Taxes, or Other Liabilities Incurred as a Result of Trainer's Activities on Stable's Property Form

What is the Taxes, Or Other Liabilities Incurred As A Result Of Trainer's Activities On Stable's Property

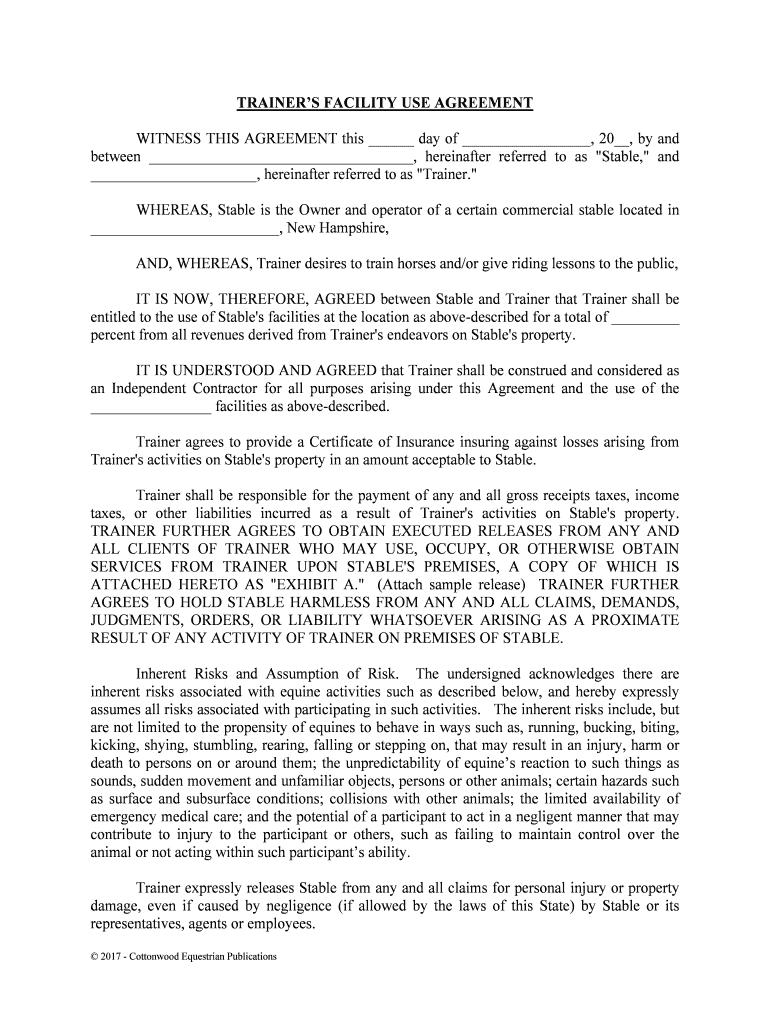

The form regarding taxes or other liabilities incurred as a result of trainer's activities on stable's property is essential for documenting any financial obligations that may arise from such activities. This form serves to clarify the responsibilities of trainers operating on stable property, ensuring that all parties understand their potential tax implications and liabilities. It is particularly relevant for trainers who may be self-employed or working under different business structures, as it outlines the financial responsibilities associated with their professional activities.

Steps to complete the Taxes, Or Other Liabilities Incurred As A Result Of Trainer's Activities On Stable's Property

Completing the form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records related to your activities on the stable's property. This includes income statements, expense receipts, and any other relevant documentation. Next, fill out the form with precise information, ensuring that all figures are accurate and reflect your financial situation. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified guidelines, whether online or by mail, to ensure it is processed correctly.

Legal use of the Taxes, Or Other Liabilities Incurred As A Result Of Trainer's Activities On Stable's Property

The legal use of this form is crucial for establishing accountability and transparency in financial dealings related to trainer activities on stable property. It is important to comply with local, state, and federal regulations when using this form. Proper execution of the form can protect trainers from potential legal issues by clearly defining their liabilities and ensuring that all tax obligations are met. Additionally, using a legally recognized eSignature solution can enhance the legitimacy of the form, providing a secure method for signing and submitting it.

Required Documents

To complete the taxes or other liabilities incurred as a result of trainer's activities on stable's property form, you will need several key documents. These typically include:

- Income statements related to your training activities

- Expense receipts for any costs incurred while operating on stable property

- Any previous tax returns that may provide context for your current liabilities

- Business registration documents if applicable

Having these documents ready will facilitate a smoother completion process and help ensure that all information is accurate and comprehensive.

IRS Guidelines

Understanding IRS guidelines is essential when dealing with taxes or other liabilities incurred as a result of trainer's activities on stable's property. The IRS provides specific instructions on how to report income and expenses related to self-employment or business activities. Familiarizing yourself with these guidelines can help you avoid common pitfalls and ensure compliance with tax laws. It is advisable to consult the IRS website or a tax professional for the most current information and guidance tailored to your specific situation.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the taxes or other liabilities incurred as a result of trainer's activities on stable's property can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to submit the form accurately and on time to avoid these consequences. Understanding the implications of non-compliance can motivate trainers to prioritize their financial responsibilities and maintain proper documentation.

Quick guide on how to complete taxes or other liabilities incurred as a result of trainers activities on stables property

Effortlessly Prepare Taxes, Or Other Liabilities Incurred As A Result Of Trainer's Activities On Stable's Property on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and safely store it online. airSlate SignNow equips you with all the tools essential to create, edit, and electronically sign your documents swiftly without delays. Manage Taxes, Or Other Liabilities Incurred As A Result Of Trainer's Activities On Stable's Property across any platform with the airSlate SignNow apps for Android or iOS and enhance your document-based workflow today.

How to Edit and Electronically Sign Taxes, Or Other Liabilities Incurred As A Result Of Trainer's Activities On Stable's Property with Ease

- Obtain Taxes, Or Other Liabilities Incurred As A Result Of Trainer's Activities On Stable's Property and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, monotonous form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Taxes, Or Other Liabilities Incurred As A Result Of Trainer's Activities On Stable's Property to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are common types of taxes or other liabilities incurred as a result of trainer's activities on stable's property?

Common types of taxes, or other liabilities incurred as a result of trainer's activities on stable's property, include sales tax on services provided, liability insurance fees, and property damage potential. Trainers operating on stables should be aware of these potential costs to avoid financial surprises. Legal advice may be beneficial to understand the specific implications.

-

How can airSlate SignNow help manage contracts related to trainer's activities?

AirSlate SignNow offers a streamlined way to manage contracts related to trainer's activities, ensuring all parties are in agreement before any liabilities arise. By digitalizing the signing process, trainers can easily handle important documents and mitigate risks associated with taxes or other liabilities incurred as a result of trainer's activities on stable's property.

-

What features does airSlate SignNow provide for tracking liabilities?

AirSlate SignNow provides features that allow users to track and document all agreements made regarding trainer's activities. By keeping accurate records, businesses can better manage taxes or other liabilities incurred as a result of trainer's activities on stable's property. This can help prevent disputes and ensure compliance.

-

Is airSlate SignNow affordable for small stables with limited budgets?

Yes, airSlate SignNow is designed to be cost-effective, making it accessible for small stables with limited budgets. By utilizing airSlate SignNow, businesses can avoid expensive administrative costs associated with managing taxes or other liabilities incurred as a result of trainer's activities on stable's property.

-

Can airSlate SignNow integrate with other accounting software for managing liabilities?

Absolutely! AirSlate SignNow can integrate with various accounting software to help manage taxes or other liabilities incurred as a result of trainer's activities on stable's property. This integration ensures that your financial data is consistent and comprehensive, simplifying tracking and reporting processes.

-

What benefits does eSigning offer for trainers operating on stable's property?

ESigning with airSlate SignNow provides several benefits for trainers, including faster document turnaround and enhanced security for contracts. This efficiency helps trainers focus on their activities without worrying about taxes or other liabilities incurred as a result of trainer's activities on stable's property.

-

How does airSlate SignNow ensure compliance concerning trainer's activities?

AirSlate SignNow ensures compliance by providing customizable templates and electronic record-keeping that align with legal requirements. This helps protect businesses from issues related to taxes or other liabilities incurred as a result of trainer's activities on stable's property. Regular updates help maintain compliance as regulations change.

Get more for Taxes, Or Other Liabilities Incurred As A Result Of Trainer's Activities On Stable's Property

- Ch 140 restraining order after hearing to stop harassment justia form

- Abl renewal form abl 565 justia

- Minnesota uniform conveyancing blanks form 3033 2011 justia

- Pioneer investments uni k remittance form

- Form 600

- Start up business plan pdf beacon funding form

- Saxon math sheets form

- Section 12 attestation consent and release form

Find out other Taxes, Or Other Liabilities Incurred As A Result Of Trainer's Activities On Stable's Property

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy