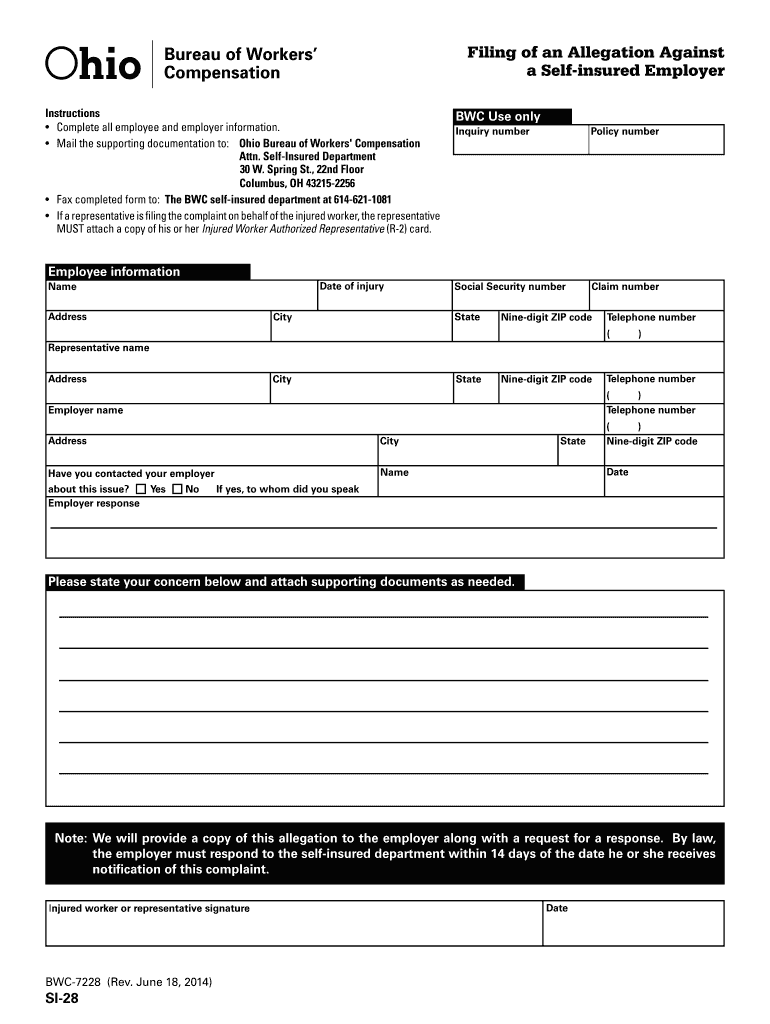

A Self Insured Employer Form

What is the A Self Insured Employer

A self insured employer is an organization that assumes the financial risk for providing health care benefits to its employees instead of purchasing insurance from a third-party insurer. This approach allows businesses to manage their health care costs more directly and can lead to significant savings. Self-insured employers typically set aside funds to cover expected health care claims and may also purchase stop-loss insurance to protect against unexpected high claims. This model is particularly common among larger companies that have the resources to handle the associated risks.

How to Use the A Self Insured Employer

Utilizing a self insured employer model involves several key steps. First, the employer must assess its employee population and health care needs to determine the appropriate level of funding. Next, the employer should establish a plan for managing claims, which may include hiring a third-party administrator (TPA) to handle day-to-day operations. The employer also needs to ensure compliance with federal and state regulations governing self-insured plans, including reporting requirements and employee notifications. Regularly reviewing claims data and adjusting funding levels is essential for maintaining financial stability.

Steps to Complete the A Self Insured Employer

To complete the process of becoming a self insured employer, follow these steps:

- Evaluate your company's size and employee health care needs.

- Determine the funding level required to cover anticipated claims.

- Select a third-party administrator if needed.

- Establish a health plan that complies with applicable laws.

- Communicate the plan details to employees, ensuring they understand their benefits.

- Monitor claims and adjust funding as necessary.

Legal Use of the A Self Insured Employer

Self insured employers must adhere to various legal requirements to ensure their plans are compliant with federal laws such as the Employee Retirement Income Security Act (ERISA) and the Affordable Care Act (ACA). These regulations require transparency in plan operations, including reporting and disclosure obligations. Employers must also ensure that their health plans provide the necessary benefits and protections mandated by law. Failure to comply with these legal requirements can result in significant penalties and liabilities.

Key Elements of the A Self Insured Employer

Several key elements define a self insured employer model:

- Risk Management: Employers must effectively manage the financial risks associated with health care claims.

- Funding Arrangement: Establishing a reserve fund to cover expected claims is crucial.

- Claims Administration: Efficient processing of claims is essential for maintaining employee satisfaction.

- Compliance: Adherence to relevant laws and regulations is necessary to avoid legal issues.

Eligibility Criteria

Eligibility to operate as a self insured employer generally depends on the size and financial stability of the organization. Larger companies with a diverse employee base often qualify, as they can better predict and manage health care costs. Additionally, employers must have the financial resources to cover potential claims and the administrative capabilities to handle the complexities of self-insurance. Smaller businesses may find it challenging to self-insure due to the unpredictability of claims and the associated financial risks.

Quick guide on how to complete a self insured employer

Accomplish A Self insured Employer effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the appropriate format and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage A Self insured Employer on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign A Self insured Employer effortlessly

- Find A Self insured Employer and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature utilizing the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you wish to send your document, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Alter and eSign A Self insured Employer and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What advantages does airSlate SignNow offer for A Self insured Employer?

A Self insured Employer can benefit from airSlate SignNow by streamlining the document signing process, reducing administrative overhead, and enhancing compliance. The platform offers features that facilitate easy e-signatures, document tracking, and customized workflows, making it a powerful tool for HR and benefits administration.

-

How does airSlate SignNow ensure compliance for A Self insured Employer?

Compliance is crucial for A Self insured Employer, and airSlate SignNow provides features like audit trails and secure data encryption to meet regulatory standards. The platform is designed to support compliance with electronic signature laws, ensuring that all signed documents are legally binding and secure.

-

What is the pricing structure for A Self insured Employer using airSlate SignNow?

airSlate SignNow offers flexible pricing plans suitable for A Self insured Employer, ensuring cost-effectiveness without compromising quality. Plans are tailored to meet different business needs, allowing employers to choose features that maximize value while keeping expenses manageable.

-

Can airSlate SignNow integrate with other tools that A Self insured Employer uses?

Yes, airSlate SignNow seamlessly integrates with various applications and software that A Self insured Employer may already use, such as CRM systems and HR platforms. This integration capability enhances workflow efficiency and enables a smoother document management experience.

-

What features are most beneficial for A Self insured Employer with airSlate SignNow?

Key features beneficial for A Self insured Employer include easy e-signature capabilities, customizable templates, and automated reminders. These features not only save time but also improve accuracy and ensure that essential documents are processed efficiently.

-

How can airSlate SignNow improve the document workflow for A Self insured Employer?

A Self insured Employer can enhance their document workflow with airSlate SignNow by utilizing automated workflows that reduce manual handling of documents. The platform allows for the easy setup of signing orders and notifications, ensuring that critical documents are signed in a timely manner.

-

Is airSlate SignNow user-friendly for A Self insured Employer staff?

Absolutely, airSlate SignNow is designed with user experience in mind, making it accessible even for those with limited technical expertise. A Self insured Employer staff can quickly get accustomed to the platform's intuitive interface, ensuring a smooth transition to digital document management.

Get more for A Self insured Employer

Find out other A Self insured Employer

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple