Section 44 30 71 Form

What is the Section 44 30 71

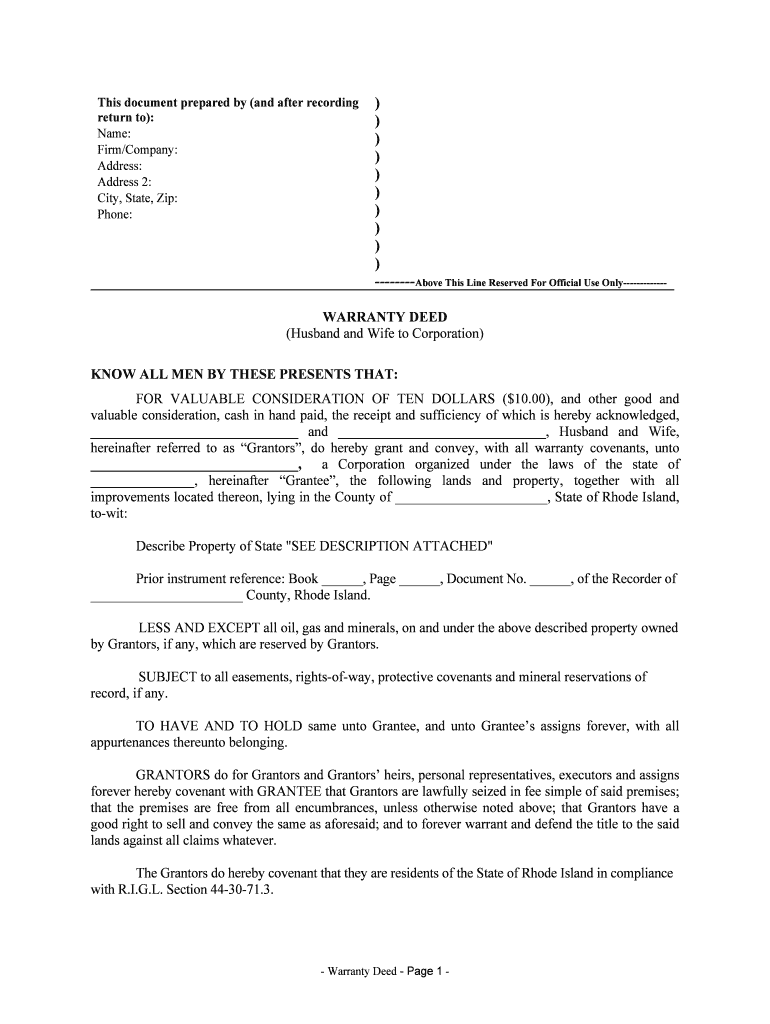

The Section 44 30 71 form is a specific document used in various legal and administrative contexts in the United States. It typically pertains to compliance requirements, ensuring that certain regulations are met. Understanding its purpose is essential for individuals and businesses alike, as it often serves as a formal declaration or request related to specific legal obligations.

How to use the Section 44 30 71

Using the Section 44 30 71 form involves several key steps. First, ensure you have the correct version of the form, as updates may occur. Next, gather all necessary information and documentation required to complete the form accurately. Once filled out, the form can be submitted electronically or via traditional mail, depending on the specific requirements associated with its use.

Steps to complete the Section 44 30 71

Completing the Section 44 30 71 form requires attention to detail. Begin by reading the instructions carefully to understand the information needed. Fill out each section methodically, ensuring that all required fields are completed. Double-check for accuracy and clarity before submitting the form. If applicable, retain a copy for your records, as this may be useful for future reference.

Legal use of the Section 44 30 71

The legal use of the Section 44 30 71 form is crucial for ensuring compliance with applicable laws and regulations. It is important to understand that the form must be completed truthfully and accurately, as any discrepancies can lead to legal consequences. Additionally, utilizing a reliable eSigning platform can enhance the legal validity of the form, ensuring that it meets all necessary requirements.

Key elements of the Section 44 30 71

Key elements of the Section 44 30 71 form include the identification of the parties involved, the specific legal obligations being addressed, and any supporting documentation that may be required. Each section of the form is designed to capture critical information that supports the overall purpose of the document. Understanding these elements is vital for effective completion and compliance.

Who Issues the Form

The Section 44 30 71 form is typically issued by a relevant governmental or regulatory body, depending on its specific purpose. This could include federal or state agencies that oversee compliance in various sectors. Knowing the issuing authority can help in understanding the requirements and processes associated with the form.

Form Submission Methods (Online / Mail / In-Person)

The Section 44 30 71 form can be submitted through various methods, including online submission, mailing a physical copy, or delivering it in person. The chosen method may depend on the specific requirements outlined by the issuing authority. Online submission is often the most efficient option, allowing for quicker processing times and confirmation of receipt.

Quick guide on how to complete section 44 30 71

Prepare Section 44 30 71 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to effortlessly locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Section 44 30 71 on any platform using the airSlate SignNow Android or iOS apps and enhance any document-oriented process today.

How to modify and eSign Section 44 30 71 effortlessly

- Locate Section 44 30 71 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information carefully and then click on the Done button to save your adjustments.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in a few clicks from any device you prefer. Modify and eSign Section 44 30 71 and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Section 44 30 71 in relation to airSlate SignNow?

Section 44 30 71 refers to a specific part of our digital eSignature compliance. This section ensures that all electronic signatures created through airSlate SignNow meet legal standards, providing peace of mind for users. By utilizing Section 44 30 71, businesses can confidently sign documents knowing they adhere to the necessary regulations.

-

How does airSlate SignNow support compliance with Section 44 30 71?

airSlate SignNow integrates features that align with Section 44 30 71 to ensure compliance with legal requirements. Our platform provides audit trails, secure storage, and authentication options that are specifically designed to satisfy this section. This makes it easier for businesses to meet regulatory standards.

-

What pricing options are available for airSlate SignNow related to Section 44 30 71?

airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes while supporting the compliance measures outlined in Section 44 30 71. Our plans are competitively priced, ensuring that both small businesses and enterprises can access cost-effective eSignature solutions. You can choose from monthly or annual subscriptions based on your needs.

-

What features does airSlate SignNow offer for Section 44 30 71 compliance?

Our features for Section 44 30 71 compliance include advanced authentication methods, detailed audit logs, and tamper-proof signatures. These ensure that your documents are not only securely signed but also legally binding. With these features, airSlate SignNow provides a complete eSigning solution that aligns with industry standards.

-

Can airSlate SignNow integrate with other software while ensuring Section 44 30 71 compliance?

Yes, airSlate SignNow seamlessly integrates with various software solutions while fully supporting Section 44 30 71 compliance. This includes popular CRM and storage platforms, allowing you to automate your workflows without compromising on legal standards. Our integrations enhance efficiency and keep your documents compliant.

-

What are the benefits of using airSlate SignNow specifically for Section 44 30 71?

Using airSlate SignNow for Section 44 30 71 offers numerous benefits including increased efficiency, reduced paper usage, and improved compliance. Companies can sign documents faster and more securely, ensuring they meet all legal standards set forth in this section. This not only streamlines operations but also enhances document security.

-

Is airSlate SignNow user-friendly for implementing Section 44 30 71?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for anyone to implement Section 44 30 71 compliance measures. Our intuitive interface allows users to quickly navigate and understand key features without extensive training, making eSigning an effortless process.

Get more for Section 44 30 71

Find out other Section 44 30 71

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast