Llc 5 25 Form 2012-2026

What is the LLC 5/25 Form

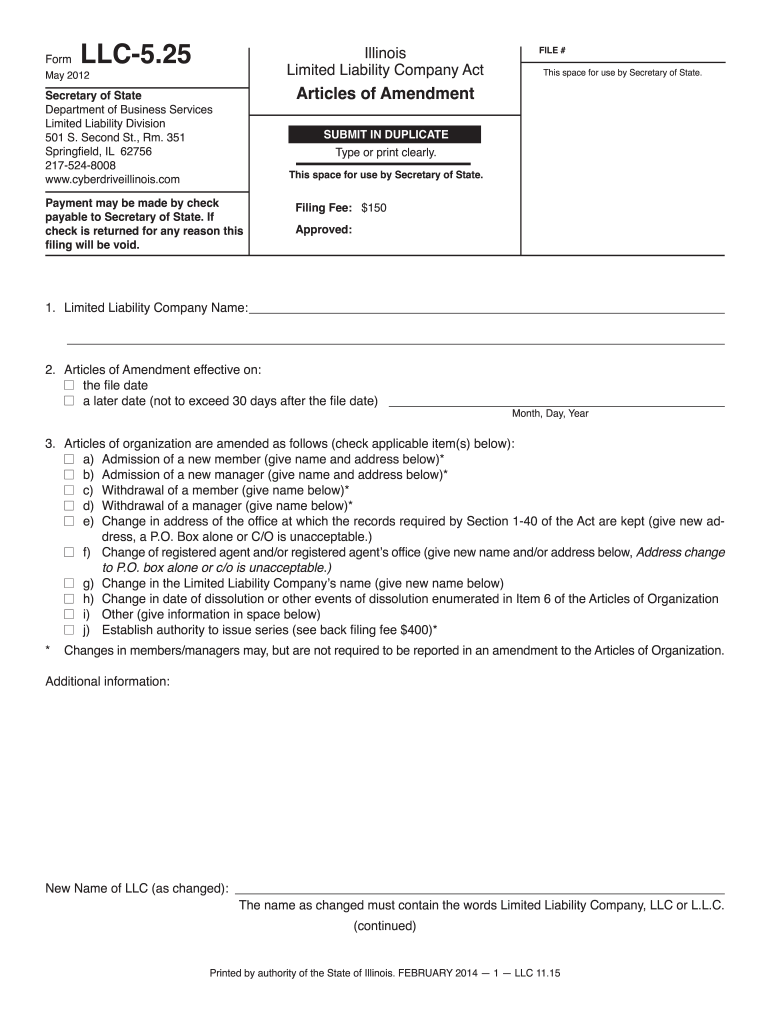

The LLC 5/25 form, also known as the Form LLC 25, is a legal document used in the state of Illinois for the purpose of amending the articles of organization for a limited liability company (LLC). This form is essential for any changes that a business may want to make regarding its structure or operations. It is designed to ensure that the state has up-to-date information about the LLC, which is crucial for legal compliance and transparency.

How to Obtain the LLC 5/25 Form

To obtain the LLC 5/25 form, individuals can visit the Illinois Secretary of State's website, where the form is available for download. The form can typically be found in the business services section, specifically under LLC forms. Additionally, physical copies may be available at local government offices that handle business registrations. Ensuring you have the correct version of the form is important, as outdated forms may not be accepted.

Steps to Complete the LLC 5/25 Form

Completing the LLC 5/25 form involves several key steps:

- Review the form: Before filling it out, read the instructions carefully to understand what information is required.

- Provide company information: Fill in the name of the LLC, the date of formation, and the changes being made.

- Sign the form: The form must be signed by an authorized member or manager of the LLC.

- Submit the form: Follow the submission guidelines, which may include online filing, mailing, or in-person delivery.

Legal Use of the LLC 5/25 Form

The legal use of the LLC 5/25 form is crucial for maintaining the good standing of an LLC in Illinois. This form must be filed whenever there are changes to the LLC's structure, such as changes in management, address, or business purpose. Failure to file this form can result in penalties or loss of good standing status, which can affect the LLC's ability to conduct business legally.

Key Elements of the LLC 5/25 Form

Key elements that must be included in the LLC 5/25 form are:

- LLC name: The official name of the limited liability company.

- Changes being made: A clear description of the amendments to be made.

- Effective date: The date when the changes will take effect.

- Signature: The signature of an authorized representative of the LLC.

Filing Deadlines / Important Dates

Filing deadlines for the LLC 5/25 form can vary depending on the nature of the amendments being made. It is essential to file the form promptly to avoid any legal complications. Generally, amendments should be filed as soon as the changes are decided upon. Keeping track of any specific deadlines related to annual reports or other filings is also important to maintain compliance with state regulations.

Quick guide on how to complete llc 5 25 2012 2019 form

Handle Llc 5 25 Form anytime, anywhere

Your everyday business activities may necessitate extra attention when managing state-specific business documents. Reclaim your working hours and minimize the costs associated with paperwork-focused processes using airSlate SignNow. airSlate SignNow provides you with a variety of pre-designed business templates, including Llc 5 25 Form, which can be utilized and shared with partners. Administer your Llc 5 25 Form seamlessly with powerful editing and eSignature features, and send it directly to your recipients.

Steps to acquire Llc 5 25 Form in just a few clicks:

- Choose a form pertinent to your state.

- Click Learn More to view the document and ensure its accuracy.

- Select Get Form to begin working with it.

- Llc 5 25 Form will automatically appear in the editor. No further actions are necessary.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or alter the form.

- Opt for the Sign feature to create your signature and eSign your document.

- Once finished, click on Done, save changes, and access your document.

- Send the form via email or SMS, or use a link-to-fill option with partners or allow them to download the document.

airSlate SignNow signNowly conserves your time managing Llc 5 25 Form and allows you to find crucial documents in one place. A comprehensive collection of forms is organized and tailored to address vital business operations essential to your enterprise. The advanced editor minimizes the likelihood of errors, enabling you to swiftly correct mistakes and review your documents on any device before sending them out. Start your free trial today to explore all the advantages of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

Create this form in 5 minutes!

How to create an eSignature for the llc 5 25 2012 2019 form

How to generate an eSignature for the Llc 5 25 2012 2019 Form online

How to generate an eSignature for your Llc 5 25 2012 2019 Form in Chrome

How to make an electronic signature for putting it on the Llc 5 25 2012 2019 Form in Gmail

How to generate an electronic signature for the Llc 5 25 2012 2019 Form from your smart phone

How to generate an eSignature for the Llc 5 25 2012 2019 Form on iOS devices

How to make an eSignature for the Llc 5 25 2012 2019 Form on Android OS

People also ask

-

What is the 'form llc 25' and how does it relate to airSlate SignNow?

The 'form llc 25' is a legal document used in certain states to register a limited liability company (LLC). With airSlate SignNow, you can efficiently complete and sign the 'form llc 25' digitally, streamlining the formation process of your LLC.

-

What features does airSlate SignNow offer for managing the 'form llc 25'?

airSlate SignNow provides features such as document templates, electronic signatures, and real-time collaboration tools specifically tailored for documents like 'form llc 25'. These functionalities ensure that you can efficiently prepare, sign, and store your LLC formation documents.

-

How much does it cost to use airSlate SignNow for filing 'form llc 25'?

airSlate SignNow offers flexible pricing plans that fit various business needs, including those looking to file 'form llc 25'. With competitive pricing, you gain access to all the essential features to manage your LLC documents without overspending.

-

Is airSlate SignNow compliant with legal standards for 'form llc 25'?

Yes, airSlate SignNow is compliant with legal standards for electronic signatures and document handling, ensuring that your 'form llc 25' is processed validly. This compliance guarantees that your LLC formation documents hold up in legal contexts.

-

Can I customize the 'form llc 25' using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the 'form llc 25' according to your specific business requirements. You can add fields, modify text, and tailor the document layout to suit your needs.

-

What integrations does airSlate SignNow offer for 'form llc 25'?

airSlate SignNow seamlessly integrates with various third-party applications, enhancing the way you file 'form llc 25'. Whether it's cloud storage services or business management tools, these integrations help streamline your document workflow.

-

How long does it take to process 'form llc 25' with airSlate SignNow?

Processing the 'form llc 25' with airSlate SignNow can be signNowly faster than traditional methods. Most users find that they can complete and send their documents for signature within minutes, speeding up the LLC formation process.

Get more for Llc 5 25 Form

Find out other Llc 5 25 Form

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free