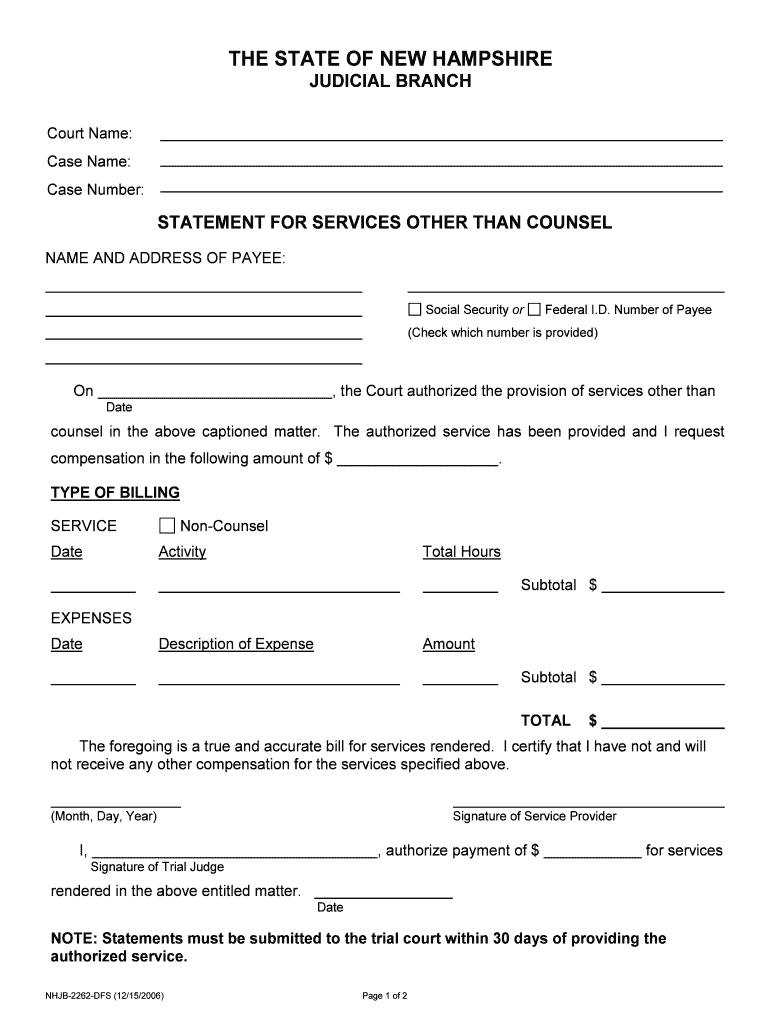

Number of Payee Form

What is the Number Of Payee

The number of payee is a crucial component in various financial and tax-related documents. It identifies the individual or entity that will receive payment or funds. This number is essential for ensuring that payments are accurately directed to the correct recipient, whether in payroll, vendor payments, or tax reporting. In the context of tax forms, it helps the Internal Revenue Service (IRS) track income and ensure compliance with tax obligations.

How to Use the Number Of Payee

Using the number of payee involves accurately filling out forms that require this information. When preparing documents such as W-9 forms or 1099s, you will need to provide the number of payee to ensure proper reporting. This process helps facilitate smooth transactions and ensures that all parties involved are correctly identified for tax purposes. Make sure to double-check the accuracy of the number to avoid any potential issues with payments or tax filings.

Steps to Complete the Number Of Payee

Completing the number of payee form involves a series of clear steps:

- Gather necessary information, including the name and address of the payee.

- Determine the appropriate form to use, such as a W-9 for individuals or a W-8 for foreign entities.

- Fill in the payee's Taxpayer Identification Number (TIN) accurately.

- Sign and date the form where required.

- Submit the completed form to the requesting party or agency.

Legal Use of the Number Of Payee

The number of payee must be used in accordance with legal guidelines to ensure compliance with tax laws. It serves as a verification tool for the IRS and other financial institutions. Misuse or incorrect reporting of this number can lead to penalties or issues with tax filings. It is essential to understand the legal implications of providing accurate information on forms that require the number of payee.

IRS Guidelines

The IRS has specific guidelines regarding the use of the number of payee. Taxpayers must provide this information on various forms, such as the W-9 and 1099 series. These forms are used to report income paid to individuals and businesses. The IRS requires that the number of payee be accurate to prevent discrepancies in tax reporting. Familiarizing yourself with these guidelines can help ensure compliance and avoid potential audits.

Examples of Using the Number Of Payee

There are several scenarios in which the number of payee is utilized:

- When an employer pays an employee, the number of payee is included on the W-2 form.

- Freelancers and contractors provide their number of payee on the W-9 form to clients for accurate tax reporting.

- Businesses report payments made to vendors using the 1099 form, which includes the number of payee.

Form Submission Methods

Submitting the number of payee form can be done through various methods, depending on the requirements of the requesting party. Common submission methods include:

- Online submission through secure portals or email.

- Mailing the completed form to the designated address.

- In-person submission at local offices or during business meetings.

Quick guide on how to complete number of payee

Complete Number Of Payee effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can obtain the proper form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Number Of Payee on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Number Of Payee seamlessly

- Locate Number Of Payee and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your requirements in document management with just a few clicks from any device of your choice. Modify and eSign Number Of Payee and ensure effective communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the maximum Number Of Payee that can be added in airSlate SignNow?

In airSlate SignNow, you can add multiple payees to a document for eSigning. The maximum Number Of Payee may depend on your subscription plan, but our standard plans typically support up to 10 payees. For larger organizations, we offer custom plans to accommodate a higher Number Of Payee as needed.

-

How does airSlate SignNow handle documents requiring multiple payees?

airSlate SignNow simplifies the signing process when multiple payees are involved. You can easily send documents to the desired Number Of Payee, and they will receive notifications to eSign in the designated order. This efficient workflow ensures all parties can quickly finalize agreements, enhancing productivity.

-

What pricing options are available for different Number Of Payee in airSlate SignNow?

airSlate SignNow offers several pricing tiers that cater to various needs, including those with a higher Number Of Payee. Our pricing plans are competitive and designed to provide value based on features and the Number Of Payee you wish to add. Visit our pricing page to find a plan that fits your requirements.

-

Can I customize the signing process for each payee in airSlate SignNow?

Yes, you can customize the signing process for each payee in airSlate SignNow. You can determine the order of signing and set specific requirements for each payee, such as fields they must fill out before signing. This level of customization ensures the document meets your specific needs.

-

What features support the management of multiple payees in airSlate SignNow?

airSlate SignNow includes features that specifically enhance the management of multiple payees. You can track the status of each payee’s signature, send reminders, and automate notifications. These features work together to streamline the document workflow and reduce delays.

-

What are the benefits of using airSlate SignNow for managing multiple payees?

Using airSlate SignNow to manage multiple payees offers numerous benefits, such as improved turnaround time and reduced paper usage. The platform ensures all payees can easily access documents from anywhere, promoting efficiency. Additionally, the digital record-keeping simplifies compliance and auditing for organizations.

-

How does airSlate SignNow integrate with other tools to manage payees?

airSlate SignNow integrates seamlessly with various applications, making it easier to manage the Number Of Payee. For example, integrations with CRM systems allow you to pull in contacts directly, ensuring efficient management. These integrations enhance your workflow and streamline document handling.

Get more for Number Of Payee

Find out other Number Of Payee

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document