MORTGAGE DEED with POWER of SALE Form

What is the mortgage deed with power of sale

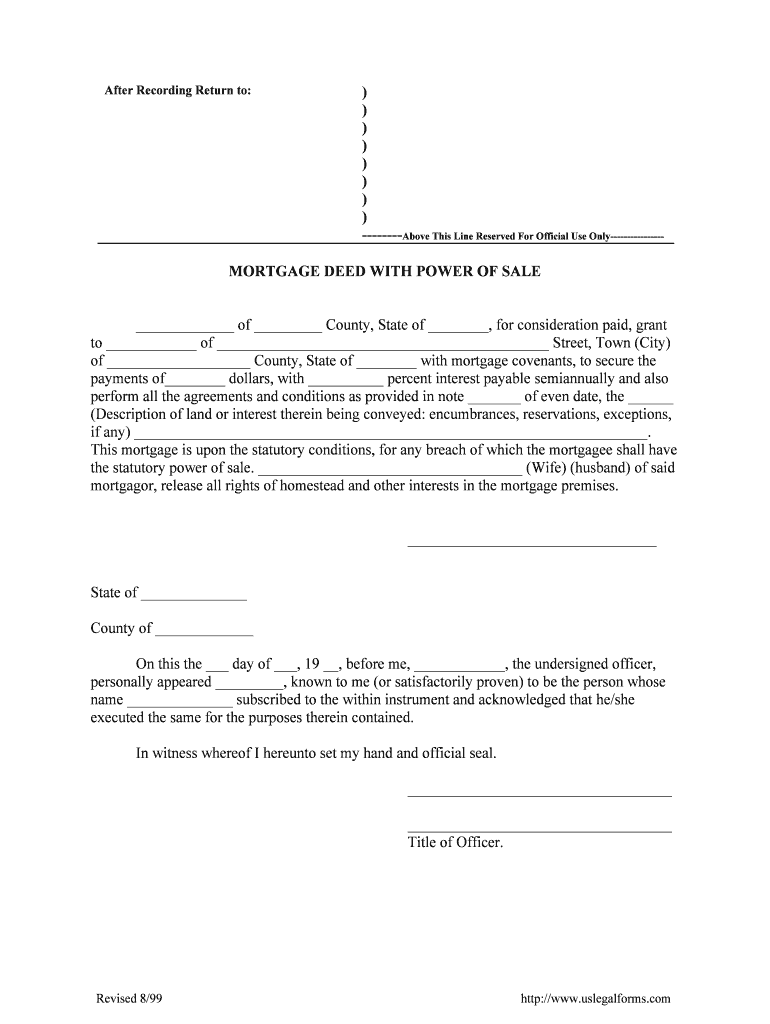

A mortgage deed with power of sale is a legal document that secures a loan by using real property as collateral. This type of deed grants the lender the authority to sell the property without court intervention if the borrower defaults on the loan. This provision is particularly important in the event of foreclosure, allowing lenders to recover their investment more efficiently. The document typically includes details such as the property description, loan amount, interest rate, and repayment terms. It is essential for both borrowers and lenders to understand the implications of this deed, as it affects their rights and responsibilities regarding the property.

How to use the mortgage deed with power of sale

Using a mortgage deed with power of sale involves several steps to ensure that both parties are protected and the document is legally binding. First, the borrower and lender should clearly outline the terms of the loan, including repayment schedules and interest rates. Next, the borrower must sign the deed in the presence of a notary public to verify their identity and willingness to enter into the agreement. Once signed, the deed should be recorded with the appropriate local government office to provide public notice of the mortgage. This step is crucial for protecting the lender's interest in the property and establishing the legal right to sell it in case of default.

Key elements of the mortgage deed with power of sale

Several key elements are essential for a mortgage deed with power of sale to be valid and enforceable. These include:

- Property Description: A clear and accurate description of the property being mortgaged.

- Loan Amount: The total amount of money borrowed, which is secured by the mortgage.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Terms: Detailed information about how and when the loan will be repaid.

- Power of Sale Clause: A provision that allows the lender to sell the property without court involvement in case of default.

- Signatures: The borrower’s signature, along with a notary acknowledgment, is necessary to validate the document.

Steps to complete the mortgage deed with power of sale

Completing a mortgage deed with power of sale involves several important steps:

- Draft the Document: Prepare the mortgage deed, ensuring all necessary elements are included.

- Review Terms: Both parties should carefully review the terms of the mortgage to ensure mutual understanding.

- Sign in Presence of Notary: The borrower must sign the deed in front of a notary public.

- Record the Deed: Submit the signed deed to the local government office for recording.

- Retain Copies: Both parties should keep copies of the recorded deed for their records.

Legal use of the mortgage deed with power of sale

The legal use of a mortgage deed with power of sale is governed by state laws, which can vary significantly. It is essential for both lenders and borrowers to understand the specific regulations in their state regarding foreclosure processes and the enforceability of power of sale clauses. This type of deed must comply with local statutes to ensure that it is valid. Additionally, both parties should be aware of their rights and obligations under the deed, including the conditions that would trigger the power of sale and the procedures that must be followed in the event of a default.

State-specific rules for the mortgage deed with power of sale

Each state has its own regulations governing mortgage deeds with power of sale. These rules can dictate the foreclosure process, the rights of borrowers, and the requirements for executing a power of sale. For instance, some states may require a judicial foreclosure process, while others allow non-judicial foreclosure. It is crucial for both lenders and borrowers to familiarize themselves with their state's specific laws to ensure compliance and protect their interests. Consulting with a legal professional can provide valuable guidance in navigating these state-specific regulations.

Quick guide on how to complete mortgage deed with power of sale

Effortlessly Prepare MORTGAGE DEED WITH POWER OF SALE on Any Device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage MORTGAGE DEED WITH POWER OF SALE on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The Simplest Way to Modify and eSign MORTGAGE DEED WITH POWER OF SALE with Ease

- Locate MORTGAGE DEED WITH POWER OF SALE and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional hand-signed signature.

- Verify the details and click the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Alter and eSign MORTGAGE DEED WITH POWER OF SALE to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a MORTGAGE DEED WITH POWER OF SALE?

A MORTGAGE DEED WITH POWER OF SALE is a legal document that grants the lender the right to sell the property if the borrower defaults on the loan. This type of deed simplifies the foreclosure process and allows lenders to reclaim their investment efficiently. Understanding this document is crucial for both lenders and borrowers in securing their financial interests.

-

How can airSlate SignNow help with MORTGAGE DEED WITH POWER OF SALE?

airSlate SignNow provides a seamless platform for creating, sending, and eSigning a MORTGAGE DEED WITH POWER OF SALE. With its user-friendly interface, you can draft and finalize your mortgage documents quickly, ensuring compliance and security. By using SignNow, you can streamline the process and focus more on your core business activities.

-

What are the pricing options for using airSlate SignNow for MORTGAGE DEED WITH POWER OF SALE?

airSlate SignNow offers flexible pricing plans to suit various business needs, starting with a basic plan that's budget-friendly. The plans include features specifically designed for managing documents like the MORTGAGE DEED WITH POWER OF SALE. By choosing the right plan, you can make the most of our powerful eSigning capabilities without breaking the bank.

-

What are the benefits of using electronic signatures for MORTGAGE DEED WITH POWER OF SALE?

Using electronic signatures for a MORTGAGE DEED WITH POWER OF SALE enhances security and speeds up the transaction process. It eliminates the need for physical paperwork and offers a more efficient way to manage your documents. Additionally, electronic signatures provide traceability, which is essential for legal compliance and record-keeping.

-

Is airSlate SignNow compliant with regulations for MORTGAGE DEED WITH POWER OF SALE?

Yes, airSlate SignNow complies with all relevant regulations for electronic signatures, including the ESIGN Act and UETA. This compliance ensures that your MORTGAGE DEED WITH POWER OF SALE remains legally binding and enforceable. Our platform prioritizes security and legal authenticity, so you can trust us with your important documents.

-

Can I integrate airSlate SignNow with other software for managing MORTGAGE DEED WITH POWER OF SALE?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, including CRMs and document management systems. This allows you to incorporate the signing process for MORTGAGE DEED WITH POWER OF SALE into your existing workflows. Enjoy a streamlined, efficient process by syncing with the tools you already use.

-

How can I ensure the security of my MORTGAGE DEED WITH POWER OF SALE on airSlate SignNow?

airSlate SignNow employs advanced security measures, including 256-bit SSL encryption and multi-factor authentication, to protect your MORTGAGE DEED WITH POWER OF SALE. We prioritize your data security by continuously updating our systems to counteract potential threats. Rest assured, your sensitive information and documents are safe with us.

Get more for MORTGAGE DEED WITH POWER OF SALE

Find out other MORTGAGE DEED WITH POWER OF SALE

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template