Trustors Place of Residence, Regardless of the Residence of the Trustee Form

Understanding the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee

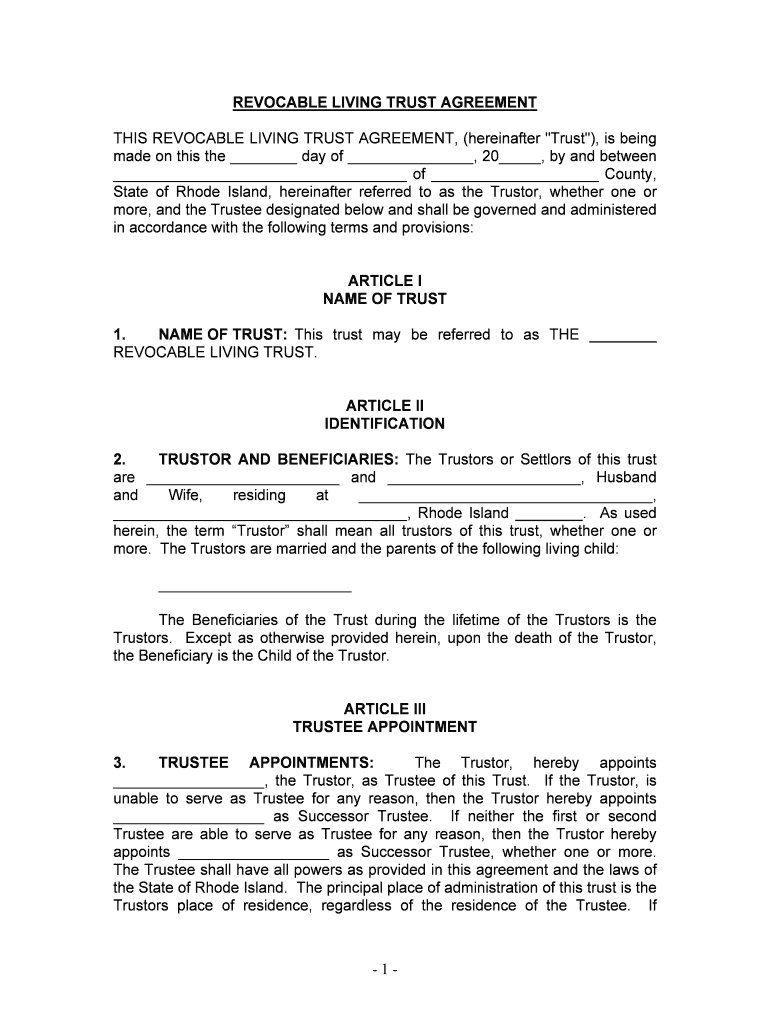

The Trustors Place Of Residence, Regardless Of The Residence Of The Trustee form is a legal document that identifies the location of the trustor, which is crucial for determining jurisdiction and applicable laws. This form is particularly significant in estate planning, as it clarifies where the trustor resides regardless of where the trustee may live. This distinction can affect the administration of the trust and the enforcement of its terms.

Steps to Complete the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee

Completing the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee form involves several key steps:

- Gather necessary personal information, including the full name and address of the trustor.

- Provide details about the trustee, including their name and residence, if applicable.

- Clearly state the purpose of the trust and any relevant terms that may affect the trustor's residence.

- Review the form for accuracy and completeness before submission.

Legal Use of the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee

This form serves a critical role in legal contexts, particularly in establishing the trustor's legal residence for trust administration purposes. It ensures that the trust is governed by the laws of the state where the trustor resides, which can impact tax obligations and legal rights. Proper use of this form can prevent disputes over jurisdiction and ensure compliance with state laws.

Key Elements of the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee

Several key elements must be included in the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee form:

- The full name and address of the trustor.

- The date the form is completed.

- Signature of the trustor, affirming the accuracy of the information provided.

- Any additional clauses that may specify conditions or limitations related to the trust.

Examples of Using the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee

Practical examples of utilizing this form include:

- Establishing a trust for estate planning purposes, where the trustor wishes to designate a specific residence for legal matters.

- Clarifying the trustor's residence in cases where the trustee resides in a different state, to avoid jurisdictional disputes.

- Providing necessary documentation for financial institutions when managing trust assets.

State-Specific Rules for the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee

Each state may have specific regulations regarding the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee form. It is important to consult local laws to ensure compliance, as requirements can vary significantly. Some states may require additional documentation or specific wording to validate the form, while others may have different filing procedures.

Quick guide on how to complete trustors place of residence regardless of the residence of the trustee

Complete Trustors Place Of Residence, Regardless Of The Residence Of The Trustee effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed papers, allowing you to find the right template and safely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Trustors Place Of Residence, Regardless Of The Residence Of The Trustee on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign Trustors Place Of Residence, Regardless Of The Residence Of The Trustee with ease

- Find Trustors Place Of Residence, Regardless Of The Residence Of The Trustee and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Choose your delivery method for the form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and eSign Trustors Place Of Residence, Regardless Of The Residence Of The Trustee and ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee?

The Trustors Place Of Residence, Regardless Of The Residence Of The Trustee, plays a critical role in determining the legal jurisdiction for trust administration. Understanding this can help ensure compliance with local laws and regulations. Properly identifying the residence can also impact taxation and the overall management of trust assets.

-

How does airSlate SignNow facilitate document signing related to trust management?

airSlate SignNow allows users to easily eSign documents, including trust documents, irrespective of where the trustor or trustee resides. Our platform streamlines the signing process, making it cost-effective and efficient. This ensures that all parties can securely sign without the hassle of physical paperwork.

-

What features does airSlate SignNow offer to support trust administrators?

airSlate SignNow provides features like customizable workflows, templates for trust agreements, and comprehensive audit trails. These tools help trust administrators manage documents effectively while maintaining compliance. Additionally, our platform supports the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee, ensuring smooth integration across different jurisdictions.

-

Is airSlate SignNow a cost-effective solution for trust documentation?

Yes, airSlate SignNow is a budget-friendly solution designed for businesses of all sizes. Our flexible pricing plans allow organizations to choose a package that best suits their needs, even if they deal with varying Trustors Place Of Residence, Regardless Of The Residence Of The Trustee. This cost-effectiveness makes it accessible for trust management and administration.

-

Does airSlate SignNow integrate with other software used in trust management?

Certainly! airSlate SignNow integrates seamlessly with various business applications commonly used in trust management, including CRM systems and document storage solutions. This makes it easier to manage documents related to the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee, without disrupting your existing workflow.

-

How secure is airSlate SignNow for managing sensitive trust documents?

airSlate SignNow prioritizes the security of your documents with end-to-end encryption and robust access controls. We understand the sensitive nature of trust-related documents and ensure that the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee, is protected. Our security measures help safeguard against unauthorized access and data bsignNowes.

-

Can I customize my trust document templates in airSlate SignNow?

Absolutely! airSlate SignNow provides customizable templates that allow you to tailor trust documents according to your specific needs. You can create templates that consider the Trustors Place Of Residence, Regardless Of The Residence Of The Trustee, ensuring all relevant details and legal requirements are met efficiently.

Get more for Trustors Place Of Residence, Regardless Of The Residence Of The Trustee

- This will replace the gray form

- Where you can go wrong with a do it yourself will cnbccom form

- With the words you type form

- Comes now plaintiff and in support of his claim for relief form

- Rule illinois courts form

- 2019 forms class oregon real estate forms

- Irrevocable trustfree legal forms

- What is a postnuptial agreement ampamp how can it helpright lawyers form

Find out other Trustors Place Of Residence, Regardless Of The Residence Of The Trustee

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure