Instructions for Transferring Assets to Your Trust Interactive Form

What is the Instructions For Transferring Assets To Your Trust Interactive

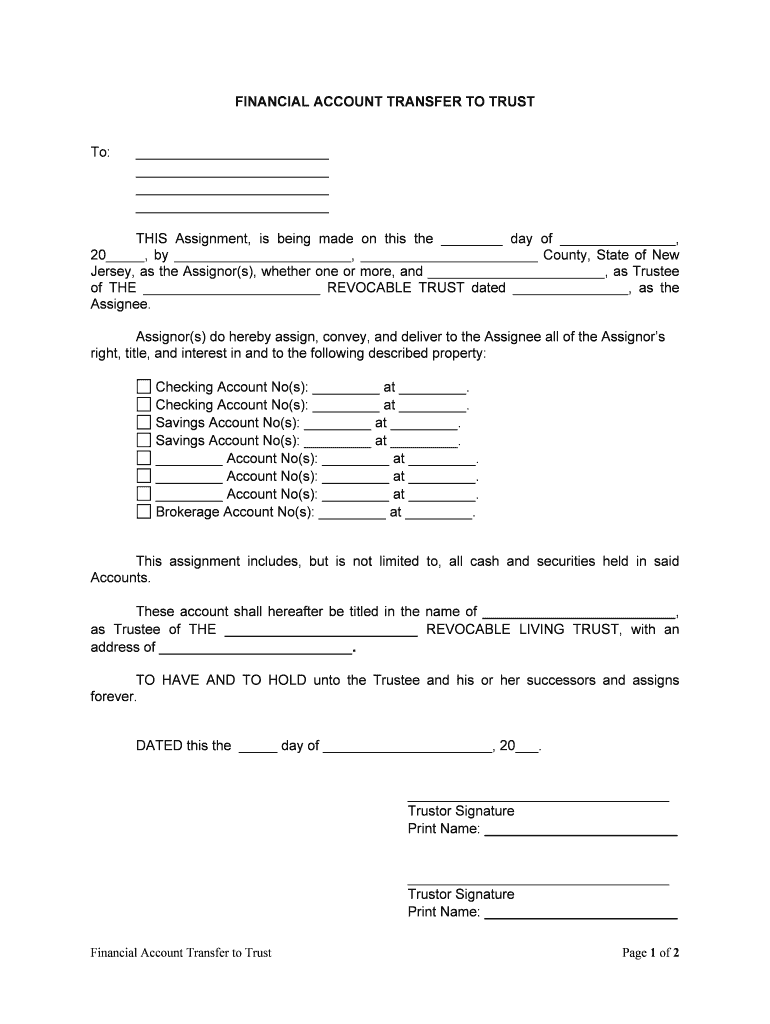

The Instructions For Transferring Assets To Your Trust Interactive is a legal document designed to facilitate the transfer of various assets into a trust. This interactive form allows individuals to specify which assets they wish to place into their trust, ensuring that their estate planning is executed according to their wishes. The form is tailored to meet the specific legal requirements necessary for the transfer process, making it a vital tool for anyone looking to manage their assets effectively.

How to use the Instructions For Transferring Assets To Your Trust Interactive

Using the Instructions For Transferring Assets To Your Trust Interactive involves a straightforward process. First, access the form through a secure digital platform. Next, fill in the required fields, which typically include personal information, asset details, and trust information. As you complete the form, ensure that all information is accurate and up-to-date. Once finished, you can electronically sign the document, ensuring it is legally binding. This method not only simplifies the process but also enhances security and compliance with legal standards.

Steps to complete the Instructions For Transferring Assets To Your Trust Interactive

Completing the Instructions For Transferring Assets To Your Trust Interactive involves several key steps:

- Access the interactive form through a secure platform.

- Provide your personal information, including your name and contact details.

- List the assets you wish to transfer, specifying their value and type.

- Include any additional instructions or conditions related to the transfer.

- Review the completed form for accuracy and completeness.

- Sign the document electronically to finalize the process.

Legal use of the Instructions For Transferring Assets To Your Trust Interactive

The Instructions For Transferring Assets To Your Trust Interactive is legally recognized as a valid document, provided it meets specific criteria. To ensure its legal standing, the form must be completed accurately and signed by the individual transferring the assets. Additionally, it should comply with relevant state laws governing trusts and asset transfers. Utilizing a trusted electronic signature solution enhances the document's legitimacy and helps maintain compliance with federal and state regulations.

Key elements of the Instructions For Transferring Assets To Your Trust Interactive

Several key elements must be included in the Instructions For Transferring Assets To Your Trust Interactive to ensure its effectiveness:

- Personal Information: Full name, address, and contact details of the individual creating the trust.

- Asset Details: A clear description of each asset being transferred, including its value.

- Trust Information: Name of the trust and any specific instructions regarding asset management.

- Signatures: Electronic signatures of the individual and any witnesses, if required by state law.

State-specific rules for the Instructions For Transferring Assets To Your Trust Interactive

State-specific rules play a crucial role in the validity of the Instructions For Transferring Assets To Your Trust Interactive. Each state may have unique requirements regarding the information that must be included, the types of assets that can be transferred, and the witnessing or notarization process. It is essential to consult state laws or a legal professional to ensure compliance with local regulations when completing the form.

Quick guide on how to complete instructions for transferring assets to your trust interactive

Effortlessly prepare Instructions For Transferring Assets To Your Trust Interactive on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hindrance. Manage Instructions For Transferring Assets To Your Trust Interactive on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Instructions For Transferring Assets To Your Trust Interactive with ease

- Locate Instructions For Transferring Assets To Your Trust Interactive and then click Obtain Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Complete button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searching for forms, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Instructions For Transferring Assets To Your Trust Interactive and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key Instructions For Transferring Assets To Your Trust Interactive?

The key Instructions For Transferring Assets To Your Trust Interactive include understanding your asset ownership, selecting the appropriate trust, and completing necessary paperwork. This interactive guide will help you systematically navigate the process, ensuring all legal requirements are met efficiently.

-

How much does it cost to use airSlate SignNow for transferring assets to a trust?

airSlate SignNow offers a variety of pricing plans tailored to different needs. Depending on your selected plan, you can access the Instructions For Transferring Assets To Your Trust Interactive at a budget-friendly price. You can explore our plans and select one that best fits your requirements.

-

Are there any integrations available for the Instructions For Transferring Assets To Your Trust Interactive?

Yes, airSlate SignNow seamlessly integrates with various platforms such as Google Drive, Dropbox, and Salesforce. This enhances the experience as you utilize the Instructions For Transferring Assets To Your Trust Interactive, allowing easy access and management of important documents across different tools.

-

What benefits can I expect from following the Instructions For Transferring Assets To Your Trust Interactive?

By using the Instructions For Transferring Assets To Your Trust Interactive, you can simplify the asset transfer process, save time, and minimize errors. These benefits maximize the efficiency of your trust setup, helping you secure your assets while ensuring legal compliance.

-

Is the Instructions For Transferring Assets To Your Trust Interactive user-friendly?

Absolutely! The Instructions For Transferring Assets To Your Trust Interactive is designed to be intuitive and simple to navigate. Users can easily follow each step, making the asset transfer process straightforward, even for those without legal experience.

-

Can I get support while using the Instructions For Transferring Assets To Your Trust Interactive?

Yes, airSlate SignNow offers comprehensive customer support to assist you with any questions or concerns. Our support team is readily available to guide you through the Instructions For Transferring Assets To Your Trust Interactive, ensuring you have assistance every step of the way.

-

What types of assets can be transferred using the interactive guide?

The Instructions For Transferring Assets To Your Trust Interactive is suitable for a variety of asset types, including real estate, bank accounts, and investments. This versatility ensures that you can effectively manage and transfer multiple asset classes into your trust.

Get more for Instructions For Transferring Assets To Your Trust Interactive

Find out other Instructions For Transferring Assets To Your Trust Interactive

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe