Obligation 4% Monthly Gross Income Form

What is the Obligation 4% Monthly Gross Income

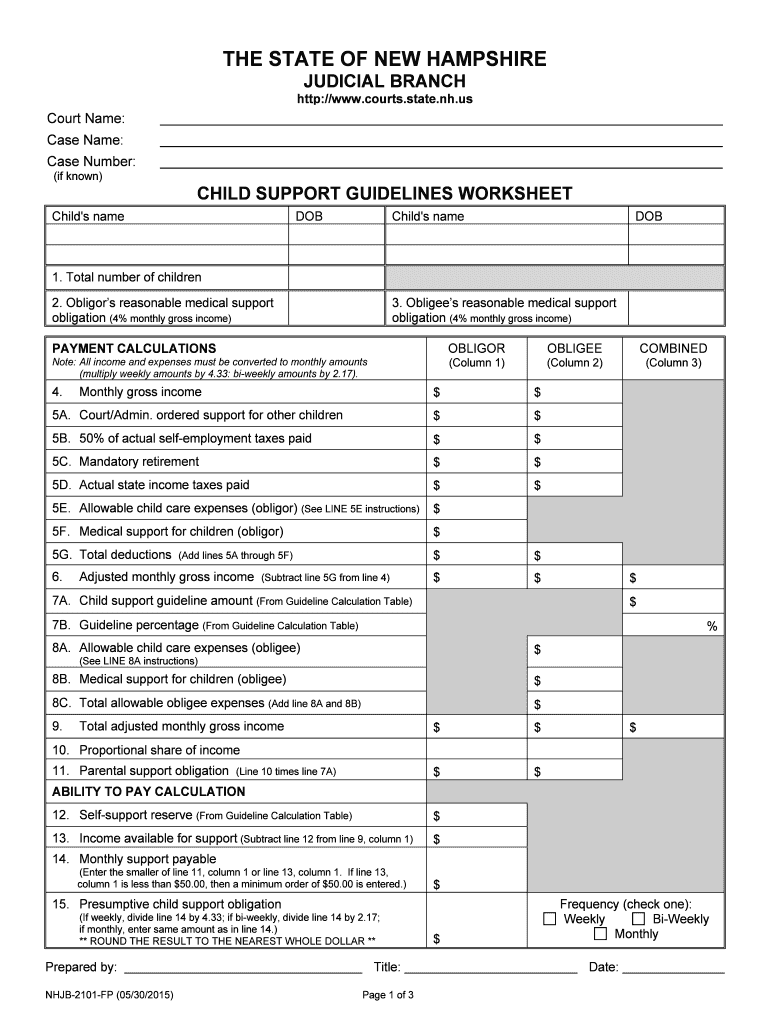

The Obligation 4% Monthly Gross Income refers to a financial commitment that typically requires individuals or businesses to allocate four percent of their gross income each month for specific obligations, such as loan repayments, taxes, or other financial responsibilities. This form is essential for tracking and documenting these commitments, ensuring that individuals meet their financial obligations consistently.

How to use the Obligation 4% Monthly Gross Income

Using the Obligation 4% Monthly Gross Income form involves several steps to ensure accurate reporting and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, calculate your total gross income for the month. Then, determine four percent of this amount to establish the required obligation. Finally, complete the form by entering your calculated obligation and any additional required information, ensuring all details are accurate before submission.

Steps to complete the Obligation 4% Monthly Gross Income

Completing the Obligation 4% Monthly Gross Income form involves a systematic approach:

- Gather financial documents, including pay stubs and tax returns.

- Calculate your total gross income for the month.

- Multiply your gross income by four percent to determine the obligation amount.

- Fill out the form with your obligation amount and any other required details.

- Review the form for accuracy before submitting it to the relevant authority.

Legal use of the Obligation 4% Monthly Gross Income

The Obligation 4% Monthly Gross Income form serves a legal purpose by documenting financial commitments. It is essential to ensure that the form is filled out accurately and submitted in compliance with applicable laws and regulations. Legal recognition of the form is contingent upon meeting specific requirements, such as proper signatures and adherence to eSignature laws, which validate the document's authenticity and enforceability.

Key elements of the Obligation 4% Monthly Gross Income

Key elements of the Obligation 4% Monthly Gross Income form include:

- Gross Income Calculation: Accurate calculation of total gross income for the reporting period.

- Obligation Amount: Clear indication of the four percent obligation derived from the gross income.

- Signatures: Necessary signatures to validate the form, ensuring compliance with legal standards.

- Date of Submission: The date when the form is completed and submitted, which is crucial for record-keeping.

Examples of using the Obligation 4% Monthly Gross Income

Examples of using the Obligation 4% Monthly Gross Income form can vary based on individual circumstances. For instance, a self-employed individual may use the form to document their monthly income and obligations for tax purposes. Similarly, a business may utilize the form to track monthly financial commitments related to loans or operational expenses, ensuring they allocate the correct percentage of their gross income to meet these obligations.

Quick guide on how to complete obligation 4 monthly gross income

Complete Obligation 4% Monthly Gross Income effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Obligation 4% Monthly Gross Income on any device with airSlate SignNow's Android or iOS applications and enhance your document-centered processes today.

The easiest way to edit and eSign Obligation 4% Monthly Gross Income effortlessly

- Obtain Obligation 4% Monthly Gross Income and select Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Obligation 4% Monthly Gross Income and ensure exceptional communication throughout every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 'Obligation 4% Monthly Gross Income' feature in airSlate SignNow?

The 'Obligation 4% Monthly Gross Income' feature in airSlate SignNow allows businesses to structure their financial commitments based on their gross income. This flexible approach helps ensure that your eSigning expenses remain manageable and directly proportional to your revenue, providing financial clarity and ease of budgeting.

-

How does airSlate SignNow help businesses stay compliant with the 'Obligation 4% Monthly Gross Income'?

airSlate SignNow ensures compliance with the 'Obligation 4% Monthly Gross Income' by providing features that help businesses manage their document workflows while adhering to financial guidelines. With audit trails and secure signing processes, you can maintain compliance and transparency in all your transactions.

-

What are the pricing plans for airSlate SignNow in relation to the 'Obligation 4% Monthly Gross Income'?

airSlate SignNow offers various pricing plans designed to fit different business needs, ensuring that your 'Obligation 4% Monthly Gross Income' is met without strain. Our cost-effective solutions allow you to choose a plan that aligns with your gross income, enabling you to maximize efficiency while minimizing expenses.

-

Can I integrate airSlate SignNow with other financial tools to manage my 'Obligation 4% Monthly Gross Income'?

Yes, airSlate SignNow integrates seamlessly with numerous financial tools and software, allowing you to manage your 'Obligation 4% Monthly Gross Income' effectively. By connecting with accounting and invoicing platforms, you can streamline your financial processes and enhance your eSigning workflows.

-

What benefits does airSlate SignNow provide for businesses considering the 'Obligation 4% Monthly Gross Income'?

By adopting airSlate SignNow, businesses can benefit from a user-friendly interface that simplifies document signing, which is crucial for managing the 'Obligation 4% Monthly Gross Income.' Furthermore, our platform enhances productivity and reduces turnaround times, ensuring that your financial commitments are handled efficiently.

-

Is airSlate SignNow suitable for small businesses focusing on 'Obligation 4% Monthly Gross Income'?

Absolutely! airSlate SignNow is ideal for small businesses looking to manage their 'Obligation 4% Monthly Gross Income' without incurring high costs. Our affordable pricing and intuitive features empower small business owners to handle their eSigning needs effectively while maintaining financial responsibility.

-

How can I customize my airSlate SignNow workflows to align with my 'Obligation 4% Monthly Gross Income'?

airSlate SignNow allows you to customize your workflows to fit your business model, ensuring that they align with your 'Obligation 4% Monthly Gross Income.' You can tailor document templates, approval processes, and signing steps to create a workflow that meets your specific financial needs.

Get more for Obligation 4% Monthly Gross Income

- How do i add shotgun let on hire on my firearm license west mercia police form

- Paper and programme amendment form arion aut university

- Citrus college transcript request form

- Sst noa gd ei form

- Western diversification program application wd gc form

- 330 60 security clearance form tbs sct gc

- Ins5140 form

- Ins5216b form

Find out other Obligation 4% Monthly Gross Income

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement