The Employer Insurance Carrier in Answer to the Claim Due to the Death of Form

What is the Employer insurance Carrier In Answer To The Claim Due To The Death Of

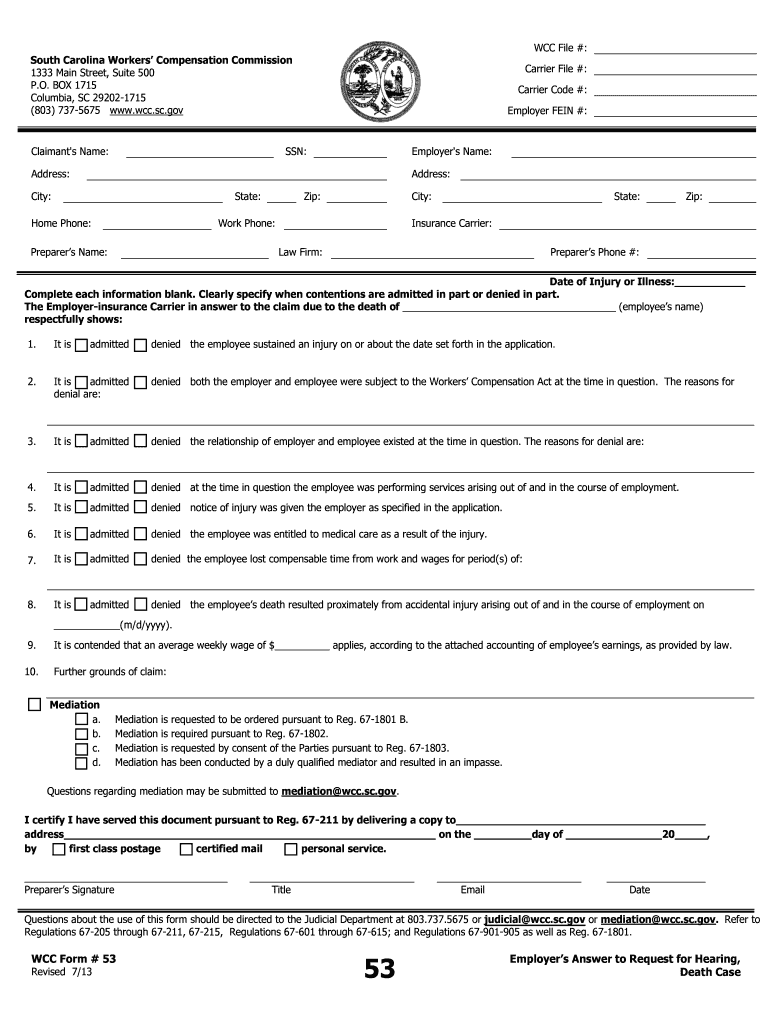

The Employer insurance Carrier In Answer To The Claim Due To The Death Of is a formal document used to address claims related to the death of an employee. This form serves as a means for beneficiaries or dependents to file a claim with the insurance carrier that provided coverage for the deceased employee. It outlines the necessary information required to process the claim, ensuring that the beneficiaries receive the entitled benefits in a timely manner.

Steps to complete the Employer insurance Carrier In Answer To The Claim Due To The Death Of

Completing the Employer insurance Carrier In Answer To The Claim Due To The Death Of form involves several important steps:

- Gather necessary documentation, including the employee's death certificate and policy information.

- Fill out the form with accurate details, including the deceased's personal information and the relationship of the claimant to the deceased.

- Review the form for completeness and accuracy to avoid delays in processing.

- Submit the form along with any required documents to the designated insurance carrier.

Legal use of the Employer insurance Carrier In Answer To The Claim Due To The Death Of

This form is legally binding when completed correctly and submitted in accordance with state and federal regulations. It is essential for beneficiaries to understand their rights and obligations when filing a claim. The form must meet specific legal standards to ensure that the claim is recognized and processed by the insurance carrier. Compliance with the Employee Retirement Income Security Act (ERISA) may also be required, depending on the employer's insurance plan.

Required Documents

When submitting the Employer insurance Carrier In Answer To The Claim Due To The Death Of form, several documents are typically required to support the claim:

- The original death certificate of the employee.

- Proof of relationship to the deceased, such as a marriage certificate or birth certificate.

- Any relevant insurance policy documents that outline coverage details.

- Identification of the claimant, such as a driver's license or Social Security number.

How to obtain the Employer insurance Carrier In Answer To The Claim Due To The Death Of

The Employer insurance Carrier In Answer To The Claim Due To The Death Of form can usually be obtained directly from the employer's human resources department or the insurance carrier's website. It is advisable to contact the insurance carrier for specific instructions on how to access the form and any additional requirements for submission. Employers may also provide guidance on the claims process to ensure beneficiaries are well-informed.

Examples of using the Employer insurance Carrier In Answer To The Claim Due To The Death Of

Practical examples of using this form include situations where a spouse files a claim for life insurance benefits following the death of their partner, or when a child submits a claim for benefits due to the death of a parent. Each scenario may have unique requirements based on the relationship to the deceased and the specific insurance policy in place.

Quick guide on how to complete the employer insurance carrier in answer to the claim due to the death of

Complete The Employer insurance Carrier In Answer To The Claim Due To The Death Of effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the required form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle The Employer insurance Carrier In Answer To The Claim Due To The Death Of on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign The Employer insurance Carrier In Answer To The Claim Due To The Death Of with ease

- Obtain The Employer insurance Carrier In Answer To The Claim Due To The Death Of and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or errors that necessitate the printing of new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device you choose. Edit and eSign The Employer insurance Carrier In Answer To The Claim Due To The Death Of and ensure optimal communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of The Employer insurance Carrier In Answer To The Claim Due To The Death Of?

The Employer insurance Carrier In Answer To The Claim Due To The Death Of acts as a vital mediator in processing claims related to life insurance. They ensure that the beneficiaries receive the necessary support and compensation following the untimely death of an employee. Understanding this role can help families navigate the claims process more efficiently.

-

How can airSlate SignNow facilitate documents related to The Employer insurance Carrier In Answer To The Claim Due To The Death Of?

airSlate SignNow provides a streamlined process for creating, sending, and signing documents required by The Employer insurance Carrier In Answer To The Claim Due To The Death Of. This ensures that all necessary paperwork is handled efficiently, reducing delays in claim processing. Our platform offers ease of use that simplifies your experience.

-

What are the pricing options for using airSlate SignNow in relation to claims with The Employer insurance Carrier In Answer To The Claim Due To The Death Of?

airSlate SignNow offers flexible pricing plans designed to fit various business needs, including those focusing on claims with The Employer insurance Carrier In Answer To The Claim Due To The Death Of. You can choose from monthly or annual plans that offer excellent value for facilitating important documentation. Our solutions are cost-effective, particularly for businesses managing multiple claims.

-

What features does airSlate SignNow offer to support claims associated with The Employer insurance Carrier In Answer To The Claim Due To The Death Of?

airSlate SignNow provides features such as customizable templates, automated reminders, and secure eSignature capabilities to support claims related to The Employer insurance Carrier In Answer To The Claim Due To The Death Of. These features help ensure that all documents are completed accurately and timely, which is crucial in sensitive situations.

-

How can airSlate SignNow help streamline the claims process for The Employer insurance Carrier In Answer To The Claim Due To The Death Of?

With airSlate SignNow, you can streamline the entire claims process by digitizing document handling related to The Employer insurance Carrier In Answer To The Claim Due To The Death Of. This reduces paperwork and allows for immediate access to necessary forms, making it easier for both employers and beneficiaries to manage claims. Efficiency in document management can signNowly expedite resolution.

-

Are there any integrations available with airSlate SignNow for managing claims to The Employer insurance Carrier In Answer To The Claim Due To The Death Of?

Yes, airSlate SignNow integrates seamlessly with popular business tools and platforms that can aid in the management of claims to The Employer insurance Carrier In Answer To The Claim Due To The Death Of. This allows businesses to maintain their workflows without interruption while ensuring that all necessary documents can be handled in one place.

-

What benefits can businesses expect when using airSlate SignNow for claims related to The Employer insurance Carrier In Answer To The Claim Due To The Death Of?

Utilizing airSlate SignNow for claims associated with The Employer insurance Carrier In Answer To The Claim Due To The Death Of provides numerous benefits, including improved organization, faster processing times, and enhanced security for sensitive information. Businesses can increase transparency and trust among stakeholders during the claims process by ensuring all documentation is present and properly filed.

Get more for The Employer insurance Carrier In Answer To The Claim Due To The Death Of

- Illinois dealer license application form

- Reserve withdrawal form

- Lost vehicle title illinoisi drive safely form

- Chicago title land trust company forms

- Internet rechartering boy scouts of america greater new form

- Cash and non cash donations irs requirements for form

- Billing address change form optimum

- Answer all questions completely and return this form immediately

Find out other The Employer insurance Carrier In Answer To The Claim Due To The Death Of

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy