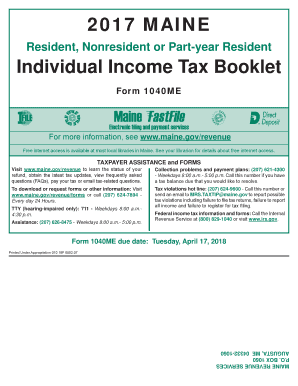

MAINE Individual Income Tax Booklet Form

Understanding the Maine Individual Income Tax Booklet

The Maine Individual Income Tax Booklet serves as a comprehensive guide for residents who need to file their state income tax returns. This booklet includes essential information about income tax rates, deductions, and credits available to taxpayers. It also outlines the necessary forms, including the Maine Form 1040ME, which is used to report income and calculate tax liability. Familiarizing yourself with this booklet is crucial for ensuring accurate and timely filing.

Steps to Complete the Maine Individual Income Tax Booklet

Completing the Maine Individual Income Tax Booklet involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions provided in the booklet to understand the required forms and information.

- Fill out the Maine Form 1040ME, ensuring that all income, deductions, and credits are accurately reported.

- Double-check calculations to avoid errors that could lead to penalties.

- Sign and date the completed form before submission.

Legal Use of the Maine Individual Income Tax Booklet

The Maine Individual Income Tax Booklet is legally recognized as a valid document for filing state income taxes. Compliance with the guidelines outlined in the booklet is essential for ensuring that your tax return is accepted by the Maine Revenue Services. Using the booklet correctly protects taxpayers from potential legal issues and ensures that they meet their tax obligations.

Filing Deadlines and Important Dates

It is important to be aware of filing deadlines to avoid penalties. For the tax year 2018, the deadline for submitting the Maine Form 1040ME is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also note any extensions that may apply and ensure that they file their returns or request extensions in a timely manner.

Required Documents for Filing

To complete the Maine Individual Income Tax Booklet, taxpayers must gather several key documents:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation of any deductions or credits being claimed

- Previous year’s tax return for reference

Having these documents readily available will streamline the filing process and help ensure accuracy.

Form Submission Methods

Taxpayers in Maine have several options for submitting their completed Form 1040ME. These methods include:

- Online submission through the Maine Revenue Services website

- Mailing a paper form to the designated address

- In-person submission at local tax offices

Choosing the right submission method can affect processing times and convenience, so it is important to consider your options carefully.

Quick guide on how to complete maine income tax booklet 2018

Complete maine income tax booklet 2018 seamlessly on any gadget

Online document management has gained prominence among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage 1040me instructions on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign maine tax booklet 2018 effortlessly

- Find maine form 1040me 2018 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes a few seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign maine form 1040me instructions 2018 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs maine individual income tax

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

Related searches to maine individual income tax form 1040me

Create this form in 5 minutes!

How to create an eSignature for the maine individual income tax form 1040me 2021

How to create an electronic signature for your 2017 Maine Individual Income Tax Booklet online

How to generate an eSignature for your 2017 Maine Individual Income Tax Booklet in Chrome

How to generate an eSignature for signing the 2017 Maine Individual Income Tax Booklet in Gmail

How to make an eSignature for the 2017 Maine Individual Income Tax Booklet straight from your smartphone

How to create an electronic signature for the 2017 Maine Individual Income Tax Booklet on iOS

How to make an eSignature for the 2017 Maine Individual Income Tax Booklet on Android

People also ask maine 1040me instructions 2018

-

What are the Maine 1040ME instructions for 2018?

The Maine 1040ME instructions for 2018 provide detailed guidelines on how to fill out your state income tax return. They include information on eligible deductions, tax credits, and filing requirements. Following these instructions carefully will ensure you comply with state regulations and maximize your refund.

-

How can airSlate SignNow help with Maine 1040ME forms?

airSlate SignNow simplifies the process of preparing and signing your Maine 1040ME forms. With its user-friendly platform, you can easily upload documents, fill in your data, and obtain e-signatures. This streamlines the submission process, making it stress-free and efficient.

-

What features does airSlate SignNow offer for tax documents?

airSlate SignNow offers features such as customizable templates, document tracking, and secure cloud storage, which are essential for handling tax documents like the Maine 1040ME for 2018. These features facilitate collaboration and ensure your documents remain organized and accessible. Additionally, the platform provides integrations with popular tax software.

-

Is there a cost associated with using airSlate SignNow for filing Maine 1040ME?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers. Each plan is designed to meet different business needs, offering various features for document management. The cost is competitive, considering the convenience and efficiency it provides for filing documents like the Maine 1040ME instructions for 2018.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage and sign your Maine 1040ME forms from anywhere. The mobile app is designed to be user-friendly, ensuring you can quickly navigate documents and gather signatures even while on the go.

-

Is electronic signing valid for Maine tax forms in 2018?

Yes, electronic signing is valid for tax forms in Maine, including the 2018 1040ME. airSlate SignNow complies with state regulations, ensuring that e-signatures are legally binding and accepted. This provides a convenient alternative to traditional signing methods, making it easier to complete your tax filings.

-

What benefits does airSlate SignNow offer for tax professionals?

For tax professionals, airSlate SignNow offers an efficient method for managing client documents, including the 2018 Maine 1040ME instructions. The platform allows for easy collaboration, secure document sharing, and quick retrieval of documents. These benefits contribute to enhanced productivity and improved client service.

Get more for maine 1040me instructions 2021

- Can a 8379 form be faxed

- Use the irs label here form

- 1040 ez form

- Form 13715 volunteer site information sheet oct 2015

- Planilla para la declaracin de la contribucin federal sobre el trabajo por cuenta propia incluyendo el crdito tributario form

- 940pr 2003 form

- Formulario 940 pr 1998

- Customs form 4790

Find out other maine form 1040me instructions 2021

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT