Declaration of Assets and Liabilities Form Download Word

Key elements of the declaration of assets and liabilities form

The declaration of assets and liabilities form is a crucial document used to provide a comprehensive overview of an individual's financial situation. This form typically includes several key elements:

- Personal Information: This section requires the individual's full name, address, and contact details.

- Asset Details: A detailed list of all assets, including real estate, vehicles, bank accounts, and investments, should be included.

- Liability Information: Individuals must disclose all liabilities, such as loans, mortgages, and credit card debts.

- Income Sources: This section outlines all sources of income, including salaries, business earnings, and any other financial inflows.

- Signature: The form must be signed and dated to validate the information provided.

Steps to complete the declaration of assets and liabilities form

Completing the declaration of assets and liabilities form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather Documentation: Collect all necessary documents that support the information you will provide, such as bank statements and property deeds.

- Fill in Personal Information: Carefully enter your personal details, ensuring they are accurate and up to date.

- List Assets: Itemize all assets, providing specific details for each, including estimated values.

- Detail Liabilities: Clearly outline all outstanding debts and obligations, including amounts owed.

- Provide Income Information: List all sources of income, ensuring to include any supplementary income streams.

- Review for Accuracy: Double-check all entries for accuracy and completeness to avoid potential issues.

- Sign and Date: Finally, sign and date the form to confirm that the information is truthful and complete.

Legal use of the declaration of assets and liabilities form

The declaration of assets and liabilities form serves several legal purposes. It is often used in legal proceedings, such as divorce or bankruptcy cases, to provide a clear picture of an individual's financial standing. Additionally, it may be required for loan applications or financial disclosures in various business transactions. Ensuring the accuracy and honesty of the information is vital, as discrepancies can lead to legal repercussions, including penalties or charges of fraud.

Required documents for the declaration of assets and liabilities form

To complete the declaration of assets and liabilities form accurately, several supporting documents are typically required:

- Bank statements for all accounts

- Property deeds and titles for real estate

- Vehicle registration documents

- Loan and mortgage statements

- Income statements, such as pay stubs or tax returns

Penalties for non-compliance with the declaration of assets and liabilities form

Failure to comply with the requirements of the declaration of assets and liabilities form can result in serious consequences. Individuals may face legal penalties, including fines or imprisonment, especially if the non-compliance is deemed intentional or fraudulent. Additionally, inaccuracies can lead to denied applications for loans or other financial services, affecting one’s ability to secure necessary funding.

Examples of using the declaration of assets and liabilities form

This form is commonly utilized in various scenarios, including:

- Divorce Proceedings: To assess the financial situation of both parties.

- Bankruptcy Filings: To provide a complete overview of assets and liabilities.

- Loan Applications: To evaluate creditworthiness and financial stability.

- Estate Planning: To document an individual's financial status for inheritance purposes.

Quick guide on how to complete declaration of assets and liabilities fill up form

A concise manual on how to organize your Declaration Of Assets And Liabilities Form Download Word

Locating the appropriate template can present a challenge when you need to deliver official foreign paperwork. Even if you have the necessary form, it may be tedious to swiftly fill it out according to all the stipulations if you rely on paper copies rather than handling everything digitally. airSlate SignNow is the online electronic signature platform that assists you in overcoming all of that. It allows you to obtain your Declaration Of Assets And Liabilities Form Download Word and promptly complete and sign it on-site without needing to reprint documents in case of any errors.

Here are the actions you should take to organize your Declaration Of Assets And Liabilities Form Download Word with airSlate SignNow:

- Click the Get Form button to add your document to our editor immediately.

- Begin with the first vacant field, input your information, and proceed with the Next tool.

- Fill in the empty fields using the Cross and Check tools from the toolbar above.

- Select the Highlight or Line options to emphasize the most important details.

- Click on Image and upload one if your Declaration Of Assets And Liabilities Form Download Word requires it.

- Utilize the right-side pane to add additional fields for you or others to fill out if needed.

- Review your responses and confirm the document by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it with a camera or QR code.

- Complete editing by clicking the Done button and choosing your file-sharing options.

Once your Declaration Of Assets And Liabilities Form Download Word is organized, you can disseminate it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your finished documentation in your account, organized into folders according to your preferences. Don’t spend time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

How do I close a newly formed private limited company?

Under Companies Act 2013, a Company can be closed in two ways.Winding UpWinding up is a tedious process and can be done either voluntary by calling up a meeting of all stakeholders and passing a special resolution or can be done on the order of Court or Tribunal. Strike Off” mode was introduced by the MCA to give the opportunity to the defunct companies to get their names struck off from the Register of Companies. On 27th December 2016, MCA has notified new rules i.e. Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016 prescribing rule for winding up or closure of private limited company under companies act 2013. By releasing the form STK 2, ministry of Corporate Affairs has brought the Section 248- 252 of 2013 act into force.Fast track ExitThis is the most awaited procedure, that got active again on 5thApril 2017. This procedure was introduced in Section 248 of Companies Act 2013.Fast Track exit can be done in two ways:Suo Moto by RegistrarThe registrar may strike off the name of Company on its own if:Company has failed to commence any business in a year of its incorporationCompany is not carrying out any business or Activity for preceding 2 financial years and has not sought the status of Dormant Company.The Registrar sends a notice (STK-1) of his intention to remove the name and seeks the representation of Company in 30 days.Note: Liability on the Directors of the company still exists. ROC can invoke penalty clauses anytime, and the penalty may range from INR 50K to INR 5Lakhs per director.Voluntary Removal of Name using Form STK 2Company can also move an application to Registrar of Companies for striking off the name by filing form STK-2 along with a fee of Rs 5000/-. Once form is filed, the Registrar has power and duty to satisfy him that all amount due by the company for the discharge of its liabilities and obligations has been realized. ROC can also issue a show cause notice in case of default in filing returns or other obligations.After above formalities, ROC issues a public notice and strike off the name of Company after its expiry.Note: The form is in approval route. Therefore, concerned ROC can ask for the completion of the fillings.Details Required:Incorporation CertificateDirector Identification NumberPending Litigation Proceedings if anyDocuments Required:Application in form STK-2Government filing fees: INR 5,000/-Copy of Board resolution authorizing the filing of this application;A statement of accounts showing the assets and liabilities of the Company made up to a day, not more than thirty days before the date of application and certified by a Chartered AccountantShareholder’s approval by way of Special ResolutionIn the case of a company regulated by any other authority, approval of such authority shall also be required.Copy of relevant order for delisting, if any, from the concerned Stock Exchange;Indemnity bond [to be given individually or collectively by the director(s)] in Form No. STK-3;Affidavit in Form No. STK-4Note: This form must be signed by a practicing CA or CSCompanies that cannot file for voluntary strike-offA company cannot fill the form STK 2 at any time in the previous 3 months if the company hasHas changed its name or shifted its registered office from one State to another;Has made a disposal for value of property or rights held by it, immediatelyBefore cesser of trade or otherwise carrying on of business, for the purpose of disposal for gain in the normal course of trading or otherwise carrying on of business;Has engaged in any other activity except the one which is necessary or expedient for the purpose of making an application under that section, or deciding whether to do so or concluding the affairs of the company or complying with any statutory requirement;Has made an application to the Tribunal for the sanctioning of a compromise or arrangement and the matter has not been finally concluded; orIs being wound up under Chapter XX of Companies Act or under the Insolvency and Bankruptcy code, 2016Companies that cannot use Fast Track Exit option:Companies Registered Under Section 8Listed companies;Companies that have been delisted due to non-compliance of listing regulations or listing agreement or any other statutory laws;Vanishing companies;Companies where inspection or investigation is ordered and being carried out or actions on such order are yet to be taken up or were completed but prosecutions arising out of such inspection or investigation are pending in the Court;Companies where notices have been issued by the Registrar or Inspector (under Section 234 of the Companies Act, 1956 (old Act) or section 206 or section 207 of the Act)and reply thereto is pending;Companies against which any prosecution for an offense is pending in any court;Companies whose application for compounding is pending;Companies which have accepted public deposits which are either outstanding or the company is in default in repayment of the same;Companies having charges which are pending for satisfaction.,After you Strike off your company:As soon as the name of company is removed from Register, from the date mentioned in the notice under sub-section (5) of section 248 cease to operate as a company and the Certificate of Incorporation issued to it shall be deemed to have been cancelled from such date except for the purpose of realizing the amount due to the company and for the payment or discharge of the liabilities or obligations of the company.- See more at: Different ways to Close a Company in India - WazzeerFor any Legal and Accounting support, Happy to help you, let us talkPS: Wazzeer Loves entrepreneurs #GoGetItIn case, you are thinking of getting some free advise from an experienced Lawyer (and Accountant), checkout Counselapplication of Wazzeer.#WazzeerKACounsel**For any Legal and Accounting support, Happy to help you, let us talkPS: Wazzeer Loves entrepreneurs #GoGetIt

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

Does an NRI need to fill in Schedule AL (Assets and Liabilities) of ITR-2 if his/her income outside India is more than 50 lakhs?

Presuming that you qualify as NR under the Income-tax Act, 1961, only following incomes would be taxable in India:Income received in IndiaIncome arising or accruing in IndiaIf the above mentioned incomes exceed the prescribed threshold in your case during this financial year (INR 50,00,000), then you have obligation to report your assets and liabilities in India in your income-tax return for that year.Hence, you do not need to report your foreign assets/income in your Indian income-tax return provided you qualify as NR in India for the relevant financial year.Hope the above helps!

Create this form in 5 minutes!

How to create an eSignature for the declaration of assets and liabilities fill up form

How to create an electronic signature for the Declaration Of Assets And Liabilities Fill Up Form in the online mode

How to make an electronic signature for the Declaration Of Assets And Liabilities Fill Up Form in Google Chrome

How to generate an electronic signature for signing the Declaration Of Assets And Liabilities Fill Up Form in Gmail

How to generate an electronic signature for the Declaration Of Assets And Liabilities Fill Up Form right from your mobile device

How to create an eSignature for the Declaration Of Assets And Liabilities Fill Up Form on iOS devices

How to create an electronic signature for the Declaration Of Assets And Liabilities Fill Up Form on Android devices

People also ask

-

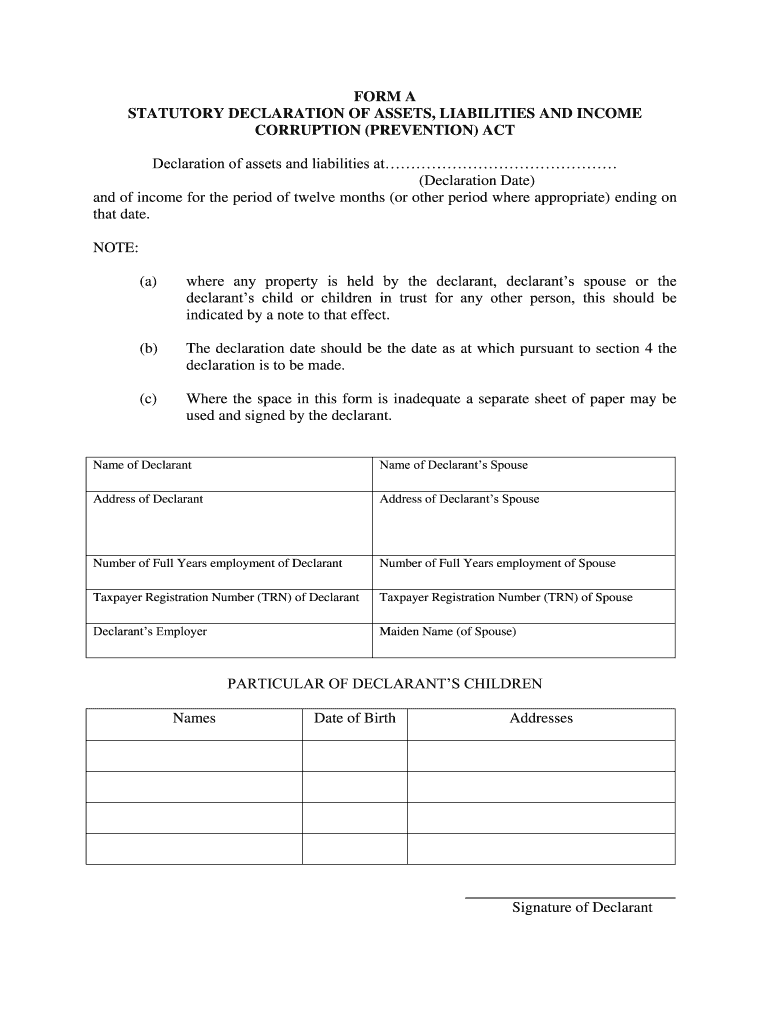

What is a Jamaica statutory declaration form?

A Jamaica statutory declaration form is a legal document used to declare certain facts or commitments under oath in Jamaica. It is often required for various legal processes, including property transactions and court proceedings. Completing this form accurately is crucial to ensure compliance with Jamaican law.

-

How do I create a Jamaica statutory declaration form using airSlate SignNow?

Creating a Jamaica statutory declaration form with airSlate SignNow is straightforward. You can utilize our customizable templates to fill in the necessary information and then eSign directly within the platform. The user-friendly interface makes it easy for anyone to complete legal documents quickly and accurately.

-

What are the pricing options for using airSlate SignNow to manage Jamaica statutory declaration forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those requiring Jamaica statutory declaration forms. Pricing packages include basic to advanced features, allowing you to choose what best fits your usage. Contact our sales team for detailed pricing specific to your requirements.

-

Can I integrate airSlate SignNow with other software for handling Jamaica statutory declaration forms?

Yes, airSlate SignNow supports various integrations allowing seamless connection with other software used for handling Jamaica statutory declaration forms. Popular integrations include CRM systems, cloud storage, and project management tools, helping streamline your document workflow. This enhances productivity by linking your existing systems effortlessly.

-

What are the benefits of using airSlate SignNow for Jamaica statutory declaration forms?

Using airSlate SignNow for Jamaica statutory declaration forms offers numerous benefits, including enhanced efficiency, cost savings, and secure electronic signatures. The platform simplifies the entire process, reducing the time needed to manage legal documents. Additionally, it provides peace of mind with robust security measures to protect sensitive information.

-

Is it legally acceptable to use an electronic Jamaica statutory declaration form?

Yes, electronic Jamaica statutory declaration forms are legally acceptable under Jamaican law, provided they meet the necessary requirements. airSlate SignNow ensures that all electronic signatures comply with legal standards, giving you confidence in the documents you create. This convenience helps you manage your legal affairs efficiently.

-

Can I access my Jamaica statutory declaration forms on mobile devices?

Absolutely! airSlate SignNow allows you to access your Jamaica statutory declaration forms on mobile devices through its app. This means you can create, edit, and eSign documents on-the-go, offering flexibility and convenience to complete your legal tasks anytime, anywhere. Take control of your document management from the palm of your hand.

Get more for Declaration Of Assets And Liabilities Form Download Word

Find out other Declaration Of Assets And Liabilities Form Download Word

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself