T5 Form V2 0 RTA Ltb Gov on

What is the T5 Form V2 0 RTA Ltb Gov On

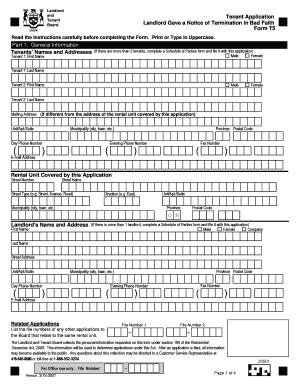

The T5 Form V2 0 RTA Ltb Gov On is a specific tax form used in the United States for reporting income from various sources. This form is typically utilized by businesses and individuals to report payments made to non-employees, such as independent contractors or freelancers. The T5 form helps ensure compliance with tax regulations by providing a clear record of income that needs to be reported to the Internal Revenue Service (IRS).

How to use the T5 Form V2 0 RTA Ltb Gov On

Using the T5 Form V2 0 RTA Ltb Gov On involves a few straightforward steps. First, gather all necessary information regarding the payments made during the tax year. This includes the recipient's name, address, and taxpayer identification number. Next, accurately fill out the form, ensuring that all amounts are correctly reported. Once completed, the form must be submitted to the IRS and a copy provided to the recipient for their records.

Steps to complete the T5 Form V2 0 RTA Ltb Gov On

Completing the T5 Form V2 0 RTA Ltb Gov On requires careful attention to detail. Follow these steps:

- Collect the necessary information about the payee, including their legal name, address, and taxpayer identification number.

- Fill in the amounts paid to the payee during the tax year, ensuring accuracy.

- Review the form for any errors or omissions before finalizing it.

- Submit the completed form to the IRS by the specified deadline.

- Provide a copy of the form to the payee for their records.

Legal use of the T5 Form V2 0 RTA Ltb Gov On

The T5 Form V2 0 RTA Ltb Gov On is legally required for reporting certain types of income. Failure to file this form correctly can result in penalties from the IRS. It is essential for businesses and individuals to understand their obligations under the law when it comes to reporting income. Proper use of the T5 form helps maintain transparency and compliance with federal tax regulations.

Key elements of the T5 Form V2 0 RTA Ltb Gov On

Key elements of the T5 Form V2 0 RTA Ltb Gov On include the following:

- Payee information: Name, address, and taxpayer identification number.

- Payment details: Total amounts paid during the tax year.

- Filing information: Specific instructions for submission and deadlines.

Understanding these elements is crucial for accurate reporting and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the T5 Form V2 0 RTA Ltb Gov On are critical to avoid penalties. Typically, this form must be filed by a specific date each year, often aligned with the end of the tax year. It is important to check the IRS guidelines for the exact deadlines, as they may vary from year to year. Timely submission ensures compliance and helps avoid unnecessary fines.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t5 form v2 0 rta ltb gov on

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the T5 Form V2 0 RTA Ltb Gov On?

The T5 Form V2 0 RTA Ltb Gov On is a document used for reporting income from various sources in Canada. It is essential for individuals and businesses to accurately report their earnings to the government. Understanding this form is crucial for compliance and tax purposes.

-

How can airSlate SignNow help with the T5 Form V2 0 RTA Ltb Gov On?

airSlate SignNow simplifies the process of completing and eSigning the T5 Form V2 0 RTA Ltb Gov On. Our platform allows users to fill out the form electronically, ensuring accuracy and efficiency. This streamlines the submission process and helps avoid common errors.

-

What are the pricing options for using airSlate SignNow for the T5 Form V2 0 RTA Ltb Gov On?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while providing access to features for managing the T5 Form V2 0 RTA Ltb Gov On. Check our website for detailed pricing information.

-

What features does airSlate SignNow provide for the T5 Form V2 0 RTA Ltb Gov On?

Our platform includes features such as customizable templates, secure eSigning, and document tracking specifically for the T5 Form V2 0 RTA Ltb Gov On. These tools enhance user experience and ensure that all documents are handled securely and efficiently.

-

Are there any benefits to using airSlate SignNow for the T5 Form V2 0 RTA Ltb Gov On?

Using airSlate SignNow for the T5 Form V2 0 RTA Ltb Gov On offers numerous benefits, including time savings and improved accuracy. Our solution eliminates the need for paper forms, reducing clutter and streamlining your workflow. Additionally, you can access your documents anytime, anywhere.

-

Can I integrate airSlate SignNow with other software for the T5 Form V2 0 RTA Ltb Gov On?

Yes, airSlate SignNow supports integrations with various software applications, making it easy to manage the T5 Form V2 0 RTA Ltb Gov On alongside your existing tools. This integration capability enhances productivity and ensures a seamless workflow across platforms.

-

Is airSlate SignNow secure for handling the T5 Form V2 0 RTA Ltb Gov On?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your T5 Form V2 0 RTA Ltb Gov On and other documents are protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the signing process.

Get more for T5 Form V2 0 RTA Ltb Gov On

- State of michigan case no michigan district courts form

- Rood v department of corcase no 11920191219953 form

- Medical information athletic waiver and release for gymnasticsand cheerleader school

- Refusal of employee request for early raise form

- Postnuptial agreement to convert separate property into community property form

- Carpool application and agreement at a college or university form

- Introduction to entrepreneurship thomas edison state form

- Employee intellectual property assignment agreement long form

Find out other T5 Form V2 0 RTA Ltb Gov On

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document