Upon the Undersigned Receiving Collected Funds in the Amount of $ Form

What is the Upon The Undersigned Receiving Collected Funds In The Amount Of $

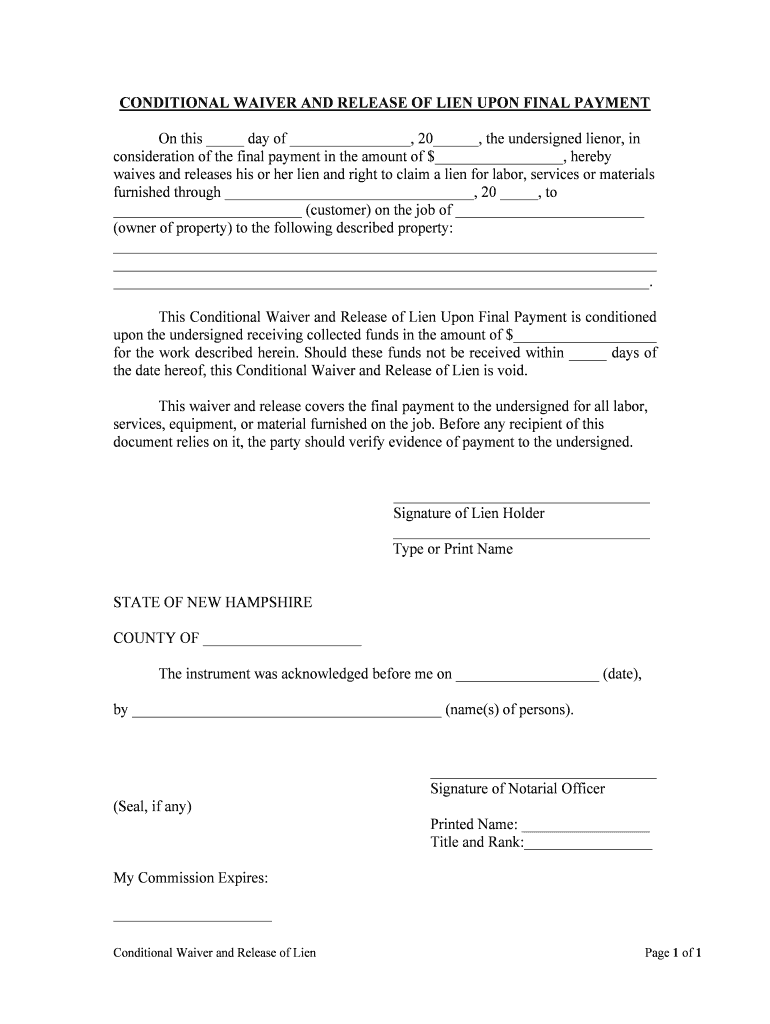

The form titled "Upon The Undersigned Receiving Collected Funds In The Amount Of $" is a legal document used to acknowledge the receipt of funds. This form serves as proof that a specified amount of money has been collected by the undersigned party. It is often utilized in various business transactions, including sales agreements, service contracts, and loan agreements. The importance of this document lies in its ability to provide a clear record of financial exchanges, which can be essential for accounting and legal purposes.

How to use the Upon The Undersigned Receiving Collected Funds In The Amount Of $

Using the form involves several key steps to ensure its effectiveness and legality. First, the parties involved should fill out the form with accurate details, including the amount received, the date of the transaction, and the names of the parties involved. Once completed, both parties should sign the document to validate the transaction. It is advisable to keep a copy for personal records and provide a copy to the other party for their records as well. This practice helps maintain transparency and accountability in financial dealings.

Steps to complete the Upon The Undersigned Receiving Collected Funds In The Amount Of $

Completing the form correctly is crucial for its legal standing. Here are the steps to follow:

- Begin by entering the date of the transaction at the top of the form.

- Clearly state the amount of funds collected in the designated area.

- Include the names of both the payer and the payee to identify the parties involved.

- Provide any additional details that may be relevant, such as the purpose of the funds.

- Both parties should sign the form to confirm their agreement and understanding.

- Make copies of the signed document for all parties involved.

Legal use of the Upon The Undersigned Receiving Collected Funds In The Amount Of $

This form is legally binding once it is signed by both parties, provided that it meets the necessary legal requirements. In the United States, electronic signatures are recognized under laws such as the ESIGN Act and UETA, making it valid for online transactions. However, it is essential to ensure that the form is filled out completely and accurately to avoid any potential disputes. Retaining a signed copy of the form can serve as evidence in case of any future legal issues regarding the transaction.

Key elements of the Upon The Undersigned Receiving Collected Funds In The Amount Of $

Several key elements must be included in the form to ensure its effectiveness:

- The full name and contact information of both parties involved.

- The specific amount of funds being acknowledged.

- The date of the transaction.

- A clear statement indicating the purpose of the funds.

- Signatures of both parties to validate the document.

Examples of using the Upon The Undersigned Receiving Collected Funds In The Amount Of $

This form can be applied in various scenarios, such as:

- A business receiving payment for goods sold.

- A contractor acknowledging receipt of payment for services rendered.

- A landlord confirming the collection of rent from a tenant.

- A loan agreement where the borrower acknowledges receiving funds from the lender.

Quick guide on how to complete upon the undersigned receiving collected funds in the amount of

Effortlessly Prepare Upon The Undersigned Receiving Collected Funds In The Amount Of $ on Any Device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without complications. Manage Upon The Undersigned Receiving Collected Funds In The Amount Of $ on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign Upon The Undersigned Receiving Collected Funds In The Amount Of $ with Ease

- Obtain Upon The Undersigned Receiving Collected Funds In The Amount Of $ and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Upon The Undersigned Receiving Collected Funds In The Amount Of $ and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean 'Upon The Undersigned Receiving Collected Funds In The Amount Of $'?

This phrase indicates the conditions under which a transaction is finalized. In the context of airSlate SignNow, it means documents can be signed and actions taken once payment is confirmed, allowing for quick processing and secure transactions.

-

How does airSlate SignNow handle payments related to 'Upon The Undersigned Receiving Collected Funds In The Amount Of $'?

With airSlate SignNow, you can easily integrate payment gateways to automate the process. This ensures that upon receiving collected funds in the specified amount, users can instantly access and sign necessary documents, streamlining operations.

-

Are there any costs associated with using airSlate SignNow for 'Upon The Undersigned Receiving Collected Funds In The Amount Of $' transactions?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business sizes. These plans include features that support transactions which are contingent upon the undersigned receiving collected funds in the agreed amount.

-

What features does airSlate SignNow provide to ensure smooth transactions upon receiving collected funds?

airSlate SignNow offers features like advanced eSignature options, document templates, and payment integrations. These allow users to manage documents easily, ensuring that transactions proceed seamlessly upon the undersigned receiving collected funds in the amount specified.

-

Can I customize my documents to reflect 'Upon The Undersigned Receiving Collected Funds In The Amount Of $'?

Absolutely! airSlate SignNow provides customizable templates where you can include important clauses like 'Upon The Undersigned Receiving Collected Funds In The Amount Of $'. This helps ensure that all parties understand the conditions before signing.

-

What benefits will my business experience using airSlate SignNow for eSigning documents?

Using airSlate SignNow enhances efficiency, accuracy, and security in document management. It allows businesses to finalize transactions contractually upon receiving collected funds in the specified amount, ultimately leading to faster turnaround times.

-

Is airSlate SignNow compatible with other software for payment processing?

Yes, airSlate SignNow can be integrated with various payment processing platforms. This makes it easier for businesses to manage transactions that are contingent upon the undersigned receiving collected funds in the agreed amount.

Get more for Upon The Undersigned Receiving Collected Funds In The Amount Of $

Find out other Upon The Undersigned Receiving Collected Funds In The Amount Of $

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple