Real Estate Transfer TaxForms & InstructionsNH

What is the Real Estate Transfer TaxForms & InstructionsNH

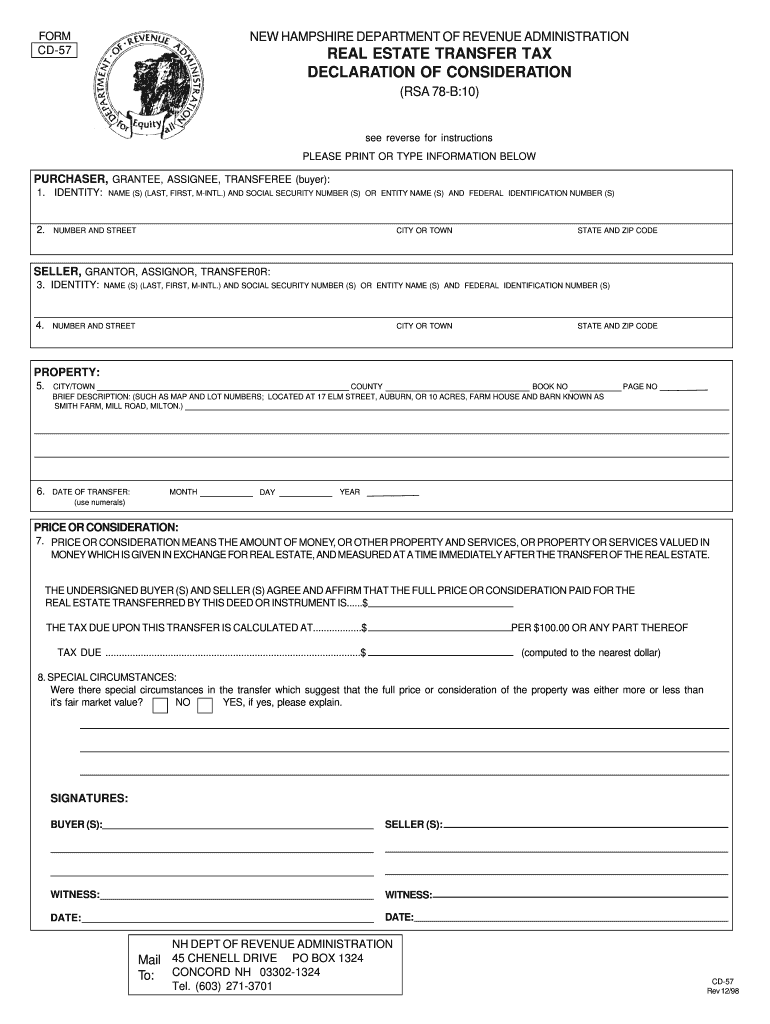

The Real Estate Transfer TaxForms & InstructionsNH are essential documents used in New Hampshire to report the transfer of real property ownership. This form is crucial for ensuring that the appropriate transfer taxes are calculated and paid. It typically includes details about the property being transferred, the parties involved in the transaction, and the amount of tax due. Understanding this form is vital for both buyers and sellers to comply with state regulations and avoid potential penalties.

Steps to complete the Real Estate Transfer TaxForms & InstructionsNH

Completing the Real Estate Transfer TaxForms & InstructionsNH involves several key steps:

- Gather necessary information about the property, including its address, type, and assessed value.

- Identify the parties involved in the transaction, including the buyer and seller.

- Calculate the transfer tax based on the sale price or assessed value, following the state guidelines.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

How to obtain the Real Estate Transfer TaxForms & InstructionsNH

The Real Estate Transfer TaxForms & InstructionsNH can be obtained from the New Hampshire Department of Revenue Administration's website or local government offices. It is advisable to ensure you are using the most current version of the form, as updates may occur. Additionally, many real estate professionals can provide assistance in obtaining and completing these forms.

Legal use of the Real Estate Transfer TaxForms & InstructionsNH

The legal use of the Real Estate Transfer TaxForms & InstructionsNH is governed by New Hampshire state law. Proper completion and submission of this form are necessary for the legal transfer of property ownership. Failure to submit the form can result in penalties, including fines or delays in the transfer process. It is important to ensure that the form is filed within the required time frame following the property transfer.

Required Documents

When completing the Real Estate Transfer TaxForms & InstructionsNH, several documents may be required:

- Proof of ownership, such as a deed.

- Sales agreement or purchase contract.

- Identification of the parties involved in the transaction.

- Any prior tax documents related to the property.

Filing Deadlines / Important Dates

Filing deadlines for the Real Estate Transfer TaxForms & InstructionsNH are critical to ensure compliance with state regulations. Typically, the form must be filed within a specific period following the transfer of property ownership, often within a few weeks. It is important to check the current regulations to confirm the exact deadlines and avoid any penalties.

Quick guide on how to complete real estate transfer taxforms ampamp instructionsnh

Prepare Real Estate Transfer TaxForms & InstructionsNH effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to generate, modify, and electronically sign your documents swiftly without delays. Manage Real Estate Transfer TaxForms & InstructionsNH on any gadget with airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to modify and electronically sign Real Estate Transfer TaxForms & InstructionsNH without hassle

- Obtain Real Estate Transfer TaxForms & InstructionsNH and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to confirm your changes.

- Select your preferred method of sharing your form, whether via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious document hunts, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Real Estate Transfer TaxForms & InstructionsNH and guarantee outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Real Estate Transfer TaxForms & InstructionsNH?

Real Estate Transfer TaxForms & InstructionsNH are essential documents required for the transfer of real estate ownership in New Hampshire. These forms provide the necessary guidelines and tax implications associated with property transfers. Understanding these forms is critical for compliance and ensuring a smooth transaction.

-

How can airSlate SignNow help with Real Estate Transfer TaxForms & InstructionsNH?

airSlate SignNow offers a user-friendly platform for completing and signing Real Estate Transfer TaxForms & InstructionsNH electronically. With our service, you can streamline your document management process, enhance collaboration, and improve efficiency in handling these essential forms. This ensures that you meet all legal requirements promptly.

-

What is the pricing for airSlate SignNow when using Real Estate Transfer TaxForms & InstructionsNH?

Our pricing for airSlate SignNow is competitive and designed to provide a cost-effective solution for managing Real Estate Transfer TaxForms & InstructionsNH. You can choose from various plans that cater to individual and business needs, ensuring you only pay for what you use. Check our website for detailed pricing information and plan comparisons.

-

Are there any features specifically designed for Real Estate Transfer TaxForms & InstructionsNH?

Yes, airSlate SignNow includes several features tailored for managing Real Estate Transfer TaxForms & InstructionsNH. These features include templates for common forms, easy document sharing, automated workflows, and secure electronic signatures. Together, these tools enhance your efficiency and ensure compliance.

-

Can I integrate airSlate SignNow with other real estate software for managing Real Estate Transfer TaxForms & InstructionsNH?

Absolutely! airSlate SignNow integrates with various real estate software platforms, making it easier to manage Real Estate Transfer TaxForms & InstructionsNH. This integration streamlines your workflow, allowing you to leverage existing tools while ensuring all documentation is handled seamlessly. Connect with your favorite tools for optimal results.

-

What are the benefits of using airSlate SignNow for Real Estate Transfer TaxForms & InstructionsNH?

Using airSlate SignNow for Real Estate Transfer TaxForms & InstructionsNH offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform enables quick access to documents and the ability to track the signing process in real-time. Ultimately, this leads to faster transaction times and improved client satisfaction.

-

Is technical support available while using airSlate SignNow for Real Estate Transfer TaxForms & InstructionsNH?

Yes, airSlate SignNow provides dedicated technical support for users handling Real Estate Transfer TaxForms & InstructionsNH. Our support team is available to assist you with any questions, troubleshooting, or guidance you may need while using our platform. We are committed to ensuring you have a smooth experience.

Get more for Real Estate Transfer TaxForms & InstructionsNH

Find out other Real Estate Transfer TaxForms & InstructionsNH

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure