Only to the Terms and Conditions of the above Described Mortgage Form

What is the Only To The Terms And Conditions Of The Above described Mortgage

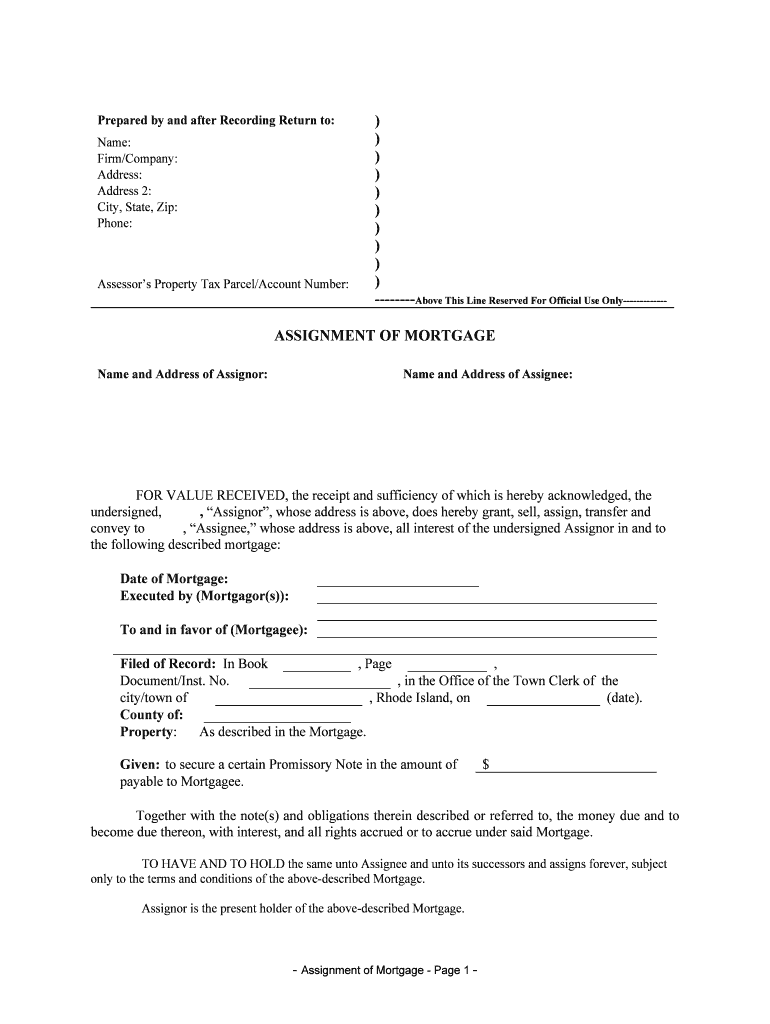

The Only To The Terms And Conditions Of The Above described Mortgage is a legal document that outlines the specific terms and conditions associated with a mortgage agreement. This form serves as a binding contract between the borrower and the lender, detailing the obligations, rights, and responsibilities of both parties. It typically includes information such as the loan amount, interest rate, repayment schedule, and any additional fees or conditions that may apply. Understanding this document is crucial for borrowers, as it ensures they are fully aware of their financial commitments and the legal implications of the mortgage.

How to use the Only To The Terms And Conditions Of The Above described Mortgage

Using the Only To The Terms And Conditions Of The Above described Mortgage involves several steps to ensure that all parties understand and agree to the terms laid out in the document. First, borrowers should carefully review the entire document, paying close attention to the details of the mortgage terms. It is advisable to consult with a legal expert or a financial advisor if there are any uncertainties. Once the terms are clear, the borrower must sign the document, either physically or electronically, to indicate their acceptance. The lender will also sign the document, completing the agreement process.

Steps to complete the Only To The Terms And Conditions Of The Above described Mortgage

Completing the Only To The Terms And Conditions Of The Above described Mortgage involves a systematic approach to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary documents, including identification, proof of income, and property details.

- Review the terms and conditions thoroughly to understand the obligations.

- Fill out the form with accurate information, ensuring all fields are completed.

- Sign the document electronically or in person, as required.

- Submit the completed form to the lender for processing.

Legal use of the Only To The Terms And Conditions Of The Above described Mortgage

The legal use of the Only To The Terms And Conditions Of The Above described Mortgage is governed by various federal and state laws. For the document to be legally binding, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish the validity of electronic signatures and ensure that electronic documents hold the same weight as traditional paper documents. It is essential for both borrowers and lenders to adhere to these regulations to avoid any legal disputes.

Key elements of the Only To The Terms And Conditions Of The Above described Mortgage

Several key elements are integral to the Only To The Terms And Conditions Of The Above described Mortgage. These include:

- Loan Amount: The total amount borrowed from the lender.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Terms: The schedule and duration for loan repayment.

- Fees and Charges: Any additional costs associated with the mortgage, such as origination fees or late payment penalties.

- Default Conditions: Circumstances under which the borrower may default on the loan and the consequences thereof.

State-specific rules for the Only To The Terms And Conditions Of The Above described Mortgage

State-specific rules can significantly affect the Only To The Terms And Conditions Of The Above described Mortgage. Each state may have unique regulations regarding mortgage agreements, including disclosure requirements, interest rate limits, and foreclosure processes. Borrowers should be aware of their state's laws to ensure compliance and protect their rights. It is advisable to consult local legal resources or professionals familiar with state-specific mortgage regulations to navigate these complexities effectively.

Quick guide on how to complete only to the terms and conditions of the above described mortgage

Easily prepare Only To The Terms And Conditions Of The Above described Mortgage on any device

Online document administration has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents promptly without issues. Manage Only To The Terms And Conditions Of The Above described Mortgage on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Only To The Terms And Conditions Of The Above described Mortgage effortlessly

- Find Only To The Terms And Conditions Of The Above described Mortgage and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for such purposes.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow effectively addresses all your document management requirements in just a few clicks from any device of your choosing. Edit and eSign Only To The Terms And Conditions Of The Above described Mortgage and ensure excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does the term 'Only To The Terms And Conditions Of The Above described Mortgage' mean in the context of airSlate SignNow?

The phrase 'Only To The Terms And Conditions Of The Above described Mortgage' refers to the legal stipulations that govern your mortgage documents. airSlate SignNow allows users to eSign documents ensuring they are compliant with these specific terms, facilitating a smoother transaction process.

-

How does airSlate SignNow ensure compliance with mortgage agreements?

airSlate SignNow ensures compliance by providing templates that adhere to the 'Only To The Terms And Conditions Of The Above described Mortgage.' This approach minimizes errors and guarantees that all parties are aware of their responsibilities under the mortgage.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing tiers designed to fit businesses of all sizes. Regardless of the plan you choose, the focus remains on simplifying processes, particularly those related 'Only To The Terms And Conditions Of The Above described Mortgage.'

-

Can I integrate airSlate SignNow with my existing software?

Yes, airSlate SignNow integrates seamlessly with numerous software applications, enhancing your workflow. This is particularly beneficial for documents that relate 'Only To The Terms And Conditions Of The Above described Mortgage,' ensuring efficient management of all related paperwork.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a comprehensive suite of features, including document templates and eSignature capabilities. These features are essential when dealing 'Only To The Terms And Conditions Of The Above described Mortgage,' making it easier to manage and sign critical documents.

-

How does airSlate SignNow improve my workflow?

By streamlining the process of sending and signing documents, airSlate SignNow signNowly improves workflow efficiency. This is particularly useful for handling documents relevant 'Only To The Terms And Conditions Of The Above described Mortgage,' as it reduces processing time.

-

Is airSlate SignNow user-friendly for new customers?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even to those new to digital document management. This ease of use is beneficial when ensuring compliance with documents referring 'Only To The Terms And Conditions Of The Above described Mortgage.'

Get more for Only To The Terms And Conditions Of The Above described Mortgage

Find out other Only To The Terms And Conditions Of The Above described Mortgage

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document