Affidavit of Compliance Palm Beach County Sheriff39s Office Pbso 2012-2026

What is the Affidavit of Compliance from the Palm Beach County Sheriff's Office?

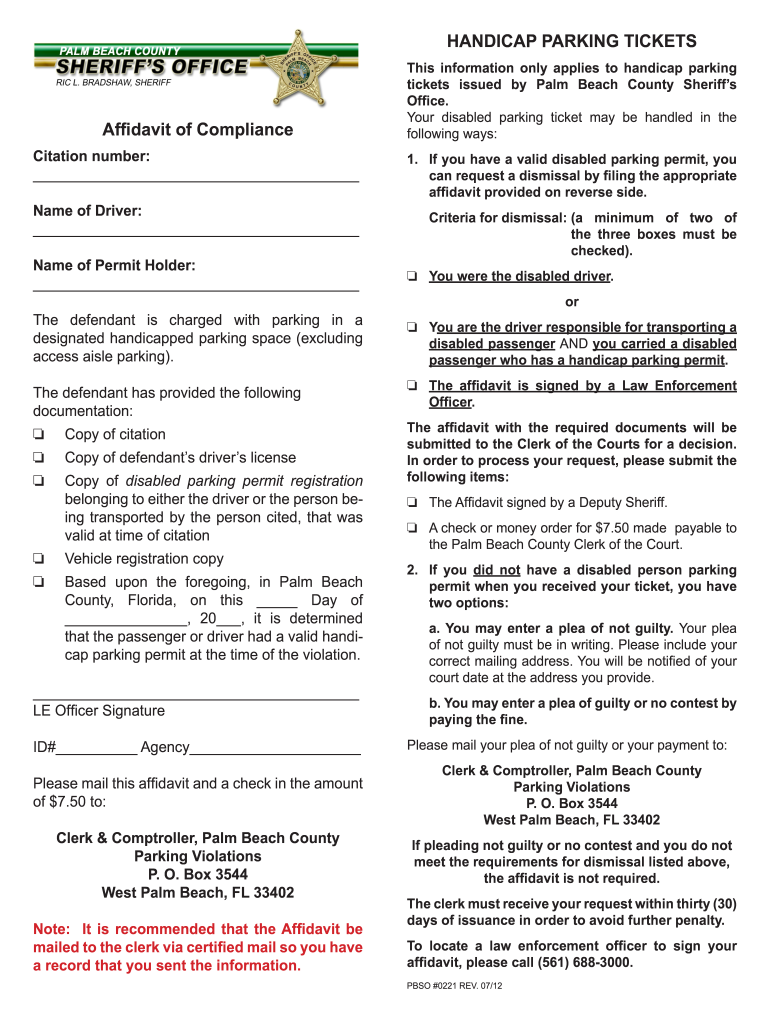

The Affidavit of Compliance is a legal document issued by the Palm Beach County Sheriff's Office (PBSO) that serves to confirm adherence to specific regulations or requirements set forth by local laws. This affidavit is often necessary in various legal and administrative processes, ensuring that individuals or entities comply with the stipulated conditions. It is commonly used in situations involving parking citations, compliance with local ordinances, or other legal matters where proof of adherence is required.

How to Use the Affidavit of Compliance from the Palm Beach County Sheriff's Office

Using the Affidavit of Compliance involves several steps to ensure that the document is completed accurately and submitted properly. First, individuals must obtain the affidavit from the PBSO. Once in possession of the form, it is essential to fill it out completely, providing all required information, such as personal details and specifics about the compliance issue. After completing the form, it should be signed and dated. The final step is to submit the affidavit to the relevant authority, which may include the PBSO or another designated office, depending on the context of its use.

Steps to Complete the Affidavit of Compliance from the Palm Beach County Sheriff's Office

Completing the Affidavit of Compliance requires careful attention to detail. Follow these steps:

- Obtain the affidavit form from the Palm Beach County Sheriff's Office.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information accurately, including your name, address, and contact details.

- Provide specific information related to the compliance issue you are addressing.

- Review the completed form for accuracy and completeness.

- Sign and date the affidavit to validate your statements.

- Submit the form to the appropriate office as instructed.

Legal Use of the Affidavit of Compliance from the Palm Beach County Sheriff's Office

The Affidavit of Compliance is legally binding when properly executed. It serves as a formal declaration that the signer is adhering to specific legal requirements. This document can be used in various legal proceedings or administrative processes, providing proof of compliance that may be required by courts or governmental agencies. It is crucial to ensure that the affidavit is filled out truthfully and accurately, as any false statements can lead to legal repercussions.

Key Elements of the Affidavit of Compliance from the Palm Beach County Sheriff's Office

Several key elements must be included in the Affidavit of Compliance to ensure its validity:

- Personal Information: Full name, address, and contact details of the individual submitting the affidavit.

- Details of Compliance: A clear description of the compliance issue being addressed.

- Signature: The signature of the individual completing the form, affirming the truthfulness of the information provided.

- Date: The date on which the affidavit is signed.

State-Specific Rules for the Affidavit of Compliance from the Palm Beach County Sheriff's Office

In Florida, the use of the Affidavit of Compliance is governed by state laws and local ordinances. It is important to be aware of any specific requirements that may apply in Palm Beach County. For instance, certain types of compliance issues may have additional documentation or evidence that must accompany the affidavit. Always check with the PBSO or legal counsel to ensure compliance with local regulations and requirements.

Quick guide on how to complete affidavit of compliance palm beach county sheriff39s office pbso

Complete Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso with ease

- Obtain Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the affidavit of compliance palm beach county sheriff39s office pbso

How to make an electronic signature for the Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso online

How to make an electronic signature for your Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso in Chrome

How to generate an electronic signature for signing the Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso in Gmail

How to create an electronic signature for the Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso straight from your smart phone

How to generate an electronic signature for the Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso on iOS

How to create an eSignature for the Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso on Android devices

People also ask

-

What is wpb citation portal com?

wpb citation portal com is an online platform that facilitates the efficient management of citations and documents. With its user-friendly interface, businesses can streamline the citation process, ensuring compliance and accuracy in their records.

-

How does airSlate SignNow integrate with wpb citation portal com?

airSlate SignNow seamlessly integrates with wpb citation portal com, allowing users to eSign and manage documents directly within the portal. This integration enhances workflow efficiency by enabling businesses to handle their citations and eSignatures in one place.

-

What are the pricing options for wpb citation portal com?

wpb citation portal com offers competitive pricing structures designed to accommodate businesses of all sizes. By utilizing airSlate SignNow, users can access cost-effective eSigning solutions that fit within their budget while optimizing their citation management.

-

What features does wpb citation portal com offer?

The wpb citation portal com provides features such as document templates, secure storage, and collaborative tools. Additionally, with airSlate SignNow's capabilities, users can easily eSign documents and manage citations efficiently.

-

How can wpb citation portal com benefit my business?

Using wpb citation portal com empowers businesses to enhance their document management processes. The platform, combined with airSlate SignNow, helps in saving time and resources by ensuring that all citations are accurate and easily traceable.

-

Is it easy to use wpb citation portal com?

Absolutely! wpb citation portal com is designed with user experience in mind. The intuitive layout allows even those with minimal technical skills to navigate effectively, making it easy to manage citations and eSign documents.

-

Can I customize my documents on wpb citation portal com?

Yes, wpb citation portal com allows for extensive customization of documents templates. By leveraging airSlate SignNow's features, users can create tailored documentation that meets their specific citation needs.

Get more for Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso

- Al legal will 497296205 form

- Legal last will and testament form for a married person with no children alabama

- Alabama married form

- Codicil to will form for amending your will will changes or amendments alabama

- Legal last will and testament form for divorced person not remarried with adult and minor children alabama

- Mutual wills package with last wills and testaments for married couple with adult children alabama form

- Mutual wills package with last wills and testaments for married couple with no children alabama form

- Mutual wills package with last wills and testaments for married couple with minor children alabama form

Find out other Affidavit Of Compliance Palm Beach County Sheriff39s Office Pbso

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word