NE DO 10A Form

What is the NE DO 10A

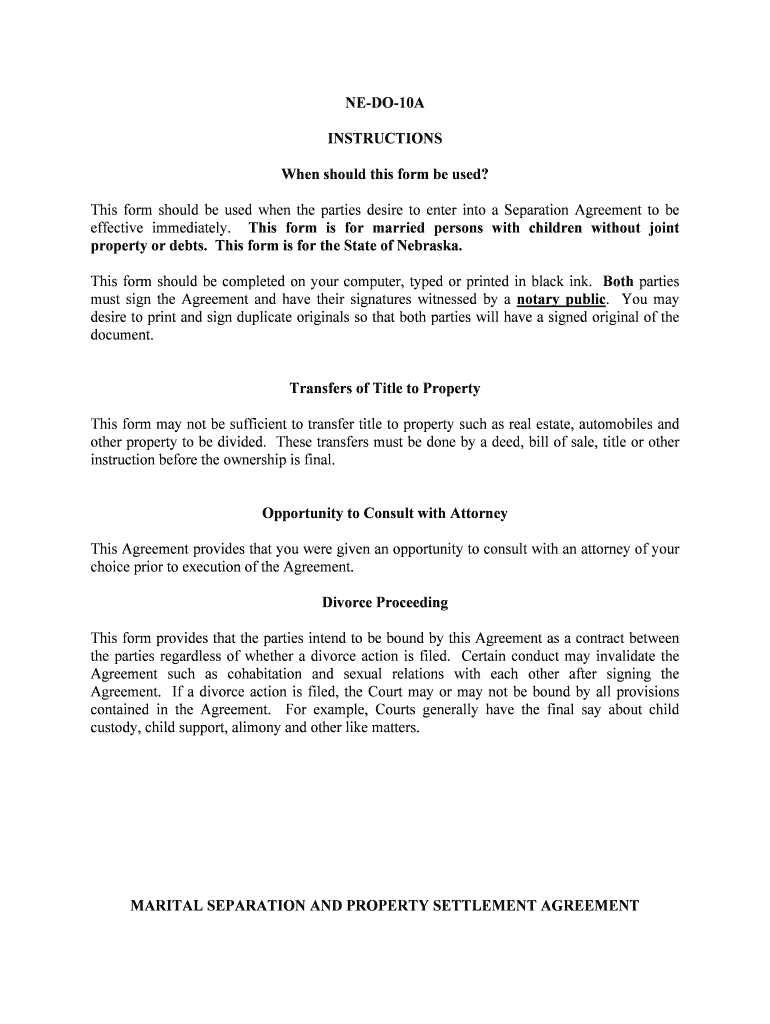

The NE DO 10A form is a specific document utilized in the state of Nebraska for various legal and administrative purposes. This form is often required for individuals and businesses to ensure compliance with state regulations. It serves as an official declaration or application, depending on the context in which it is used. Understanding the purpose of the NE DO 10A is crucial for anyone needing to navigate legal processes in Nebraska.

How to use the NE DO 10A

Using the NE DO 10A involves several key steps to ensure that the form is completed accurately. First, gather all necessary information that will be required on the form, such as personal identification details or business information. Next, carefully fill out the form, making sure to follow the instructions provided. It is essential to review the completed form for any errors before submission. Finally, submit the NE DO 10A according to the specified guidelines, which may include online submission, mailing, or in-person delivery.

Steps to complete the NE DO 10A

Completing the NE DO 10A requires a methodical approach to ensure accuracy and compliance. Here are the steps to follow:

- Obtain the NE DO 10A form from a reliable source.

- Read the instructions carefully to understand the requirements.

- Fill in the required fields with accurate information.

- Double-check for any errors or omissions.

- Sign and date the form as required.

- Submit the form through the appropriate channels.

Legal use of the NE DO 10A

The NE DO 10A must be used in accordance with Nebraska state laws to ensure its legal validity. This includes understanding the specific legal implications of the information provided on the form. Proper use of the NE DO 10A can protect individuals and businesses from potential legal issues. It is advisable to consult legal professionals if there are any uncertainties regarding the form's usage.

Key elements of the NE DO 10A

Several key elements are essential for the NE DO 10A to be considered complete and valid. These elements typically include:

- Personal or business identification information.

- Specific details relevant to the purpose of the form.

- Signatures from all required parties.

- Date of completion.

Ensuring that all these elements are accurately filled out is critical for the form's acceptance by the relevant authorities.

Who Issues the Form

The NE DO 10A form is issued by the state of Nebraska, typically through a designated government agency. This agency is responsible for overseeing the compliance and processing of the form. It is important for users to verify that they are using the most current version of the form, as updates may occur.

Quick guide on how to complete ne do 10a

Complete NE DO 10A seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage NE DO 10A on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and electronically sign NE DO 10A with ease

- Obtain NE DO 10A and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign NE DO 10A and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is NE DO 10A and how does it relate to airSlate SignNow?

NE DO 10A refers to the regulatory framework that allows businesses to efficiently manage document signing electronically. With airSlate SignNow, you can ensure compliance while streamlining the eSigning process, making it easy to implement NE DO 10A practices within your organization.

-

How can airSlate SignNow help my business comply with NE DO 10A?

AirSlate SignNow provides a secure and compliant platform for electronic signatures that aligns with NE DO 10A guidelines. This ensures that your documents are legally binding and minimizes the risk of errors, helping your business to adhere to necessary regulations.

-

What features does airSlate SignNow offer for NE DO 10A compliance?

AirSlate SignNow offers a variety of features such as secure electronic signatures, audit trails, and customizable workflows designed to support NE DO 10A compliance. These functionalities ensure that you can manage your documents effectively while meeting the necessary legal requirements.

-

Is airSlate SignNow cost-effective for businesses looking to implement NE DO 10A?

Yes, airSlate SignNow is a cost-effective solution for businesses aiming to align with NE DO 10A. With flexible pricing plans and a range of features, it allows companies to enhance their document signing process without breaking the bank.

-

What integrations does airSlate SignNow offer that support NE DO 10A workflows?

AirSlate SignNow integrates seamlessly with various applications including CRM systems and cloud storage services. This facilitates efficient document management and supports NE DO 10A workflows, allowing you to connect all your tools in one place.

-

Can airSlate SignNow improve the efficiency of document handling while adhering to NE DO 10A?

Absolutely! With airSlate SignNow, you can automate document routing and signing processes, signNowly increasing efficiency. By adhering to NE DO 10A guidelines, your team can focus more on core activities rather than getting bogged down by manual processes.

-

What benefits can my organization expect from using airSlate SignNow for NE DO 10A?

By using airSlate SignNow for NE DO 10A, your organization can expect enhanced security, improved compliance, and reduced turnaround times for document signing. These benefits lead to increased customer satisfaction and streamlined operations.

Get more for NE DO 10A

- Naic biographical affidavit form

- Montana state prison visiting questioneer form

- Parenting plan montana form

- Telemarketing registration application montana department of doj mt form

- Menu template printable form

- Cfs 068 financial statement dphhs mt form

- Your inventory for keeping everyone safe department of public dphhs mt form

- Provideramp39s guide to the first health authorization process mar 04 dphhs mt form

Find out other NE DO 10A

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit