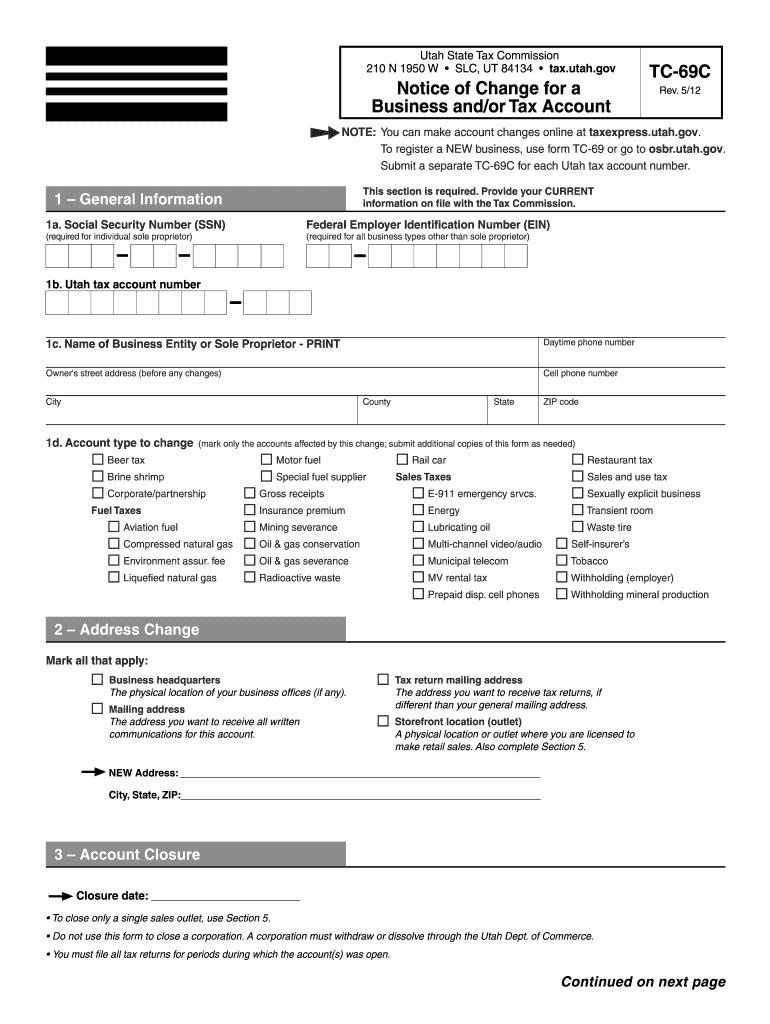

TC 69C Notice of Change for a Tax Account 2012

What is the TC 69C Notice Of Change For A Tax Account

The TC 69C Notice Of Change For A Tax Account is a specific form used by taxpayers to report changes related to their tax accounts. This form is essential for updating information such as address changes, name changes, or changes in filing status. Ensuring that the IRS has accurate and current information is crucial for effective communication and compliance with tax regulations. The TC 69C form helps streamline this process, allowing taxpayers to maintain their records accurately and avoid potential issues with their tax filings.

How to use the TC 69C Notice Of Change For A Tax Account

Using the TC 69C Notice Of Change For A Tax Account involves a few straightforward steps. First, obtain the form, which can typically be found on the IRS website or through tax preparation resources. Once you have the form, fill in the required fields with the updated information. It is important to double-check your entries for accuracy. After completing the form, you can submit it electronically or by mail, depending on your preference and the IRS guidelines. Utilizing an eSignature solution can simplify the signing process, ensuring that your submission is legally binding and secure.

Steps to complete the TC 69C Notice Of Change For A Tax Account

Completing the TC 69C Notice Of Change For A Tax Account involves several key steps:

- Obtain the TC 69C form from the IRS or a trusted source.

- Carefully read the instructions provided with the form.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the specific changes you are reporting, such as a new address or name change.

- Review the completed form for accuracy and completeness.

- Sign the form electronically or by hand, ensuring it meets IRS requirements.

- Submit the form via your preferred method, either electronically or by mail.

Legal use of the TC 69C Notice Of Change For A Tax Account

The TC 69C Notice Of Change For A Tax Account is legally recognized as a valid method for taxpayers to update their information with the IRS. When completed accurately and submitted according to IRS guidelines, this form serves as a formal notification of changes. It is important to ensure that all information provided is truthful and complies with tax laws to avoid potential penalties or issues with your tax account. Using an eSignature solution can further enhance the legal validity of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the TC 69C Notice Of Change For A Tax Account can vary based on the type of change being reported. Generally, it is advisable to submit the form as soon as a change occurs to ensure that the IRS has up-to-date information. For certain changes, such as those affecting your filing status, it may be necessary to file the form before specific tax deadlines to avoid complications during tax season. Always consult the IRS guidelines for the most accurate and current deadlines related to your tax account changes.

Form Submission Methods (Online / Mail / In-Person)

The TC 69C Notice Of Change For A Tax Account can be submitted through various methods, providing flexibility for taxpayers. You can choose to file the form online using an eSignature solution, which allows for a quicker and more efficient process. Alternatively, you may opt to mail the completed form to the appropriate IRS address based on your location and the nature of the changes. In-person submission is typically not required for this form, but it may be possible in certain circumstances, such as for urgent matters. Always verify the submission method that best suits your needs and complies with IRS regulations.

Quick guide on how to complete tc 69c notice of change for a tax account

Your assistance handbook on how to prepare your TC 69C Notice Of Change For A Tax Account

If you’re looking to understand how to finalize and submit your TC 69C Notice Of Change For A Tax Account, here are some brief guidelines to simplify tax processing.

To start, you simply need to create your airSlate SignNow account to transform how you handle documentation online. airSlate SignNow is a user-friendly and robust document solution that enables you to modify, generate, and finalize your tax forms with ease. Utilizing its editor, you can alternate between text, check boxes, and eSignatures, and return to adjust responses when necessary. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your TC 69C Notice Of Change For A Tax Account in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your TC 69C Notice Of Change For A Tax Account in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to submit your taxes digitally with airSlate SignNow. Please be aware that paper filing can lead to more errors and delays in refunds. Additionally, before e-filing your taxes, consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct tc 69c notice of change for a tax account

FAQs

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

-

Can I print a notice of intent form to homeschool in Nevada, fill it out, and turn it in?

It's best to ask homeschoolers in your state. Every state has different laws. What works in one may not work in another.This looks like the information you need: Notice of Intent (NOI)

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the tc 69c notice of change for a tax account

How to create an eSignature for the Tc 69c Notice Of Change For A Tax Account in the online mode

How to make an eSignature for the Tc 69c Notice Of Change For A Tax Account in Chrome

How to create an electronic signature for putting it on the Tc 69c Notice Of Change For A Tax Account in Gmail

How to generate an electronic signature for the Tc 69c Notice Of Change For A Tax Account right from your smartphone

How to make an eSignature for the Tc 69c Notice Of Change For A Tax Account on iOS devices

How to generate an eSignature for the Tc 69c Notice Of Change For A Tax Account on Android

People also ask

-

What is a TC 69C Notice Of Change For A Tax Account?

The TC 69C Notice Of Change For A Tax Account is a critical form issued by tax authorities that informs businesses of changes regarding their tax account. Understanding and managing this notice effectively is essential to ensure compliance and avoid potential penalties. airSlate SignNow can simplify the process of handling these notices by enabling efficient e-signature workflows.

-

How does airSlate SignNow help with TC 69C Notice Of Change For A Tax Account?

airSlate SignNow streamlines the management of TC 69C Notices Of Change For A Tax Account by allowing users to electronically sign and send documents quickly. This reduces the time spent on manual paperwork and ensures that critical updates are handled promptly. Our platform integrates seamlessly with various applications to enhance your document management experience.

-

Is airSlate SignNow a cost-effective solution for managing TC 69C Notice Of Change For A Tax Account?

Yes, airSlate SignNow offers a cost-effective solution for managing TC 69C Notice Of Change For A Tax Account. With competitive pricing plans, businesses can take advantage of our robust features without breaking the budget. By optimizing your workflow, you can save both time and money in the long run.

-

What features does airSlate SignNow provide for TC 69C Notice Of Change For A Tax Account?

Our platform includes features like customizable templates, secure cloud storage, and automated reminders tailored for TC 69C Notice Of Change For A Tax Account. Additionally, the user-friendly dashboard allows you to track document status in real time, ensuring that your tax-related documentation is always up to date. Enhanced collaboration tools also allow for easy sharing among team members.

-

Can I integrate airSlate SignNow with other software to manage TC 69C Notice Of Change For A Tax Account?

Absolutely! airSlate SignNow offers numerous integrations with popular software applications to streamline the management of TC 69C Notice Of Change For A Tax Account. By connecting with platforms like CRM systems, project management tools, and financial software, you can create a comprehensive ecosystem that enhances productivity and collaboration.

-

What benefits does using airSlate SignNow provide for TC 69C Notice Of Change For A Tax Account?

Using airSlate SignNow for TC 69C Notice Of Change For A Tax Account provides numerous benefits, including faster turnaround times on document approvals and improved compliance tracking. The electronic signature feature ensures legal validity while maintaining security, which is crucial for sensitive tax documents. This efficiency allows businesses to focus on core activities rather than on cumbersome paperwork.

-

Is training available for using airSlate SignNow to manage TC 69C Notice Of Change For A Tax Account?

Yes, airSlate SignNow provides ample training resources to assist users in managing TC 69C Notice Of Change For A Tax Account effectively. We offer tutorials, webinars, and customer support to ensure you can navigate our platform efficiently. Our aim is to help you make the most of our features to enhance your document management processes.

Get more for TC 69C Notice Of Change For A Tax Account

- Quitclaim deed four individuals to husband and wife florida form

- Florida deed trust 497302723 form

- Fl affidavit form

- Quitclaim deed husband and wife to three individuals florida form

- Enhanced life estate or lady bird deed individual to individual florida form

- Florida quitclaim deed template 497302727 form

- Florida warranty deed 497302728 form

- Fl restraining form

Find out other TC 69C Notice Of Change For A Tax Account

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile