaboration and ensure nothing is overlooked.

-

How much does airSlate SignNow cost?

airSlate SignNow offers various pricing plans to accommodate different business needs. Depending on the features required, the cost can vary. For optimal use, including the ability to type names of beneficiaries and advanced management tools, check their pricing page for detailed information.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates with various applications to enhance productivity. You can connect with CRM systems, cloud storage solutions, and other platforms. This allows you to seamlessly type names of beneficiaries directly from those applications, streamlining your workflow.

-

What are the benefits of using airSlate SignNow for beneficiary documentation?

Using airSlate SignNow for beneficiary documentation ensures efficiency and security. You can quickly type names of beneficiaries, eSign documents, and access them anytime from anywhere. The platform’s robust security measures help protect sensitive information, giving you peace of mind.

-

How secure is the information I input, including names of beneficiaries?

airSlate SignNow employs advanced security protocols to safeguard all information, including names of beneficiaries. Data is encrypted in transit and at rest, ensuring privacy and compliance. You can trust that your documents are protected while you manage signing and documentation.

Get more for Type Names Of Beneficiaries

- California assumption agreement of deed of trust and release of original mortgagors form

- Az bill of sale form

- Quit claim deed form individual to individual georgia

- Michigan legal last will and testament form for a married person with no children

- Arizona warranty deed from corporation to corporation form

- Dnr form

- South dakota notice of default for past due payments in connection with contract for deed form

- Maryland articles of organization for domestic limited liability company llc form

Find out other Type Names Of Beneficiaries

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast