OK DO 1 Form

What is the OK DO 1

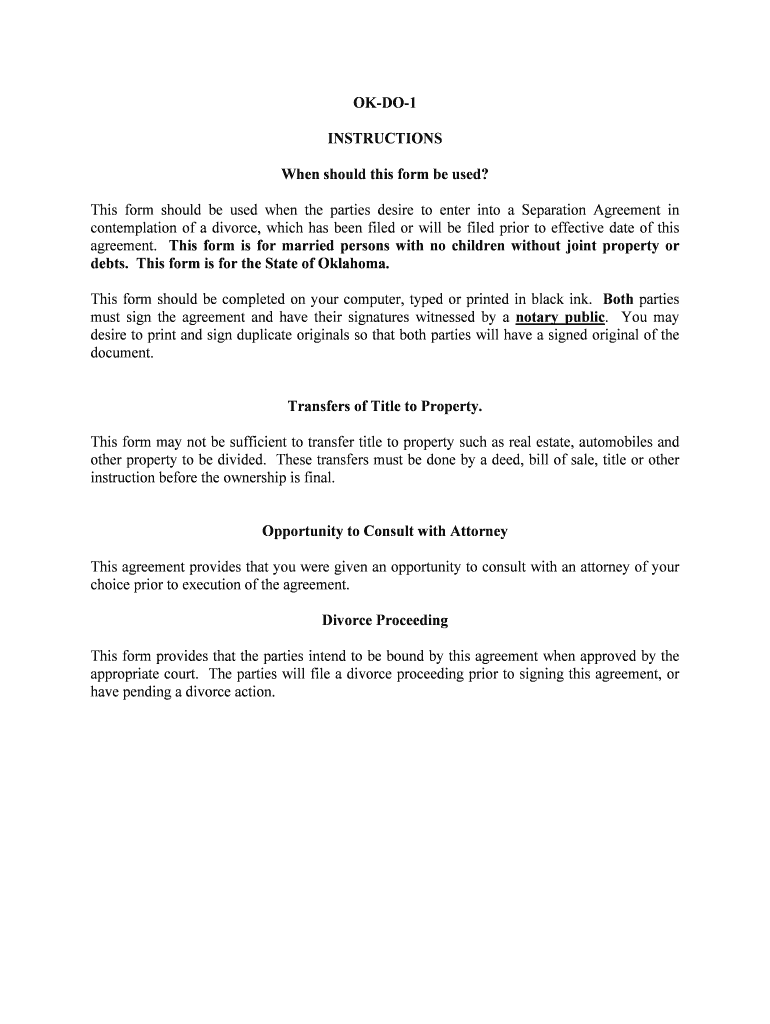

The OK DO 1 form is a document used primarily for tax purposes in the United States. It serves as a declaration for certain types of income or deductions, allowing individuals and businesses to report their financial information accurately. Understanding the purpose of this form is crucial for compliance with federal tax regulations. It is essential for taxpayers to familiarize themselves with the specific requirements associated with the OK DO 1 to ensure proper filing and avoid potential penalties.

How to use the OK DO 1

Using the OK DO 1 form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form carefully, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. It is advisable to keep a copy for your records. Depending on your situation, you may need to consult a tax professional for guidance on specific entries related to your financial circumstances.

Steps to complete the OK DO 1

Completing the OK DO 1 form involves a systematic approach. Follow these steps:

- Collect relevant financial documents, such as W-2s, 1099s, and receipts.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring to include all sources.

- Detail any deductions you are eligible for, supported by appropriate documentation.

- Double-check all entries for accuracy before signing the form.

- Submit the completed form by the designated deadline, either electronically or via mail.

Legal use of the OK DO 1

The legal use of the OK DO 1 form is governed by federal tax laws. To be considered valid, the form must be filled out accurately and submitted within the required timeframe. Compliance with IRS regulations is essential to avoid penalties. Additionally, the information provided on the form must be truthful and supported by documentation. Misrepresentation or failure to file correctly can lead to legal consequences, including fines or audits.

Key elements of the OK DO 1

Several key elements are essential for the proper completion of the OK DO 1 form. These include:

- Personal Information: Accurate details about the taxpayer, including name, address, and Social Security number.

- Income Reporting: A comprehensive list of all income sources, including wages, dividends, and interest.

- Deductions: Clear documentation of any deductions claimed, such as business expenses or charitable contributions.

- Signature: A signature certifying that the information provided is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the OK DO 1 form are critical to ensure compliance with tax regulations. Typically, the form must be submitted by April 15 of the tax year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, as they can vary based on specific tax situations or federal guidelines. Marking these dates on your calendar can help prevent late submissions and associated penalties.

Quick guide on how to complete ok do 1

Effortlessly Prepare OK DO 1 on Any Device

The management of online documents has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without delay. Handle OK DO 1 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Change and eSign OK DO 1 with Ease

- Locate OK DO 1 and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Choose how you wish to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign OK DO 1 while ensuring great communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is OK DO 1 and how does it work with airSlate SignNow?

OK DO 1 is a feature within airSlate SignNow that enables users to efficiently manage document signing workflows. By integrating OK DO 1, businesses can streamline their processes, reduce turnaround times, and enhance overall productivity, allowing for quick eSigning and document management.

-

What pricing plans are available for airSlate SignNow with OK DO 1?

airSlate SignNow offers several pricing plans that include access to the OK DO 1 feature. Each plan is designed to cater to the needs of different businesses, ensuring that you find a cost-effective solution suitable for your size and requirements.

-

What features does airSlate SignNow provide with the OK DO 1 integration?

With the OK DO 1 integration, airSlate SignNow provides features such as customizable templates, advanced reporting, and real-time tracking of document status. These features help businesses streamline their eSigning process and improve efficiency in document management.

-

How can OK DO 1 benefit my business?

Utilizing OK DO 1 can signNowly benefit your business by speeding up the signing processes and reducing paper usage. This not only lowers operational costs but also enhances customer satisfaction by providing a more efficient and user-friendly experience.

-

Can I integrate OK DO 1 with other software?

Yes, airSlate SignNow with OK DO 1 integrates seamlessly with various software applications, enabling you to enhance your document workflows. This integration allows you to connect your existing tools and create a more cohesive environment for managing eSignatures.

-

Is the airSlate SignNow mobile app compatible with OK DO 1?

Absolutely! The airSlate SignNow mobile app supports OK DO 1, allowing users to eSign documents and manage their workflows on-the-go. This flexibility ensures that you can handle important documents anytime, anywhere, improving accessibility and convenience.

-

What types of documents can I sign using OK DO 1?

With OK DO 1, you can eSign a wide variety of documents, including contracts, agreements, and forms. airSlate SignNow ensures that all types of documents can be securely signed and stored, making it easier to maintain compliance and track records.

Get more for OK DO 1

- Bof 4009c request for hearing for relief from firearms cagov form

- Florida supreme court approved family law form 12980c1 temporary injunction for protection against domestic violence with minor 206294942

- Request for hearing miami dade county 2018 2019 form

- 12 943 2015 2019 form

- I hereby grant authorization to form

- Instructions for florida supreme court approved family law forms 12931a notice of production from nonparty and 12931b subpoena

- Forms packet counterpetition florida 2015 2019

- No administration necessary 2016 2019 form

Find out other OK DO 1

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself