503 B 9 Blank Form 2011-2026

What is the 503 B 9 Blank Form

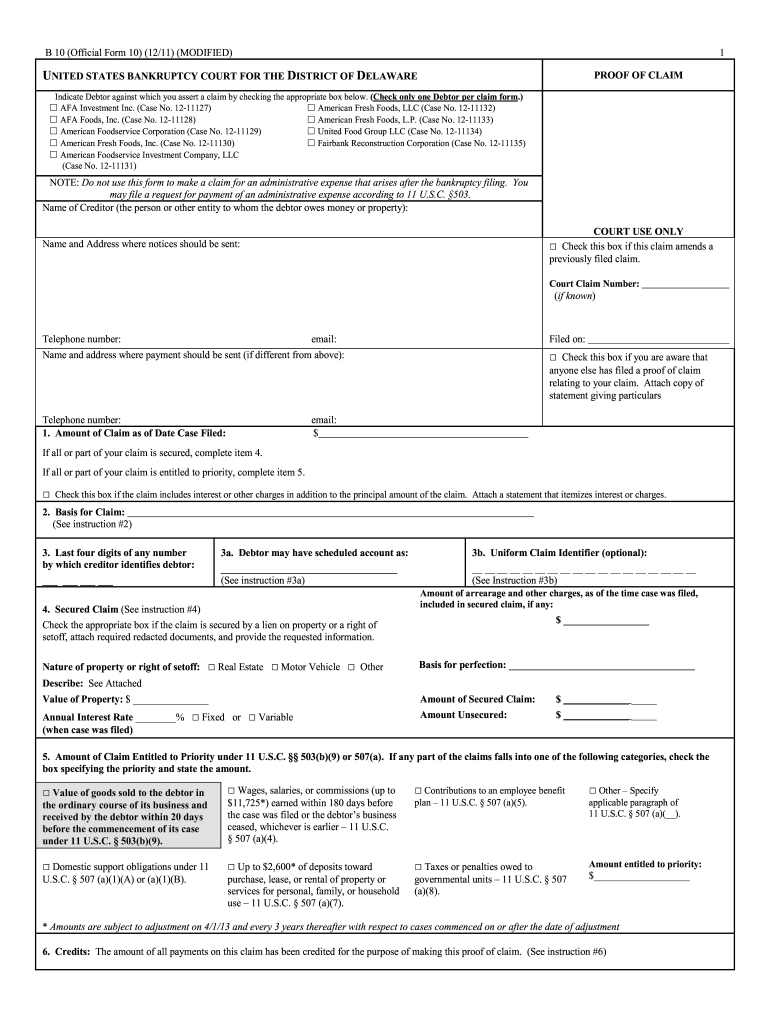

The 503 B 9 Blank Form is a crucial document used in bankruptcy proceedings, specifically for filing claims under Section 503(b)(9) of the U.S. Bankruptcy Code. This form allows creditors to assert their claims for goods received by the debtor within twenty days before the bankruptcy filing. By completing this form, creditors can ensure that they are recognized in the bankruptcy process and may receive payment for the goods provided. Understanding the purpose and structure of the form is essential for effective participation in bankruptcy proceedings.

Steps to Complete the 503 B 9 Blank Form

Completing the 503 B 9 Blank Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the goods provided to the debtor, including dates of delivery and descriptions of the goods. Next, fill in your contact information as the creditor, along with the details of the debtor. It is important to clearly state the amount owed for the goods and provide any supporting documentation that verifies the claim. After filling out the form, review it thoroughly for any errors before submission.

Legal Use of the 503 B 9 Blank Form

The legal use of the 503 B 9 Blank Form is governed by the U.S. Bankruptcy Code, specifically Section 503(b)(9). This section allows creditors to file claims for goods received shortly before the bankruptcy filing. To ensure the claim is valid, it must be submitted within the specified time frame and include accurate information about the goods and the amounts owed. Failure to adhere to these legal requirements may result in the claim being disallowed, emphasizing the importance of understanding the legal context of the form.

How to Obtain the 503 B 9 Blank Form

The 503 B 9 Blank Form can typically be obtained from the official website of the U.S. Courts or through bankruptcy court clerks. Many legal resources and bankruptcy-related websites also provide downloadable versions of the form. It is advisable to ensure that you are using the most current version of the form to comply with any recent legal updates. If assistance is needed, consulting with a legal professional can provide guidance on obtaining and completing the form correctly.

Filing Deadlines / Important Dates

Filing deadlines for the 503 B 9 Blank Form are critical for creditors wishing to assert their claims in bankruptcy cases. Generally, the form must be filed within twenty days of the debtor's bankruptcy filing date. Missing this deadline can result in the loss of the right to claim payment for the goods provided. It is essential to keep track of important dates related to the bankruptcy case and ensure timely submission of the form to protect your interests as a creditor.

Key Elements of the 503 B 9 Blank Form

The 503 B 9 Blank Form includes several key elements that must be accurately completed. These elements typically consist of the creditor's name and contact information, the debtor's information, a detailed description of the goods provided, the date of delivery, and the total amount owed. Additionally, the form may require the creditor to provide supporting documentation that verifies the claim. Ensuring that all key elements are correctly filled out is vital for the claim's acceptance in the bankruptcy process.

Quick guide on how to complete 503 b 9 blank claim form

The optimal method to locate and endorse 503 B 9 Blank Form

At the level of an entire organization, ineffective workflows surrounding document authorization can consume a signNow amount of work hours. Executing paperwork such as 503 B 9 Blank Form is an inherent aspect of operations in any enterprise, which is why the efficacy of each agreement’s lifecycle signNowly impacts the organization’s overall performance. With airSlate SignNow, endorsing your 503 B 9 Blank Form is as simple and swift as possible. You will discover with this platform the latest version of nearly any form. Even better, you can sign it instantly without the need to install external software on your device or print hard copies.

Steps to obtain and endorse your 503 B 9 Blank Form

- Explore our collection by category or use the search box to find the form you require.

- Review the form preview by clicking on Learn more to confirm it is the correct one.

- Press Get form to begin editing immediately.

- Fill out your form and input any necessary details using the toolbar.

- Once completed, click the Sign tool to endorse your 503 B 9 Blank Form.

- Choose the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as needed.

With airSlate SignNow, you have everything required to manage your documents effectively. You can locate, complete, modify, and even send your 503 B 9 Blank Form all in one tab with no trouble. Enhance your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

In what cases do you have to fill out an insurance claim form?

Ah well let's see. An insurance claim form is used to make a claim against your insurance for financial, repair or replacement of something depending on your insurance. Not everything will qualify so you actually have to read the small print.

-

How do I fill out the disability forms so well that my claim is approved?

Contact Barbara Case, the founder of USA: Providing Free Advocacy & Support She's incredible!

Create this form in 5 minutes!

How to create an eSignature for the 503 b 9 blank claim form

How to create an electronic signature for your 503 B 9 Blank Claim Form in the online mode

How to create an electronic signature for the 503 B 9 Blank Claim Form in Google Chrome

How to make an eSignature for signing the 503 B 9 Blank Claim Form in Gmail

How to make an electronic signature for the 503 B 9 Blank Claim Form straight from your smartphone

How to create an eSignature for the 503 B 9 Blank Claim Form on iOS

How to make an eSignature for the 503 B 9 Blank Claim Form on Android OS

People also ask

-

What is the 503 B 9 Blank Form used for?

The 503 B 9 Blank Form is designed for businesses to comply with specific regulations by providing necessary information in a standardized format. By using the 503 B 9 Blank Form, organizations can streamline their documentation processes and ensure compliance with industry standards.

-

How can I fill out the 503 B 9 Blank Form using airSlate SignNow?

Filling out the 503 B 9 Blank Form is simple with airSlate SignNow. You can upload the form, fill it out electronically, and even add signatures, all within the platform. This allows for quick processing and reduces the chance of errors that can occur with manual entry.

-

Is there a cost associated with using the 503 B 9 Blank Form on airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to the 503 B 9 Blank Form. Depending on your business needs, you can choose a plan that fits your budget while enjoying features like unlimited document signing and advanced integrations.

-

What features does airSlate SignNow offer for the 503 B 9 Blank Form?

With airSlate SignNow, you can easily create, edit, and eSign the 503 B 9 Blank Form. The platform also provides templates, collaboration tools, and secure storage options to ensure your documents are well-managed and easily accessible.

-

Can I integrate the 503 B 9 Blank Form with other applications?

Yes, airSlate SignNow allows you to integrate the 503 B 9 Blank Form with various applications such as CRM systems and cloud storage services. This integration capability enhances workflow efficiency by connecting your documents to your existing business processes.

-

What are the benefits of using airSlate SignNow for the 503 B 9 Blank Form?

Using airSlate SignNow for the 503 B 9 Blank Form offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform’s user-friendly interface makes it easy to manage documents, ensuring that your team can focus on more critical tasks.

-

Can I track the status of the 503 B 9 Blank Form after sending it for signature?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including the 503 B 9 Blank Form. You can monitor the status of your sent forms, see when they are opened, signed, and completed, keeping you informed throughout the process.

Get more for 503 B 9 Blank Form

- Burnaby supplementary utility fees form

- Driving test sheet pdf form

- Toronto on m2n 7j8 advisor screening form

- Criteria and application for accreditation as a aasw asn form

- Formule 243 rapport annuel service new brunswick pxw1 snb

- Referee statement form

- California acknowledgement 2022 form

- Answer to petition for dissolution of marriage with children form

Find out other 503 B 9 Blank Form

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now