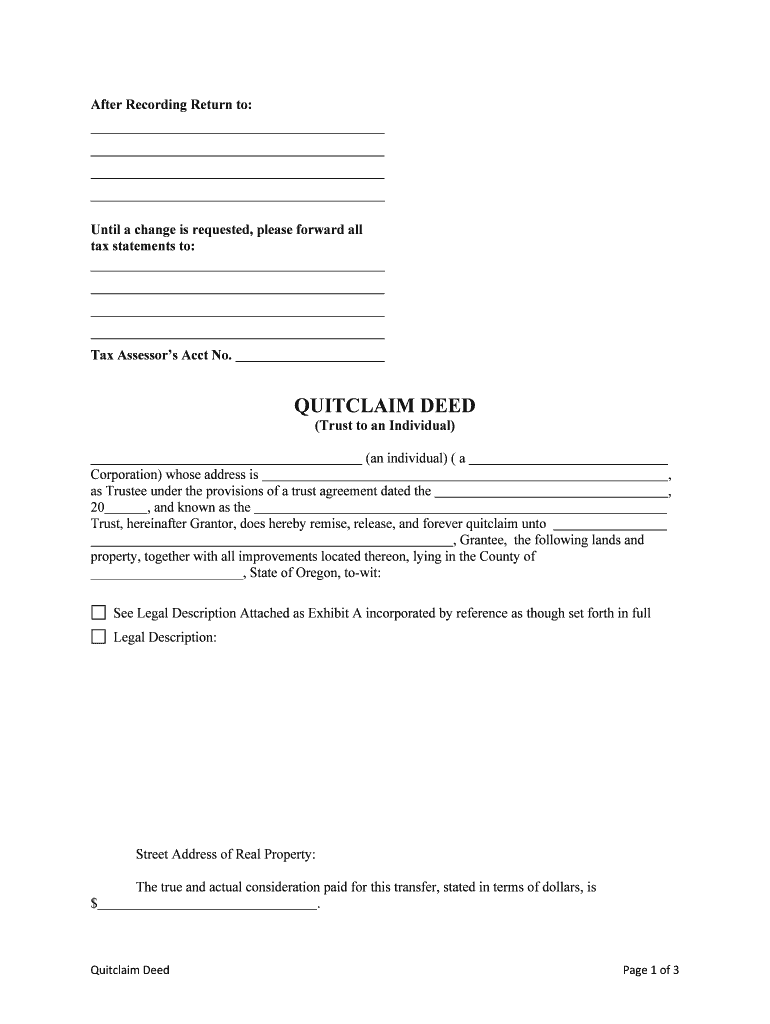

Trust to an Individual Form

What is the Trust To An Individual

The Trust To An Individual form is a legal document that allows a person to designate another individual as the trustee of a trust. This trust can hold assets, manage property, and distribute income according to the terms set forth by the grantor. It is essential for estate planning, ensuring that the grantor's wishes are honored after their passing. This form provides clarity on how assets should be managed and distributed, making it a vital component of personal financial planning.

Steps to Complete the Trust To An Individual

Completing the Trust To An Individual form involves several key steps to ensure accuracy and legal compliance. First, gather all necessary information about the grantor and the trustee, including full names, addresses, and identification details. Next, specify the assets to be included in the trust, detailing how they should be managed and distributed. It is crucial to articulate the terms of the trust clearly, including any conditions for distribution. After filling out the form, both the grantor and trustee must sign it, ideally in the presence of a notary public to enhance its legal standing.

Legal Use of the Trust To An Individual

The Trust To An Individual form is legally binding, provided it meets specific requirements. To be enforceable, the trust must comply with state laws governing trusts and estates. This includes proper execution, which often requires signatures from the grantor and trustee, and sometimes witnesses. Additionally, the trust must be funded correctly, meaning that assets must be transferred into the trust to be legally recognized. Understanding these legal parameters is vital for ensuring that the trust operates as intended.

Key Elements of the Trust To An Individual

Several key elements define the Trust To An Individual form. These include the identification of the grantor and trustee, a clear description of the trust assets, and specific instructions regarding the management and distribution of those assets. The form should also outline the powers granted to the trustee, including the authority to make decisions about the assets. Furthermore, it may include provisions for the appointment of successor trustees and any conditions under which the trust may be terminated.

Examples of Using the Trust To An Individual

There are various scenarios where the Trust To An Individual form is beneficial. For instance, a parent may establish a trust for their minor children, designating a trusted family member as the trustee to manage the assets until the children reach adulthood. Another example includes individuals wanting to ensure their assets are managed by a responsible party during their incapacity. This form provides a structured approach to asset management and distribution, catering to diverse personal circumstances.

Required Documents

To complete the Trust To An Individual form, several documents may be required. These typically include identification for both the grantor and trustee, such as a driver's license or social security number. Additionally, a list of assets intended for the trust should be prepared, along with any existing wills or estate plans that may impact the trust's terms. Gathering these documents beforehand can streamline the process and ensure that all necessary information is readily available.

Form Submission Methods

The Trust To An Individual form can be submitted through various methods, depending on state regulations. Common submission options include online filing through designated state websites, mailing a physical copy to the appropriate government office, or delivering it in person. Each method has its own processing times and requirements, so it is important to verify the preferred submission method for your specific state to ensure timely processing.

Quick guide on how to complete trust to an individual

Complete Trust To An Individual effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, as it allows you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Trust To An Individual on any device with the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to modify and eSign Trust To An Individual effortlessly

- Locate Trust To An Individual and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Edit and eSign Trust To An Individual and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'Trust To An Individual' mean in the context of airSlate SignNow?

'Trust To An Individual' in the context of airSlate SignNow refers to the ability to have confidence in the signing authority and identity of individuals involved in document transactions. Our platform employs advanced security measures ensuring that every signature comes from a verified person, reinforcing credibility and trust in the process.

-

How does airSlate SignNow ensure trust between parties in document signing?

airSlate SignNow ensures trust between parties through robust verification processes such as multi-factor authentication and audit trails for every transaction. This 'Trust To An Individual' feature enables all parties to feel confident that documents are signed by authorized individuals, thus maintaining the integrity of the signing process.

-

What are the pricing options available for using airSlate SignNow?

AirSlate SignNow offers various pricing plans designed to fit different business needs. Whether you're an individual or a team, our plans provide extensive features for secure document signing and management, allowing you to trust to an individual with your signing needs at every level.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow provides integrations with various applications that enhance workflow efficiency. You can connect our service with tools like CRM systems and document storage services, ensuring that every aspect of your document management aligns with the concept of Trust To An Individual.

-

What features does airSlate SignNow provide to enhance document security?

AirSlate SignNow includes features like end-to-end encryption, audit logs, and secure access controls. These features are crucial for building and maintaining Trust To An Individual within your organization, ensuring that confidential documents remain protected throughout the signing process.

-

How does airSlate SignNow improve the signing experience for users?

Our platform simplifies the signing experience with its intuitive interface and mobile-friendly design. By streamlining the process, airSlate SignNow allows users to easily trust to an individual signing, contributing to faster and more efficient document handling.

-

Is it easy to track signed documents using airSlate SignNow?

Absolutely! AirSlate SignNow offers comprehensive tracking features that allow you to monitor the status of your documents in real time. This functionality not only keeps you informed but also strengthens the concept of Trust To An Individual by providing transparency in the signing process.

Get more for Trust To An Individual

- Paml federal drug testing custody and control form 110 w

- Parentage amp allocation petition illinois legal aid online illinoislegalaid form

- Fl 341d 2016 2019 form

- Fl 341 c 2016 2019 form

- 1411 10g election see instructions eitc irs form

- Sc 1120s 2016 form

- Form 1997 civil cover sheet the civil cover sheet and the

- Taking hamilton health sciences form

Find out other Trust To An Individual

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors