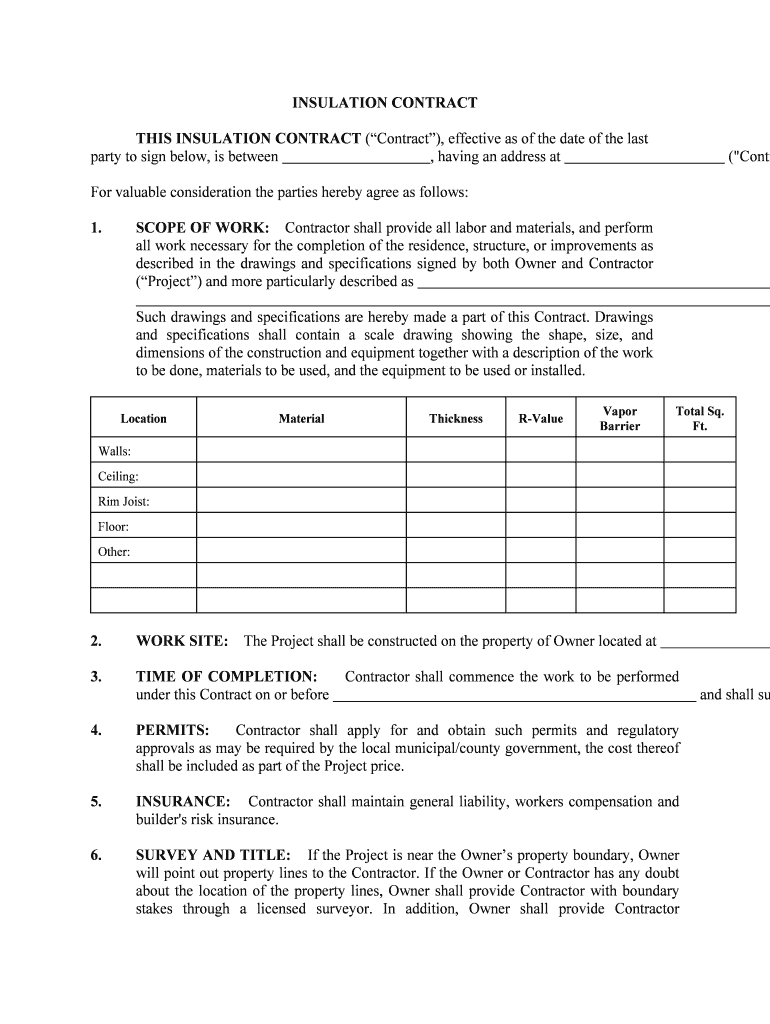

Builder's Risk Insurance Form

What is Builder's Risk Insurance

Builder's Risk Insurance is a specialized type of property insurance designed to protect buildings under construction. This insurance covers the structure itself, as well as materials and equipment on-site, from various risks such as fire, theft, vandalism, and certain weather-related damages. It is essential for contractors, builders, and property owners to secure this coverage to mitigate financial losses during the construction phase.

How to Obtain Builder's Risk Insurance

To obtain Builder's Risk Insurance, start by assessing your specific needs based on the project's scope and value. Contact insurance providers or agents who specialize in construction insurance. They will guide you through the application process, which typically involves providing details about the project, including the location, estimated completion date, and total construction costs. After submitting the application, the insurer will evaluate the risk and provide a quote based on the information provided.

Steps to Complete Builder's Risk Insurance

Completing Builder's Risk Insurance involves several key steps:

- Determine the coverage amount needed based on the total project cost.

- Gather necessary documentation, including project contracts and construction plans.

- Fill out the insurance application with accurate information regarding the project.

- Review the policy terms and conditions to ensure adequate coverage.

- Submit the application and await approval from the insurance provider.

Key Elements of Builder's Risk Insurance

Key elements of Builder's Risk Insurance include:

- Coverage Scope: Protection against risks such as fire, theft, and vandalism.

- Policy Duration: Coverage typically lasts until the project is completed or the property is occupied.

- Exclusions: Common exclusions may include natural disasters, employee injuries, and equipment breakdowns.

- Additional Coverage: Options for extending coverage to include soft costs, such as lost income due to delays.

Legal Use of Builder's Risk Insurance

Builder's Risk Insurance is legally recognized in the United States as a valid form of coverage for construction projects. It is important for contractors and property owners to understand their legal obligations regarding insurance. This includes ensuring that the policy meets state regulations and adequately protects all parties involved in the construction process. Failure to maintain proper coverage can lead to legal complications and financial liabilities.

Examples of Using Builder's Risk Insurance

Builder's Risk Insurance can be utilized in various scenarios, including:

- New residential home construction projects.

- Renovation of existing commercial properties.

- Large-scale infrastructure projects, such as bridges or roads.

- Seasonal construction work, where projects may be paused due to weather conditions.

Quick guide on how to complete builders risk insurance

Effortlessly Prepare Builder's Risk Insurance on Any Device

Digital document management has gained immense popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to quickly create, modify, and electronically sign your documents without any delays. Manage Builder's Risk Insurance on any device using the airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

The Easiest Method to Modify and eSign Builder's Risk Insurance without Hassle

- Find Builder's Risk Insurance and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management requirements with just a few clicks from any device you choose. Alter and eSign Builder's Risk Insurance to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Builder's Risk Insurance?

Builder's Risk Insurance is a specialized type of property insurance that provides coverage for buildings under construction. It protects against various risks, including fire, theft, and vandalism during the construction period. This insurance is essential for contractors and property owners to safeguard their investment.

-

Who needs Builder's Risk Insurance?

Builder's Risk Insurance is often required for contractors, property developers, and homeowners involved in a construction project. It's particularly important for those who are managing risks while work is being done on a property. Ensuring you have the right coverage can avoid signNow financial losses.

-

What does Builder's Risk Insurance cover?

Builder's Risk Insurance typically covers damages due to fire, wind, theft, and vandalism while the building is under construction. It can also extend to materials and equipment that are on-site. However, coverage specifics may vary, so it's advisable to review your policy details.

-

How much does Builder's Risk Insurance cost?

The cost of Builder's Risk Insurance can vary widely based on the project's size, location, and the value of the property being built. Generally, it's calculated as a percentage of the total construction cost. For accurate pricing, it’s best to obtain quotes from multiple insurers.

-

How long does Builder's Risk Insurance last?

Builder's Risk Insurance typically lasts for the duration of the construction project, but coverage can sometimes extend for a limited period after completion. You should plan to update or change your coverage once the building is completed to avoid lapses. Always consult with your insurer for specific terms.

-

Can Builder's Risk Insurance be customized?

Yes, Builder's Risk Insurance can often be tailored to meet the specific needs of your construction project. Policy customizations may include alterations in coverage limits, additional endorsements for unique risks, or exclusions for specific perils. Working with an insurance agent can help you customize a policy that fits your project.

-

Do I need Builder's Risk Insurance for renovations?

Yes, Builder's Risk Insurance is typically recommended for renovations, especially if structural changes are being made. This type of insurance protects against potential risks that arise from construction activities, even in existing buildings. It ensures coverage for both the renovation work and the building itself.

Get more for Builder's Risk Insurance

- Form 2441 rev 2006 fill in capable

- Form 8288a rev january 2004 realtor

- Cpgorg 2011 form

- Form move in inspection

- B1 official form 1 1211 united states bankruptcy court district name of debtor if individual enter last first middle all other

- Calpers beneficiary form

- Tenant qualification application form

- Marriage registration form mrf 779592879

Find out other Builder's Risk Insurance

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later