Multi Parcel Tax Exemption Report Pc 220a Form 2009

What is the Multi Parcel Tax Exemption Report Pc 220a Form

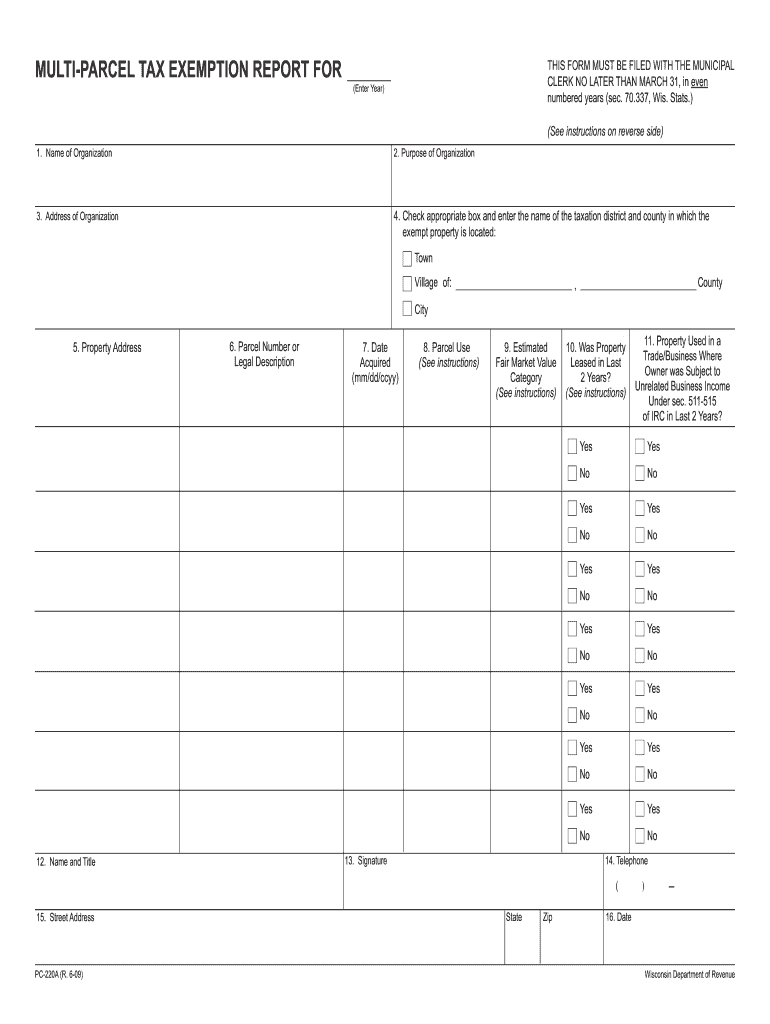

The Multi Parcel Tax Exemption Report Pc 220a Form is a specific document utilized in the United States for reporting tax exemptions related to multiple parcels of property. This form is essential for property owners seeking to claim tax benefits on eligible properties. The form requires detailed information about each parcel, including ownership details, property descriptions, and the specific exemptions being sought. It is crucial for property owners to ensure that all information is accurate and complete to avoid delays in processing their exemptions.

How to use the Multi Parcel Tax Exemption Report Pc 220a Form

Using the Multi Parcel Tax Exemption Report Pc 220a Form involves several key steps. First, gather all necessary information about the properties for which exemptions are being claimed. This includes property addresses, parcel numbers, and any relevant documentation supporting the exemption claims. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, review it for any errors before submission. Finally, submit the form according to the specified guidelines, which may include online submission, mailing, or in-person delivery.

Steps to complete the Multi Parcel Tax Exemption Report Pc 220a Form

Completing the Multi Parcel Tax Exemption Report Pc 220a Form requires a systematic approach. Start by downloading the form from an official source. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documentation, including property deeds and previous tax returns.

- Fill in the property details, ensuring accuracy in parcel numbers and addresses.

- Indicate the specific exemptions being claimed for each parcel.

- Review the completed form for any mistakes or missing information.

- Sign and date the form as required.

- Submit the form according to the instructions provided.

Eligibility Criteria

To qualify for exemptions reported on the Multi Parcel Tax Exemption Report Pc 220a Form, property owners must meet specific eligibility criteria. Generally, these criteria include ownership of the property, the intended use of the property, and compliance with local tax regulations. Different states may have varying requirements, so it is essential for applicants to review state-specific guidelines to ensure they meet all necessary conditions for exemption eligibility.

Required Documents

When completing the Multi Parcel Tax Exemption Report Pc 220a Form, several documents may be required to support the exemption claims. These documents typically include:

- Proof of property ownership, such as a deed or title.

- Previous tax statements or assessments for the properties in question.

- Documentation outlining the intended use of the properties.

- Any additional forms or evidence required by local tax authorities.

Having these documents ready can facilitate a smoother filing process and help ensure that all claims are substantiated.

Form Submission Methods

The Multi Parcel Tax Exemption Report Pc 220a Form can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission via the appropriate tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices or designated locations.

It is advisable to check with local tax authorities for specific submission guidelines and any applicable deadlines.

Quick guide on how to complete multi parcel tax exemption report pc 220a 2009 form

Your assistance manual on how to prepare your Multi Parcel Tax Exemption Report Pc 220a Form

If you’re curious about how to finalize and submit your Multi Parcel Tax Exemption Report Pc 220a Form, here are some quick tips to simplify the tax submission process.

Initially, you only need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that enables you to modify, generate, and complete your tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to edit responses as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Multi Parcel Tax Exemption Report Pc 220a Form in a few minutes:

- Set up your account and begin editing PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through various versions and schedules.

- Click Obtain form to access your Multi Parcel Tax Exemption Report Pc 220a Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Signature Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any discrepancies.

- Save modifications, print your copy, send it to your recipient, and download it onto your device.

Make the most of this guide to electronically submit your taxes using airSlate SignNow. Please keep in mind that submitting on paper can lead to errors in returns and postpone reimbursements. Naturally, before electronically filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct multi parcel tax exemption report pc 220a 2009 form

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the multi parcel tax exemption report pc 220a 2009 form

How to make an eSignature for your Multi Parcel Tax Exemption Report Pc 220a 2009 Form online

How to make an electronic signature for the Multi Parcel Tax Exemption Report Pc 220a 2009 Form in Google Chrome

How to generate an electronic signature for signing the Multi Parcel Tax Exemption Report Pc 220a 2009 Form in Gmail

How to make an eSignature for the Multi Parcel Tax Exemption Report Pc 220a 2009 Form right from your smart phone

How to create an eSignature for the Multi Parcel Tax Exemption Report Pc 220a 2009 Form on iOS devices

How to make an eSignature for the Multi Parcel Tax Exemption Report Pc 220a 2009 Form on Android devices

People also ask

-

What is the Multi Parcel Tax Exemption Report Pc 220a Form?

The Multi Parcel Tax Exemption Report Pc 220a Form is a specific document used to request tax exemption for multiple parcels of property. It allows property owners to file for relief on their property taxes collectively. Understanding this form is essential for maximizing potential savings on your tax obligations.

-

How can airSlate SignNow help with the Multi Parcel Tax Exemption Report Pc 220a Form?

airSlate SignNow provides an easy-to-use platform for creating and signing the Multi Parcel Tax Exemption Report Pc 220a Form. Our solution ensures that all necessary fields are completed and allows for seamless electronic signatures, making the filing process efficient and organized.

-

Is there a cost associated with using airSlate SignNow for the Multi Parcel Tax Exemption Report Pc 220a Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is affordable and reflects the value of eSigning capabilities, including the ability to manage the Multi Parcel Tax Exemption Report Pc 220a Form electronically, thus saving time and reducing paperwork.

-

What features does airSlate SignNow offer for handling the Multi Parcel Tax Exemption Report Pc 220a Form?

airSlate SignNow includes features such as customizable templates, secure electronic signatures, and real-time tracking of document status. These functionalities streamline the process of managing the Multi Parcel Tax Exemption Report Pc 220a Form, ensuring that you can quickly send, sign, and store necessary documents.

-

What are the benefits of using airSlate SignNow for the Multi Parcel Tax Exemption Report Pc 220a Form?

By using airSlate SignNow, you gain the benefits of increased efficiency and reduced errors in your tax exemption filings. The digital platform allows for easy collaboration, quick access to documents, and a reliable method for maintaining compliance when submitting the Multi Parcel Tax Exemption Report Pc 220a Form.

-

Can I integrate airSlate SignNow with other software for handling the Multi Parcel Tax Exemption Report Pc 220a Form?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various applications, enabling you to manage your documents and workflows better. This means you can connect your existing systems to efficiently handle the Multi Parcel Tax Exemption Report Pc 220a Form alongside other crucial business operations.

-

How secure is the airSlate SignNow platform for the Multi Parcel Tax Exemption Report Pc 220a Form?

airSlate SignNow prioritizes security, utilizing advanced encryption and compliance protocols to safeguard your documents. When working with sensitive forms like the Multi Parcel Tax Exemption Report Pc 220a Form, you can trust that your information is protected throughout the signing and storage process.

Get more for Multi Parcel Tax Exemption Report Pc 220a Form

- Pursuant to federal guidelines for vantage health plan form

- New york grants organizations form

- Admission agreement final form

- Spring semester first round open for application form

- Waipahu waikele pet hospital pet hospitals of hawaii form

- Application for admission forest hills of dc form

- Travel to tara tara anglican school for girls website form

- Southern university law center application fee waiver form

Find out other Multi Parcel Tax Exemption Report Pc 220a Form

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself