Third Party Notification for Real Property Taxes Application Form

What is the Third Party Notification For Real Property Taxes Application

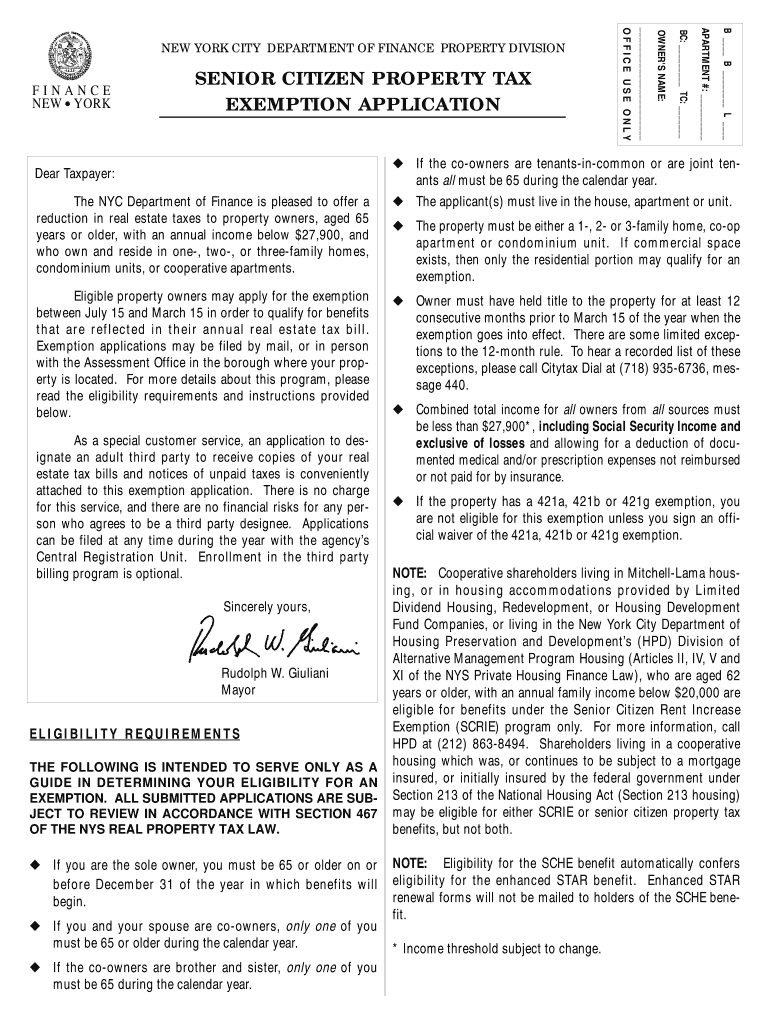

The Third Party Notification for Real Property Taxes Application is a form that allows property owners to designate a third party to receive notifications regarding real property tax matters. This application is particularly useful for individuals who may not be able to manage their property taxes directly due to various circumstances, such as age, health issues, or other personal challenges. By submitting this form, property owners ensure that important tax-related information is communicated to a trusted individual or organization, helping to prevent any potential misunderstandings or missed deadlines.

Steps to complete the Third Party Notification For Real Property Taxes Application

Completing the Third Party Notification for Real Property Taxes Application involves several straightforward steps:

- Obtain the application form from your local tax authority or relevant government website.

- Fill in your personal information, including your name, address, and property details.

- Provide the contact information of the designated third party, ensuring accuracy to avoid communication issues.

- Sign and date the application to validate your request.

- Submit the completed form via the preferred method, which may include online submission, mailing, or in-person delivery.

Legal use of the Third Party Notification For Real Property Taxes Application

The legal use of the Third Party Notification for Real Property Taxes Application is governed by state laws and regulations. This form is recognized as a legitimate means for property owners to authorize a third party to receive tax notifications on their behalf. To ensure compliance, it is essential to understand the specific legal requirements in your state, including any necessary signatures or additional documentation that may be required. Properly executed, this form can help protect property owners from potential tax-related issues.

Eligibility Criteria

Eligibility to use the Third Party Notification for Real Property Taxes Application typically includes property owners who may require assistance in managing their tax responsibilities. This can include:

- Individuals with disabilities.

- Senior citizens who may have difficulty keeping track of their tax obligations.

- Those who are temporarily unable to manage their property due to health issues.

- Any property owner who wishes to appoint a trusted individual or organization to handle tax notifications.

How to obtain the Third Party Notification For Real Property Taxes Application

The Third Party Notification for Real Property Taxes Application can be obtained through several channels. Property owners can typically find the form on their local tax authority's website or request a physical copy by contacting the office directly. Some states may also provide the application through official government portals or public libraries. It is important to ensure that you are using the most current version of the form to avoid any potential issues during submission.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Third Party Notification for Real Property Taxes Application can be done through various methods, depending on the policies of the local tax authority. Common submission methods include:

- Online submission through the tax authority's official website, if available.

- Mailing the completed form to the designated address provided by the tax authority.

- Delivering the application in person at the local tax office during business hours.

It is advisable to check the specific submission guidelines for your locality to ensure proper processing.

Quick guide on how to complete third party notification for real property taxes application

Effortlessly prepare Third Party Notification For Real Property Taxes Application on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Third Party Notification For Real Property Taxes Application on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Third Party Notification For Real Property Taxes Application without hassle

- Obtain Third Party Notification For Real Property Taxes Application and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether through email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device you choose. Edit and eSign Third Party Notification For Real Property Taxes Application and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Third Party Notification For Real Property Taxes Application?

The Third Party Notification For Real Property Taxes Application is a service that allows property owners to designate a third party to receive notifications regarding real property tax obligations. This feature ensures that important tax information is communicated effectively, helping property owners stay informed and avoid potential penalties.

-

How does airSlate SignNow enhance the Third Party Notification For Real Property Taxes Application?

AirSlate SignNow simplifies the process of managing your Third Party Notification For Real Property Taxes Application by providing an intuitive platform to send and eSign documents instantly. With our solution, you can easily handle notifications digitally without the hassle of paperwork, streamlining communication for all parties involved.

-

Is there a cost associated with using the Third Party Notification For Real Property Taxes Application?

Yes, while airSlate SignNow offers various pricing plans, the cost of the Third Party Notification For Real Property Taxes Application will depend on your chosen plan and the features you require. We provide competitive pricing designed to be cost-effective for businesses of all sizes, ensuring you receive great value for the services provided.

-

What are the benefits of using airSlate SignNow for the Third Party Notification For Real Property Taxes Application?

Using airSlate SignNow for your Third Party Notification For Real Property Taxes Application offers numerous benefits, including quicker document turnaround, enhanced collaboration, and increased security. Our platform ensures that all communications are encrypted and compliant, providing peace of mind throughout the notification process.

-

Can I integrate the Third Party Notification For Real Property Taxes Application with existing software?

Absolutely! airSlate SignNow allows seamless integration with various business applications, enhancing your Third Party Notification For Real Property Taxes Application. This flexibility ensures you can maintain your current workflows while taking advantage of the efficient document management capabilities we offer.

-

How secure is the Third Party Notification For Real Property Taxes Application with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our Third Party Notification For Real Property Taxes Application utilizes advanced encryption and secure access protocols to protect sensitive information, ensuring that all documents and notifications are safe from unauthorized access.

-

Is training available for using the Third Party Notification For Real Property Taxes Application?

Yes, airSlate SignNow provides comprehensive training and support resources for users of the Third Party Notification For Real Property Taxes Application. Whether through online tutorials, detailed documentation, or customer service, we ensure you have all the tools to maximize the efficiency of your document processes.

Get more for Third Party Notification For Real Property Taxes Application

Find out other Third Party Notification For Real Property Taxes Application

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself