ADDITIONAL DEBTOR'S NAME Provide Only One Debtor Name 21a or 21b Use Exact, Full Name; Do Not Omit, Modify, or Abbreviate Any Pa Form

Understanding the ADDITIONAL DEBTOR'S NAME Requirement

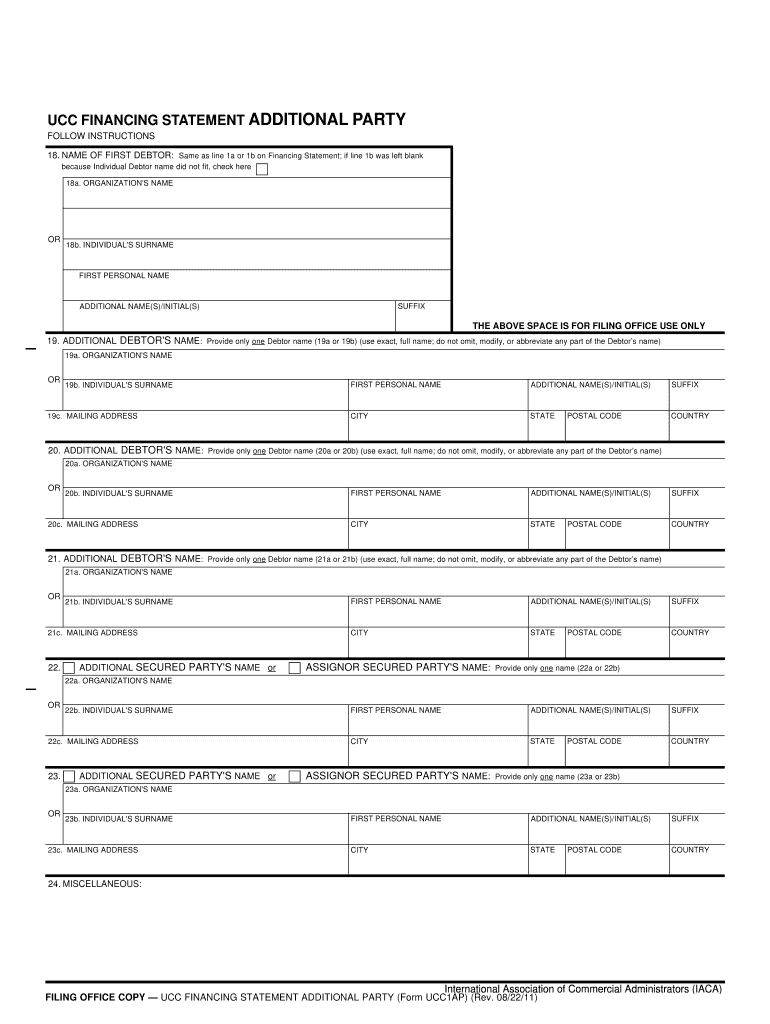

The ADDITIONAL DEBTOR'S NAME section is crucial for accurately identifying the debtor in legal and financial documents. It requires the inclusion of only one debtor's name, either in section 21a or 21b. The name must be the exact, full name of the individual or entity involved. Omitting, modifying, or abbreviating any part of the debtor's name can lead to complications or invalidation of the document. This requirement ensures clarity and legal compliance, making it essential for all parties involved.

Steps to Complete the ADDITIONAL DEBTOR'S NAME Section

Filling out the ADDITIONAL DEBTOR'S NAME section involves several straightforward steps:

- Identify the debtor: Determine whether you are entering an individual's name or a business entity.

- Use the full name: Write the debtor's name exactly as it appears on legal documents, without any modifications.

- Choose the correct section: Decide whether to fill out section 21a or 21b, ensuring only one name is provided.

- Review for accuracy: Double-check the spelling and completeness of the name to avoid any errors.

Legal Implications of the ADDITIONAL DEBTOR'S NAME

The legal use of the ADDITIONAL DEBTOR'S NAME is significant in various contexts, such as loan agreements, contracts, and court filings. Providing the correct name is essential for the enforceability of the document. Failure to comply with this requirement may result in legal disputes or challenges regarding the validity of the agreement. Therefore, understanding the importance of this section can help mitigate risks associated with legal documentation.

Examples of Properly Filling Out the ADDITIONAL DEBTOR'S NAME

When completing the ADDITIONAL DEBTOR'S NAME section, consider the following examples:

- If the debtor's name is John Smith, enter it as "John Smith" in the designated section.

- For a business, such as ABC Corporation, write "ABC Corporation" without any abbreviations.

- Avoid using nicknames or initials; always use the full legal name as it appears in official records.

Common Mistakes to Avoid

When filling out the ADDITIONAL DEBTOR'S NAME section, be aware of these common mistakes:

- Omitting middle names or suffixes, such as Jr. or Sr.

- Using abbreviations or acronyms instead of the full name.

- Providing multiple names when only one is required.

State-Specific Considerations for the ADDITIONAL DEBTOR'S NAME

Different states may have specific regulations regarding the ADDITIONAL DEBTOR'S NAME. It is important to be aware of these variations to ensure compliance. For instance, some states may require additional documentation or specific formats for business names. Always check local laws or consult with a legal professional to understand the requirements relevant to your jurisdiction.

Quick guide on how to complete additional debtors name provide only one debtor name 21a or 21b use exact full name do not omit modify or abbreviate any part 490202979

Complete ADDITIONAL DEBTOR'S NAME Provide Only One Debtor Name 21a Or 21b use Exact, Full Name; Do Not Omit, Modify, Or Abbreviate Any Pa seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with everything you need to create, edit, and electronically sign your documents swiftly and without delays. Effortlessly handle ADDITIONAL DEBTOR'S NAME Provide Only One Debtor Name 21a Or 21b use Exact, Full Name; Do Not Omit, Modify, Or Abbreviate Any Pa across any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

How to modify and eSign ADDITIONAL DEBTOR'S NAME Provide Only One Debtor Name 21a Or 21b use Exact, Full Name; Do Not Omit, Modify, Or Abbreviate Any Pa with ease

- Find ADDITIONAL DEBTOR'S NAME Provide Only One Debtor Name 21a Or 21b use Exact, Full Name; Do Not Omit, Modify, Or Abbreviate Any Pa and then click Get Form to begin.

- Make use of the tools provided to fill in your form.

- Emphasize important sections of your documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal legitimacy as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign ADDITIONAL DEBTOR'S NAME Provide Only One Debtor Name 21a Or 21b use Exact, Full Name; Do Not Omit, Modify, Or Abbreviate Any Pa to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of providing the ADDITIONAL DEBTOR'S NAME in documents?

Providing the ADDITIONAL DEBTOR'S NAME is crucial for legal accuracy in documents. You must provide only one debtor name in section 21a or 21b, utilizing the exact, full name without omitting, modifying, or abbreviating any part. This ensures the document's validity and avoids potential disputes.

-

How does airSlate SignNow simplify the signing process for documents requiring a debtor's name?

airSlate SignNow streamlines the signing process by allowing users to enter the required ADDITIONAL DEBTOR'S NAME easily. Our platform guides you to provide only one debtor name in sections 21a or 21b in the proper format, enhancing efficiency and compliance in your documentation.

-

What features does airSlate SignNow offer that are particularly relevant to handling debtor names?

airSlate SignNow offers features like customizable templates, guided form filling, and real-time editing to ensure the ADDITIONAL DEBTOR'S NAME is included correctly. Users are prompted to use the exact, full name without omitting or modifying any part of it, making the workflow seamless and compliant with legal standards.

-

Can I integrate airSlate SignNow with other tools for managing debtor information?

Yes, airSlate SignNow integrates seamlessly with various business tools, allowing you to manage debtor information efficiently. By integrating with CRM systems, you can ensure that the ADDITIONAL DEBTOR'S NAME is always up-to-date. This feature enhances your document flow while maintaining compliance with the requirement to provide only one specific debtor name.

-

What are the pricing options for using airSlate SignNow for managing documents with debtor names?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Choose a plan that includes access to features for providing the ADDITIONAL DEBTOR'S NAME, ensuring you can manage your documents effectively without breaking the bank. The pricing provides excellent value for such a robust tool.

-

What benefits can I expect when using airSlate SignNow for debtor-related documents?

Using airSlate SignNow enhances your document management process by ensuring that the ADDITIONAL DEBTOR'S NAME is input accurately and efficiently. With easy-to-use features and guidance in filling out the required debtor fields, you reduce the risk of errors, thus improving your transaction security and compliance.

-

How can I ensure I'm entering the ADDITIONAL DEBTOR'S NAME correctly?

To ensure accuracy, always input the ADDITIONAL DEBTOR'S NAME as it appears officially, following the requirements to use only one name in sections 21a or 21b. airSlate SignNow provides guidance throughout the process to help avoid omissions or modifications to the name, thereby ensuring your documents maintain their legal standing.

Get more for ADDITIONAL DEBTOR'S NAME Provide Only One Debtor Name 21a Or 21b use Exact, Full Name; Do Not Omit, Modify, Or Abbreviate Any Pa

- Hoag medical records form

- Centura health annual tuberculosis screening form for penrosestfrancis

- Greater baltimore medical center obstetrical pre gbmc form

- Lymphedema intake form

- Patient service center valley baptist medical center valleybaptist form

- Referral intake form swedish hospital

- Washington federal foundation grant application form

- Filing a motion for continuance form

Find out other ADDITIONAL DEBTOR'S NAME Provide Only One Debtor Name 21a Or 21b use Exact, Full Name; Do Not Omit, Modify, Or Abbreviate Any Pa

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF