South Carolina Fixed Rate Note, Installment Payments Secured by Personal Property Form

What is the South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property

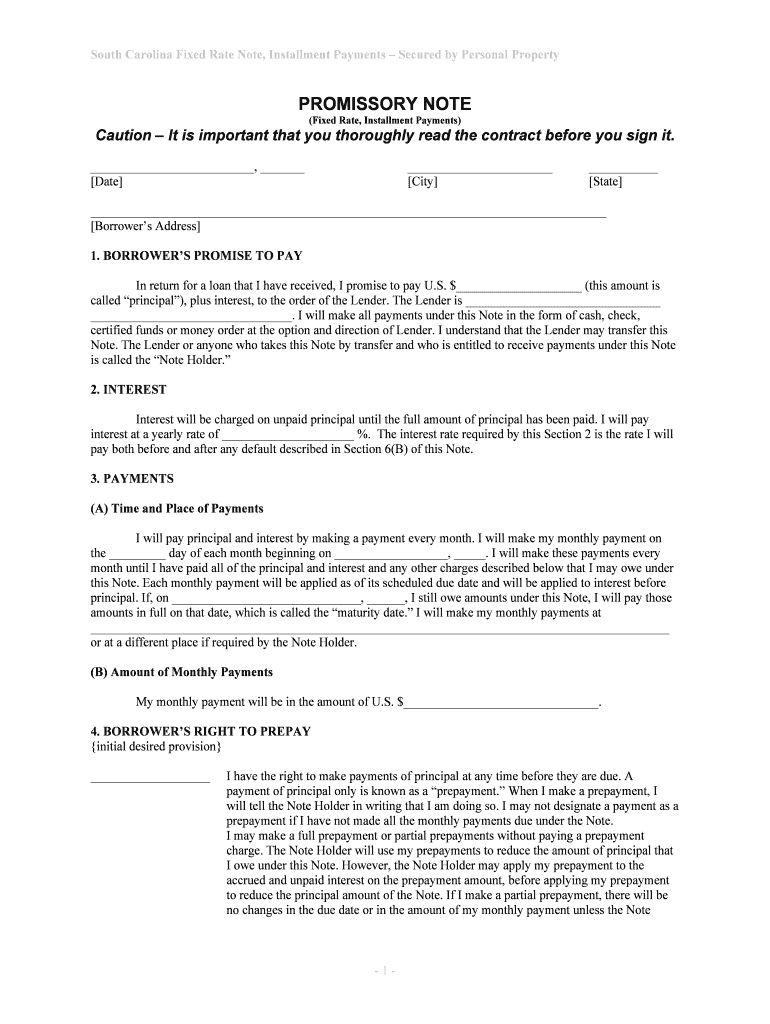

The South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property is a legal document that outlines the terms of a loan secured by personal property. This type of note specifies a fixed interest rate and a schedule for installment payments, allowing borrowers to repay the loan over time. The personal property serves as collateral, providing lenders with a level of security in case of default. Understanding the structure and implications of this note is essential for both borrowers and lenders in South Carolina.

How to use the South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property

Using the South Carolina Fixed Rate Note involves several key steps. First, both parties must agree on the terms, including the loan amount, interest rate, and repayment schedule. Next, the borrower must provide details about the personal property being used as collateral. Once the terms are finalized, the document should be filled out accurately and signed by both parties. It is advisable to keep a copy of the signed note for personal records and ensure that it is stored securely.

Steps to complete the South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property

Completing the South Carolina Fixed Rate Note requires careful attention to detail. Here are the steps to follow:

- Identify the parties involved in the agreement, including full names and addresses.

- Clearly state the loan amount and the fixed interest rate.

- Outline the repayment schedule, including the frequency and amount of each installment payment.

- Describe the personal property being used as collateral, including any necessary identification details.

- Include any additional terms or conditions that both parties agree upon.

- Sign and date the document in the presence of a witness, if required.

Key elements of the South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property

Several key elements are essential to the South Carolina Fixed Rate Note. These include:

- Loan amount: The total sum being borrowed.

- Interest rate: The fixed rate at which interest will accrue on the loan.

- Installment payments: The amount and frequency of payments to be made by the borrower.

- Collateral description: Detailed information about the personal property securing the loan.

- Default terms: Conditions under which the lender may take action if the borrower fails to meet obligations.

Legal use of the South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property

The legal use of the South Carolina Fixed Rate Note is governed by state laws regarding secured transactions. This means that the note must comply with relevant statutes to be enforceable in court. It is important for both parties to understand their rights and obligations under the law. Proper execution of the document, including signatures and any required witnesses, is crucial for its legality. Additionally, the lender must ensure that the personal property is properly documented to secure their interest.

State-specific rules for the South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property

In South Carolina, specific rules apply to the execution and enforcement of the Fixed Rate Note. These may include:

- Compliance with the South Carolina Uniform Commercial Code (UCC) regarding secured transactions.

- Requirements for notarization or witnessing, depending on the nature of the agreement.

- Specific provisions related to the repossession of collateral in case of default.

Quick guide on how to complete south carolina fixed rate note installment payments secured by personal property

Complete South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a remarkable eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Manage South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest way to modify and eSign South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property without hassle

- Obtain South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property and then click Get Form to initiate.

- Utilize the tools provided to complete your form.

- Select relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device of your choice. Modify and eSign South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property?

A South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property is a financial instrument used to secure a loan through a fixed interest rate. This type of note involves installment payments, allowing borrowers to repay over time while using personal property as collateral. It's essential for those looking to manage their debt with predictable payments.

-

How does airSlate SignNow support the creation of a South Carolina Fixed Rate Note?

airSlate SignNow provides customizable templates tailored for generating a South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property. Users can easily fill in relevant information and apply digital signatures, ensuring compliance and authenticity. This feature streamlines the paperwork process, making it efficient for both lenders and borrowers.

-

What are the benefits of using airSlate SignNow for managing installment payments?

Using airSlate SignNow for managing your South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property offers several benefits. You'll gain easy document management, secure electronic signatures, and automated reminders for payment due dates. This helps maintain clear communication while reducing the chance of missed payments.

-

Are there any integration options with airSlate SignNow for financial applications?

Yes, airSlate SignNow offers integration options with various financial applications to enhance the process of managing a South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property. Users can connect with accounting software, CRM systems, and more, ensuring a seamless workflow. This integration boosts productivity and enhances document handling.

-

What is the pricing structure for using airSlate SignNow for legal documents?

airSlate SignNow offers flexible pricing plans based on user needs and the volume of documents processed, giving businesses access to tools for managing South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property. There is usually a range of options that cater to individual users as well as larger teams. Consider exploring these plans to find one that aligns with your budget.

-

How secure is the signing process with airSlate SignNow?

The signing process with airSlate SignNow is highly secure, which is crucial for documents like the South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property. The platform utilizes end-to-end encryption and complies with industry standards for data protection. This ensures that your sensitive information remains confidential and secure.

-

Can I use airSlate SignNow for multiple loan agreements?

Absolutely! airSlate SignNow is designed to handle multiple loan agreements, including various forms of South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property. The platform allows users to track different agreements concurrently, making it easy to manage all your loan documentation efficiently in one place.

Get more for South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property

- Excel home care pittsburgh form

- Bureau of workers comp form r2

- Lpdc forms east cleveland city schools

- Preschool observation form warren county schools

- Career center student information form fy14doc

- Gun range in queens ny that files your gun permit fast form

- Nycdoe fingerprint referral form

- 2011 nelp form

Find out other South Carolina Fixed Rate Note, Installment Payments Secured By Personal Property

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney