New Jersey Fixed Rate Note, Installment Payments Unsecured Form

What is the New Jersey Fixed Rate Note, Installment Payments Unsecured

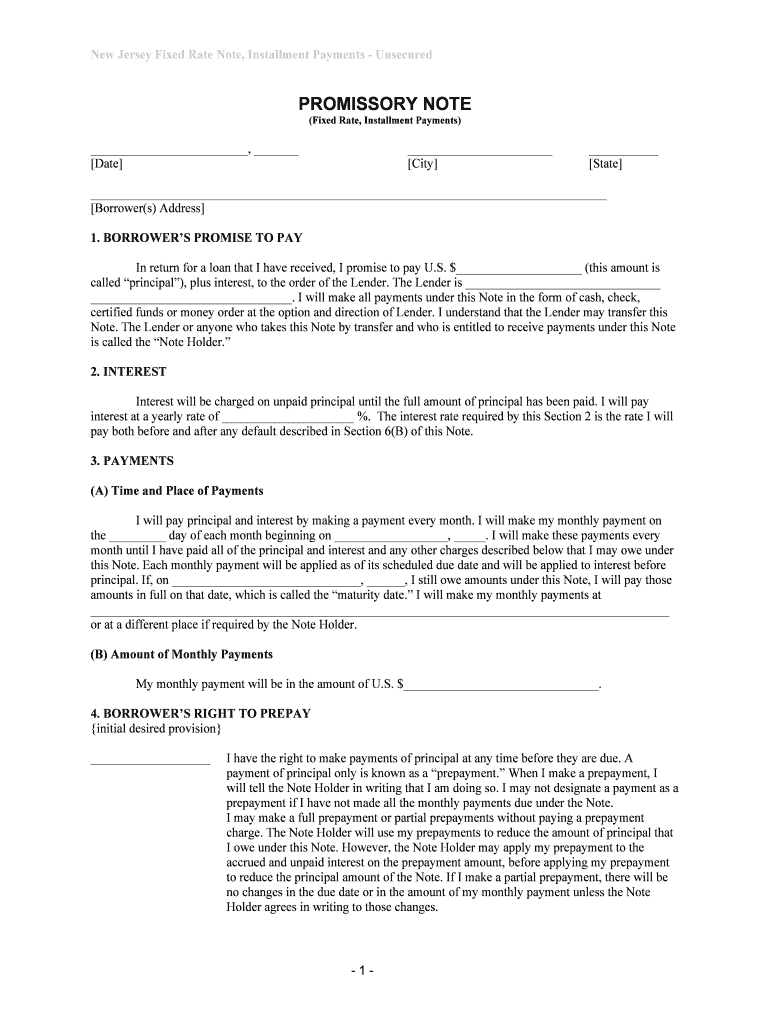

The New Jersey Fixed Rate Note, Installment Payments Unsecured is a financial instrument that allows borrowers to secure funds without providing collateral. This type of note outlines the terms of repayment, including the interest rate, payment schedule, and total amount due. It is particularly useful for individuals or businesses seeking to finance projects or consolidate debts without tying up assets. The fixed rate ensures predictable monthly payments, making budgeting easier for borrowers.

How to use the New Jersey Fixed Rate Note, Installment Payments Unsecured

Using the New Jersey Fixed Rate Note involves several steps. First, the borrower must complete the form accurately, ensuring all personal and financial information is correct. Next, both the borrower and lender should review the terms outlined in the note, including the repayment schedule and interest rate. Once both parties agree, they can sign the document electronically using a secure platform, ensuring legal compliance. This process simplifies the execution of the agreement and provides a clear record of the transaction.

Steps to complete the New Jersey Fixed Rate Note, Installment Payments Unsecured

Completing the New Jersey Fixed Rate Note requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including personal identification and financial details.

- Fill out the form, ensuring all sections are completed accurately.

- Review the terms, including the interest rate and payment schedule, to ensure understanding.

- Sign the document electronically, which may require a secure eSignature platform.

- Distribute copies of the signed note to all parties involved for their records.

Legal use of the New Jersey Fixed Rate Note, Installment Payments Unsecured

The legal use of the New Jersey Fixed Rate Note hinges on compliance with state and federal regulations. For the note to be enforceable, it must include essential elements such as clear terms, signatures from both parties, and adherence to eSignature laws like the ESIGN Act and UETA. These regulations ensure that electronic signatures hold the same legal weight as traditional handwritten signatures, facilitating smoother transactions in a digital landscape.

Key elements of the New Jersey Fixed Rate Note, Installment Payments Unsecured

Several key elements define the New Jersey Fixed Rate Note. These include:

- Principal Amount: The total amount borrowed.

- Interest Rate: The fixed rate applied to the principal.

- Payment Schedule: A detailed timeline for repayment, including due dates.

- Signatures: Required signatures from both the borrower and lender to validate the agreement.

- Governing Law: Specification that New Jersey law governs the note.

Eligibility Criteria

Eligibility for obtaining a New Jersey Fixed Rate Note typically includes factors such as creditworthiness, income verification, and the purpose of the loan. Lenders may require documentation to assess the borrower's financial stability and ability to repay the loan. Individuals or businesses seeking unsecured financing should be prepared to provide relevant financial information and demonstrate a reliable repayment plan.

Quick guide on how to complete new jersey fixed rate note installment payments unsecured

Effortlessly manage New Jersey Fixed Rate Note, Installment Payments Unsecured on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage New Jersey Fixed Rate Note, Installment Payments Unsecured on any device through airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to edit and electronically sign New Jersey Fixed Rate Note, Installment Payments Unsecured with ease

- Find New Jersey Fixed Rate Note, Installment Payments Unsecured and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically designed for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign New Jersey Fixed Rate Note, Installment Payments Unsecured and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New Jersey Fixed Rate Note, Installment Payments Unsecured?

A New Jersey Fixed Rate Note, Installment Payments Unsecured, is a type of loan agreement where the borrower pledges to repay the principal amount with a fixed interest rate over a specified period. This type of note is particularly beneficial for individuals seeking predictable monthly payments without the need for collateral. It helps borrowers manage their finances better by knowing exactly how much to budget each month.

-

What are the benefits of using a New Jersey Fixed Rate Note, Installment Payments Unsecured?

Using a New Jersey Fixed Rate Note, Installment Payments Unsecured offers numerous benefits, including stable monthly payments that simplify budgeting. Additionally, this type of unsecured note does not require collateral, making it accessible for those who may not have assets to pledge. Borrowers can also enjoy flexibility in repayment terms that fit their financial situations.

-

How can I apply for a New Jersey Fixed Rate Note, Installment Payments Unsecured through airSlate SignNow?

To apply for a New Jersey Fixed Rate Note, Installment Payments Unsecured through airSlate SignNow, simply visit our website and fill out the online application form. After submitting your application, you will receive confirmation and further instructions via your preferred contact method. The entire eSigning process is streamlined for efficiency and convenience.

-

Are there any fees associated with a New Jersey Fixed Rate Note, Installment Payments Unsecured?

Yes, there may be certain fees associated with a New Jersey Fixed Rate Note, Installment Payments Unsecured, including origination fees or processing fees. It’s essential to read the terms and conditions carefully to understand all potential costs. However, airSlate SignNow is dedicated to providing a transparent and cost-effective solution.

-

What features does airSlate SignNow offer for managing New Jersey Fixed Rate Note, Installment Payments Unsecured?

airSlate SignNow offers a comprehensive suite of features for managing your New Jersey Fixed Rate Note, Installment Payments Unsecured, including electronic signatures, document tracking, and customizable templates. These features enhance user experience and ensure that the loan process is efficient and secure. You can easily manage all your documents in one place.

-

Can I customize my New Jersey Fixed Rate Note, Installment Payments Unsecured agreement?

Absolutely! airSlate SignNow allows you to customize your New Jersey Fixed Rate Note, Installment Payments Unsecured agreement to fit your specific needs. You can modify terms, payment schedules, and other details easily through our platform. Customization ensures that both parties are satisfied with the terms of the agreement.

-

Is the New Jersey Fixed Rate Note, Installment Payments Unsecured option available for businesses?

Yes, the New Jersey Fixed Rate Note, Installment Payments Unsecured can be utilized by businesses seeking to manage finances without putting up collateral. This option provides businesses with the flexibility to cover operating expenses or invest in growth opportunities while maintaining cash flow. airSlate SignNow facilitates the application process for business loans.

Get more for New Jersey Fixed Rate Note, Installment Payments Unsecured

- Application for certificate of fitness the los angeles fire department form

- Info on the statutory declaration of common law union single signature 2011 form

- Illinois driving record sheet for illinois 2006 form

- Non profit application form

- Florida workers compensation exemption form pdf

- Gaca forms

- Hotel bill format in excel sheet

- Scope of sales appointment confirmation form maforagentscom

Find out other New Jersey Fixed Rate Note, Installment Payments Unsecured

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT