Ch 11 Tax Appeals NJActB Org Form

What is the Ch 11 Tax Appeals NJActB org

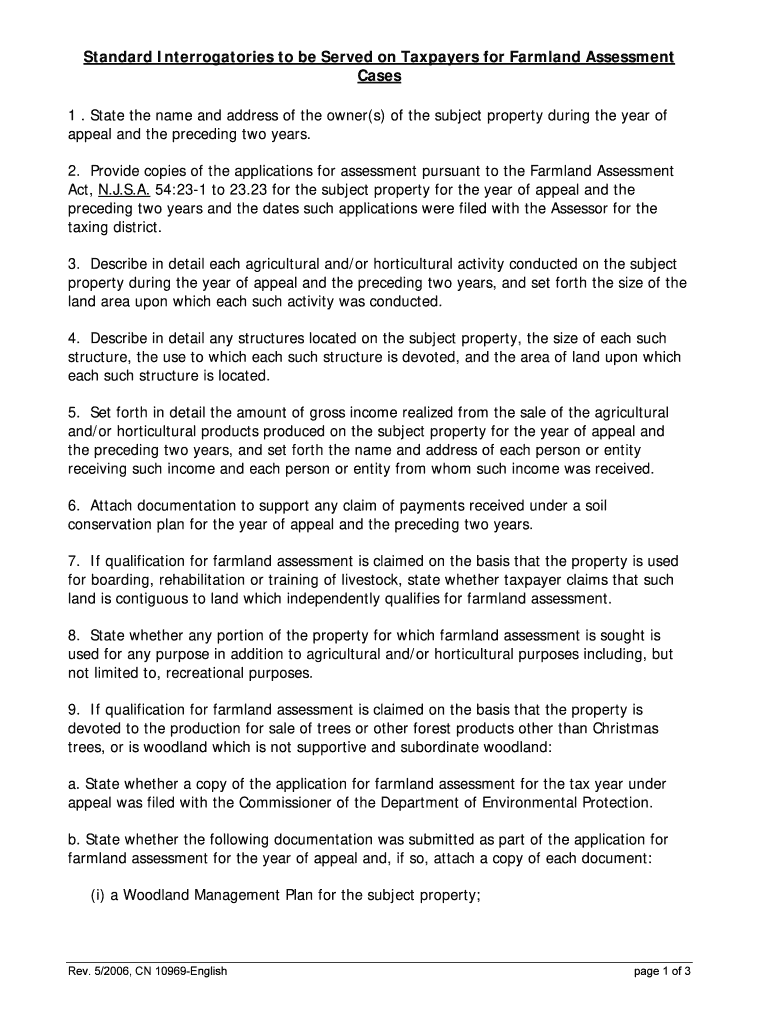

The Ch 11 Tax Appeals NJActB org serves as a crucial resource for individuals and businesses navigating the complexities of tax appeals in New Jersey. This organization provides guidance on how to challenge property tax assessments, ensuring that taxpayers understand their rights and the processes involved. The form is designed to facilitate the appeal process, making it easier for users to address discrepancies in their tax assessments effectively.

How to use the Ch 11 Tax Appeals NJActB org

Using the Ch 11 Tax Appeals NJActB org involves several straightforward steps. First, gather all relevant documentation related to your property and tax assessment. Next, access the official form through the NJActB website. Fill out the form carefully, ensuring that all required information is accurate and complete. Once completed, submit the form as per the guidelines provided, either online or through traditional mail. It is essential to keep copies of all submitted documents for your records.

Steps to complete the Ch 11 Tax Appeals NJActB org

Completing the Ch 11 Tax Appeals NJActB org requires a systematic approach:

- Review your current tax assessment and identify specific areas of concern.

- Collect supporting documents, such as property appraisals and tax bills.

- Access the Ch 11 form from the NJActB website.

- Fill out the form, ensuring all sections are completed accurately.

- Submit the form by the designated deadline, either online or by mail.

Legal use of the Ch 11 Tax Appeals NJActB org

The legal framework surrounding the Ch 11 Tax Appeals NJActB org ensures that all appeals are processed fairly and transparently. The form complies with state regulations, making it a valid tool for taxpayers to contest their assessments. Understanding the legal implications of submitting this form is crucial, as it can impact the outcome of your appeal. Proper use of the form can lead to adjustments in property taxes based on accurate assessments.

Eligibility Criteria

To use the Ch 11 Tax Appeals NJActB org, certain eligibility criteria must be met. Taxpayers must be the property owners or have a vested interest in the property being assessed. Additionally, the appeal must be filed within the specified time frame, typically within a certain number of days from the date of the tax bill. Familiarizing yourself with these criteria can help streamline the appeal process and increase the likelihood of a successful outcome.

Required Documents

When preparing to submit the Ch 11 Tax Appeals NJActB org, it is important to gather all necessary documents. Required documents often include:

- Recent property tax bills.

- Property appraisal reports.

- Any correspondence with the tax assessor's office.

- Proof of property ownership.

Having these documents ready will facilitate a smoother submission process and provide the necessary evidence to support your appeal.

Quick guide on how to complete ch 11 tax appeals njactborg

Complete Ch 11 Tax Appeals NJActB org effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides all the functionalities necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Ch 11 Tax Appeals NJActB org on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign Ch 11 Tax Appeals NJActB org with ease

- Locate Ch 11 Tax Appeals NJActB org and click Get Form to commence.

- Employ the tools available to complete your form.

- Identify relevant sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes just moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text (SMS), invitation link, or download to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Ch 11 Tax Appeals NJActB org and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is njavtb and how does it work with airSlate SignNow?

Njavtb refers to our document management and eSignature solution that seamlessly integrates with airSlate SignNow. This feature allows businesses to create, send, and track documents effortlessly. By utilizing njavtb, organizations can streamline their workflows, save time, and reduce paper waste.

-

What pricing options are available for njavtb on airSlate SignNow?

AirSlate SignNow offers flexible pricing plans for njavtb to suit businesses of all sizes. You can choose from monthly subscriptions or opt for annual plans for added savings. Each plan provides access to essential features that enhance productivity and streamline document processes.

-

What are the key features of njavtb in airSlate SignNow?

Key features of njavtb include customizable templates, secure eSigning, and real-time tracking of document status. AirSlate SignNow ensures that you can easily manage all your documents while maintaining compliance with industry standards. The intuitive interface also allows for quick document creation and distribution.

-

How can njavtb improve my business operations with airSlate SignNow?

Implementing njavtb through airSlate SignNow can signNowly enhance your business operations by automating repetitive tasks and reducing turnaround times for document signing. This means faster approvals, improved collaboration among teams, and ultimately a more efficient workflow. Your business can enjoy these benefits while also ensuring the security of sensitive documents.

-

Can njavtb integrate with other applications?

Yes, njavtb can easily integrate with a variety of third-party applications using airSlate SignNow. This includes popular productivity tools like Google Workspace, Microsoft Office, and CRMs such as Salesforce. Such integrations allow for a more cohesive workflow and enable teams to access njavtb features across their preferred platforms.

-

Is njavtb available for mobile users?

Absolutely! Njavtb through airSlate SignNow is fully optimized for mobile use, enabling users to eSign and manage documents on-the-go. This feature is especially beneficial for businesses with remote workers or those who require flexibility in their operations. Mobile accessibility ensures that you never miss a signing opportunity.

-

What security measures does njavtb offer in airSlate SignNow?

AirSlate SignNow takes security seriously, and njavtb includes various measures to protect your documents. With features such as end-to-end encryption, secure cloud storage, and compliance with global data protection regulations, you can trust that your sensitive information is safe. This allows businesses to focus on operations without worrying about document security.

Get more for Ch 11 Tax Appeals NJActB org

Find out other Ch 11 Tax Appeals NJActB org

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF