Oregon Fixed Rate Note, Installment Payments Unsecured Form

What is the Oregon Fixed Rate Note, Installment Payments Unsecured

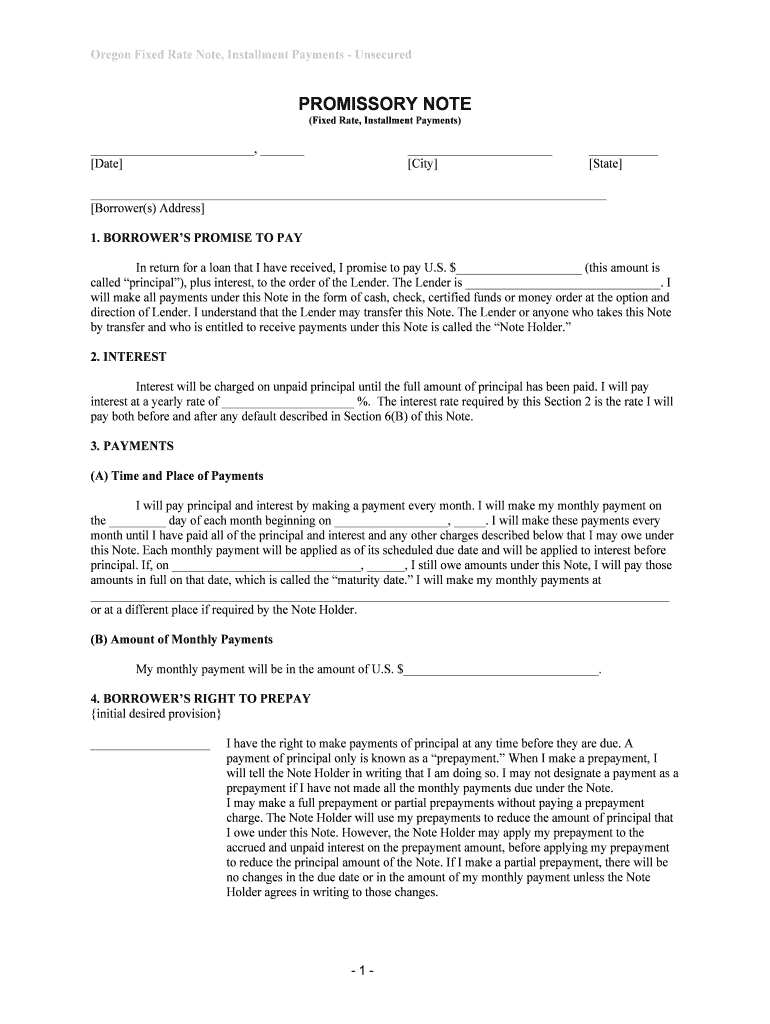

The Oregon Fixed Rate Note, Installment Payments Unsecured is a financial instrument that outlines the terms of a loan where the borrower agrees to repay the lender in fixed installments over a specified period. This note is considered unsecured, meaning it is not backed by any collateral. Instead, it relies on the borrower's promise to repay the debt. Such notes are often used in personal loans, business financing, and other lending scenarios where the lender seeks a clear repayment schedule without requiring physical assets as security.

How to use the Oregon Fixed Rate Note, Installment Payments Unsecured

Using the Oregon Fixed Rate Note involves several steps. First, both parties should agree on the loan terms, including the interest rate, repayment schedule, and total amount borrowed. Next, the lender and borrower will fill out the fixed rate note, ensuring all details are accurate. Once completed, both parties should sign the document, ideally using a secure electronic signature platform to ensure legal compliance. This method not only streamlines the process but also provides a digital record of the agreement.

Key elements of the Oregon Fixed Rate Note, Installment Payments Unsecured

Several key elements are essential in the Oregon Fixed Rate Note. These include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the principal amount, which can be fixed for the duration of the loan.

- Payment Schedule: The frequency and amount of each installment payment.

- Maturity Date: The date by which the loan must be fully repaid.

- Default Terms: Conditions outlining what happens if the borrower fails to make payments.

Steps to complete the Oregon Fixed Rate Note, Installment Payments Unsecured

Completing the Oregon Fixed Rate Note involves the following steps:

- Discuss and agree on the loan terms between the lender and borrower.

- Obtain the Oregon Fixed Rate Note template, ensuring it meets state requirements.

- Fill in the necessary details, including borrower and lender information, loan amount, interest rate, and payment schedule.

- Review the document for accuracy and completeness.

- Sign the document using a reliable electronic signature service to ensure it is legally binding.

Legal use of the Oregon Fixed Rate Note, Installment Payments Unsecured

The Oregon Fixed Rate Note is legally binding when executed correctly. To ensure its legality, it must comply with state laws governing contracts and loans. This includes proper identification of both parties, clear terms, and signatures. Additionally, using an electronic signature platform that adheres to the ESIGN and UETA acts can further validate the note's enforceability in a court of law.

State-specific rules for the Oregon Fixed Rate Note, Installment Payments Unsecured

In Oregon, specific rules apply to the execution and enforcement of the Fixed Rate Note. These include:

- Compliance with Oregon's Uniform Commercial Code (UCC), which governs secured transactions.

- Adherence to state usury laws, which limit the amount of interest that can be charged on loans.

- Ensuring that the note contains all required disclosures to protect both parties.

Quick guide on how to complete oregon fixed rate note installment payments unsecured

Handle Oregon Fixed Rate Note, Installment Payments Unsecured effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and without issues. Manage Oregon Fixed Rate Note, Installment Payments Unsecured on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The most efficient way to edit and electronically sign Oregon Fixed Rate Note, Installment Payments Unsecured with ease

- Obtain Oregon Fixed Rate Note, Installment Payments Unsecured and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive data using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you want to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Oregon Fixed Rate Note, Installment Payments Unsecured and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Oregon Fixed Rate Note, Installment Payments Unsecured?

An Oregon Fixed Rate Note, Installment Payments Unsecured is a type of loan agreement that allows borrowers to repay the amount borrowed in fixed installments over a specified period. This financial instrument is designed for those who prefer predictable monthly payments and do not want to provide collateral. It offers flexibility and ease of management for personal or business-related expenses.

-

How does the pricing work for the Oregon Fixed Rate Note, Installment Payments Unsecured?

Pricing for an Oregon Fixed Rate Note, Installment Payments Unsecured typically includes the interest rate set at the time of agreement, which remains constant throughout the repayment period. Additional fees may apply based on the lender's policies, so it's essential to review these details before signing. Understanding the full cost will help you make an informed decision.

-

What are the key benefits of using an Oregon Fixed Rate Note, Installment Payments Unsecured?

The primary benefits of an Oregon Fixed Rate Note, Installment Payments Unsecured include predictable payments, no collateral requirements, and straightforward terms. Borrowers can leverage this agreement for various financial needs without worrying about fluctuating interest rates. Additionally, it simplifies budgeting, as you’ll know exactly how much to pay each month.

-

Are there any specific eligibility requirements for an Oregon Fixed Rate Note, Installment Payments Unsecured?

Eligibility for an Oregon Fixed Rate Note, Installment Payments Unsecured generally includes a minimum credit score, proof of income, and residency in Oregon. Lenders may also consider your debt-to-income ratio and financial stability during the approval process. Checking these factors in advance can help streamline your application.

-

Can I pay off my Oregon Fixed Rate Note, Installment Payments Unsecured early?

Yes, most lenders allow you to pay off your Oregon Fixed Rate Note, Installment Payments Unsecured early without penalties. Early repayment can save you on interest costs and help you become debt-free sooner. However, it's advisable to confirm this with your lender to ensure there are no hidden fees.

-

How do I apply for an Oregon Fixed Rate Note, Installment Payments Unsecured?

To apply for an Oregon Fixed Rate Note, Installment Payments Unsecured, start by gathering your financial documents, such as income statements and identification. Then, approach a lender or financial institution that offers this type of note. Complete the application process as per their directions, and await their response regarding approval.

-

What types of businesses can benefit from an Oregon Fixed Rate Note, Installment Payments Unsecured?

Various businesses, from startups to established enterprises, can benefit from an Oregon Fixed Rate Note, Installment Payments Unsecured. It can provide necessary funding for purchasing equipment, managing cash flow, or embarking on expansion projects. The fixed installment nature of this note makes it easier for businesses to plan their finances.

Get more for Oregon Fixed Rate Note, Installment Payments Unsecured

- Doe o 5411a doe directives department of energy form

- Request for appointment gsagov form

- Initial screening worksheet for merit promotion gsa form

- Credit plan for candidate evaluation form

- Duties usajobs job announcement form

- Chapter 7 performance management appraisal program

- Master labor agreement defense commissary afge form

- Master agreement between fs and nffe usda form

Find out other Oregon Fixed Rate Note, Installment Payments Unsecured

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself